简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Euro May Fall on ECB Minutes, Jackson Hole and Eurozone PMIs

Özet:The Euro may fall against the US Dollar if ECB minutes carry ultra-dovish undertones and commentary from Jackson Hole spooks markets against the backdrop of Eurozone PMI data.

US Dollar, Euro, Jackson Hole, Eurozone PMIs – TALKING POINTS

Euro may fall vs. US Dollar if ECB minutes evoke ultra-dovish expectations

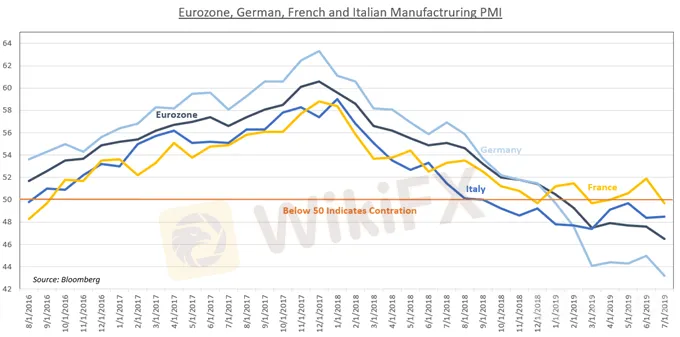

Eurozone PMIs may exacerbate regional growth fears and undermine Euro

Official commentary on growth outlook at Jackson Hole may spook markets

The Euro may suffer against the US Dollar if the release of the ECB minutes reveal stronger-than-expected dovish inclinations against the backdrop of Eurozone PMI publications. Regional growth concerns have been mounting as Germany – Europes largest economy – is expected to show a contraction in Q2. Comments from officials at the Jackson Hole symposium may also stoke growth fears and boost the anti-risk USD vs the Euro.

Jackson Hole Symposium

Markets will be closely watching the Jackson Hole symposium for comments from officials regarding the growth outlook. The release of the FOMC meeting minutes revealed that trade war concerns remain a “persistent headwind” and low inflation remain key obstacles along with corporate debt and leveraged lending. The latter has begun to sound the alarm as the collateralized loan obligation market stirs familiar fears.

European Growth Concerns, Political Instability

If comments from the Jackson Hole symposium carry overwhelming undertones of uncertainty, the Euro may fall against its US Dollar counterparts. EURUSDs decline may be amplified if Eurozone PMI data reinforces the fear that the Eurozone is significantly decelerating in its growth prospects. As it stands, Germany is planning on implementing stimulative policies as a contingency for a crisis ahead.

Europe is also dealing with chronic political upset in both the mainland and overseas. The latter is referring to the ongoing Brexit negotiations that remain unclear despite the October 31 deadline approaching. Italian political volatility and another possible budget dispute in the same month may magnify market volatility. During times of economic uncertainty, the capacity for political shocks to disrupt markets is notably increased.

CHART OF THE DAY: Weak European Manufacturing PMI May Spill Over into Services Soon

FX TRADING RESOURCES

Feragatname:

Bu makaledeki görüşler yalnızca yazarın kişisel görüşlerini temsil eder ve bu platform için yatırım tavsiyesi teşkil etmez. Bu platform, makale bilgilerinin doğruluğunu, eksiksizliğini ve güncelliğini garanti etmez ve makale bilgilerinin kullanılması veya bunlara güvenilmesinden kaynaklanan herhangi bir kayıptan sorumlu değildir.

WikiFX Broker

Son Haberler

Borsa yeni haftaya yüzde 0,26'lık artışla başladı

Deprem bölgesi için 400 milyon euroluk yeni finansman

Altında rekor serisi sürüyor

Piyasalar Fed faiz kararına odaklandı

Piyasalarda hareketlilik: Borsa düştü, dolar ve euro rekor kırdı

CME Groupun solana vadeli işlemleri hamlesi SOL fiyatını yükseltti

Bitcoin için uçuk tahmin: "1,5 milyon dolar olabilir"

AB'de işçi maliyetleri yükseliyor

Bitcoin ETFlerine ilgi yeniden arttı

34 ilde ihracat arttı: İstanbul'da kıymetli taşlar ilk sırada!

Kur Hesaplayıcı