Overview of Tradelax

Tradelax is an Australian-based online forex broker that offers trading services to clients worldwide. The company was founded in 2020 and operates with no regulations, which may raise some concerns for potential clients. Despite this, Tradelax aims to provide a reliable and user-friendly trading platform that can accommodate both novice and experienced traders.

Tradelax offers a variety of trading instruments, including forex, commodities, indices, and cryptocurrencies. Their trading platform is web-based, allowing traders to access their account and make trades from any device with internet connectivity. Additionally, the platform includes features such as technical analysis tools, market news, and an economic calendar to assist traders in making informed decisions.

Is Tradelax Legit or a scam?

As of now, there are no official reports or evidence suggesting that Tradelax is a scam. However, it's important to note that the broker is not regulated by any financial authority, which can be a cause of concern for some traders. Here we can see clearly that upon conducting a thorough search on the Australian Securities and Investments Commission (ASIC) website, it is apparent that the name of Tradelax is not listed among the regulated entities. This evidence conclusively suggests that Tradelax lacks the required authorization and regulation from any reputable regulatory authority, including ASIC.

It's always recommended to do thorough research and exercise caution when dealing with unregulated brokers. Additionally, traders should be wary of potential risks and should only invest funds that they can afford to lose.

Market Instruments

Tradelax provides its clients with a variety of trading instruments in different markets, including Forex, stocks, commodities, and cryptocurrencies. In terms of Forex, the broker offers traders the opportunity to trade major, minor, and exotic currency pairs, allowing for diversification and the ability to capitalize on various market movements.

In addition to Forex, Tradelax also provides traders with the ability to trade stocks of popular companies from around the world, as well as commodities like gold, silver, and oil. Furthermore, the broker offers access to some of the most popular cryptocurrencies, such as Bitcoin, Ethereum, and Litecoin. This wide range of trading instruments provides traders with numerous options to diversify their portfolios and potentially increase their profits.

Account Types

It seems that Tradelax understands that different traders have different needs and preferences when it comes to trading. Therefore, the broker offers a variety of account types to cater to the diverse trading needs of its clients. Whether you are a beginner or a seasoned trader, you can choose an account type that suits your trading goals and budget.

The Starter account is the most basic account type available at Tradelax. Traders can open this account with a minimum deposit of $250. With the Starter account, traders can access all of the trading instruments offered by the broker. However, there are no additional features or benefits that come with this account type.

The Advancedaccount is the mid-level account type at Tradelax. With the Advancedaccount, traders can access all of the trading instruments offered by the broker, enjoy a 25% swap discount, as well as some additional features such as market analysis and research tools.

The Expertaccount offers a fixed spread and provides the support of a senior account manager. Those who opt for this package are granted access to advanced trading tools and receive real-time updates on critical market news from a team of Tradelax experts.

The VIP account is the most advanced account type offered by Tradelax. With the VIP account, traders can access all of the trading instruments offered by the broker, as well as a range of premium features such as a personal account manager, exclusive trading signals, and customized trading strategies. With this account, traders can negotiate discounts on swaps.

Tradelax offers Islamic accounts for traders who follow Sharia law, also known as swap-free accounts.To open an Islamic account with Tradelax, traders need to meet the same minimum deposit requirement as the regular trading account.

Leverage

Tradelax offers leverage up to 1:500 for forex trading, which means traders can control a larger position with a relatively small deposit. However, it is important to note that higher leverage also means higher risk, and traders should be aware of the potential losses that can occur if the market moves against them. Traders can choose their desired leverage level when opening a trading account with Tradelax, and they can also adjust their leverage at any time.

Spreads & Commissions (Trading Fees)

Tradelax's spreads and commissions are an important aspect to consider when evaluating the overall trading costs with this broker. The spreads offered by Tradelax vary depending on the account type, market conditions, and the trading instrument being used.

The spreads offered by Tradelax are relatively high compared to some other brokers in the industry. For example, the EUR/USD spread starts at 2.8 pips, which is wider than the industry average. Additionally, the broker does not offer any discounts on spreads for high-volume traders.

In terms of commissions, Tradelax does not charge any commissions on trades, which means the broker's revenue is generated mostly through the spreads offered on trades.

Here's a table comparing the spreads for EUR/USD at Tradelax, FXTM, XM, and IC Markets:

Non Trading Fees

Non-trading fees are charges that are not directly related to the trading of financial instruments. These fees can include deposit and withdrawal fees, inactivity fees, and other administrative charges. Let's take a look at the non-trading fees offered by Tradelax:

Deposit fees: Tradelax does not charge any deposit fees for any payment method.

