简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

USDCAD 1-Week Implied Volatility at Highest Level Since January

Resumo:Canadian Dollar forex traders are expecting heightened price volatility ahead of the Bank of Canada's upcoming interest rate decision.

Implied Volatility – Talking Points:

CAD traders eye upcoming event risk with a focus on Bank of Canadas interest rate decision expected tomorrow

Currency option traders continue to price in higher anticipated price swings across EUR, GBP, AUD and NZD forex pair

Looking to refine your trading skills? Check out the DailyFX Top Trading Lessons here!

USDCAD 1-Week implied volatility remains elevated as currency traders anxiously await the Bank of Canada‘s interest rate decision on deck for 15:00 GMT tomorrow. Although the central bank is widely expected to keep its policy rate unchanged at 1.75 percent, follow-up commentary provided from BOC’s Governor Stephen Poloz will likely provide markets with an update on Canadas economy and future policy outlook.

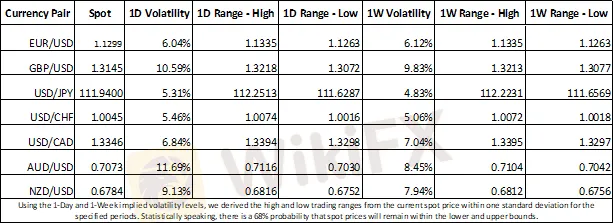

CURRENCY MARKAT IMPLIED VOLATILITY AND TRADING RANGE

Implied volatility on 1-Day and 1-Week currency options contracts has steadily crept higher in recent days. USDCAD implied volatility has been moving higher over the last 5 trading days with currency option hedging costs rising from 5.93 percent last Tuesday to 7.04 percent today. AUDUSD and NZDUSD also look to experience some price volatility as markets digest Chinas weak economic growth estimates released this morning.

USDCAD CURRENCY PRICE CHART: DAILY TIME FRAME (JANUARY 30, 2018 TO MARCH 05, 2019)

Recent USD strength on the back of relatively upbeat economic data has pushed the USDCAD higher as indicated on the chart above. Spot prices rebounded aggressively off uptrend support and the 61.8 percent Fibonacci retracement level yesterday but have remained range-bound between the 1.310 and 1.336 handles since the start of the year.

Despite near-term resistance at the 78.6 Fibonacci retracement line, the currency pair may break out above this price ceiling judging by USDCAD trading ranges derived from by implied volatility. BOC remarks that are more dovish than expected could serve as a fundamental driver for a topside breakout.

USDCAD RETAIL FOREX TRADER CLIENT POSITIONING

Take a look at IGs real-time Client Sentiment tracker to see the bullish and bearish biases of traders on other forex markets.

USDCAD traders have grown increasingly bearish on the currency pair ahead of the BOCs rate decision with the number of traders net-long falling 7.6 percent while the number of traders net-short jumped 20.7 percent higher compared to last week. This has resulted in a short-to-long ratio of 1.41.

Isenção de responsabilidade:

Os pontos de vista expressos neste artigo representam a opinião pessoal do autor e não constituem conselhos de investimento da plataforma. A plataforma não garante a veracidade, completude ou actualidade da informação contida neste artigo e não é responsável por quaisquer perdas resultantes da utilização ou confiança na informação contida neste artigo.

Corretora WikiFX

Últimas notícias

FBS Ganha Três Prêmios Prestigiados e Reforça sua Posição no Mercado Global

Como Evitar Riscos de Corretoras Fraudulentas no Investimento em Forex

Neex: Um Broker Regulamentado com Solidez e Eficiência no Mercado Forex

Oscilações no Mercado Forex: Impactos nos Principais Pares de Moedas

TradeEU Global: Investidor Mexicano Perde Quase 6 Mil Dólares

Dólar Hoje: Moeda Cai com Otimismo no Brasil e Incertezas Globais

PIB e Inflação no Brasil: Impacto das Taxas de Juros Elevadas

Zind Forex: Investimento de Trader Brasileiro Some de Sua Conta

Dólar Hoje: Moeda em Queda e Expectativas para a Super Quarta

USD/JPY: Dólar Entra em Fase de Consolidação e Pode Buscar Novos Patamares

Cálculo da taxa de câmbio