Score

DMA Capitals

Saint Lucia|2-5 years|

Saint Lucia|2-5 years| https://dmacapitals.com

Website

Rating Index

MT4/5 Identification

MT4/5 Identification

Full License

United States

United StatesContact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

Saint Lucia

Saint Lucia

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Users who viewed DMA Capitals also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Exness

- 10-15 years |

- Regulated in Cyprus |

- Market Maker (MM) |

- MT4 Full License

Pepperstone

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

VT Markets

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Website

dmacapitals.com

Server Location

United States

Website Domain Name

dmacapitals.com

Server IP

108.175.3.102

Company Summary

| Aspect | Information |

| Company Name | DMA Capitals |

| Registered Country/Area | Saint Vincent and the Grenadines |

| Founded year | 2021 |

| Regulation | Unregulated |

| Market Instruments | Forex, Commodities, Indices, Stocks |

| Account Types | STANDARD, UNIVERSAL, PRO, VIP |

| Minimum Deposit | $10 |

| Maximum Leverage | 1:500 |

| Spreads | Starting from 0.3 pips |

| Trading Platforms | MT5 |

| Customer Support | 24/7 support via email at support@dmacapitals.com , phone line at +971 56 994-3431, and live chat |

| Deposit & Withdrawal | Bank Transfer, MasterCard, Perfect Money, Bitcoin, USDT |

Overview of DMA Capitals

DMA Capitals, established in 2021 in Saint Vincent and the Grenadines, offers a wide range of trading assets, including forex, commodities, indices, and stocks.

With over 1000 assets available for trading, it provides traders with various investment opportunities. The platform boasts competitive spreads, starting as low as 0.3 pips, and offers leverage of up to 1:500, enhancing trading flexibility.

However, DMA Capitals operates without regulation, potentially posing risks to investors. Additionally, some users have reported withdrawal issues, indicating potential challenges in accessing funds.

Despite these drawbacks, DMA Capitals provides access to the popular MT5 platform and offers multiple payment options for client convenience.

Regulatory Status

DMA Capitals operates without authorization from the NFA, indicating a lack of regulatory oversight in its operations.

This absence of regulatory backing deters traders seeking a secure and compliant trading environment, as it raises doubts about the platform's adherence to industry standards and investor protection measures.

Pros and Cons

| Pros | Cons |

| Spreads as low as 0.3 pips | Unregulated |

| Multiple payment options including Bank Transfer, MasterCard, Perfect Money, Bitcoin, USDT | Withdrawal issues reported by users |

| Access to MT5 platform | |

| Over 1000 assets available for trading, including forex, commodities, indices, and stocks | |

| Leverage up to 1:500 |

Pros:

Spreads as low as 0.3 pips: DMA Capitals offers highly competitive spreads, starting from as low as 0.3 pips for major currency pairs like EURUSD. Low spreads reduce trading costs for investors and can potentially enhance profitability.

Multiple payment options: DMA Capitals provides a wide range of payment methods, including Bank Transfer, MasterCard, Perfect Money, Bitcoin, and USDT.

Access to MT5 platform: DMA Capitals grants access to the MetaTrader 5 (MT5) trading platform, a renowned platform in the financial industry. MT5 offers advanced charting tools, technical indicators, and automated trading functionalities.

Over 1000 assets available for trading: DMA Capitals boasts a vast selection of assets available for trading, encompassing forex, commodities, indices, and stocks.

Leverage up to 1:500: DMA Capitals offers leverage of up to 1:500, allowing traders to amplify their trading positions significantly.

Cons:

Unregulated: DMA Capitals operates without regulation from financial authorities such as the NFA, raising risks about investor protection and regulatory oversight.

