简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Silver Price Targets: XAG Surges to Fresh Yearly Highs– Trade Levels

요약:Silver prices have rallied to fresh yearly highs with the advance now targeting uptrend resistance. These are the levels that matter on the XAG/USD charts this week.

Silver prices rally to fresh yearly highs vulnerable into 18.04 - Constructive above 17.39

Check out our 2019 projections in our Free DailyFX Trading Forecasts

Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

Silver prices have surged to fresh yearly highs with XAG/USD rallying six of the past seven weeks. These are the updated targets and invalidation levels that matter on the XAG/USD charts heading into the close of the week. Review this week's Strategy Webinar for an in-depth breakdown of this silver price setup and more.

Silver Price Chart – XAG/USD DailyChart

Prepared by Michael Boutros, Technical Strategist; Silver (XAG/USD) on Tradingview

Technical Outlook: In my last Silver Price Outlook we noted that XAG/USD was, “testing confluence uptrend resistance here and leaves the long-bias vulnerable while below the upper parallel.” Prices pulled back nearly 3% last week before stabilizing with the subsequent breakout taking Silver to fresh 20-month highs. The advance hit initial resistance objectives at 17.74 today after gapping higher into the open with the daily chart highlighting ongoing momentum divergence into these highs- risk for topside exhaustion is mounting.

A breach higher from here exposes channel resistance / the 1.618% extension of the November advance at 18.04 backed closely by the 61.8% retracement / August 2016 swing low at 18.37/40. Daily support rests at 16.95 with a broader bullish invalidation now raised to 16.61.

Silver Price Chart – XAG/USD 120min

Chart Prepared by Michael Boutros, Technical Strategist; Silver (XAG/USD) on Tradingview

Notes: A closer look at silver price action shows XAG/USD continuing to trade within the confines of ascending pitchfork formation extending off the late-June / July lows. The weekly opening-range is taking shape just below the 17.74 resistance target with initial support eyed at 17.52. Look for losses to be limited to the median-line / Fridays close at 17.39 IF prices are indeed heading higher on this stretch.

For a complete breakdown of Michaels trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

Bottom line: The Silver price breakout is maturing at fresh yearly highs and while the broader outlook remains constructive, the advance may be vulnerable near-term on the back of this three-week advance. From at trading standpoint, a good place to raise protective stops- look to reduce long-exposure on a stretch towards slope resistance- expect a bigger reaction there IF reached. Be on the lookout for possible downside exhaustion ahead of the Friday close to keep the immediate long-bias viable. Review my latest Silver Weekly Price Outlook for a longer-term look at the technical trading levels for GBP/USD heading.

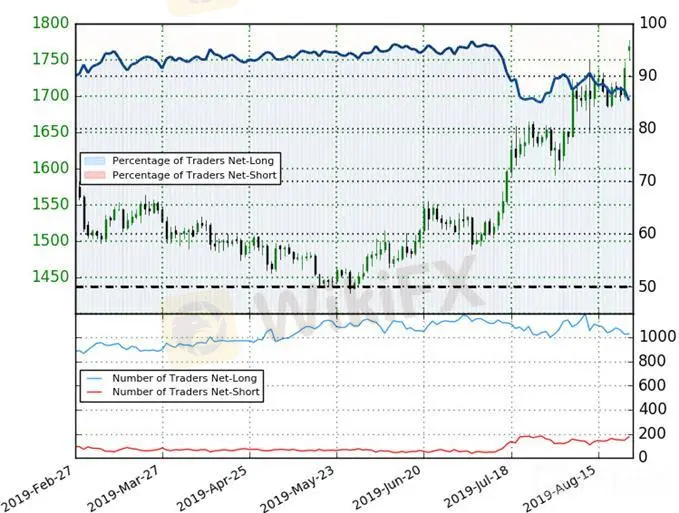

Silver Trader Sentiment (XAG/USD)

A summary of IG Client Sentiment shows traders are net-long Silver - the ratio stands at +5.85 (85.4% of traders are long) – bearish reading

The percentage of traders net-long is now its lowest since July 26th

Long positions are 1.0% lower than yesterday and 1.9% lower from last week

Short positions are 10.0% higher than yesterday and 12.8% higher from last week

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Spot Silver prices may continue to fall. Yet traders are less net-long than yesterday & compared with last week. From a sentiment standpoint, the recent changes in positioning warn that the current Spot Silver price trend may soon reverse higher despite the fact traders remain net-long.

See how shifts in Silver retail positioning are impacting trend- Learn more about sentiment!

Active Trade Setups

Sterling Price Targets: Pound Reversal Tests Initial GBP/USD Hurdles

S&P 500 Price Targets: SPX Consolidation Levels – Technical Trade Outlook

Gold Price Targets: XAU/USD Bulls on a Break– Technical Trade Outlook

Canadian Dollar Price Targets: USD/CAD Bulls Eye Key Resistance Pivot

US Dollar Price Outlook: DXY Threatens Larger Recovery– Trade Targets

면책 성명:

본 기사의 견해는 저자의 개인적 견해일 뿐이며 본 플랫폼은 투자 권고를 하지 않습니다. 본 플랫폼은 기사 내 정보의 정확성, 완전성, 적시성을 보장하지 않으며, 개인의 기사 내 정보에 의한 손실에 대해 책임을 지지 않습니다.

WikiFX 브로커

최신 뉴스

WikiFX "3·15 외환 권리 보호의 날" – 블랙리스트 공식 발표

한국 경제, ‘반짝 성장’ 후 둔화… 원·달러 환율 어디로 갈까?

제1회 WikiFX Korea 모의 투자 대회 시작! 벚꽃이 흩날리는 봄, WikiFX와 함께

외환 투자에서 사기 브로커의 위험을 피하는 방법 | WikiFX, 규제 라이선스를 통해 리스크 식별 지원

환율 계산기