Score

Neptune Securities

Australia|2-5 years|

Australia|2-5 years| https://neptunefx.com.au

Website

Rating Index

Influence

Influence

C

Influence index NO.1

Germany 2.71

Germany 2.71Contact

Licenses

Licenses

Licensed Entity:Neptune Securities LTD

License No. 000332890

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

Australia

AustraliaUsers who viewed Neptune Securities also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

AvaTrade

- 15-20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

HFM

- 10-15 years |

- Regulated in Cyprus |

- Market Maker (MM) |

- MT4 Full License

Website

neptunefx.com.au

Server Location

United States

Website Domain Name

neptunefx.com.au

Server IP

172.67.146.136

Genealogy

VIP is not activated.

VIP is not activated.Relevant Enterprises

Company Summary

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

| Neptune Securities Review Summary in 10 Points | |

| Founded | 2009 |

| Registered Country/Region | Australia |

| Regulation | ASIC (suspicious clone) |

| Market Instruments | Forex, Commodities, Indices |

| Demo Account | Available |

| Leverage | 30:1 |

| EUR/USD Spread | N/A |

| Trading Platforms | MT4 |

| Minimum deposit | N/A |

| Customer Support | Email, WhatsApp |

What is Neptune Securities?

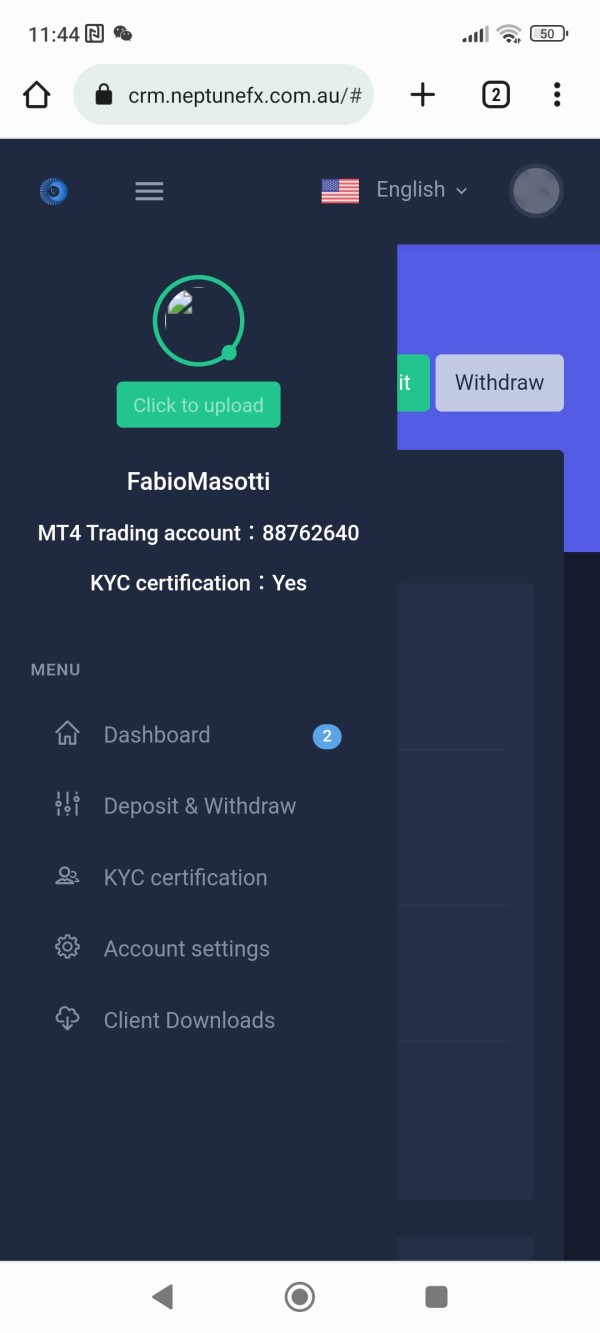

Neptune Securities, a trading name of Neptune Securities LTD, is allegedly an STP broker and financial provider involving online financial and trading services. It is established in 2009 and is located in Sydney, Australia. The broker provides online trading services in Forex, Commodities, and Indices with a choice of two trading account types on the MetaTrader 4 (MT4) trading platform. However, there is some controversy surrounding the legitimacy of Neptune Securities' Australia Securities & Investment Commission (ASIC) license.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

Neptune Securities has a few pros, including offering a demo account, providing market analysis, and having the client's personal capital saved in a trust account.

