Score

GO MARKETS

Mauritius|Above 20 years| Benchmark AA|

Mauritius|Above 20 years| Benchmark AA|https://www.gomarkets.com/en/

Website

Rating Index

Benchmark

Benchmark

AA

Average transaction speed (ms)

MT4/5

Full License

GOMarketsIntl-Real 9

Influence

A

Influence index NO.1

Australia 7.10

Australia 7.10Benchmark

Speed:AA

Slippage:AAA

Cost:A

Disconnected:AAA

Rollover:A

MT4/5 Identification

MT4/5 Identification

Full License

Hong Kong

Hong KongInfluence

Influence

A

Influence index NO.1

Australia 7.10

Australia 7.10Contact

100% Mediation in the complaints

Response of EMC during7working days

Single Core

1G

40G

1M*ADSL

Basic Information

Mauritius

Mauritius 2024 SkyLine Thailand

2024 SkyLine ThailandAccount Information

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Benchmark

Total Margin Trend

| VPS Region | User | Products | Closing time |

|---|---|---|---|

Taipei Taipei | 647*** | XAUUSD.ch | 02-13 02:25:14 |

Dubai Dubai | 594*** | EURUSD | 02-13 06:46:23 |

Tokyo Tokyo | 137*** | EURUSD | 02-13 06:46:23 |

Stop Out

0.70%

Stop Out Symbol Distribution

6 months

Sources

Language

Mkt. Analysis

Creatives

Website

Most visited countries/areas

Italy

South Africa

Australia

gomarkets-jp.com

Server Location

United States

Website Domain Name

gomarkets-jp.com

Server IP

18.244.214.82

gomarkets.ltd

Server Location

United States

Website Domain Name

gomarkets.ltd

Server IP

34.117.154.248

gomarkets.mu

Server Location

Canada

Website Domain Name

gomarkets.mu

Server IP

69.172.201.91

Genealogy

VIP is not activated.

VIP is not activated.Star Stone

Galaxy Global Group

GOLD COPIOUS RAIN

Relevant Enterprises

Company Summary

Company Summary

Company profile

Who is GO Markets?

GO Markets is an Australia-based Forex and CFDs broker founded in 2006. The broker provides 1000+ tradable CFD instruments including forex, shares, commodities, indices, metals, and treasuries. GO Markets is regulated by the ASIC in Australia, the CySEC in Cyprus, the FSC in Mauritius, and the FSA (Seychelles).

GO Markets is one of the first Australian MetaTrader 4 brokers, later on, it added MetaTrader 5, WebTrader, cTrader and mobile apps to its suite of services. The broker is well known for its strict compliance and competitive spreads.

| Registered in | Australia, Cyprus, Mauritius, Seychelles |

| Regulation status | ASIC, CYSEC, FSC, FSA |

| Year(s) of incorporation | 15-20 years |

| market instruments | Forex CFDs, Share CFDs, Index CFDs, Metals CFDs, Cryptocurrency CFDs, Commodity CFDs and Treasury CFDs. |

| minimum initial deposit | USD $0 |

| maximum leverage | 1:500 |

| minimum spread | From 0.0 pips |

| trading platform | MT4, MT5, WebTrader, cTrader, Mobile Trading |

| Customer Service | Email/phone number/address/live chat, 24/5 |

| fraud complaints | NO |

Pros and cons of GO Markets

GO Markets has multiple regulations from recognized organizations in the industry, which gives greater credibility and security to its clients.

It offers a wide variety of financial instruments, including more than 1000 instruments, including Forex CFDs, Share CFDs, Index CFDs, Metals CFDs, Cryptocurrency CFDs, Commodity CFDs and Treasury CFDs. It has a market-leading trading platform, MetaTrader 4 and MetaTrader 5, which has numerous technical analysis tools and customizable charts.

It offers excellent customer service, available in multiple languages and through multiple communication channels.

Deposits and withdrawals are processed quickly, with a one business day lead time for withdrawals.

It has an educational section on its website that offers materials for beginners and advanced traders.

As for the cons, we found that the main point is that the conditions are different in each entity. Another point is that the brokers support is not available 24/7.

