简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

The Fear of Epidemic Resurgence Caused Gold to Rise

요약:Due to the fear of an epidemic resurgence and a constantly low Fed interest rate, US stocks have witnessed a fatigued late, bringing a strong momentum to the US dollar and meanwhile suppressing the rise in gold price.

WikiFX News (18 June) - Due to the fear of an epidemic resurgence and a constantly low Fed interest rate, US stocks have witnessed a fatigued late, bringing a strong momentum to the US dollar and meanwhile suppressing the rise in gold price.

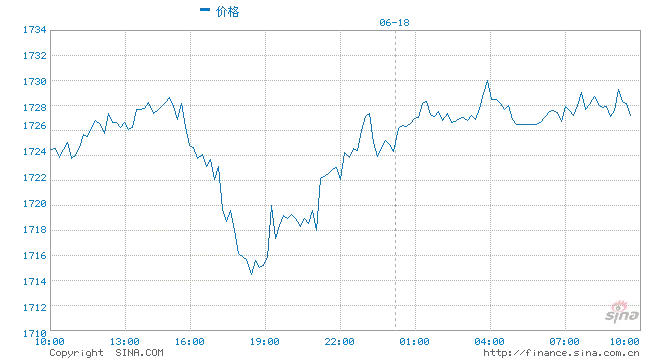

Yesterday, spot gold once rebounded by US$17, refreshing its daily high to US$1730.22 per ounce, but the US dollar later strengthened to suppress golds upward trend.

In terms of gold futures, the price of gold futures delivered on the New York Mercantile Exchange in August has fallen by 90 cents, a decline amount of 0.05%, closing at $1735.60 per ounce. Analysts said that gold prices have performed irregularly in the past few days, and gold futures price is not always negatively related to stock markets and debt yields.

According to Michael Matousek, chief trader of US Global Investors, gold prefers a long-term investment and it should be bought in when there is a slight correction in price. Prott CEO Peter Grosskopf says that it is time to buy gold in a large amount now, because the credit crisis has already broken out.

The above information is provided by WikiFX, a world-renowned foreign exchange information query provider. For more information, please download the WikiFX App. bit.ly/WIKIFX

면책 성명:

본 기사의 견해는 저자의 개인적 견해일 뿐이며 본 플랫폼은 투자 권고를 하지 않습니다. 본 플랫폼은 기사 내 정보의 정확성, 완전성, 적시성을 보장하지 않으며, 개인의 기사 내 정보에 의한 손실에 대해 책임을 지지 않습니다.

WikiFX 브로커

최신 뉴스

WikiFX "3·15 외환 권리 보호의 날" – 블랙리스트 공식 발표

제1회 WikiFX Korea 모의 투자 대회 시작! 벚꽃이 흩날리는 봄, WikiFX와 함께

환율 계산기