简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

【MACRO Alert】The rise of Bitcoin and the traditional status of gold: the competition for future valu

Zusammenfassung:Research firm Bernstein made a bold prediction in its latest report: Bitcoin may eventually replace gold as the premier store of value asset in the new era. Analyst Gautam Chhugani believes that Bitco

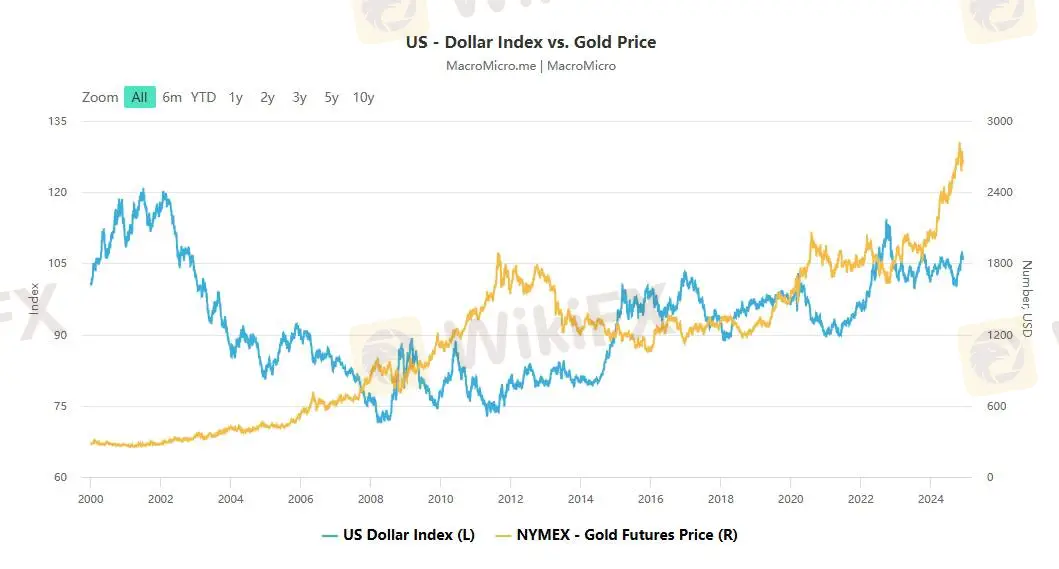

Research firm Bernstein made a bold prediction in its latest report: Bitcoin may eventually replace gold as the premier "store of value" asset in the new era. Analyst Gautam Chhugani believes that Bitcoin will replace gold in the next decade and become a permanent component of institutional multi-asset allocation and a standard for corporate financial management. This view coincides with the view of Federal Reserve Chairman Powell, who also compared Bitcoin with gold, claiming that Bitcoin is not a competitor to the US dollar, but a competitor to gold.

As a traditional safe-haven asset and inflation hedge tool, gold has always been regarded as a symbol of wealth and a means of storing value. However, the emergence of Bitcoin has challenged the status of gold. Bitcoin's decentralized nature, limited global supply (21 million coins) and its rapid asset appreciation potential have made it digital gold in the eyes of some investors. Compared with gold, Bitcoin transactions are more convenient, more liquid, and not restricted by physical storage and transportation. However, the physical properties and historical status of gold provide it with a stable value foundation. In the context of digitalization and globalization, the liquidity and innovation potential of gold are limited.