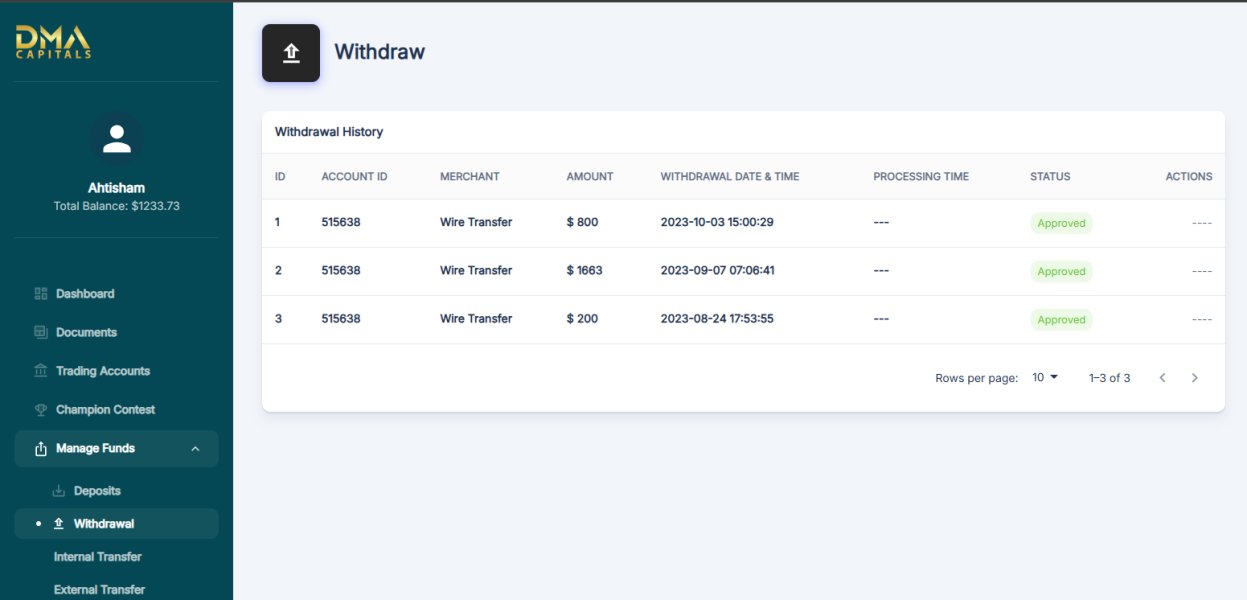

Withdrawal issues reported by users: Some users have reported difficulties in withdrawing funds from their DMA Capitals accounts, despite allegedly making profits. Complaints about withdrawal issues raise risks about the platform's reliability and transparency in handling client funds.

Market Instruments

DMA Capitals offers a wide range of trading assets, providing traders with access to over 1000 assets.

These include CFD Forex, allowing investors to engage in currency trading, CFD Commodities for trading in various raw materials like gold, oil, and agricultural products, CFD Indices offering exposure to global stock market indices such as the S&P 500 and FTSE 100, and CFD Stocks enabling traders to speculate on the price movements of individual company shares.

Account Types

A total of four trading accounts are available with DMA Capitals, including Standard, Universal, Pro, and VIP.

The STANDARD account type offered by DMA Capitals requires a minimum deposit of $10, making it accessible to traders who are just starting or have limited capital. With a spread starting at 1.8 pips for EURUSD, this account suits those who prefer trading with wider spreads and are less sensitive to transaction costs. The absence of commissions makes it attractive for traders looking to avoid additional fees, particularly those engaging in lower trading volumes. Its maximum leverage of 1:500 and unlimited number of transactions provide flexibility.

The UNIVERSAL account type requires a higher minimum deposit of $50 but offers tighter spreads, starting at 1.1 pips for EURUSD. This account is suitable for traders who value competitive pricing and are willing to commit a slightly larger initial investment. With a commission of $7 per lot, it may appeal to traders who prioritize lower transaction costs over spread width. Like the STANDARD account, it offers a maximum leverage of 1:500 and unlimited transactions.

The PRO account type targets more experienced traders with a minimum deposit requirement of $100. With a minimum spread of 0.6 pips for EURUSD, it is suitable for traders who demand tighter spreads for optimal trading conditions. While it offers a slightly lower commission of $6 per lot compared to the UNIVERSAL account, it maintains similar leverage and transaction capabilities. The PRO account's features make it suitable for traders with a higher risk tolerance and a preference for more competitive pricing structures.

