简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

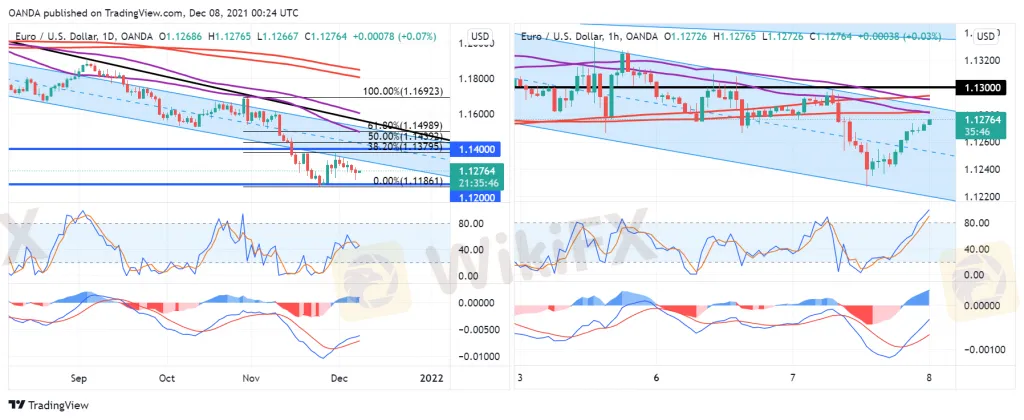

EUR/USD – Can it turn things around?

요약:The euro is trading lower against the dollar again after a brief rebound late last month. But was the rebound brief or is there more to come?

While the one-hour chart appears to show no shortage of momentum, the latest daily candle appears to indicate some hesitation. That appears to be contradictory, but the fact that this happened so close to the prior lows may be significant.

The question is whether the hesitation near the lows or the momentum on the shorter-timeframe is more significant. Its hard to ignore either but it should become clear one way or the other, and very soon.

Another failure to break the lows could come on rapidly deteriorating momentum, or a breakout could occur on much more.

Or, we could see a breakaway attempt in the other direction. The first hurdle here is 1.13. A move above here takes us above the descending channel on the one-hour chart, and the 55/89 and 200/233-hour SMA bands.

That would be a strong bullish signal on the hour chart that may generate some upward momentum in the near term and could lead to a broader correction on the longer timeframes.

면책 성명:

본 기사의 견해는 저자의 개인적 견해일 뿐이며 본 플랫폼은 투자 권고를 하지 않습니다. 본 플랫폼은 기사 내 정보의 정확성, 완전성, 적시성을 보장하지 않으며, 개인의 기사 내 정보에 의한 손실에 대해 책임을 지지 않습니다.

WikiFX 브로커

최신 뉴스

한국 경제, ‘반짝 성장’ 후 둔화… 원·달러 환율 어디로 갈까?

외환 투자에서 사기 브로커의 위험을 피하는 방법 | WikiFX, 규제 라이선스를 통해 리스크 식별 지원

환율 계산기