简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

GemForex - weekly analysis

요약:weekly analysis

During the previous week, we experienced one of the most volatile periods for the majority of Forex pairs, in the spotlight the major ones. EURUSD achieved a 1:1 parity, something not seen since 2002, USDJPY spiked towards 139.345, and GBPUSD reached a 2-year low around 1.17328, amid a strengthening dollar, the odyssey of sanctions towards Russia, and the subsequent supply shortages that peak and affect the majority of the “Western” Economic order, further driving inflation up.

USD & European indices like the NASDAQ, DOW, CAC & DAX moved sideways during the passing week amid the uncertainty of the long-term policies implied by Western central banks, who have delayed tightening monetary policy for so long, now brace for significant effects on the global economic outlook which is still getting priced into financial assets.

ECB in particular, finds itself between a rock and a hard place, as the euro's fall to parity against the dollar for the first time in two decades poses a problem for the ECB. Letting the currency fall exacerbates inflation, already well above its 2% target. A more hawkish stance to shore up the currency, or more rapid rate hikes, could hit growth. know that getting caught in that loop of trying to support your currency through central bank actions is pretty dangerous as you need to tighten too much, hurting the economy and the currency.

Germany, and Italy, some of the biggest economies in the EU, brace for a hard landing, and in Italy, as we speak, a fresh political crisis is putting more upward pressure on Italian borrowing costs, which is already extreme compared to the German counterparts.

And yet the ECB announced recently that they will unveil a new anti-fragmentation tool in response to a surge in bond yields that has hit the most indebted countries hardest. Announcing a large envelopecould boost confidence in the ECB's commitment to fighting so-called fragmentation risks, but investor disappointment could follow if the size is too small, and confidence in the ECB central planning policymakers would plummet further.

Both US and European Central Bank cut their GDP growth expectations for 2022 and 2023 to be less than 2021, something that, amid all the drastic geopolitical changes and priced-in variables in the markets, would assure the growth expectations to not be based on the current reality, as energy supplies are worryingly low for the upcoming winter for almost all European nations, therefore the industrial output expectations for the upcoming quarters have to be more realistic.

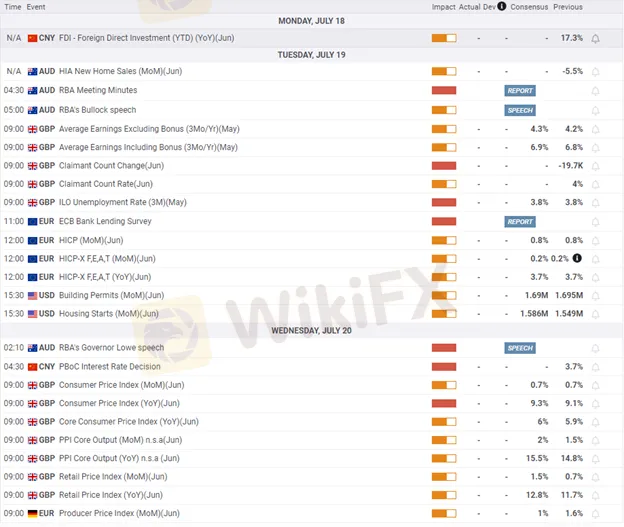

Nevertheless, this upcoming week is expected to be hot, as this week we can expect the Euro and the British inflation numbers and retail price indices, and there is still no effective and positive signal from the policymakers of the Western banks, to combat inflation and the rising month-by-month borrowing costs.

면책 성명:

본 기사의 견해는 저자의 개인적 견해일 뿐이며 본 플랫폼은 투자 권고를 하지 않습니다. 본 플랫폼은 기사 내 정보의 정확성, 완전성, 적시성을 보장하지 않으며, 개인의 기사 내 정보에 의한 손실에 대해 책임을 지지 않습니다.

WikiFX 브로커

환율 계산기