The VIP account type is designed for seasoned traders and institutional investors, requiring a substantial minimum deposit of $500. With a minimum spread of 0.3 pips for EURUSD, it offers the tightest spreads among the account types, appealing to traders who prioritize precision and efficiency in their trades. The commission of $5 per lot further enhances its cost-effectiveness for high-volume trading. With identical leverage and transaction allowances as the other account types, the VIP account provides elite trading conditions for discerning traders seeking top-tier service and performance.

| ACCOUNT TYPES | STANDARD | UNIVERSAL | PRO | VIP |

| Minimum Deposit | $10 | $50 | $100 | $500 |

| Minimum Spread (EURUSD) | 1.8 pip | 1.1 pip | 0.6 pip | 0.3 pip |

| Minimum Lot Size | 0.01 | 0.01 | 0.01 | 0.01 |

| Maximum Lot Size | 100 | 100 | 100 | 100 |

| Commissions | 0 | $7 per lot | $6 per lot | $5 per lot |

| Maximum Leverage | 1:500 | 1:500 | 1:500 | 1:500 |

| Maximum Number of Transactions | unlimited | unlimited | unlimited | unlimited |

| Platforms | MT5 | MT5 | MT5 | MT5 |

| Withdrawal Commissions | Less than $50 - $10 | Less than $50 - $10 | Less than $50 - $10 | Less than $50 - $10 |

How to Open an Account?

To open an account with DMA Capitals, follow these concrete steps:

Registration Process:

Visit the DMA Capitals website and navigate to the “Live Account” section.

Fill out the registration form with accurate personal information, including your full name, email address, phone number, and country of residence.

Account Verification:

After completing the registration process, DMA Capitals will require you to verify your identity and residency.

Upload clear copies of your identification documents, such as a government-issued ID (passport, driver's license) and proof of address (utility bill, bank statement).

Deposit Funds:

Once your account is successfully verified, log in to your DMA Capitals account dashboard.

Navigate to the “Deposit Funds” or “Account Funding” section.

Select your preferred payment method (bank transfer, credit/debit card, e-wallet) and follow the instructions to transfer funds into your trading account.

Start Trading: Once your funds are deposited and available in your DMA Capitals account, you can start trading.

Leverage

DMA Capitals offers a maximum leverage of 1:500, allowing traders to amplify their trading positions by up to 500 times the amount of their initial investment.

Spreads & Commissions

DMA Capitals offers competitive spreads and commissions across its various account types.

For instance, the STANDARD account features a minimum spread of 1.8 pips for major currency pairs like EURUSD, while the PRO and VIP accounts offer tighter spreads, starting from 0.6 and 0.3 pips, respectively. Additionally, commissions differ across accounts, with the STANDARD account having no commissions, while the PRO and VIP accounts charge $6 and $5 per lot, respectively.

Traders seeking lower transaction costs will find the STANDARD account suitable, while those prioritizing tighter spreads may opt for the PRO or VIP accounts despite higher commission fees.