General Information and Regulation of GO Markets

GO MARKETS is an online forex brokerage company that offers clients access to a wide variety of financial instruments, including Forex CFDs, Share CFDs, Index CFDs, Metals CFDs, Cryptocurrency CFDs, Commodity CFDs and Treasury CFDs. The company is regulated by multiple regulatory bodies including ASIC, CYSEC, FSC and FSA.

GO Markets Pty Ltd - authorized by ASIC (Australia) registration AFSL: 254963 ABN: 85 081 864 039

GO Markets Ltd - authorized by CySEC (Cyprus) registration no. 322/17

GO Markets Pty Ltd (MU) - authorized by FSC (Mauritius) license no. GB 19024896

GO Markets International Ltd - authorized by the FSA (Seychelles) license no. SD043

GO Markets Leverage

GO Markets Leverage depends on the entity you have an account with since leverage falls under certain regulations. International Traders can access high-leverage ratios. GO Markets Pty Ltd, Mauritius (FSC regulated) offers leverage up to 1:500.

GO Markets Account Types

The broker offers two account types Standard and GO Plus Accounts with the flexibility to manage the trading way and choose the best fit. So there is an option between a Standard trading proposal based on spread charges and access to a true ECN environment via GO Plus+ specifically designed through light-fast technology.

In addition, the account can be opened in a few different currencies as a base one including AUD, USD, GBP, EUR, NZD, SGD, CHF, CAD, and HKD.

GO Markets Fees and Spreads

Apart from offering one of the best spreads for the products suite, GO Markets is also the most competitive in terms of holding costs or overnight swaps. GO Markets offers Swap-Free Accounts to traders available on the Standard and GO Plus+ accounts on Meta trader platforms. GO Markets Swap-Free account is available to legitimate holders who are Muslim and cannot use “swaps” due to their religious belief.

Further, the GO Plus Account is already a choice for advanced traders or those whose strategy requires it as spreads from 0.0 pips and trading costs inbuilt in the commission as low as 2.50$ per side.

GO Markets spreads are aggregated from 22+ Tier 1 and 2 liquidity providers making them go as low as 0.0 pips. The GO Markets average spreads for Standard and GO Plus+ accounts are listed on their page. However, the data is provided for general information only and is taken over a one-month period. Prices shown may vary. For instance, see below a comparison of the Standard spread offering, as well as your comparing fees to another popular broker.

Besides, always consider overnight fee as a cost, also known as Rollover rate or interest for holding positions open overnight.

GO Markets Deposits and Withdrawals

Deposits to the live trading account can be done in numerous convenient ways while the payments will attract no additional processing fees. GO Markets does not charge any internal fees for withdrawals, however, fund withdrawals to non-Australian banking institutions may be waived for some fees and are your responsibility, so make sure to check those as well.

GO Markets minimum deposit amount is 0$ as a beginning which allows you to use the full service of live trading and open a Standard account. GO Markets Withdrawal option uses the same methods for money deposits like Bank Transfers, Cards and e-wallets, yet verify with customer service what method is applicable for you according to your own residence and its policies, or laws applied. We tested withdrawal at GO Markets and it took us 1 business day.

GO Markets Trading Platforms

| Platforms | GO Markets |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| Mobile Trading Platforms | Yes |

| WebTrader | Yes |

| cTrader | Yes |

| cTrader Copy Trading | Yes |

GO Markets Customer Support

GO Markets Customer Service was rated #1, in addition to its great Awards received in other aspects. Successful brokers recognized the need for quality service, but of course, not everyone can have one.

with 14+ language coverage, GO Markets stands ahead in that point too, so you can count on relevant and fast answers from the Customer Support GO Markets. The brokers team is available around the clock and supports international languages accessible via Live Chat, email, and phone lines in Australia, the UK and internationally as well. And although the broker does not provide 24/7 client support, it has highly acclaimed 24/5 client support.

GO Markets Education

And of course, since novice traders always pass through great challenges while exploring trading opportunities, GO Markets provide the educational materials and research resources necessary to perform seamless trading. Eventually, GO Markets educational programs and its GO Markets Academy are numerously award-winning materials that are defined by all levels of traders and available for Free use.

So in GO Markets Academy and Education Centre, you will find Forex trading learning courses, Video Tutorials, also Tutorials and regularly held Seminars and Webinars in various languages. Also, Demo Account is offered for free use with no limits where beginners can place their strategy at the test or see GO Markets environment.

