Score

FP Markets

Seychelles|15-20 years| Benchmark AAA|

Seychelles|15-20 years| Benchmark AAA|https://www.fpmarkets.com

Website

Rating Index

Benchmark

Benchmark

AAA

Average transaction speed (ms)

MT4/5

Full License

FPMarketsLLC-Demo

Influence

AA

Influence index NO.1

Spain 8.25

Spain 8.25Benchmark

Speed:AAA

Slippage:AA

Cost:AA

Disconnected:AA

Rollover:AA

MT4/5 Identification

MT4/5 Identification

Full License

United States

United StatesInfluence

Influence

AA

Influence index NO.1

Spain 8.25

Spain 8.25Contact

100% Mediation in the complaints

Response of EMC during7working days

Single Core

1G

40G

1M*ADSL

Basic Information

Seychelles

Seychelles 2024 SkyLine Thailand

2024 SkyLine ThailandAccount Information

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Benchmark

Sources

Language

Mkt. Analysis

Creatives

Website

Most visited countries/areas

Australia

fpmarkets.eu

Server Location

United States

Website Domain Name

fpmarkets.eu

Server IP

104.26.14.16

firstprudentialmarkets.com

Server Location

United States

Website Domain Name

firstprudentialmarkets.com

Server IP

104.21.65.168

fpmarkets.com.cn

Server Location

Singapore

Website Domain Name

fpmarkets.com.cn

Website

WHOIS.CNNIC.CN

Company

阿里云计算有限公司(万网)

Domain Effective Date

2015-08-28

Server IP

202.160.129.164

Genealogy

VIP is not activated.

VIP is not activated.Fake FP Markets

FP Markets

FP Markets

Relevant Enterprises

AMF GLOBAL SERVICES LIMITED

Secretary

Start date

--

Status

Employed

FIRST PRUDENTIAL MARKETS LTD(Cyprus)

CRAIG MCKINLAY ALLISON

Director

Start date

--

Status

Employed

FIRST PRUDENTIAL MARKETS LTD(Cyprus)

ΚΩΝΣΤΑΝΤΙΝΟΣ ΔΗΜΗΤΡΙΟΥ

Director

Start date

--

Status

Employed

FIRST PRUDENTIAL MARKETS LTD(Cyprus)

Company Summary

| Quick FP Markets Review Summary | |

| Founded | 2005 |

| Registered Country | Australia |

| Regulation | ASIC, CySEC |

| Trading Instruments | 70+ forex currency pairs, 10,000+ stocks, 19 indices, commodities, bonds, metals, digital currencies |

| Demo Account | ✅ (30 days) |

| Islamic Account | ✅ |

| Account Type | Standard, Raw |

| Leverage | Up to 1:500 |

| Spread | From 1.0 pips (Standard account) |

| Trading Platform | MT4/5, TradingView, cTrader, FP Markets Trading App |

| Min Deposit | $100 AUD or equivalent |

| Payment Methods | Visa, MasterCard, BPAY, UnionPay, POLi, PayPal, Skrill, Neteller, Fasapay, Bank Transfer |

| Deposit Fee | ❌ |

| Withdrawal Fee | ✔ |

| Customer Support | 24/7 live chat |

| Tel: +44 20 3831 3622 | |

| Email: supportsc@fpmarkets.com | |

| Regional Restrictions | Afghanistan, Cuba, Islamic Republic of Iran, Iraq, Liberia, Libya, Myanmar, Palestine, Russian Federation, Somalia, Syrian Arab Republic, Sudan, Yemen, United States |

FP Markets Information

FP Markets is an Australian-based online brokerage firm that offers various trading instruments including 70+ forex currency pairs, 10,000+ stocks, 19 indices, commodities, bonds, metals, and digital currencies. The company was founded in 2005 and is regulated by the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC).