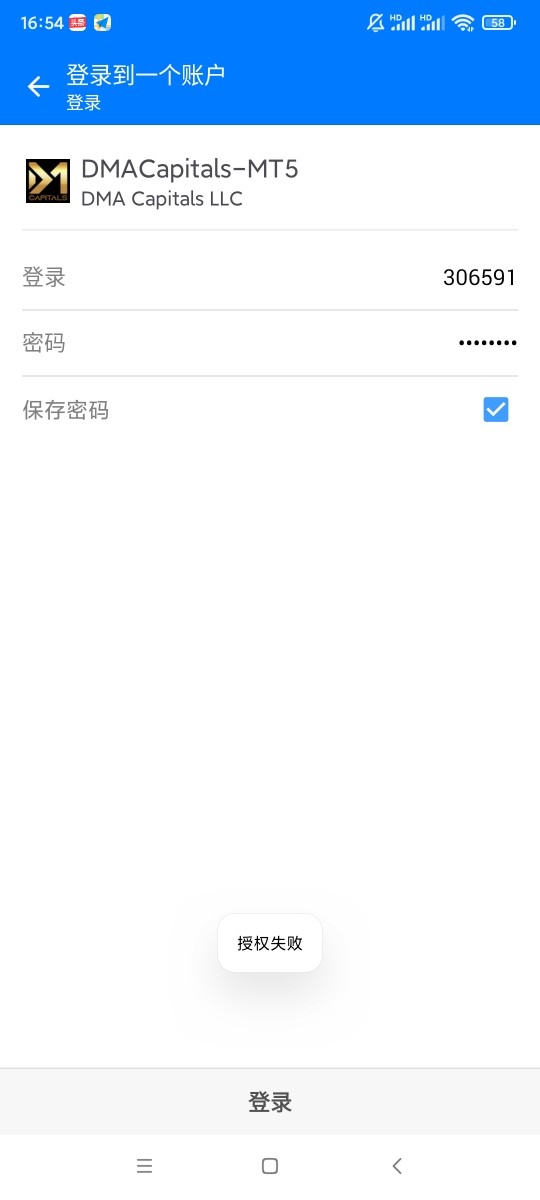

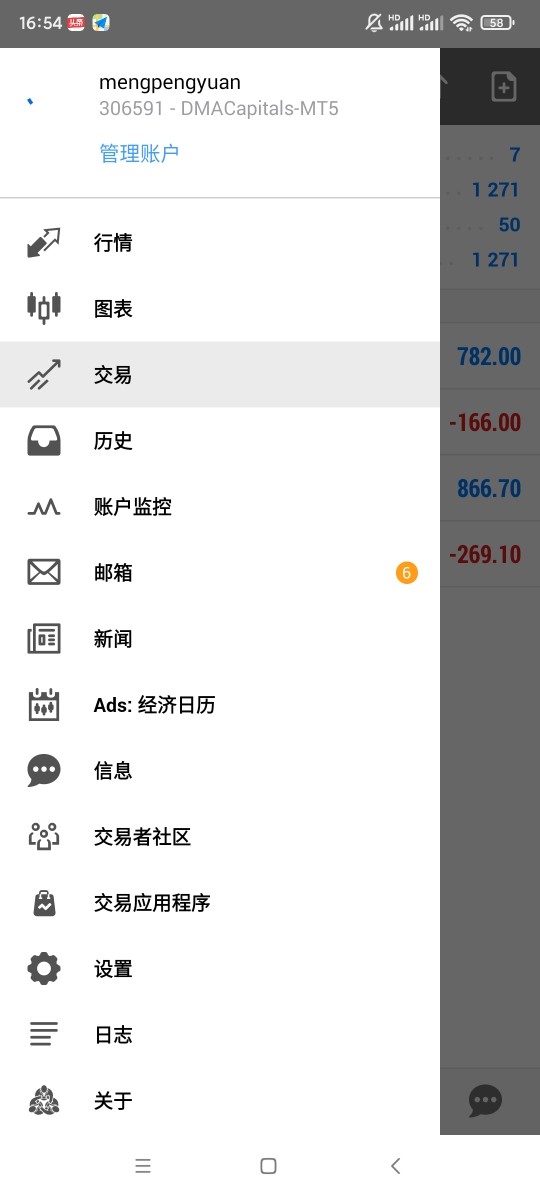

Trading Platform

DMA Capitals provides access to the MetaTrader 5 (MT5) trading platform, which is widely recognized and utilized in the financial industry.

MT5 offers a comprehensive suite of tools and features for trading various asset classes, including forex, commodities, indices, and stocks. Clients can access the MT5 platform across multiple devices, including IOS, Windows, and web terminals, enhancing accessibility and flexibility for traders.

With its user-friendly interface and advanced charting capabilities, MT5 enables traders to execute trades, conduct technical analysis, and manage their portfolios efficiently. Its availability on different operating systems ensures easy trading experiences for clients across various platforms.

Copy Trading

DMA Capitals offers a copy trading feature that allows users to replicate the trading portfolios of skilled traders effortlessly. With a simple tap of a button, clients can select from a wide range of experienced traders whose portfolios align with their investment goals and preferences.

By copying the trades of these selected traders, users can potentially benefit from their expertise and market insights without needing to conduct extensive market analysis themselves. This feature enables users to spend less time studying the markets and eliminates the guesswork associated with trading decisions.

