Score

JFD

Cyprus|10-15 years|

Cyprus|10-15 years| https://www.jfdbrokers.com/en

Website

Rating Index

MT4/5 Identification

MT4/5

Full License

JFD-Live01

Influence

C

Influence index NO.1

Spain 3.87

Spain 3.87MT4/5 Identification

MT4/5 Identification

Full License

France

FranceInfluence

Influence

C

Influence index NO.1

Spain 3.87

Spain 3.87Contact

Single Core

1G

40G

1M*ADSL

- United KingdomFCA (license number: 580193) The regulatory status is abnormal, the official regulatory status is Unsubscribed. Please be aware of the risk!

Basic Information

Cyprus

Cyprus

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Users who viewed JFD also viewed..

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Taurex

- 5-10 years |

- Regulated in United Kingdom |

- Market Maker (MM) |

- MT4 Full License

Exness

- 10-15 years |

- Regulated in Cyprus |

- Market Maker (MM) |

- MT4 Full License

HFM

- 10-15 years |

- Regulated in Cyprus |

- Market Maker (MM) |

- MT4 Full License

Sources

Language

Mkt. Analysis

Creatives

Website

Most visited countries/areas

Cyprus

Malaysia

Algeria

jfdchina.com

Server Location

United States

Website Domain Name

jfdchina.com

Server IP

104.28.0.249

jfdbrokers.com

Server Location

United States

Most visited countries/areas

Israel

Website Domain Name

jfdbrokers.com

Website

WHOIS.CRONON.NET

Company

CRONON AG

Domain Effective Date

0001-01-01

Server IP

107.154.140.185

Genealogy

VIP is not activated.

VIP is not activated.JF-D

FX Options24

CBFX

Relevant Enterprises

Company Summary

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

| JFD Review Summary in 10 Points | |

| Founded | 2011 |

| Registered Country/Region | United Kingdom |

| Regulation | CySEC, BaFin, BDF |

| Market Instruments | Forex, Precious Metals, CFDs, Indices, Stocks, Crypto, Commodities, ETFs & ETNs |

| Demo Account | Available |

| Leverage | 1:30/1:400 |

| EUR/USD Spread | 0.3 pips |

| Trading Platforms | MT4+, MT5+, WebTrader, stock 3 |

| Minimum deposit | $/€/£/Fr500 |

| Customer Support | 24/5 live chat, phone, email |

What is JFD?

JFD, also known as JFD Group Ltd, is a multi-regulated online trading and investment services provider founded in 2011, headquartered in Limassol, Cyprus, with offices in Germany and Spain. The company offers access to a wide range of financial instruments, including Forex, CFDs, indices, stocks, commodities, and cryptocurrencies. JFD is known for its transparent and customer-centric approach, providing clients with advanced trading platforms, competitive pricing, and a range of educational resources.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

JFD offers several notable advantages, including multi-regulation from respected authorities, a wide range of financial instruments, and transparent pricing with competitive spreads and commissions. Traders can also benefit from advanced trading platforms and access to research and educational resources.

However, it's important to consider the higher minimum deposit requirement and the reports of withdrawal issues that some users have encountered.

| Pros | Cons |

| • Multi-regulated by CySEC, BaFin, BDF | • Reports of withdrawal issues |

| • Wide range of financial instruments | • Regional restrictions |

| • Demo accounts available | • Only one type of account |

| • Transparent pricing | • No Swap-free accounts |

| • Advanced trading platforms - MT4/5 | • Higher minimum deposit |

| • Multiple payment methods | • Deposit/withdrawal fees charged |

| • Research and educational resources |

Overall, JFD can be a suitable choice for traders looking for a regulated broker with diverse trading options, but it's crucial to exercise caution and conduct thorough research before making any decisions.

JFD Alternative Brokers

Hantec Markets - A reliable choice for traders with its strong regulatory oversight and competitive trading conditions.

FxPrimus - A trusted broker with a focus on client protection and a wide range of trading instruments, suitable for both beginner and experienced traders.

Vantage FX - An established broker offering diverse trading options, advanced platforms, and competitive pricing, making it a preferred choice for active traders.

There are many alternative brokers to JFD depending on the specific needs and preferences of the trader. Some popular options include:

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

Is JFD Safe or Scam?