FP Markets provides clients with access to multiple trading platforms including MT4/5, TradingView, cTrader, and FP Markets Trading App. The broker also offers two live account types, Standard and Raw, with the minimum deposit of $100 AUD or equivalent amount. In addition, the company offers free demo accounts for traders to test their strategies in a risk-free environment.

When it comes to trading conditions, FP Markets is known for its competitive spreads and low commissions. The broker also offers high leverage options of up to 500:1 for forex trading. Additionally, the broker offers 24/7 customer support and rich educational resources such as webinars, trading guides, and video tutorials, which can help both novice and experienced traders to improve their trading skills.

Pros & Cons of FP Markets

FP Markets has several pros, including its strong regulatory framework, low trading fees, diverse range of financial instruments, and robust trading platforms.

However, some potential cons of FP Markets include limited live trading account types, withdrawal fees charged, and the fact that the broker is not available to clients from certain countries.

| Pros | Cons |

| Regulated by reputable authorities (ASIC, CySEC) | Regional restrictions |

| Various tradable instruments supported | Limited live account types |

| Website easy to navigate | Minimum deposit not the friendiest compared to other brokers |

| Low spreads and competitive pricing | Withdrawal fee charged for some methods |

| Generous leverage up to 1:500 | |

| Rich educational resources available | |

| Negative balance protection | |

| Multiple trading platforms - MT4/5, TradingView, cTrader, FP Markets Trading App | |

| High-quality customer service and support |

Is FP Market Legit?

Yes, FP Markets is a regulated broker. They are regulated by two reputable regulatory bodies: the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC).

ASIC is known for its strict regulations and is considered to be one of the most trusted regulators in the world. CySEC is also a reputable regulator and is responsible for regulating the financial markets in Cyprus, which is an important hub for forex and CFD trading. FP Markets' adherence to these regulatory bodies' rules and regulations ensures its transparency, and fairness in its operations.

Market Intruments

FP Markets offers over various market instruments for traders to choose from, including 70+ forex currency pairs, 10,000+ stocks, 19 indices, commodities, bonds, metals, and digital currencies.

With Forex, traders can access major currency pairs, as well as minor and exotic currency pairs.

For indices, FP Markets offers a selection of popular indices from around the world, including the S&P 500, NASDAQ, FTSE 100, DAX 30, and more.

In the commodities market, traders can trade precious metals like gold and silver, as well as oil, natural gas, and other commodities.

FP Markets also offers trading in cryptocurrencies, such as Bitcoin, Ethereum, and Litecoin, as well as shares from various exchanges, including the NYSE and NASDAQ.

Account Types

When it comes to FP Markets' account types, there are a few important things to consider. Firstly, it is worth noting that the available account types depend on which trading platform you choose to use. The MT4 and MT5 platforms offer Standard and Raw account types.

Let's take a closer look at each account type. The Standard account offers commission-free trading with spreads starting from 1.0 pips, while the Raw account offers commission-based trading with spreads starting from 0.0 pips. The Raw account is designed for traders who require lower spreads and are willing to pay a commission for the privilege.

The minimum deposit requirement is $100 AUD or equivalent for both account types.

Demo Accounts

FP Markets offers free demo accounts for both the MT4 and MT5 platforms, allowing traders to practice their strategies and familiarize themselves with the platforms before opening a live trading account. The demo accounts provide access to real-time market data, competitive spreads, and a range of trading tools, making it an ideal option for traders of all levels to test their trading skills without risking their capital.

One of the key advantages of FP Markets' demo accounts is that they allow traders to experience the same trading conditions as their live accounts, giving them a realistic view of the market environment. In addition, the demo accounts are unlimited, meaning that traders can practice for as long as they want without any time restrictions.

FP Markets' demo accounts are valid for 30 days.However, if you require an extension, you can contact their customer support team to request it. They may extend the demo account for an additional 30 days.

Islamic Accounts

FP Markets also offers Islamic or swap-free accounts to clients who follow the Muslim faith and cannot receive or pay interest due to religious reasons. These accounts comply with Sharia law and allow traders to hold positions overnight without incurring any rollover fees or interest charges.