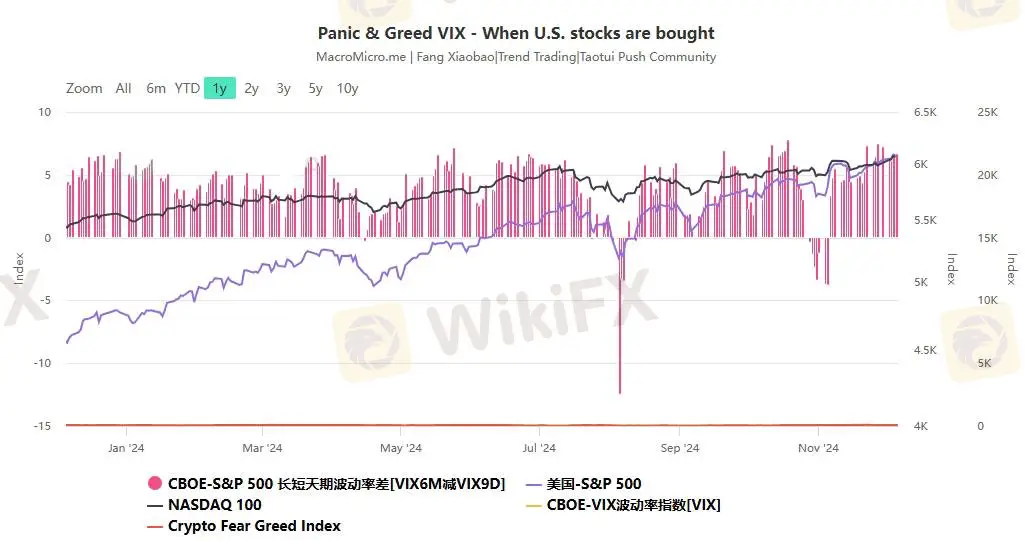

Bernstein's comments came after Bitcoin hit $100,000 for the first time ever, extending its huge gains in 2024. Year-to-date, the world's largest digital currency is up 141%, thanks in large part to investors betting that the incoming Trump administration will be more friendly to the cryptocurrency industry. This growth not only reflects the market's recognition of Bitcoin's future potential, but also shows investors' re-evaluation of traditional assets such as gold.

Gil Luria, head of technology research at DA Davidson, believes that Bitcoin's main application at the moment is as a store of value - an appreciating, low-correlation asset that can replace gold as a hedge against declining economic stability. Although Bitcoin prices are currently less correlated with inflation and more correlated with other risk assets, Luria believes that Bitcoin is "primarily driven by adoption," which he sees as "loosely correlated" with market drivers. The analyst cites factors such as employment, regulation, tax policy and globalization.

Faced with the challenge of Bitcoin, the gold market is also changing. Although gold remains an important asset for many investors and central banks, the rise of Bitcoin has forced the gold market to reconsider its role in the modern financial system. Gold's physical properties and historical status provide it with a stable value basis, but in the context of digitalization and globalization, gold's liquidity and innovation potential have been limited. In addition, the gold market is also adapting to new investment trends, such as the growth of gold ETFs, which provide investors with a convenient way to invest in gold while maintaining its attributes as a safe-haven asset.

Bernstein expects Bitcoin to reach $200,000 by the end of 2025, a prediction based on the assumption that Bitcoin is more widely accepted as a store of value and a medium of exchange. Standard Chartered Bank also believes that the price of this cryptocurrency could double by the end of next year, and its analyst Geoff Kendrick said that if Bitcoin is accepted more quickly by US pension funds, global sovereign wealth funds (SWFs) or potential US strategic reserve funds, they will become more bullish.

Despite the strong growth of Bitcoin, gold's position as a traditional safe-haven asset has not been completely replaced. Gold's stability, historical value and global recognition make it still have a place in the investment portfolio. Many investors still prefer gold because its value is relatively stable and not easily affected by market fluctuations. In addition, the role of gold in the financial market is not limited to investment, but also includes jewelry, industrial applications and other fields.

The rise of Bitcoin has undoubtedly brought challenges to the gold market, but it has also brought new opportunities to the entire field of value storage and exchange. Investors and policymakers need to pay close attention to the development of these two assets and their changing positions in the global economy. As technology advances and financial markets evolve, the competition between Bitcoin and gold may shape future investment strategies and wealth management methods. Gold and Bitcoin each have their own advantages, and investors should reasonably allocate these two assets based on their risk preferences and investment goals.

Haftungsausschluss:

Die Ansichten in diesem Artikel stellen nur die persönlichen Ansichten des Autors dar und stellen keine Anlageberatung der Plattform dar. Diese Plattform übernimmt keine Garantie für die Richtigkeit, Vollständigkeit und Aktualität der Artikelinformationen und haftet auch nicht für Verluste, die durch die Nutzung oder das Vertrauen der Artikelinformationen verursacht werden.

WikiFX-Broker

Aktuelle Nachrichten

Elon Musk hat Streit mit dem Chef des norwegischen Pensionsfonds, zeigen geleakte SMS

Elon Musk wird Nissan nicht retten – der japanische Autobauer braucht eine neue Strategie

US-Aktien unter Druck: Diese drei Gründe stecken hinter dem schlechtesten Börsen-Tag des Jahres

Ich bin 33 und habe 199 Wohnungen – so kratzte ich das Eigenkapital für meine erste Immobilie zusammen

Egal, ob als Angestellter oder Arbeitgeber: So einfach pusht ihr mit Personal Branding eure Karriere, verrät ein Experte

„Zombie-VCs: Warum immer mehr Investoren Probleme haben, neue Fonds zu raisen

Ihr bekommt dauernd Absagen auf eure Bewerbungen? Das könnt ihr laut einer Personalexpertin dagegen tun

Preisprognose für Bitcoin: BTC-Pattsituation hält an

Am Abend seiner bittersten Niederlage erhält Olaf Scholz ein kleines Trostpflaster – Debakel für Annalena Baerbock

Volt: So hat die pro-europäische Partei bei der Bundestagswahl abgeschnitten

Wechselkursberechnung