As for the Research tools, besides very comprehensive research inbuilt into Metatrader 4 platform, GO Markets also cooperates with Autochartist and Trading Central providers so you can use its free trading signals and ideas for your benefit. Besides, thousands of MetaTrader 4 & 5 Add-ons remain at your suite which is defined by the instrument and specified criteria, where also you may use the great tool MT4 Genesis.

FAQs

GO Markets knows that knowing where to find the information that you need and having the confidence that you can find the answers to your trading questions could be very helpful with your day-to-day trading.

Use these comprehensive Forex Trading FAQs to learn all the basics as well as the more advanced topics in forex trading. GO Markets has covered the lot from how to open a forex trading account to how to use the MetaTrader trading platform, Forex trading system, and more. Whether you're new to trading FX or you have several years of experience trading currencies, you will find a lot of useful information in these FAQs.

Keywords

2024 SkyLine Thailand

- Above 20 years

- Regulated in Australia

- Regulated in Cyprus

- Regulated in Seychelles

- Market Maker (MM)

- Retail Forex License

- MT4 Full License

- MT5 Full License

- cTrader

- Self-developed

- Global Business

| Broker | GO Markets |

| Founded | 2006 |

| Registered | Australia, Cyprus, Mauritius, Seychelles |

| Regulation Status | ASIC, CYSEC, FSA (Offshore) |

| Market Instruments | Forex CFDs, Share CFDs, Index CFDs, Metals CFDs, Cryptocurrency CFDs, Commodity CFDs and Treasury CFDs |

| Demo Account | ✔ |

| Maximum Leverage | 1:500 |

| Minimum Spread | From 0.0 pips |

| Tading platform | MT4, MT5, cTrader, Go WebTrader, Mobile Trading |

| Social Trading | ✔ |

| Minimum Initial Deposit | $200 |

| Customer Service | 24/7 - live chat, contact form, phone, email |

GO Markets Information

GO Markets is an Australia-based Forex and CFDs broker founded in 2006, providing 1000+ tradable CFD instruments including forex, shares, commodities, indices, metals, and treasuries. GO Markets is regulated by the ASIC in Australia, the CySEC in Cyprus, and the FSA (Seychelles).

GO Markets is one of the first Australian MetaTrader 4 brokers, later on, it added MetaTrader 5, WebTrader, cTrader and mobile apps to its suite of services. The broker is well known for its strict compliance and competitive spreads.

GO Markets Pros & Cons

| Pros | Cons |

|

|

|

|

|

|

| |

| |

|

GO Markets Legit?

GO MARKETS is an online forex brokerage company that is regulated by multiple regulatory bodies including ASIC, CYSEC, and FSA.

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number |

| ASIC | GO MARKETS PTY LTD | Market Making (MM) | 254963 |

| CYSEC | Go Markets Ltd | Market Making (MM) | 322/17 |

| FSA | Go Markets International Ltd | Retail Forex License | SD043 |

- GO Markets Pty Ltd - authorized by ASIC (Australia) registration AFSL: 254963 ABN: 85 081 864 039

- GO Markets Ltd - authorized by CySEC (Cyprus) registration no. 322/17

- GO Markets International Ltd - offshore regulated by the FSA (Seychelles) license no. SD043

Market Instruments

With Go Markets, clients can easily trade with over 1,000 products, covering Fore, Shares CFDs, Indices, Metals, Commodities, and Treasury. However, this broker does not trading on some other popular asssets like Futures, options, or ETFs.

| Tradable Assets | Supported |

| Forex Pairs | ✅ |

| Shares CFDs | ✅ |

| Indices | ✅ |

| Metals | ✅ |

| Commodities | ✅ |

| Treasury | ✅ |

| Futures | ❌ |

| Options | ❌ |

| ETFs | ❌ |

GO Markets Account Types

The Plus+ Account offers a range of benefits including 24/5 support, a dedicated account manager, tighter spreads from 0.0 pips, and free VPS access. It charges a commission of $2.50 per side on FX standard lots, while the Standard Account has slightly higher spreads starting from 0.8 pips and no commission fee.