FP Markets' Islamic accounts are available for all account types, including the Standard and Raw accounts for MT4 and MT5. Traders can open an Islamic account by submitting a request to the FP Markets support team, which will review and approve the application.

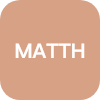

How to Open an Account?

Here is some more detailed information about how to open an account with FP Markets:

To begin the account opening process, prospective clients can go to the FP Markets website and click on the “OPEN LIVE” button. They will then be directed to a page where they can choose between opening a live or a demo account.

After selecting the account type, clients will need to fill out an application form that requires personal and financial information. This includes details such as their full name, email address, phone number, country of residence, and employment status.

Clients will also need to provide some identification documents, such as a passport or national ID card, as well as proof of address, which could be in the form of a utility bill or bank statement. FP Markets takes security seriously and has a strict verification process to ensure the safety of client funds and information.

Once the application has been submitted and the client's identity and address have been verified, they will receive an email with their login credentials and instructions on how to fund their account. FP Markets offers a variety of payment options, including Visa, MasterCard, BPAY, UnionPay, POLi, PayPal, Skrill, Neteller, Fasapay, and Bank Transfer.

Leverage

The leverage offered by FP Markets for other instruments varies based on the type of instrument and the entity under which it operates. For example, the Australian entity of FP Markets offers a maximum trading leverage of up to 1:500 for major forex trading, while the CySEC entity offers a maximum trading leverage of up to 1:30 for forex trading. Besides, for commodities and indices, the maximum leverage available is usually lower than for forex trading.

Please bear in mind that trading with leverage involves a higher degree of risk, and traders should use it wisely and with caution. It is always advisable to understand the risks involved and have a sound risk management plan in place before using leverage in trading.

Spreads & Commissions

FP Markets offers competitive spreads and commissions for its traders.

The spreads for forex trading start from as low as 0.0 pips, depending on the type of account and trading platform.

The Raw account, which is available on both the MT4 and MT5 trading platforms, charges a commission of $3 per side per lot traded, while the Standard account has no commission but slightly wider spreads.

| Account Type | Spread | Commission |

| Standard | From 1.0 pips | ❌ |

| Raw | From 0.0 pips | USD $3 per lot |

You can find more real-time spreads by searching on https://www.fpmarkets.com/sc/en-hk/forex-spreads/

Trading Platforms

FP Markets offers its clients a variety of trading platforms to choose from, including MT4/5, TradingView, cTrader, and FP Markets Trading App.

The MT4 platform is well-known for its user-friendly interface and extensive range of analytical tools, making it a popular choice among traders of all levels. The MT5 platform is an upgraded version of MT4, offering additional features such as more timeframes, additional order types, and advanced technical analysis tools.

Please note that FP Markets charges fees, which depend on the account type and trading platform being used.

Specifically, Standard account holders using any platforms are charged zero commissions for all trading assets, while Raw account holders using MT4/5 platforms are charged a commission of $3.5 per lot for forex and metals trades, and Raw account holders using cTrader platform are charged a commission of $3 USD per lot.

Copy/Social Trading

FP Markets presents robust copy trading services.The options include an embedded MT4 service from a leading algorithmic broker, an embedded MT5 service ideal for equity CFD copy trading, and an embedded cTrader service as a reasonable MT4 alternative.

Additionally, traders can leverage the well-trusted third-party service Myfxbook AutoTrade or explore the fee-based emerging alternative Signal Start.

Furthermore, FP Markets provides an in-house maintained copy trading service, FP Markets Social Trading, catering to traders seeking a proprietary solution.

Deposit & Withdrawal

FP Markets requires a minimum deposit of $100 AUD or equivalent. This means that you can not open an account with FP Markets unless you deposit at least $100. However, it is important to note that some payment methods may require a higher minimum deposit. For example, if you are using a bank wire transfer, the minimum deposit may be higher than $100 due to processing fees.