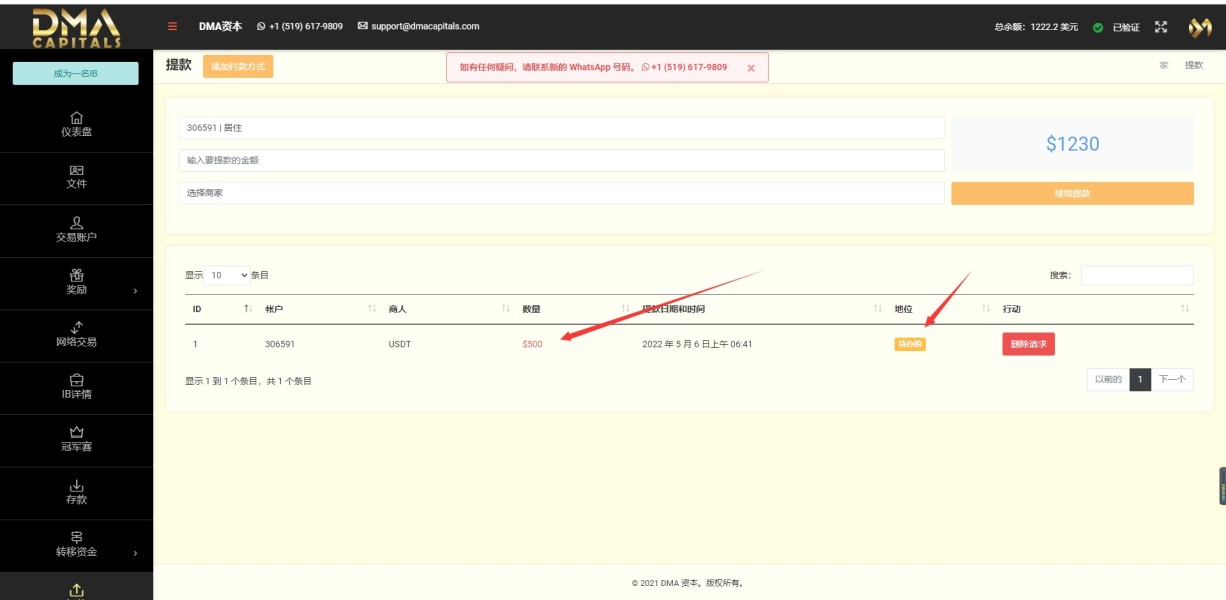

Deposit & Withdrawal

DMA Capitals offers a variety of payment methods to accommodate the various needs of its clients. These options include Bank Transfer, MasterCard, Perfect Money, Bitcoin, and USDT, among others.

The minimum deposit requirement varies depending on the chosen account type with DMA Capitals.

For the STANDARD account, the minimum deposit is $10, making it accessible to traders with smaller initial capital. The UNIVERSAL account requires a slightly higher minimum deposit of $50, suitable for clients willing to invest a bit more to access tighter spreads and potentially enhanced trading conditions.

For more experienced traders, the PRO account demands a minimum deposit of $100, while the VIP account necessitates a more substantial deposit of $500, reflecting a preference for higher-tier services and benefits.

Withdrawal commissions are applied on a sliding scale, with fees varying depending on the withdrawal amount. For instance, withdrawals of less than $50 incur a flat fee of $10, regardless of the chosen account type.

Customer Support

DMA Capitals offers comprehensive customer support accessible through multiple channels.

For inquiries or assistance, individuals can reach out via email at support@dmacapitals.com or through the 24/7 available phone line at +971 56 994-3431.

Additionally, clients can engage with live chat support on the platform's website.

For media inquiries, marketing collaboration, partnership opportunities, or to address any complaints, specific email addresses are provided: media@dmacapitals.com, marketing@dmacapitals.com, partnerships@dmacapitals.com, and complaints@dmacapitals.com.