Both accounts offer similar leverage (up to 500:1), allow trading in a wide range of markets, and support various base currencies. Additionally, both accounts permit trading tools, EAs, and scalping.

| Feature | Plus+ Account | Standard Account |

| Support | 24/5 Support | 24/5 Support |

| Dedicated Account Manager | Yes | No |

| Spreads | From 0.0 pips | From 0.8 pips |

| Commission | $2.50 per side on FX standard lot | A$0.00 |

| Available Markets | Wide range of FX pairs, Shares, Indices & Commodities | Wide range of FX pairs, Shares, Indices & Commodities |

| Minimum Trade Size | 0.01 lots | 0.01 lots |

| Leverage | Up to 500:1 | Up to 500:1 |

| Trading Tools | Available | Available |

| EAs Allowed | Yes | Yes |

| FREE VPS^ | Yes | No |

| Scalping Allowed | Yes | Yes |

| Available Base Currencies | AUD, USD, EUR, GBP, NZD, CAD, SGD, CHF, HKD | AUD, USD, EUR, GBP, NZD, CAD, SGD, CHF, HKD |

GO Markets Leverage

GO Markets Leverage depends on the entity you have an account with since leverage falls under certain regulations. International Traders can access high-leverage ratios. For forex trading, GO Markets Pty Ltd, Mauritius (FSC regulated) offers generous leverage up to 1:500.

GO Markets Spreads & Fees

Apart from offering one of the best spreads for the products suite, GO Markets is also the most competitive in terms of holding costs or overnight swaps. GO Markets offers Swap-Free Accounts to traders available on the Standard and GO Plus+ accounts on Meta trader platforms. GO Markets Swap-Free account is available to legitimate holders who are Muslim and cannot use “swaps” due to their religious belief.

Further, the GO Plus Account is already a choice for advanced traders or those whose strategy requires it as spreads from 0.0 pips and trading costs inbuilt in the commission as low as $2.5 per side.

GO Markets spreads are aggregated from 22+ Tier 1 and 2 liquidity providers making them go as low as 0.0 pips. The GO Markets average spreads for Standard and GO Plus+ accounts are listed on their page. However, the data is provided for general information only and is taken over a one-month period. Prices shown may vary. For instance, see below a comparison of the Standard spread offering, as well as your comparing fees to another popular broker.

Besides, always consider overnight fee as a cost, also known as Rollover rate or interest for holding positions open overnight.

GO Markets Trading Platforms

In terms of trading platform suppored, GO Markets offers a robust suite, which makes it stands tall among most brokers. MetaTrader 4 and 5 platforms provide advanced charting tools, expert advisors, and VPS options. The user-friendly cTrader platform enables advanced customization and order capabilities. Copy trading solutions like MetaTrader Copy Trader and cTrader Copy Trading allow following successful traders' strategies. Mobile trading apps for Android and iOS ensure access on-the-go. The GO WebTrader offers a web-based MT4 and MT5 experience without downloads.

| Platforms | GO Markets |

| MetaTrader 4 | ✅ |

| MetaTrader 5 | ✅ |

| Mobile Trading Platforms | ✅ |

| cTrader | ✅ |

| Go WebTrader | ✅ |

| WebTrader | ❌ |

Trading Tools

Additionally, GO Markets offers the following trading tools to enhance trading experience:

- VPS (Virtual Private Server): A VPS provides continuous access and optimal speed for MT4 and MT5 platforms, ensuring vital speed and uninterrupted trading.

- Autochartist: Autochartist specializes in real-time price action alerts, volatility analysis, and event impact assessments, allowing traders to easily apply charts and stay informed about market movements.

- Trading Central: Trading Central offers a collection of programs that provide actionable investment support with 24-hour multi-asset coverage and analysis, empowering traders with comprehensive market insights.

- MetaTrader Genesis: MetaTrader Genesis is a comprehensive suite of Expert Advisors (EAs) designed to enhance the capabilities of the standard MetaTrader platform, enabling advanced trading automation and strategy implementation.

