简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

The top 10 most active clean-energy investors in 2019 - Business Insider

요약:Investors bet the most money on clean energy last year since 2010. These are the 10 most active investors, according to BloombergNEF.

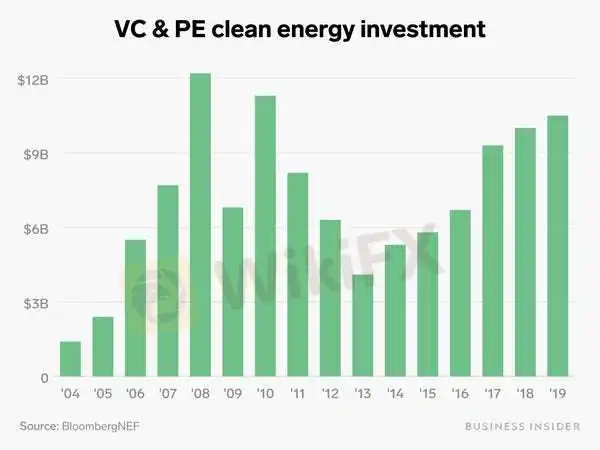

Venture capital and private equity investors flooded clean energy with $10.5 billion in 2019, according to a new report by BloombergNEF. It's the largest annual investment since 2010. Business Insider highlighted the 10 most active venture capital and private equity investors, based on the number of deals that closed in 2019, using data from BloombergNEF. The list shows that oil and gas giants are among the most active private investors, alongside the Bill Gates-led investor coalition, Breakthrough Energy Ventures. Click here to subscribe to Power Line, Business Insider's weekly clean-energy newsletter.Click here for more BI Prime stories.Private investment in clean energy is continuing to climb, with venture capital and private equity funding in the sector reaching $10.5 billion in 2019, according to a new report by the research firm BloombergNEF (BNEF). That's the largest annual investment in clean energy since 2010 and more than two times higher than the decade low of $4.1 billion in 2013.“We're seeing a resurgence in the last two years,” Tom Blum, a member of Clean Energy Venture Group, told Business Insider late last year. “Renewables, which had been plodding along steadily, are taking a huge upturn.”

Ruobing Su/Business Insider

Data from PitchBook show a similar trend: VCs flooded the clean-tech industry with nearly $10 billion in 2019, which is the second-highest investment sum in a decade.The largest clean-energy investors of 2019 include well-known giants like T. Rowe Price, Amazon, and BlackRock. They were all involved in a $1.3 billion PE deal with the electric vehicle (EV) company Rivian Automotive in December. None of the top 20 clean-energy investors, by capital, were involved in more than two deals, according to BNEF. Business Insider looked, instead, at VC and PE investors that were most active, based on the number of deals they financed or co-financed that closed in 2019.Here are the most active clean energy VC and PE investors, ranked from fewest to most deals in 2019. Note: “Clean energy” refers to “renewable energy excluding large hydro-electric projects, but including equity-raising by companies in smart grid, digital energy, energy storage, and electric vehicles,” per a BNEF spokesperson.

면책 성명:

본 기사의 견해는 저자의 개인적 견해일 뿐이며 본 플랫폼은 투자 권고를 하지 않습니다. 본 플랫폼은 기사 내 정보의 정확성, 완전성, 적시성을 보장하지 않으며, 개인의 기사 내 정보에 의한 손실에 대해 책임을 지지 않습니다.

WikiFX 브로커

최신 뉴스

WikiFX "3·15 외환 권리 보호의 날" – 블랙리스트 공식 발표

한국 경제, ‘반짝 성장’ 후 둔화… 원·달러 환율 어디로 갈까?

제1회 WikiFX Korea 모의 투자 대회 시작! 벚꽃이 흩날리는 봄, WikiFX와 함께

외환 투자에서 사기 브로커의 위험을 피하는 방법 | WikiFX, 규제 라이선스를 통해 리스크 식별 지원

환율 계산기