JFD is regulated by reputable financial authorities such as Cyprus Securities and Exchange Commission (CYSEC, License No. 150/11), Germany Federal Financial Supervisory Authority (BaFin, License No. 126399), and France Banque de France (BDF, License No. 74013). These regulatory licenses indicate that JFD adheres to certain standards and regulations to ensure the safety and protection of client funds.

Additionally, the provision of negative balance protection is an added safety feature that safeguards clients from potentially owing more than their initial investment. However, it's important to note that while regulatory oversight and negative balance protection are positive factors, it's always recommended to conduct thorough research and due diligence before engaging with any broker.

Market Instruments

JFD offers 1,500+ financial instruments across 9 asset classes. The available instruments include Forex currency pairs, allowing traders to participate in the global currency market. Precious metals such as gold and silver are also available for those looking to invest in safe-haven assets.

Additionally, JFD offers Contracts for Difference (CFDs) on various indices, giving traders exposure to the performance of major stock indices around the world. Stocks of leading companies can also be traded, allowing investors to take positions in individual equities.

Furthermore, JFD provides access to cryptocurrencies, commodities, and ETFs & ETNs, offering opportunities for diversification and potential profit in these markets. With a comprehensive selection of market instruments, JFD caters to the diverse trading needs and strategies of its clients.

Accounts

JFD offers traders an account type with a minimum deposit of $/€/£/Fr500. While this requirement may be higher compared to some other brokers, it may attract more serious and experienced traders who are willing to commit a larger capital.

The margin call level of 100% ensures that traders receive notifications when their account equity falls below the required margin, helping them manage their positions effectively. The stop out level of 50% serves as a safety net, automatically closing positions when the account equity reaches a specified level, preventing further losses.

Additionally, JFD offers free demo accounts, allowing traders to practice and test their strategies in a risk-free environment before committing real funds.

Leverage

JFD is subject to the laws and regulations of each jurisdiction in which it operates. For this reason, JFD often employs a small leverage ratio. In addition, traders based in Europe can utilize a maximum leverage of 1:30 on Forex products, while traders based elsewhere who use JFD can ask for a leverage of up to 1:400. The leverage is 1:30 for major currency pairs, 1:20 for minor currency pairs, 1:20 for gold trading, 1:5 for silver trading, and 1:5 for stocks trading.

Spreads & Commissions

JFD offers competitive spreads and commissions on a wide range of trading instruments. The EUR/USD pair, for example, has a floating spread of approximately 0.3 pips, which is favorable for traders looking to engage in forex trading. The specific spreads for other trading instruments can be found on JFD's website or through the provided screenshot.

In terms of commissions, JFD charges $3/€2.75/£2.5/Fr3 per lot per side for forex and precious metals trading, providing transparency and clarity for traders. For indices and commodities, the commission is $/€/£/Fr0.1 per CFD per side, ensuring a cost-effective trading experience.

When it comes to stocks trading, JFD applies a commission structure of $0.02 per share with a minimum ticket charge of $5 per side for US stocks. For French, German, Dutch, Spanish, and UK stocks, the commission is 0.05% of the order volume with a minimum ticket fee of $5 per side.

Crypto trading does not attract any commission charges, making it an attractive option for traders interested in this asset class. Lastly, for ETFs & ETNs, JFD applies a commission of $0.025 per share with a minimum ticket charge of $5.

| Trading Instrument | Commission |

| Forex / precious metals | $3/ €2.75/£2.5/Fr3 per lot per side |

| Indices / commodities | $/€/£/Fr0.1 per CFD per side |

| US stocks | $0.02 per share / minimum ticket charge $5 per side |

| French / German / Dutch / Spanish / UK stocks | 0.05% of order volume / minimum ticket fee of $5 per side |

| crypto | 0% |

| ETFs / ETNs | $0.025 per share / minimum ticket charge $5 |

Overall, JFD's spreads and commissions are competitive and provide traders with transparent and fair pricing structures for their trading activities.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread (pips) | Commission (per lot per side) |

| JFD | 0.3 | $3/€2.75/£2.5/Fr3 (Forex / precious metals) |

| Hantec Markets | 0.2 | $6 |

| FxPrimus | 0.5 | $5 |

| Vantage FX | 0.0 | $7 |

Note: The information presented in this table may be subject to change and it is always recommended to check with the broker's official website for the latest information on spreads and commissions.