The following is a table showing the comparison of the minimum deosit required by FP Markets and other brokers, Pepperstone, XM, and IC Markets Global:

| Broker | Minimum Deposit |

| A$100 or equivalent |

| $200 |

| $5 |

| $200 |

FP Markets offers a variety of convenient deposit and withdrawal methods to ensure that clients can easily fund and withdraw their accounts. Clients can deposit funds using credit/debit cards, bank wire transfers, electronic wallets such as Neteller and Skrill. FP Markets does not charge any deposit fees, and the processing time for deposits is usually instant or up to 1 business day, depending on the deposit method.

For withdrawals, clients can use the same methods they used for depositing, and FP Markets does not charge any fees for most withdrawal methods. Withdrawal processing times vary depending on the method used, with electronic wallets usually taken instantly, while international bank wire can take up to 5 days. Clients are advised to verify their accounts before making a withdrawal to avoid any delays or complications in the withdrawal process.

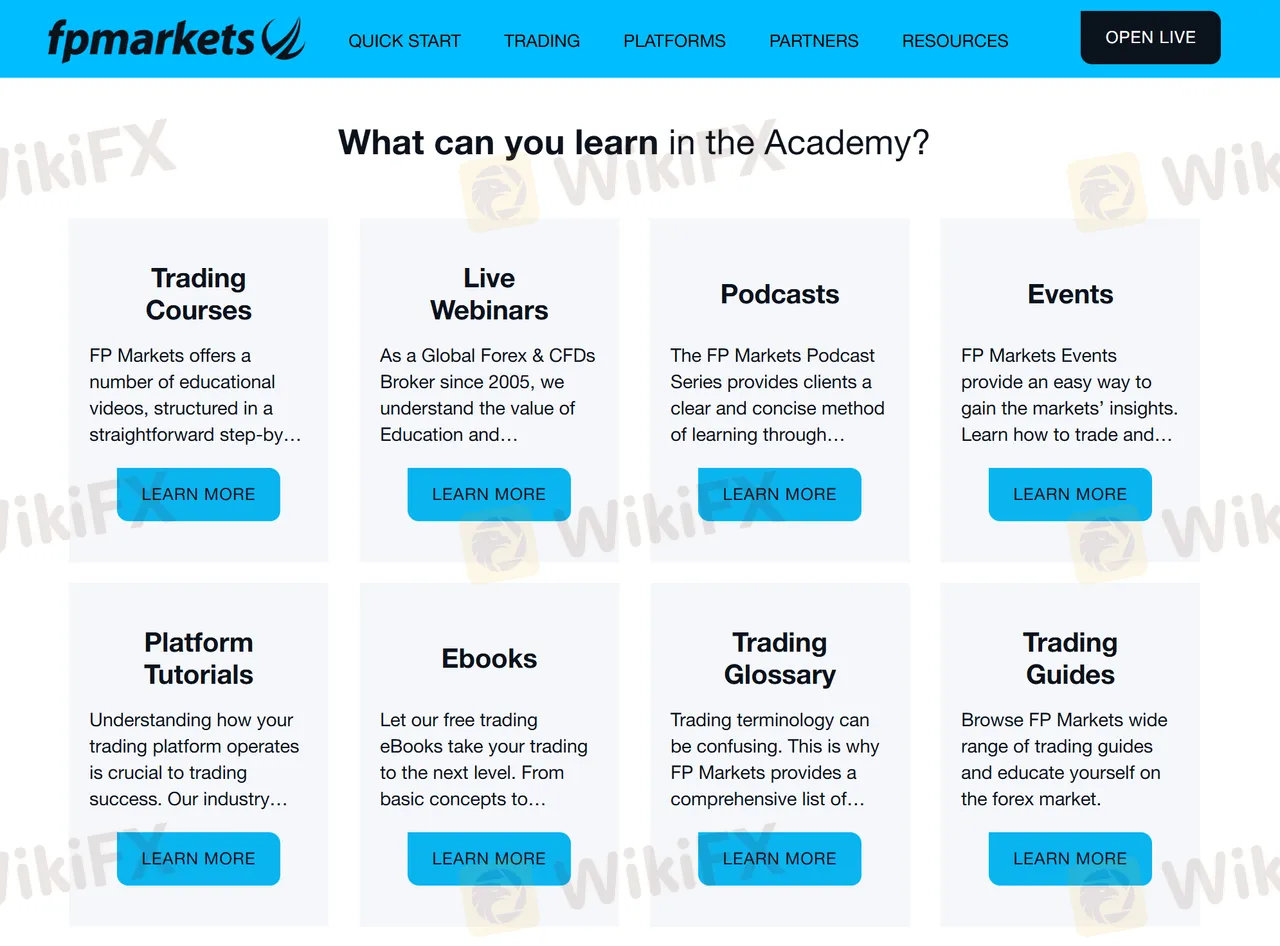

Educational Resources

FP Markets offers some educational resources to help traders improve their knowledge and skills in trading. These resources include video tutorials, webinars, podcasts, trading guides, ebooks, glossary, etc. The broker also provides a demo account for traders to practice their trading strategies without risking real money.

Overall, the educational resources provided by FP Markets are comprehensive and easily accessible to traders. The broker's commitment to educating its clients is commendable, and it shows that it values the success of its clients.

Customer Support

FP Markets offers various customer support options to its clients, including email, phone, and live chat.Additionally, FP Markets offers multilingual support in various languages, including English, Chinese, Spanish, Portuguese, and more.

In addition, FP Markets has an extensive FAQ section on their website that covers a wide range of topics and can help clients find answers to their questions quickly. 24/7 customer support is a significant advantage for clients who may need assistance outside of regular business hours.

