Score

nextmarkets

Malta|5-10 years|

Malta|5-10 years| https://www.nextmarkets.com

Website

Rating Index

Influence

Influence

C

Influence index NO.1

Germany 3.83

Germany 3.83Contact

Licenses

Licenses

Licensed Entity:NEXTMARKETS TRADING LTD.

License No. C 77603

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

Malta

MaltaUsers who viewed nextmarkets also viewed..

EC Markets

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

XM

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

IC Markets Global

- 15-20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Sources

Language

Mkt. Analysis

Creatives

Website

nextmarkets.com

Server Location

Netherlands

Website Domain Name

nextmarkets.com

Server IP

23.101.67.245

Company Summary

| Registered Country/Region | Malta |

| Regulation | MFSA |

| Minimum Deposit | €500 |

| Maximum Leverage | 1:30 |

| Minimum Spreads | 0.6 pips on EURUSD |

| Trading Platform | Web-based trading platform |

| Demo Account | Yes |

| Trading Assets | currency pairs, cryptocurrencies, over 8,000+ shares, and over 1,000+ exchange-traded funds |

| Payment Methods | VISA, MasterCard, Trustly, SOFORT, GIROPAY, EPS, IDEAL |

| Customer Support | Phone, Email, Online Chat |

General Information & Regulation

nextmarkets Trading Limited is a company registered in Malta (registration number C 77603) and authorised and regulated by the Malta Financial Services Authority (MFSA) as a financial services company under licence IS/ 77603. nextmarkets Trading Limited is a subsidiary of nextmarkets AG with headquarters in Cologne.

Market Instruments

Investors can trade popular currency pairs, cryptocurrencies, over 8,000 shares, and over 1,000+ exchange-traded funds on the NextMarkets trading platform.

nextmarkets Minimum Deposit

Investors trade all assets on the NextMarkets platform through one account with a minimum deposit of €500. The amount is quite high. Many other brokers would require a much less initial deposit.

nextmarkets Account Opening

Traders can open their Nextmarkets account directly in the app or on the broker's website in less than 6 minutes. Traders will be required to submit a scanned copy of acceptable proof of identification and proof of address. After successful registration, Traders will receive their trading account without any minimum deposit. As soon as they fund their account, they can start trading with their Nextmarkets App or via the broker's website.

nextmarkets Leverage

nextmarkets offers a maximum of 1:30, in accordance with ESMA guidelines. This is a low leverage ratio, but all European brokers must comply with the requirements set within the EU.

Spreads & Commissions

Like many online brokers, nextmarkets employs a commission-free mode, charging spreads as commissions. Spreads on the NextMarkets platform start from a minimum spread of 0.6 pips on EURUSD.

nextmarkets Trading Platform

nextmarkets offers traders a self-developed web-based trading platform with a very clear and intuitive trading interface, user-friendly, with a range of trading and charting tools that allow traders to access all markets and assets. This trading platform also includes different technical indicators that allow traders to easily follow NextMarkets' in-house analysts to develop their own trading strategies. The trading platform is available for Android and iOS mobile versions.

Deposit and withdrawal

The minimum deposit to trade with nextmarkets is €500

nextmarkets does not accept the follwing deposits:

Deposits from busiess accounts

Deposits that are not clearly attributable to you as account holder (e.g. Paypal, Payback, Transferwise)

Customer Support

nextmarkets' client support team is available 24/7 to respond to clients' trading inquiries, and they can be reached by filling the contact form available on the brokers website. The website is available in seven different languages to reach a wider audience.

Accepted Regions

nextmarkets offers its services to clients from different parts of the globe where the use of such services would not be contrary to local laws and regulations. Some Nextmarkets features and products mentioned within this Nextmarkets review may not be available to traders from certain countries because of legal restrictions.

Pros & Cons

| Pros | Cons |

| Wide product portfolios | Offshore broker |

| Commission-free trad | High minimum initial deposit |

| Opening an account free of charge | No account description |

| Compeitive forex spreads | Conservative leverage up to 1:30 |

| Various payment methods supported | Only A web-based platform |

| 7/24 & multilingual Customer support |

Frequently Asked Questions

How many financial instruments does nextmarkets offer?

nextmarkets provides access tocurrency pairs, cryptocurrencies, over 8,000+ shares, and over 1,000+ exchange-traded funds.