Trading Platforms

JFD provides a range of robust trading platforms to cater to the diverse needs of its clients. Traders have the option to choose from MetaTrader 4+ (MT4+), MetaTrader 5+ (MT5+), and JFD's own proprietary platform called Stock 3. The popular MetaTrader platforms offer advanced charting capabilities, a wide range of technical indicators, and the ability to execute trades efficiently.

Traders can access MT4+ and MT5+ not only on desktop but also through the web-based versions, known as MT4+ WebTrader and MT5+ WebTrader. These web-based platforms enable traders to access their accounts and trade from any device with an internet connection, providing flexibility and convenience.

Additionally, JFD's proprietary platform, Stock 3, offers a unique trading experience tailored to stock trading, providing traders with the tools and features necessary for efficient stock market analysis and execution.

With a choice of these powerful trading platforms, JFD ensures that traders have the tools and technology they need to execute their trading strategies effectively and make informed investment decisions.

See the trading platform comparison table below:

| Broker | Trading Platforms |

| JFD | MetaTrader 4+, MT4+ WebTrader, MetaTrader 5+, MT5+ WebTrader |

| Hantec Markets | MetaTrader 4, Currenex, Hantec Web Trader |

| FxPrimus | MetaTrader 4, MetaTrader 5 |

| Vantage FX | MetaTrader 4, MetaTrader 5, WebTrader |

Deposits & Withdrawals

JFD offers a variety of convenient and secure payment methods for both deposits and withdrawals. Traders can fund their accounts using popular options such as Visa, MasterCard, Maestro, Skrill, Neteller, nuvei, Sofort, bank wire, and payabl.

The minimum deposit requirement is set at $/€/£/Fr500, ensuring accessibility for traders with different budget sizes.

JFD minimum deposit vs other brokers

| JFD | Most other | |

| Minimum Deposit | $/€/£/Fr500 | $100 |

Deposit and withdrawal fees may vary depending on the chosen payment method. To obtain specific details regarding these fees, traders can refer to the broker's website.

Customer Service

JFD values the importance of excellent customer service and aims to provide reliable support to its clients. With a dedicated team available 24/5, traders can reach out to JFD through various channels, including email, telephone, and live chat. This ensures prompt assistance and allows traders to address any inquiries or trading-related issues they may encounter.

In addition to traditional communication methods, JFD also maintains an active presence on popular social media platforms such as Linkedin, Twitter, Facebook, YouTube, and Telegram. By following JFD on these platforms, traders can stay updated on the latest news, market insights, educational resources, and more.

JFD also provides a Frequently Asked Questions (FAQ) section on its website where you can find answers to common queries regarding account opening, platform usage, and more. The FAQ section can be a helpful resource for obtaining quick and concise information about various aspects of trading with JFD.

The comprehensive customer service offered by JFD reflects their commitment to ensuring a positive trading experience for their clients.

| Pros | Cons |

| • Multiple contact channels | • No 24/7 customer support |

| • 24/5 live chat support | |

| • Active presence on popular social media | |

| • FAQ section is available |

Note: These pros and cons are subjective and may vary depending on the individual's experience with JFD's customer service.

User Exposure at WikiFX

On our website, you can see that some reports of unable to withdraw. Traders are encouraged to carefully review the available information and consider the risks associated with trading on an unregulated platform. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Education

JFD provides a range of educational resources to support traders in enhancing their knowledge and skills in the financial markets. Traders can benefit from research and analysis materials, which offer insights into market trends, news, and technical analysis.

Additionally, JFD offers webinars and live events where traders can learn from industry experts and gain practical trading tips. The broker also provides a comprehensive trading glossary, which serves as a valuable reference tool for understanding trading terminology and concepts.

By offering these educational resources, JFD demonstrates its commitment to empowering traders and equipping them with the necessary knowledge to make informed trading decisions.

Conclusion

In conclusion, JFD is a regulated broker with a strong reputation and years of industry experience. It offers a diverse range of financial instruments, competitive spreads, and commissions. The availability of multiple trading platforms, along with research and educational resources, adds to its appeal. However, it's worth noting the higher minimum deposit requirement and some reports of withdrawal issues. Traders should carefully consider these factors and conduct their own due diligence before engaging with JFD. Overall, JFD presents a solid option for traders seeking a regulated brokerage, but caution is advised.