Withdrawal fees: Tradelax does not charge any withdrawal fees for any payment method.

Inactivity fees: Tradelax charges an inactivity fee of $50 per month for accounts that have been inactive for more than 60 days.

Currency conversion fees: Tradelax does not charge any currency conversion fees for deposits or withdrawals.

Trading Platform

Tradelax provides its clients with two trading platforms to choose from: the popular MetaTrader 4 (MT4) platform and a proprietary web-based platform called WebTrader.

The MetaTrader 4 platform is one of the most widely used trading platforms in the world and is favored by traders for its user-friendly interface, advanced charting tools, and customizable indicators. It also allows for the use of automated trading strategies through the use of Expert Advisors (EAs). Traders can access the MT4 platform on their desktop computers or through mobile apps for iOS and Android devices.

Tradelax's proprietary WebTrader platform is a web-based trading platform that allows traders to access their accounts and trade directly from their web browsers. It is accessible from any device with an internet connection and does not require any software downloads or installations. The platform features a user-friendly interface and a variety of trading tools, including real-time market quotes, advanced charting capabilities, and the ability to place and manage orders.

Behold, a simple table showcasing the illustrious trading platforms proffered by some of the most esteemed forex brokers of our time, including none other than Tradelax, IC Markets, FXCM, and IG:

Deposits and Withdrawals

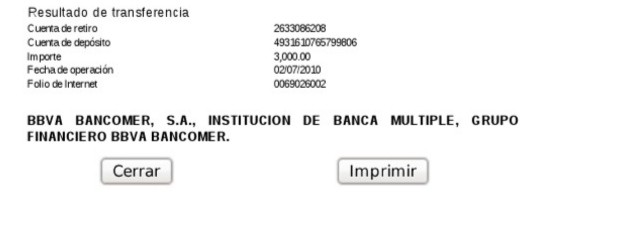

Tradelax provides its customers with various payment methods to fund their trading accounts or withdraw their profits. The broker offers two primary payment methods, which include credit/debit cards and bank transfers.

For credit/debit card transactions, the minimum deposit for credit/debit cards is $250, and the maximum deposit is $10,000. Withdrawals to credit/debit cards are processed within 3-5 business days, and the minimum withdrawal amount is $100.

For bank transfers, clients can make deposits or withdrawals in USD, EUR. The minimum deposit for bank transfers is $250, and there is no maximum deposit limit. Deposits are typically processed within 3-5 business days. Withdrawals via bank transfer can take up to 5 business days to process, and the minimum withdrawal amount is $100.

Customer Support

Despite the limited communication channels, only email available, Tradelax's customer support team strives to provide efficient and effective service to its clients. They offer assistance with various account-related inquiries, technical issues, and general trading queries.

Educational Resources

Unfortunately, it appears that Tradelax does not offer any educational resources for its clients. This means that traders who are looking to improve their skills and knowledge may need to look elsewhere for educational materials, such as online courses or books.

While the absence of educational resources may be disappointing for some traders, it is worth noting that there are many other forex brokers who do offer comprehensive educational resources, including video tutorials, webinars, and e-books.

Conclusion

As we wrap up our discussion on Tradelax, it's important to note that the forex market is highly competitive, and traders need to exercise caution when selecting a broker. While Tradelax may seem like an attractive option at first glance, there are some concerns to consider.

One of the primary concerns is that the broker is not regulated, which may make some traders hesitant to entrust their funds with the company. Additionally, while the broker offers a range of account types with different features and benefits, some of the terms and conditions may be unfavorable to traders.

Ultimately, whether or not to trade with Tradelax is a decision that each trader must make based on their own risk tolerance and preferences. As with any investment, it's important to conduct thorough research and due diligence before making a decision.

FAQs

A: No, Tradelax is not a regulated broker. It is not registered with any major regulatory authority such as ASIC, FCA, or CySEC.

A: Tradelax offers a maximum leverage of 1:400 for Forex trading.

A: Tradelax offers two trading platforms: MetaTrader 4 (MT4) and a web-based platform.

A: Tradelax offers two primary payment methods for deposits and withdrawals: credit/debit cards and bank transfers.

A: Yes, Tradelax offers Islamic accounts for traders who follow Sharia law.

A: Tradelax's customer support can be reached only through email. However, they do have a comprehensive FAQ section on their website.

A: No, Tradelax does not provide any educational resources such as webinars, tutorials, or trading guides.