How much does it cost to open an account?

The opening of an account is free of charge. Threre is no deposit fee, negative interest rates, minimum investment amount or anything similar.

What is the minimum deposit amount required to trade with nextmarkets ?

The minimum deposit amount to trade with nextmarkets is €500.

Does nextmarkets offer leverage?

Yes. nextmarkets offers a maximum of 1:30, in accordance with ESMA guidelines.

What types of orders are available?

With Nextmarkets, limit and stop orders are available in addition to the market order.

Keywords

- 5-10 years

- Suspicious Regulatory License

- High potential risk

News

News Apeiron invests in Nextmarkets to fuel organic growth and acquisitions.

Germany-based broker Nextmarkets has recently received an investment from Apeiron to support its organic growth and acquisition plans. The investment will enable Nextmarkets to expand its offerings and reach a wider audience. With this investment, Nextmarkets aims to establish itself as a leading player in the financial market.

2023-04-18 19:29

News Nextmarkets Receives Investment from Apeiron to Fuel Organic Growth and Acquisitions

German neobroker Nextmarkets has secured new funding from Apeiron Investment Group to finance its organic growth and a series of acquisitions, after FinLab and Samara Asset Group indicated their intention to liquidate the company. The exact size of the investment has not been disclosed, but it is believed to be around €10m ($11.9m). Nextmarkets will use the funds to expand its existing offering and focus on international growth.

2023-04-18 17:00

Comment 6

Content you want to comment

Please enter...