GO Markets Deposits & Withdrawals

Various payment methods are available for deposits, including Master Account, VISA, Skrill, Neteller, and Bank Transfer. Most payments via Master Account and VISA are processed within an hour, while Skrill and Neteller take 1-2 hours. Bank Transfers generally require 1-2 business days. Accepted currencies include AUD, USD, GBP, EUR, and others depending on the payment method.

| Payment Method | Accepted Currencies | Deposit Processing Time |

|---|---|---|

| Master Account | AUD, USD, GBP, EUR, AED, SGD, CAD, CHF, HKD, NZD | Up to 1 hour |

| VISA | AUD, USD, GBP, EUR, AED, SGD, CAD, CHF, HKD, NZD | Up to 1 hour |

| SKRILL | AUD, USD, GBP, EUR, NZD, SGD | 1-2 hours |

| NETELLER | AUD, USD, GBP, EUR, SGD | 1-2 hours |

| Bank Transfer | AUD, USD, GBP, EUR, SGD, NZD, HKD, CAD, CHF | 1-2 business days |

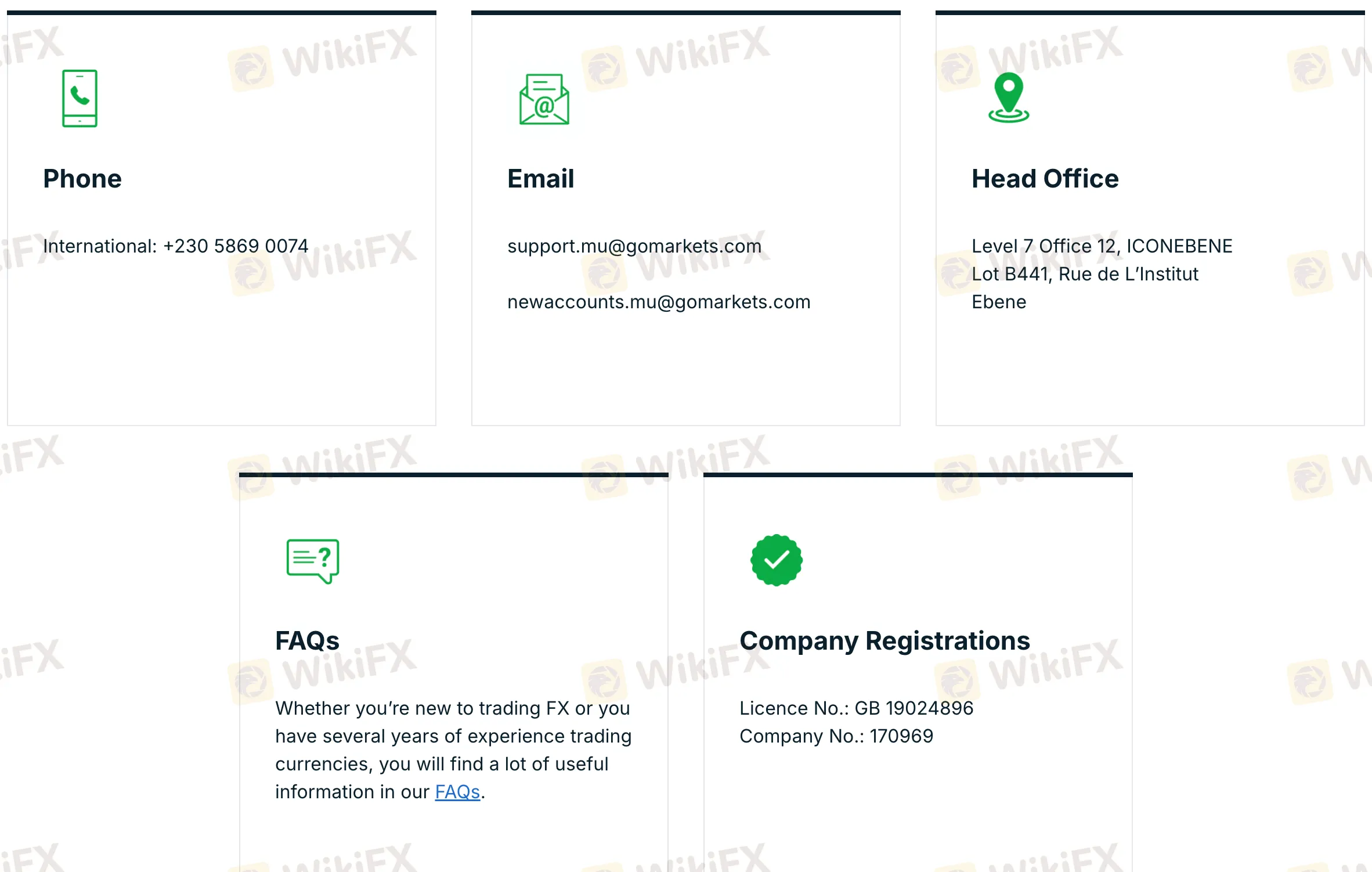

GO Markets Customer Support

24/7 - live chat, contact form

Phone: +230 5869 0074 (International)