Exposure

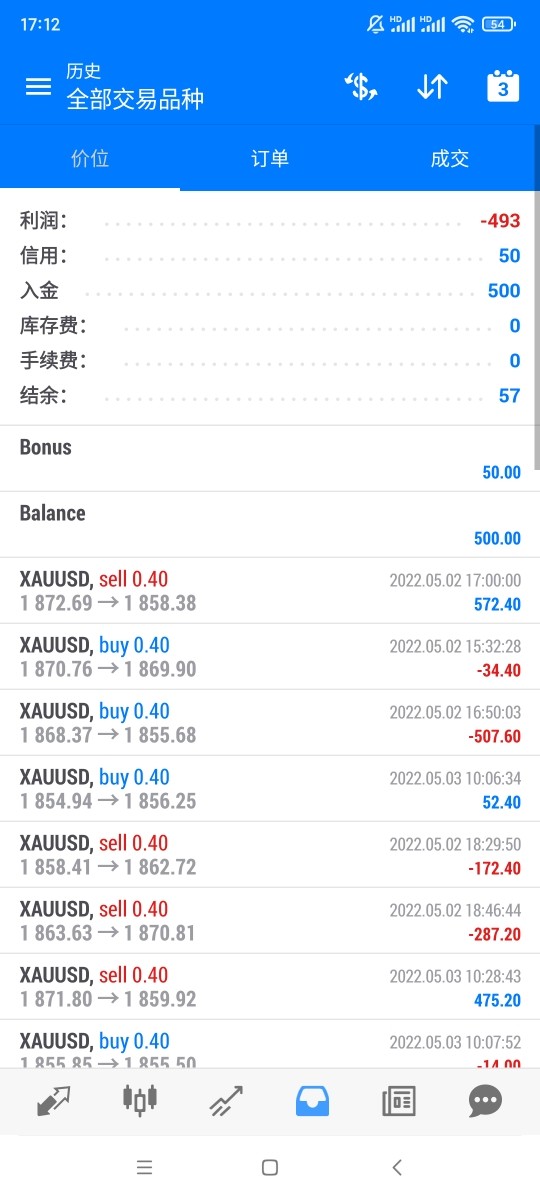

The user exposure of DMA Capitals includes complaints related to pyramid schemes, withdrawal difficulties, and accusations of fraud.

Users have reported instances where they were unable to withdraw their funds, despite allegedly making profits on the platform.

Some claim that withdrawal requests were either ignored or deleted by the platform, leading to frustration and suspicion of fraudulent activities. Such negative user experiences can significantly influence trading on the platform, eroding trust and confidence among users.

Conclusion

In conclusion, DMA Capitals offers a range of advantages such as competitive spreads starting from 0.3 pips and leverage of up to 1:500, facilitating potentially profitable trading opportunities. Additionally, its wide range of market instruments and multiple payment options enhance accessibility for traders.

However, operating without regulation and reported withdrawal issues raise risks for investors. Despite the drawbacks, DMA Capitals' provision of the popular MT5 platform and 24/7 customer support contribute to its appeal.

FAQs

Question: How can users deposit funds into my DMA Capitals account?

Answer: Users can deposit funds using multiple payment methods including bank transfer, MasterCard, Perfect Money, Bitcoin, and USDT.

Question: What are the minimum deposit requirements for DMA Capitals?

Answer: Minimum deposit requirements vary based on the account type, starting from $10 for the STANDARD account.

Question: Does DMA Capitals offer leverage?

Answer: Yes, DMA Capitals offers leverage of up to 1:500, allowing traders to control larger positions with a smaller amount of capital.

Question: What trading platform does DMA Capitals provide?

Answer: DMA Capitals provides access to the MetaTrader 5 (MT5) trading platform, offering advanced charting tools and automated trading functionalities.

Question: Is DMA Capitals regulated?

Answer: No, DMA Capitals operates without regulation, which may pose risks for investors.

Keywords

- 2-5 years

- Suspicious Regulatory License

- MT5 Full License

- Regional Brokers

- High potential risk

Comment 5

Content you want to comment

Please enter...

Comment 5

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

FX7000499742

Hong Kong

Fraud platform. I deposit 500U and earn 771U. They do not withdraw and take my principle. Deleting it from account and personal backstage. I submit the withdrawal request, but they delete it.

Exposure

2022-05-26

shaamkhan

Pakistan

No problems yet. Their withdrawal time is 24 hours. Sometimes they withdraw before 24 hours, the only problem is they dont process on Saturday & Sunday.

Positive

02-27

Dreman

Peru

"DMA Capitals rocks! They've got a diverse range of market instruments and a smooth payment process. Plus, their payment methods are super convenient.

Positive

2024-07-29

FX1300492820

Cyprus

I heard about them on one of my favourite trading forums. It was positively pictured as a broker with decent execution. But when I came there I discovered one more pleasant thing - Web MT5. Once I tried it I understood that it was much easier to use than anything I tried before. It allows trading much faster due to a more rationally organized layout.

Positive

03-21

ZOHAN

Pakistan

low spread instant widhrawl no recote 100% useable bonus , happy to trade through DMA CAPITALS

Positive

2022-11-06