简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Silver Price Targets: XAG Surges to Fresh Yearly Highs– Trade Levels

Özet:Silver prices have rallied to fresh yearly highs with the advance now targeting uptrend resistance. These are the levels that matter on the XAG/USD charts this week.

Silver prices rally to fresh yearly highs vulnerable into 18.04 - Constructive above 17.39

Check out our 2019 projections in our Free DailyFX Trading Forecasts

Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

Silver prices have surged to fresh yearly highs with XAG/USD rallying six of the past seven weeks. These are the updated targets and invalidation levels that matter on the XAG/USD charts heading into the close of the week. Review this week's Strategy Webinar for an in-depth breakdown of this silver price setup and more.

Silver Price Chart – XAG/USD DailyChart

Prepared by Michael Boutros, Technical Strategist; Silver (XAG/USD) on Tradingview

Technical Outlook: In my last Silver Price Outlook we noted that XAG/USD was, “testing confluence uptrend resistance here and leaves the long-bias vulnerable while below the upper parallel.” Prices pulled back nearly 3% last week before stabilizing with the subsequent breakout taking Silver to fresh 20-month highs. The advance hit initial resistance objectives at 17.74 today after gapping higher into the open with the daily chart highlighting ongoing momentum divergence into these highs- risk for topside exhaustion is mounting.

A breach higher from here exposes channel resistance / the 1.618% extension of the November advance at 18.04 backed closely by the 61.8% retracement / August 2016 swing low at 18.37/40. Daily support rests at 16.95 with a broader bullish invalidation now raised to 16.61.

Silver Price Chart – XAG/USD 120min

Chart Prepared by Michael Boutros, Technical Strategist; Silver (XAG/USD) on Tradingview

Notes: A closer look at silver price action shows XAG/USD continuing to trade within the confines of ascending pitchfork formation extending off the late-June / July lows. The weekly opening-range is taking shape just below the 17.74 resistance target with initial support eyed at 17.52. Look for losses to be limited to the median-line / Fridays close at 17.39 IF prices are indeed heading higher on this stretch.

For a complete breakdown of Michaels trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

Bottom line: The Silver price breakout is maturing at fresh yearly highs and while the broader outlook remains constructive, the advance may be vulnerable near-term on the back of this three-week advance. From at trading standpoint, a good place to raise protective stops- look to reduce long-exposure on a stretch towards slope resistance- expect a bigger reaction there IF reached. Be on the lookout for possible downside exhaustion ahead of the Friday close to keep the immediate long-bias viable. Review my latest Silver Weekly Price Outlook for a longer-term look at the technical trading levels for GBP/USD heading.

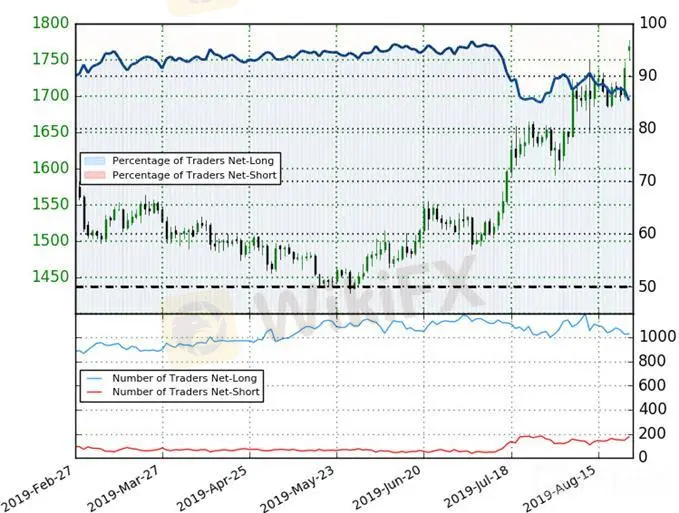

Silver Trader Sentiment (XAG/USD)

A summary of IG Client Sentiment shows traders are net-long Silver - the ratio stands at +5.85 (85.4% of traders are long) – bearish reading

The percentage of traders net-long is now its lowest since July 26th

Long positions are 1.0% lower than yesterday and 1.9% lower from last week

Short positions are 10.0% higher than yesterday and 12.8% higher from last week

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Spot Silver prices may continue to fall. Yet traders are less net-long than yesterday & compared with last week. From a sentiment standpoint, the recent changes in positioning warn that the current Spot Silver price trend may soon reverse higher despite the fact traders remain net-long.

See how shifts in Silver retail positioning are impacting trend- Learn more about sentiment!

Active Trade Setups

Sterling Price Targets: Pound Reversal Tests Initial GBP/USD Hurdles

S&P 500 Price Targets: SPX Consolidation Levels – Technical Trade Outlook

Gold Price Targets: XAU/USD Bulls on a Break– Technical Trade Outlook

Canadian Dollar Price Targets: USD/CAD Bulls Eye Key Resistance Pivot

US Dollar Price Outlook: DXY Threatens Larger Recovery– Trade Targets

Feragatname:

Bu makaledeki görüşler yalnızca yazarın kişisel görüşlerini temsil eder ve bu platform için yatırım tavsiyesi teşkil etmez. Bu platform, makale bilgilerinin doğruluğunu, eksiksizliğini ve güncelliğini garanti etmez ve makale bilgilerinin kullanılması veya bunlara güvenilmesinden kaynaklanan herhangi bir kayıptan sorumlu değildir.

WikiFX Broker

Son Haberler

Tarım ve kırsal kalkınmaya 7,2 milyar lira hibe

Altın, Bitcoin'i geride bıraktı: Sert düşüş yatırımcıları altına yönlendirdi

Borsa yeni haftaya yüzde 0,26'lık artışla başladı

Deprem bölgesi için 400 milyon euroluk yeni finansman

34 ilde ihracat arttı: İstanbul'da kıymetli taşlar ilk sırada!

Endişe verici açıklamalar sonrası kripto para piyasalarında düşüş

Borsa spekülasyonları piyasayı nasıl etkiliyor?

Elon Muskın Mars görevleri planlandı

Çiftçilerin prim ödemesi için çağrı

Borsada yükseliş sürecek mi?

Kur Hesaplayıcı