However, there are also several cons, including the fact that Neptune Securities' ASIC license is a suspicious clone, and they do not detail additional trading costs or provide transparent information about deposit and withdrawal methods. Additionally, Neptune Securities only offers limited customer support. Overall, it is recommended that traders carefully consider all the pros and cons before deciding to trade with Neptune Securities.

| Pros | Cons |

| • Demo accounts available | • No effective regulation |

| • MT4 trading platform for various devices | • Lack of transparency on additional trading costs |

| • Market data for trading | • No info on deposits/withdrawals |

| • Basic education and technical analysis | • Only email and WhatsApp support |

| • No copy trading |

Neptune Securities Alternative Brokers

Grand Capital - a well-regulated broker with a user-friendly trading platform, but their high fees and lack of educational resources may be a disadvantage for some traders.

Hirose Financial - a regulated broker that offers low minimum deposits, competitive spreads, and a variety of trading instruments, but their limited customer support may be a concern for some traders.

Investous - a regulated broker with a user-friendly trading platform, low minimum deposits, and a wide range of trading instruments, but their high fees and limited educational resources may be a disadvantage for some traders.

There are many alternative brokers to Neptune Securities depending on the specific needs and preferences of the trader. Some popular options include:

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

Is Neptune Securities Safe or Scam?

Neptune Securities claims to be regulated by Australia Securities & Investment Commission (ASIC) but their license is a suspicious clone. It raises serious concerns about the legitimacy and trustworthiness of the company. Without proper regulation, although the client personal capital is saved in trust account, there is a higher risk of fraud and the safety of clients' funds cannot be guaranteed. Therefore, it is recommended to be cautious and to consider alternative options that are properly regulated and licensed.

Market Instruments

Neptune Securities offers a range of market instruments to its clients, including Forex, Commodities, and Indices. Forex traders can access 50 currency pairs such as such as EUR/USD, GBP/USD, and USD/JPY. Commodities traders can trade precious metals like gold and silver, as well as energy commodities like crude oil and natural gas. In addition, Neptune Securities provides access to a range of global stock indices, such as the S&P 500, Nasdaq, and FTSE 100. However, cryptocurrencies and stocks are currently unavailable.

Accounts

Demo Account: Neptune Securities provides a demo account that allows traders to try out the financial markets without risking real money. However, it is unclear what specific features are available on the demo account and if there are any limitations.

Live Account: Neptune Securities offers two types of trading accounts, Standard and Pro. The minimum initial deposit required to open a Standard account is not disclosed, which can make it difficult for traders to know if this account is a feasible option for them. The Pro account, on the other hand, requires a significantly higher minimum initial deposit of $50,000, which may not be accessible to all traders. It is unclear what specific features and benefits are available with each account type, such as leverage, spreads, and commissions.

Note: There is limited information available on Neptune Securities and their trading accounts, so please take this information with caution.

Leverage

The maximum leverage offered by Neptune Securities is only 1:30, which may seem too low to you. In reality, those leverage of up to 1:500 or even 1:1000 are all from unregulated or offshore regulated brokers, and as we know, offshore regulation is much less strict regulation. For brokers that are formally regulated by the major regulatory bodies, they can only offer leverage of 1:30 or 1:50 at best, which is sufficient for the novice Forex trader. Lower leverage reduces the potential gains on trades, but more importantly, it reduces much of the risk. We recommend that you always keep your account risk at 2% or less.

Spreads & Commissions

Neptune Securities does not detail on its website additional trading costs such as spreads, commissions, SWAPs, etc. These costs are very important when calculating profits and losses, and should be considered in aggregate and not chosen in isolation. If you want to trade with Neptune Securities, we recommend that you take the time to calculate these transaction costs.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission |

| Neptune Securities | Not disclosed | Not disclosed |

| Grand Capital | 1.6 pips | $5 per lot |

| Hirose Financial | 1.4 pips | Not disclosed |

| Investous | 0.7 pips | Not disclosed |

Note: The above information is subject to change and may vary depending on market conditions and account type. It is recommended to always check the official website of the broker for the most up-to-date information.