Comment 6

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

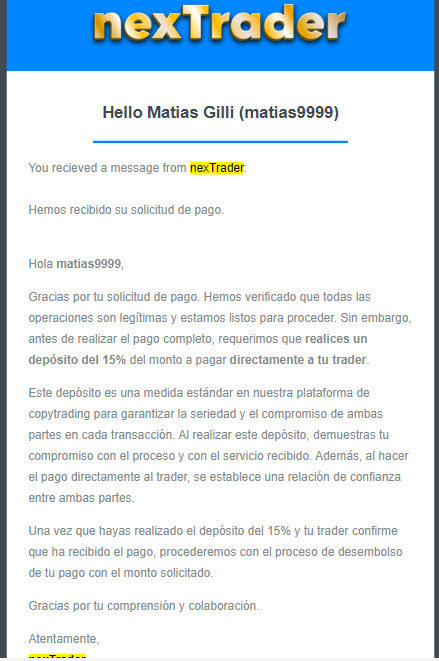

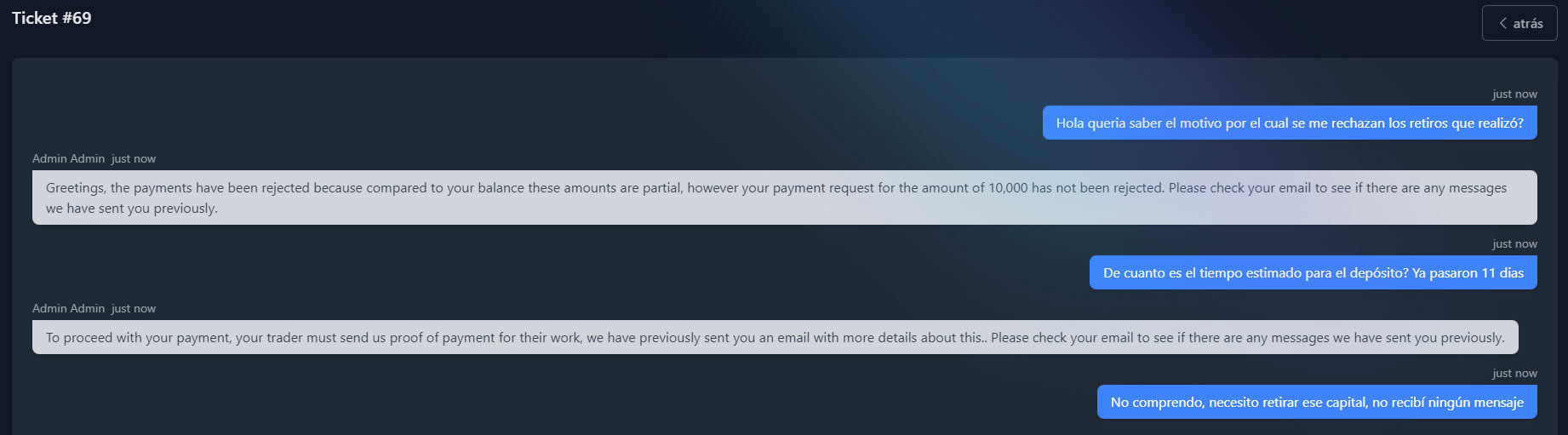

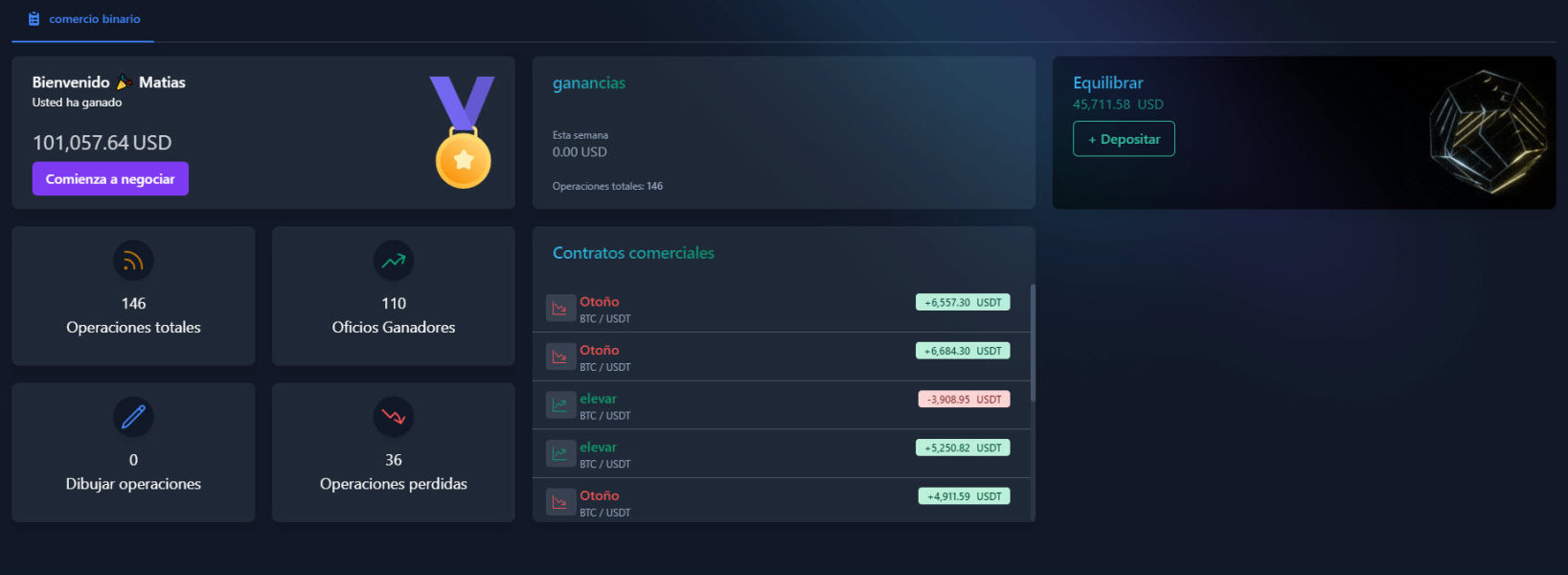

MatiasG

Argentina

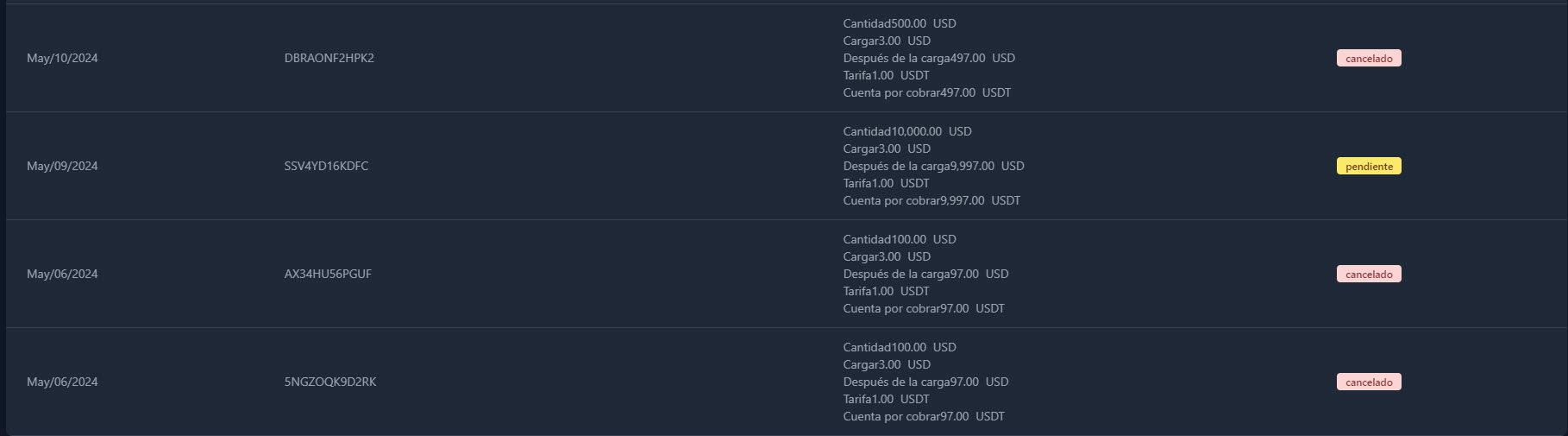

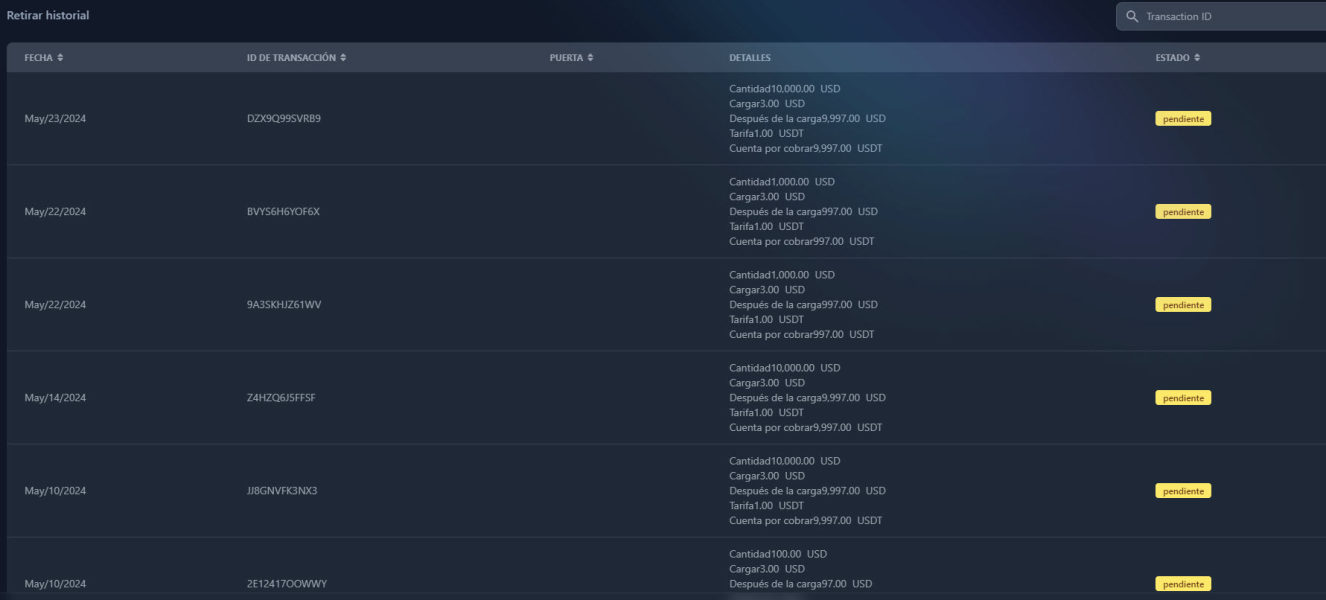

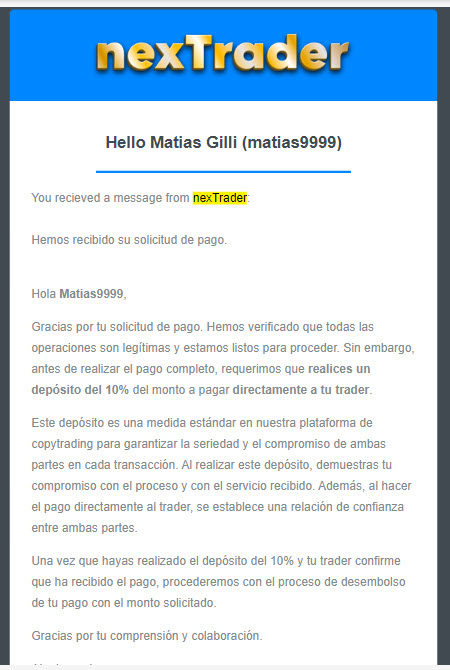

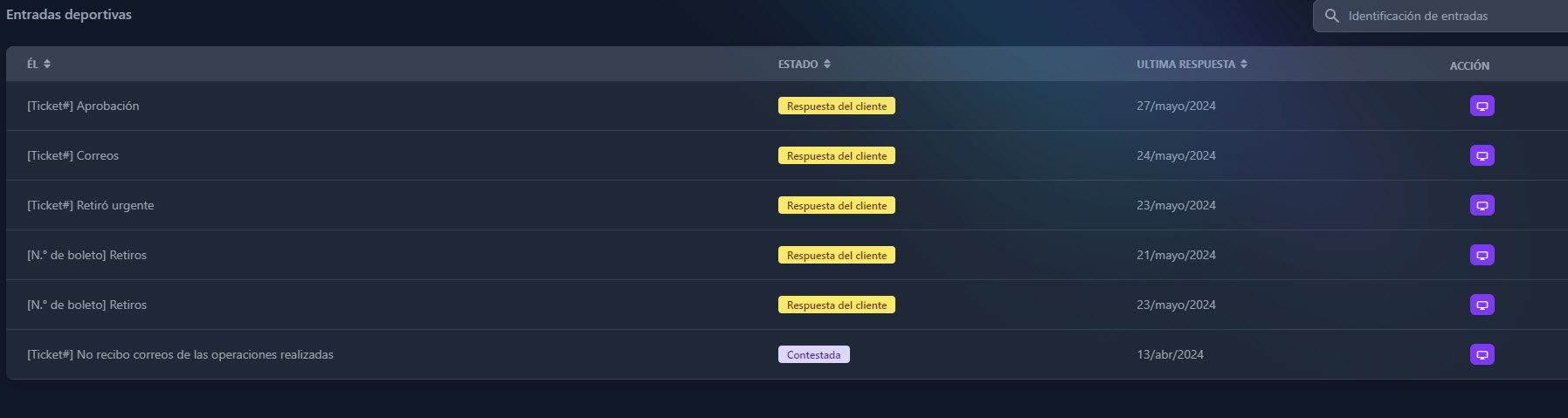

The name of the broker is nexTrader. It does not allow me to withdraw my capital; I tried to withdraw several times and it rejected me, asking me to deposit more money to enable the withdrawal.

Exposure

2024-05-28

Jimmy Manuluck

United Kingdom

nextmarkets' support team really helped me out when i had issues depositing into my account. Would like to especially thank Adam for helping me out so quickly.

Neutral

2023-02-28

nazir4h

Nigeria

good day, this is very nice and great website that enable users to get alot of benefits like knowledge, income and others helpful thing 🙏🙏🙏🙏🙏

Neutral

2022-12-05

家住海边喜欢浪

Hong Kong

I am not the owner of any nextmarkets account but I just want to complain here about the lack of information on their platform. If you do not offer me information, how can I know if it is reliable or not? I don't know who wants to trade with such a broker with little information.

Neutral

2022-11-16

虎背熊腰

Hong Kong

As tested on demo accounts, the EUR/USD spreads is tight and the interface looks quite easy to use. so, i want to open a live account, however, the minimum initial deposit requirement is too high for me! Can the broker sets a mini account with just a few euros? Please..

Positive

2022-11-16

在难遇我i

Hong Kong

Great customer support, but trading conditions are not that attractive...

Positive

In a week