简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold this Week: Bullish!

요약:Gold prices consolidates after hitting a record high ($2,075) in August, but the macroeconomic environment may keep gold afloat.

WikiFX News (24 Aug)- Gold prices consolidates after hitting a record high ($2,075) in August, but the macroeconomic environment may keep gold afloat.

The rebound in gold prices from the monthly low ($1,863) struggles to retain the momentum as the Federal Open Market Committee (FOMC) in its meeting minutes revealed a looming change in the monetary policy outlook: the FOMC has voted unanimously to push back “the expiration of the temporary U.S. Dollar liquidity swap lines through March 31, 2021” after extending its lending programs till the end of the year.

In addition, the Feds chairman Jerome Powell is expected to reveal something new at the Jackson Hole Economic Symposium scheduled for August 27-28, with the information further supporting gold prices.

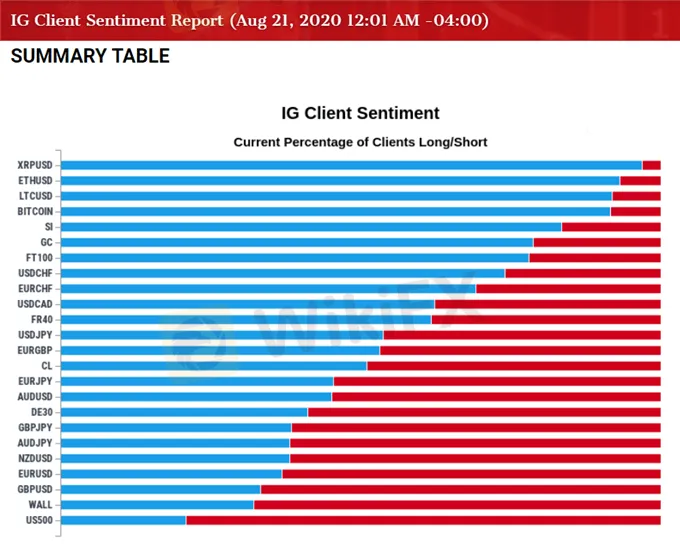

The IG Client Sentiment report implies that the continuous crowding behavior may raise gold prices, heightening the appeal of gold as an alternative to fiat currencies. Technically speaking, it is expected to see bullish gold enduring as it has been trading to fresh yearly highs for every single month so far in 2020.

All the above is provided by WikiFX, a platform world-renowned for foreign exchange information. For details, please download the WikiFX App:

bit.ly/WIKIFX

Chart: IG Client Sentiment

면책 성명:

본 기사의 견해는 저자의 개인적 견해일 뿐이며 본 플랫폼은 투자 권고를 하지 않습니다. 본 플랫폼은 기사 내 정보의 정확성, 완전성, 적시성을 보장하지 않으며, 개인의 기사 내 정보에 의한 손실에 대해 책임을 지지 않습니다.

WikiFX 브로커

최신 뉴스

WikiFX "3·15 외환 권리 보호의 날" – 블랙리스트 공식 발표

제1회 WikiFX Korea 모의 투자 대회 시작! 벚꽃이 흩날리는 봄, WikiFX와 함께

환율 계산기