Email: support.mu@gomarkets.com, newaccounts.mu@gomarkets.com

Head Office: Level 7 Office 12, ICONEBENE Lot B441, Rue de LInstitut Ebene

GO Markets Education

And of course, since novice traders always pass through great challenges while exploring trading opportunities, GO Markets provide the educational materials and research resources necessary to perform seamless trading. Eventually, GO Markets educational programs and its GO Markets Academy are numerously award-winning materials that are defined by all levels of traders and available for Free use.

So in GO Markets Academy and Education Centre, you will find Forex trading learning courses, Video Tutorials, also Tutorials and regularly held Seminars and Webinars in various languages. Also, Demo Account is offered for free use with no limits where beginners can place their strategy at the test or see GO Markets environment.

As for the Research tools, besides very comprehensive research inbuilt into Metatrader 4 platform, GO Markets also cooperates with Autochartist and Trading Central providers so you can use its free trading signals and ideas for your benefit. Besides, thousands of MetaTrader 4 & 5 Add-ons remain at your suite which is defined by the instrument and specified criteria, where also you may use the great tool MT4 Genesis.

FAQs

Is Go Markets legit?

Yes, Go Markets operates legally, and it is regulated in three different jurisdications globally.

Is demo trading available at Go Markets?

Yes. It offers risk-free demo accounts.

Does Go Markets offer MT4/5?

Yes. Both MT4 and MT5 are available.

What is the minimum deposit required to open an account with Go Markets?

The minimum deposit required varies depending on the account type you choose. The Standard account requires a minimum deposit of $200, while the Pro account requires a minimum deposit of $300.

Is Go Markets a good broker for beginners?

Yes. It is a regulated broker that offers demo accounts and rich educational resources. But $200 minimum deposit requirement may be high for beginners.

Risk Warning

Trading online carries inherent risks, including the potential loss of invested capital.

News

News Best Forex Brokers in India: 2025 Edition

Have you been frustrated with your present forex broker and wish to invest in another broker, or are you a newbie wanting to try your hand in this dynamic market? This article answers both of your questions. In this article, you will learn about the best five forex brokers in India.

2025-01-08 18:48

News Italian Regulator Warns Against Go Markets Clone

Calling Your Attention! CONSOB, the Italian regulator, recently issued a warning against the clone of Go Markets, a well-known broker. This clone provides legitimate brokers. Below are the illegal websites you need to stay away from:

2024-11-29 19:41

News Go Markets: Is this broker a Go or No-Go?

GO Markets is an Australia-based Forex and CFDs broker founded in 2006. The broker provides 1000+ tradable CFD instruments including forex, shares, commodities, indices, metals, and treasuries. GO Markets is regulated by the ASIC in Australia, the CySEC in Cyprus, the FSC in Mauritius, and the FSA (Seychelles).

2024-08-20 19:45

News FX Analysis – Dollar dumps, Gold surges on Fed pivot

Wednesdays FOMC meeting was always going to be about whether we’d see a hawkish pushback against market expectations of a dovish Fed in 2024, or a validation of those expectations, from the market reaction to the meeting, traders decided the latter is the conclusion.

2023-12-15 11:32

News Market Analysis – USD surges, AUD hit by RBA, Oil and Gold continue decline

USD was bid in Tuesdays session with DXY finding strong support at its 200 Day MA and pushing up to test the big 104 figure before losing steam.

2023-12-08 12:22

News The Week Ahead – Charts to watch EURUSD, Crude Oil, Gold

Global markets enter the new week in a risk on tone with as market participants are positioning for no more rate hikes out of the Federal Reserve and pricing in cuts from Q2 2024.

2023-11-28 09:59

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now