Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

FX2681062020

Hong Kong

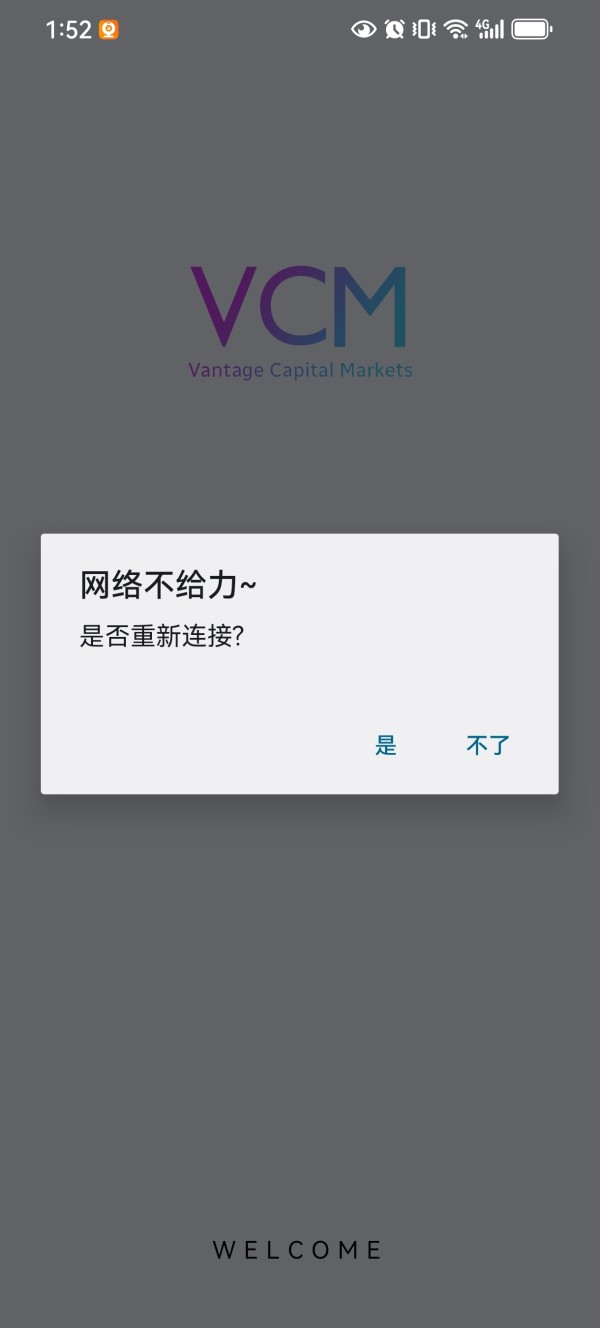

This is a fraudulent company. The funds are in the app and I can't log in to. I have already reported the case.

Exposure

2024-09-16

FX1469712699

Hong Kong

VCM cannot be accessed.

Exposure

2024-09-16

FX2215929691

Hong Kong

This is a large-scale fraud group. Currently, I can't access the platform and all my funds are locked inside.

Exposure

2024-09-16

XY1936

Hong Kong

The VCM platform cannot be accessed, there are many products inside, unable to withdraw funds. It has run away. What should I do

Exposure

2024-09-16

FX9122129452

Hong Kong

I can't log into my account, the platform has run away, and suddenly everything is gone.

Exposure

2024-09-16

江水采

Hong Kong

I can't log into the platform and am unable to withdraw funds. Please, regulatory authorities, handle this issue.

Exposure

2024-09-16

阿宝9727

Hong Kong

Withdrawals are not being processed, and many people are affected by the inability to log into the platform where their principal is stuck.

Exposure

2024-09-16

盲生未知

Hong Kong

The platform cannot be logged in, there are many instruments purchased inside, today cannot be logged in, what should I do

Exposure

2024-09-16

可乐老师

Hong Kong

Unable to log in, unable to withdraw funds, Ponzi scheme, regulatory authorities provide a solution

Exposure

2024-09-16

杨先生3328

Hong Kong

The platform cannot be accessed, hoping to get it resolved, and the group chat software is missing.

Exposure

2024-09-16

FX2958109804

United States

Unable to withdraw money. There are all kinds of payment. It has been delayed. Until the margin is paid, it is said that the credit score is insufficient, and the fee still needs to be paid

Exposure

2022-02-03

FX2958109804

United States

The card number is wrong, a margin needs to be paid. The card number is changed, the credit score is less than 100, and the money cannot be withdrawn

Exposure

2022-02-03

FX2958109804

United States

Delay in withdrawing money, wrong card number, need to pay margin, high margin payment, modified bank card, credit score is insufficient now, and high fees are required

Exposure

2022-01-31

FX1322406998

India

VCM team is very professional and systematic. I highly recommend this company if you want to enhance your business globally or if you need financial solutions for your trades. Have a try!

Positive

2023-03-02