Frequently Asked Questions (FAQs)

| Q 1: | Is JFD regulated? |

| A 1: | Yes. It is regulated by CySEC, BaFin, and BDF. |

| Q 2: | At JFD, are there any regional restrictions for traders? |

| A 2: | Yes. A restriction on offering investment services applies to residents of certain jurisdictions including the USA, Russia, Belarus, Poland, Latvia, Japan, Australia, New Zealand, Singapore, Egypt, Czech Republic, UK and to residents of other countries whose domestic regulations classify such investment offering as prohibited. |

| Q 3: | Does JFD offer demo accounts? |

| A 3: | Yes. |

| Q 4: | Does JFD offer the industry leading MT4 & MT5? |

| A 4: | Yes. It supports MT4+, MT5+, WebTrader, and stock 3. |

| Q 5: | What is the minimum deposit for JFD? |

| A 5: | The minimum initial deposit to open an account is $/€/£/Fr500. |

| Q 6: | Is JFD a good broker for beginners? |

| A 6: | No. It is not a good choice for beginners. Though it is a regulated broker and offers quite competitive trading conditions and the leading trading platforms, the initial deposit requirement is too high for beginners. |

Keywords

- 10-15 years

- Regulated in Cyprus

- Regulated in Vanuatu

- Market Maker (MM)

- Retail Forex License

- MT4 Full License

- MT5 Full License

- Global Business

- United Kingdom European Authorized Representative (EEA) Unsubscribed

- Medium potential risk

- Offshore Regulated

News

News WIKIFX REPORT: Will Amadeus IT Stock Make Another Push Higher?

Looking at the technical picture of the Amadeus IT Group SA (BME: AMS) stock on our 4-hour chart we can see that as of yesterday, the share price managed to overcome a short-term tentative downside resistance line taken from the high of May 30th. For now, AMS continues to trade above that line, meaning that more byers might see it as a good sign to step in. We will take a positive approach for now.

2022-10-25 13:53

News WIKIFX REPORT: Can USD/ZAR Go For A Higher High?

Looking at the technical picture of USD/ZAR on our daily chart, we can see that after reversing higher at the end of March, the pair is now trading above a short-term upside support line taken from the low of April 13th. That said, the rate is currently trading below a key resistance area between the 16.1848 and 16.3195 levels, marked by the highs of June 13th and May 16th respectively. In order to aim further north, we would prefer to wait for a push above that resistance area first.

2022-10-25 13:48

News WIKIFX REPORT: Will Amadeus IT Stock Make Another Push Higher?

Amadeus IT Group SA has risen higher in 8 of those 11 years over the subsequent 52-week period, corresponding to a historical accuracy of 72.73%. Looking at the technical picture of the Amadeus IT Group SA (BME: AMS) stock on our 4-hour chart we can see that, today, the share price managed to overcome a short-term tentative downside resistance line taken from the high of May 30th.

2022-09-06 19:20

News WIKIFX REPORT: Waiting For The Fraport AG Stock To Exit The Range

Looking at the technical picture of the Fraport AG (ETR: FRA) stock on our daily chart, we can see that from around the beginning of March, the share price is trading in a range, roughly between the 45.50 and 55.12 levels. Before entering the range, the prevailing trend was to the downside. The price is currently closer to the lower bound of that range, meaning that there is a good chance to see a breakout lower. That said, as long as the stock continues to stay inside that range, we will keep a neutral approach.

2022-09-06 19:18

Comment 4

Content you want to comment

Please enter...

