简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

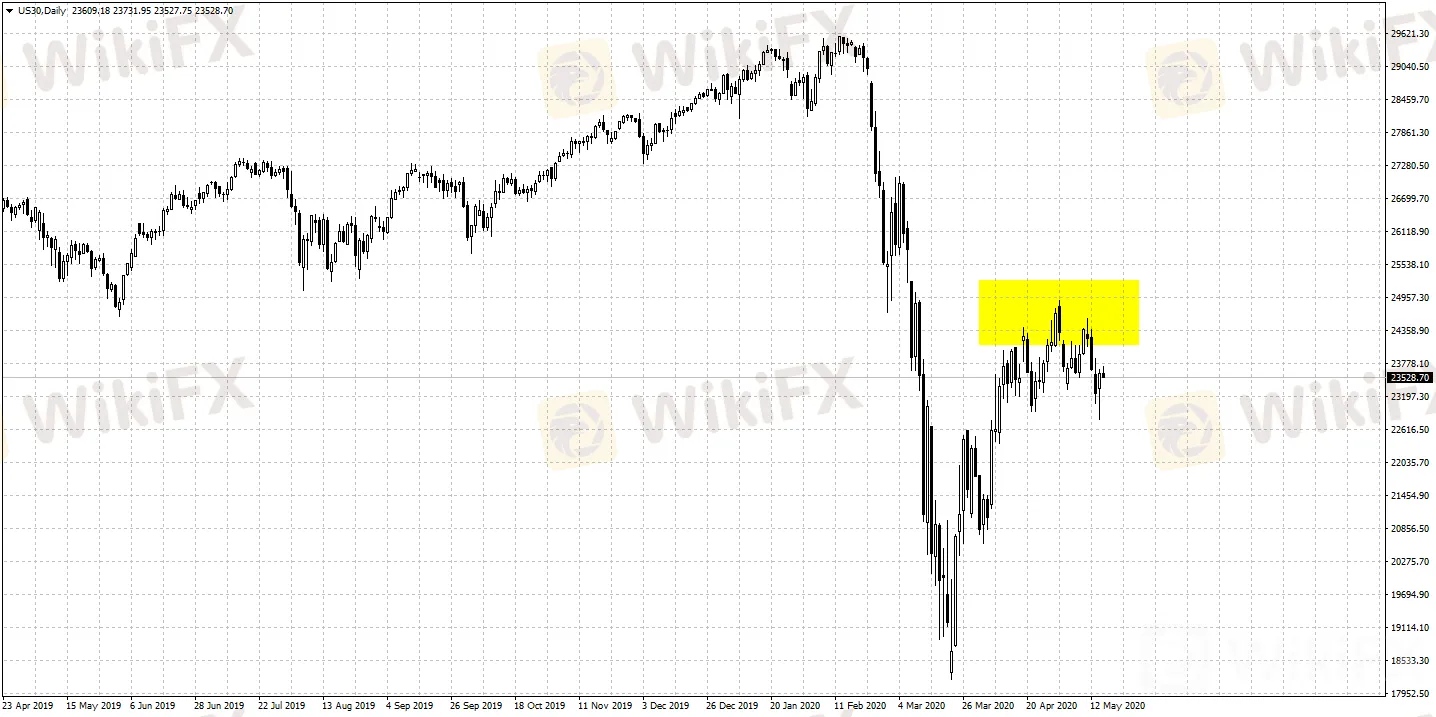

Investors Should Mind the Risks of Overpriced US Stocks

요약:U.S. hedge fund tycoon David Tepper recently said that the current US stock market is one of the most overvalued markets he has seen, other than that in 1999.

May 15th, from WikiFX. U.S. hedge fund tycoon David Tepper recently said that the current US stock market is one of the most overvalued markets he has seen, other than that in 1999.

He believes that certain large technology stocks such as Amazon and Facebook may have been “fully valued”, saying that “the market is pretty high, and the Fed has put a lot of money in here”.

In addition, there has been various capital misallocations in the markets, and the estimated S&P 500 forward price-earnings ratio for the next 12 months has surged to over 20, the highest level since 2002. Tepper said his stance is “relatively conservative” and he remains “very cautious”. He currently holds about 10% to 15% of long positions in equities.

Relevant US statistics show that, the position allocation of retail investors shows that they are actually vigilant about the unusual rise in the stock market. Since the 1920s, the stock market has never been able to rise against the sluggish fundamentals during the recession, but investors began to believe in bottom-fishing strategies after the subprime mortgage crisis, and the stock market full of “bottom buyers” has seen faster but very unstable rally.

Dow Jones daily pivot points: 23236 - 23484

S1: 23042 R1: 23926

S2: 22476 R2: 24244

면책 성명:

본 기사의 견해는 저자의 개인적 견해일 뿐이며 본 플랫폼은 투자 권고를 하지 않습니다. 본 플랫폼은 기사 내 정보의 정확성, 완전성, 적시성을 보장하지 않으며, 개인의 기사 내 정보에 의한 손실에 대해 책임을 지지 않습니다.

WikiFX 브로커

최신 뉴스

WikiFX "3·15 외환 권리 보호의 날" – 블랙리스트 공식 발표

한국 경제, ‘반짝 성장’ 후 둔화… 원·달러 환율 어디로 갈까?

제1회 WikiFX Korea 모의 투자 대회 시작! 벚꽃이 흩날리는 봄, WikiFX와 함께

외환 투자에서 사기 브로커의 위험을 피하는 방법 | WikiFX, 규제 라이선스를 통해 리스크 식별 지원

환율 계산기