简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

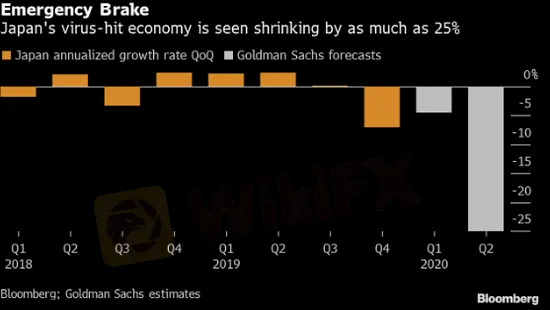

Japan’s Economy May See a Record 25% Shrinkage

요약:JCER Senior Researcher Jun Saito recently commented that the global epidemic may be the final blow on Japan’s sluggish economy, while Goldman Sachs estimated Japan’s economy may see a record 25% shrinkage this quarter.

JCER Senior Researcher Jun Saito recently commented that the global epidemic may be the final blow on Japan’s sluggish economy, while Goldman Sachs estimated Japan’s economy may see a record 25% shrinkage this quarter.

Jun Saito repeated the point that Japan is heading towards a severe recession, attributing it to the shocks on demand and supply. In addition, the delaying of Olympics and Paralympics will “put more downward pressure” on Japan’s economy.

According to the estimation of Goldman Sachs, Japan’s economy will shrink an unprecedented 25% this quarter despite a stimulus scheme never seen in history. While coronavirus outbreak in the US and some European economies is easing, this may not be a very good news for the safe-haven yen, which has benefited from the continuous global economic slump in March. Now that the market expects a peak of global coronavirus cases, risk aversion sentiment is eventually thinning, which will definitely weigh on the yen.

면책 성명:

본 기사의 견해는 저자의 개인적 견해일 뿐이며 본 플랫폼은 투자 권고를 하지 않습니다. 본 플랫폼은 기사 내 정보의 정확성, 완전성, 적시성을 보장하지 않으며, 개인의 기사 내 정보에 의한 손실에 대해 책임을 지지 않습니다.

WikiFX 브로커

최신 뉴스

WikiFX "3·15 외환 권리 보호의 날" – 블랙리스트 공식 발표

한국 경제, ‘반짝 성장’ 후 둔화… 원·달러 환율 어디로 갈까?

제1회 WikiFX Korea 모의 투자 대회 시작! 벚꽃이 흩날리는 봄, WikiFX와 함께

외환 투자에서 사기 브로커의 위험을 피하는 방법 | WikiFX, 규제 라이선스를 통해 리스크 식별 지원

환율 계산기