Comment 4

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

Kristy780996

Hong Kong

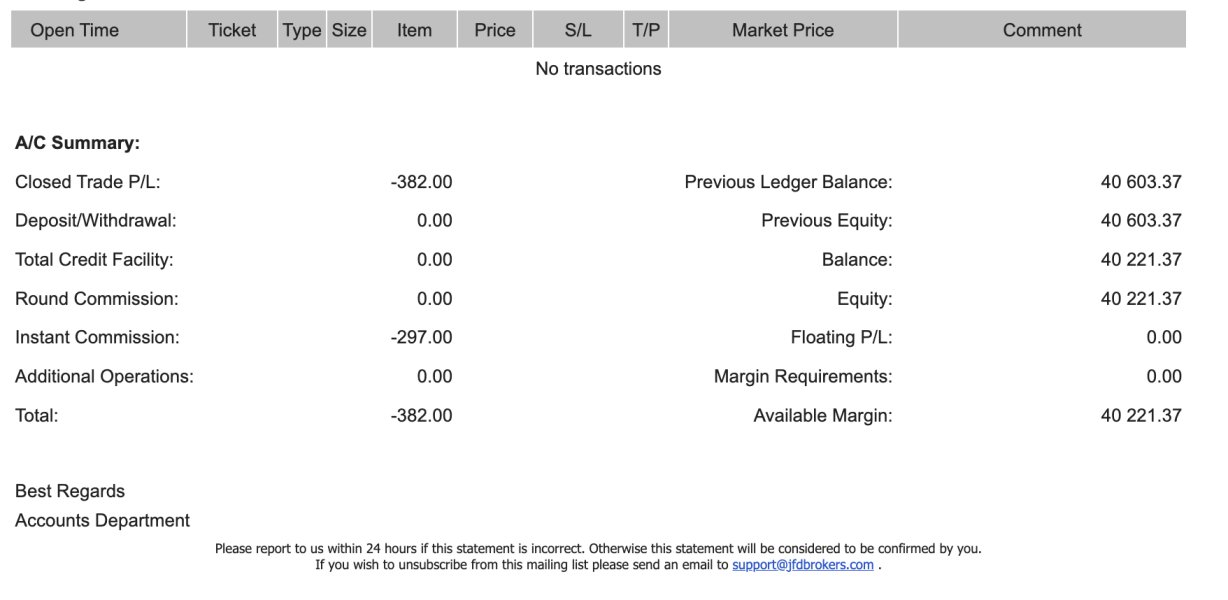

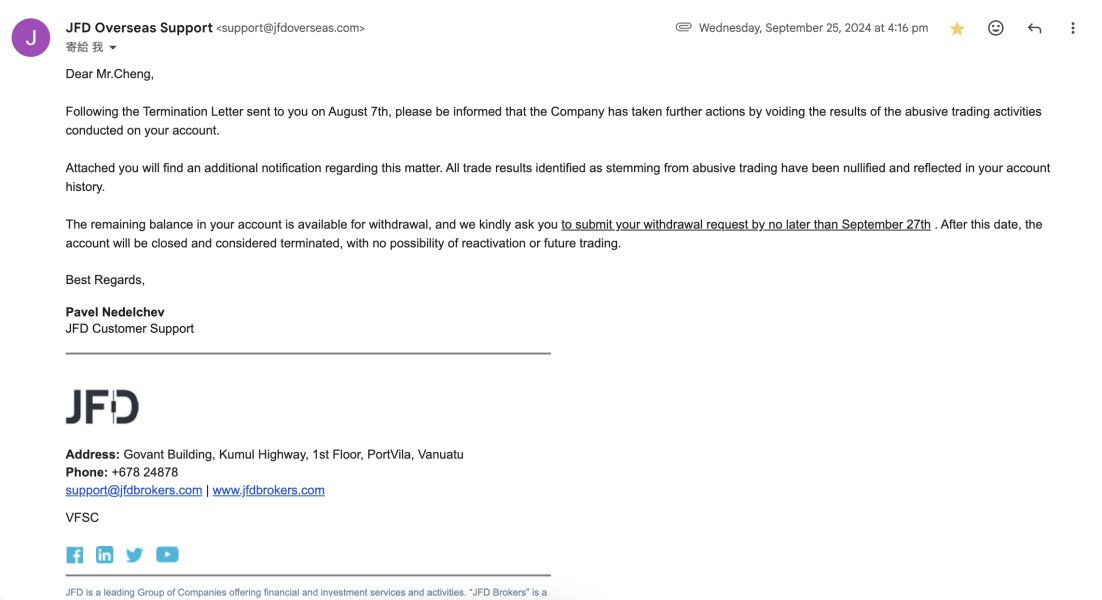

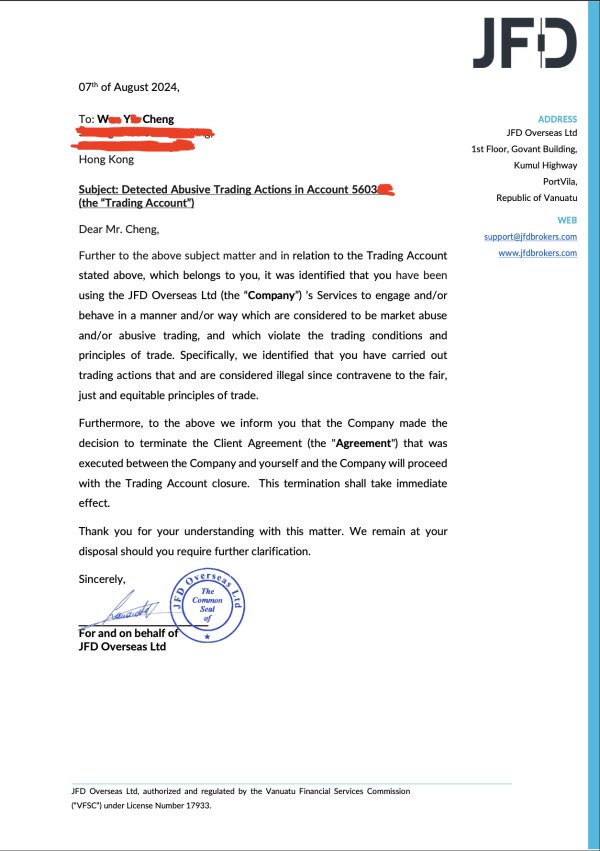

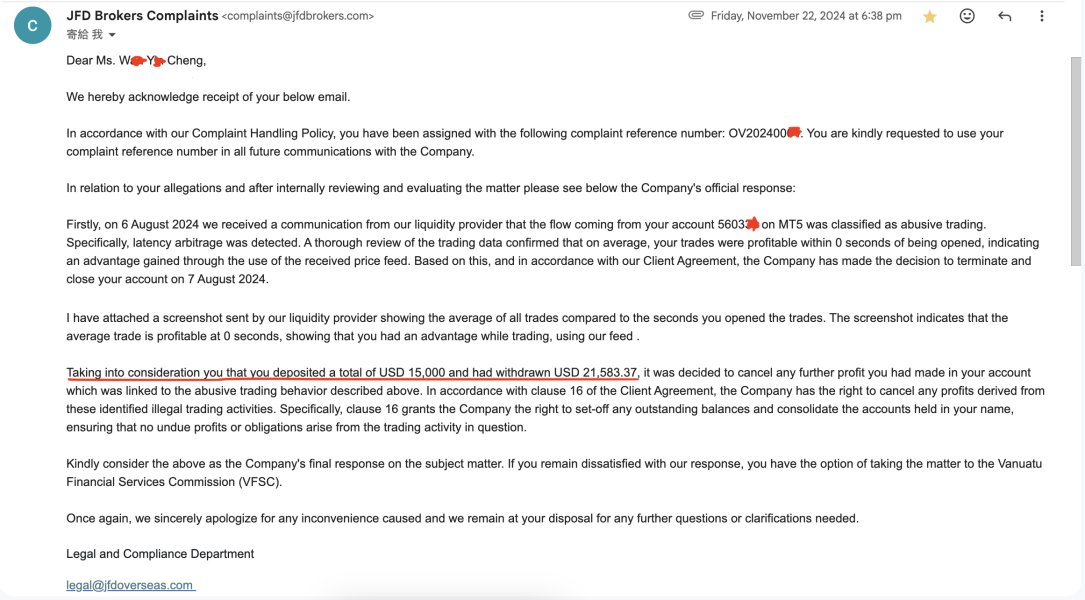

I must share my recent extremely unpleasant experience with JFD Brokers. As a brokerage that claims to be professional and reputable, their actions are shocking and completely unacceptable. I initially deposited only $15,000 into my trading account with JFD Brokers and successfully withdrew $21,583.37 during my trading activities. However, when my account had accumulated approximately $40,000 in profits, JFD Brokers arbitrarily cancelled my account and deducted all my profits! This behavior is clearly unjustified, raising serious suspicions that they acted simply because I earned “too much” profit from my trading. As a brokerage claiming professionalism and credibility, such actions not only violate the principles of fair trading but also betray the trust of their clients. I have already filed an official complaint with the Cyprus Securities and Exchange Commission (CySEC), urging the regulatory authority to investigate and take appropriate actions. I strongly condemn this irresponsi