Keywords

2024 SkyLine Thailand

- 15-20 years

- Regulated in Australia

- Regulated in Cyprus

- Market Maker (MM)

- Straight Through Processing (STP)

- MT4 Full License

- MT5 Full License

- Global Business

News

News 5 MOST RELIABLE BROKERS IN INDIA 2025

Is the Forex market appealing to you? You want to enter and experience the excitement of this vibrant, massive FX market. But for some reason, you might not join in 2024. But Do you plan to enter the Forex market in 2025? Then, you must be aware of which brokers are trustworthy, profitable to invest in, and legitimate. In this article, we will tell you about the best Forex brokers in India 2025.

2024-12-18 19:47

News FP Markets Partners with xsee to Offer Live Trading Signals

FP Markets partners with xsee to provide real-time trading signals, empowering traders with expert strategies and data-backed insights for informed decisions.

2024-11-07 14:22

News FP Markets Secures Three Major Honours at the Inaugural Finance Magnates Annual Award Gala

Australian-founded broker FP Markets further cemented its position as a market leader,winning ‘Most Trusted Broker - Global’, ‘Broker of the Year - Asia’, and Fastest GrowingBroker - LATAM at the inau

2024-11-05 09:39

News FP Markets Received Three Major Awards

The prominent multiasset broker FP Markets won three major awards: “Most Trusted Broker—Global," “Broker of the Year—Asia," and “Fastest Growing Broker—LATAM” at the inaugural Finance Magnates Annual Award (FMAA) Gala. The event happened on Wednesday, October 23, at the Lemon Park Venue in Nicosia, Cyprus.

2024-11-04 18:34

News FP Markets Team Attends Forex Expo Dubai 2024 And Brings Home Two Awards

FP Markets, a global multi-asset Forex and CFD broker, participated in the Forex Expo Dubai 2024 earlier this month. The largest trading event in the Middle East took place in Dubai, UAE, fr

2024-10-17 17:48

News FP Markets Wins Treble at The Global Forex Awards

Following recent success at the Finance Magnates Pacific Summit in Australia earlier this month, multi-asset Forex and CFD broker, FP Markets, was presented with three coveted Global Forex Awards at a

2024-09-18 09:38

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now