Exposure

01-13

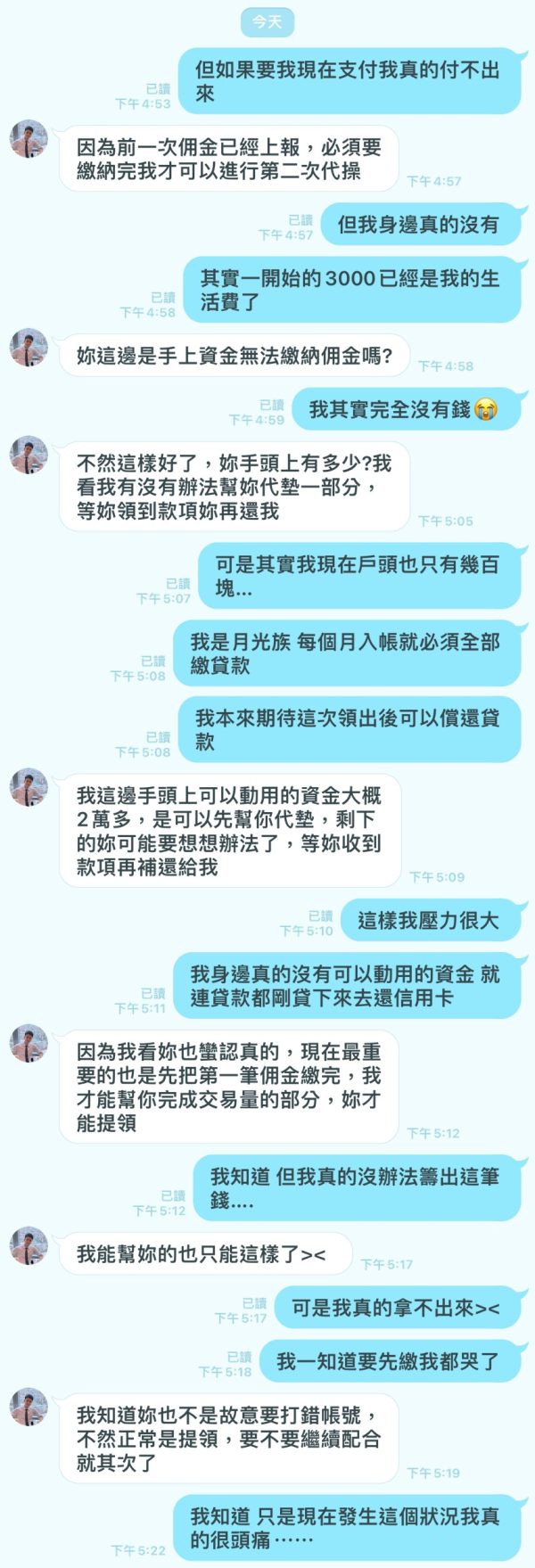

FX8293462832

Taiwan

At first, I just wanted to find other ways to increase my income. Then, I joined the official line account after seeing the FB advertisement. At first, the editor asked me to use Huobi to make a deposit of 3000. Later, the system customer service opened a platform account and then found a specialist to operate it for me. Then, they said that there is a reward of 7000, but to be able to withdraw the money, it takes 30 times of the principal to withdraw, which is 30 times of the 10,000. Then there will be appointments for the practice from time to time until the commissioner said that it can be withdrawn after the end of the practice yesterday so I provided my account the platform. The customer service said the bank's business hours, so they will handle it today, but later they said that the financial control department said that the account was filled incorrectly and could not withdraw the money. The original profit will be refunded, but the money can only be withdrawn after the operation has reached 3 times the transaction volume and tell me that commissioner will help me. I asked the commissioner to assist and then I also told the commissioner that the commissioner said that he could assist, but the technical commission in the front has to be paid first, and the total cost is 51,000. If you don’t pay first, you can’t do the next action. I told him that I don’t have any money, but he said that he can help me pay more than 20,000 and I will handle the rest and then continue to operate after paying. I have always said that I have no way to pay. I always spend all my money in that month and I have lots of debt. Although it is nothing for now but I'm worried about my account.

Exposure

2022-01-21

QQ糖

Hong Kong

JFD profits cannot be withdrawn, and must reach 80% of the recharge amount to withdraw

Exposure

2021-01-30

毛毛19107

Hong Kong

I've traded JFD brokers for more than two year, and I am quite statisfied with their services . I mainly used JFD for trading currency pairs, with low trading costs, competitive spreads. The customer support responsive and answer my questions politely with enough details. Spreads are quite stable, but I expect lower spreads.

Positive

2022-11-15