Trading Platforms

Neptune Securities offers MetaTrader 4 (MT4) as its trading platform of choice. MT4 is known for its reliability, stability, and user-friendly interface, and supports a wide range of technical analysis tools and indicators, as well as automated trading through Expert Advisors (EAs).

Although a long time has passed since the launch of MT4, it is still a major player in the market and is loved by both novice and experienced traders all over the world. Accessing it from different devices (PC, Mac, iOS, and Android) also makes it easier for users to trade.

See the trading platform comparison table below:

| Broker | Trading Platforms |

| Neptune Securities | MetaTrader 4 |

| MetaTrader 4 | |

| Grand Capital | MetaTrader 4, MetaTrader 5, WebTrader |

| Hirose Financial | LION Trader, MetaTrader 4, LION Binary |

| Investous | WebTrader, MetaTrader 4 |

Deposits & Withdrawals

Neptune Securities is ambiguous about how deposits and withdrawals work. It may cause uncertainty for potential clients.

Wire transfers, MasterCard, VISA, Maestro and some e-wallet processors such as Skrill, Neteller, PayPal and others are some of the most frequent and popular payment methods handled by most Forex brokers. The availability of popular and widely used payment methods is crucial for a smooth and efficient deposit and withdrawal process.

Neptune Securities minimum deposit vs other brokers

| Neptune Securities | Most other | |

| Minimum Deposit | N/A | $100 |

Additionally, timely processing of withdrawal requests is essential for clients convenience and satisfaction. Without clear and transparent information on deposit and withdrawal methods, clients may be hesitant to trust the broker with their funds, which can impact the broker's reputation.

See the fee comparison table below:

| Broker | Deposit Fees | Withdrawal Fees |

| Neptune Securities | Not disclosed | Not disclosed |

| Grand Capital | Depends on the method, from 0% to 6% | Depends on the method, from 0% to 6% |

| Hirose Financial | Free | Free |

| Investous | Free | $10-$50 depending on the method used |

Customer Service

Neptune Securities only provides email (service@neptunefx.com.au) and WhatsApp support for its clients. This may be concerning for traders who prefer to speak with a customer support representative over the phone or through live chat. Additionally, there is no indication on their website about the availability of customer support outside of regular business hours or on weekends. While email and WhatsApp support may suffice for some traders, it is important to have access to efficient and responsive customer support in case of any issues or concerns that arise while trading.

| Pros | Cons |

| N/A | • Limited customer service options |

| • No phone or live chat support | |

| • No detailed FAQ section | |

| • No social media support or forums for customer feedback |

Note: These pros and cons are subjective and may vary depending on the individual's experience with Neptune Securities' customer service.

Education

Neptune Securities provides its clients with basic and technical analysis as its educational resources. Basic knowledge is covered in an overview of the economy, data analysis, and analysis method. On the other hand, the technical analysis section covers Dow theory, candlestick chart, support level & resistance, technical analysis, and position management.

While these educational resources can be useful for novice traders, experienced traders may find them limited. Additionally, Neptune Securities could expand their educational resources by providing additional materials such as webinars, trading guides, or a trading glossary to enhance their clients' learning experience.

User Exposure on WikiFX

On our website, you can see that one user has reported scam. Please be aware and exercise caution when investing. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Conclusion

All things considered, Neptune Securities is an online Forex and CFD broker that offers access to trade a range of financial instruments, including Forex, commodities and indices through the MetaTrader 4 platform. While the broker claims to be regulated by the Australian Securities and Investments Commission (ASIC), there are concerns about the authenticity of their license.

Neptune Securities offers limited trading accounts with low leverage, and the broker is not transparent about their fees and charges. The broker also only offers email and WhatsApp support. Overall, due to the concerns about their regulatory status and lack of transparency, we recommend traders exercise caution if considering trading with Neptune Securities.

Frequently Asked Questions (FAQs)

| Q 1: | Is Neptune Securities regulated? |

| A 1: | No. It is currently not effectively regulated and you are advised to be aware of its potential risks. |

| Q 2: | Does Neptune Securities offer demo accounts? |

| A 2: | Yes. |

| Q 3: | Does Neptune Securities offer the industry-standard MT4 & MT5? |

| A 3: | Yes. It supports MT4. |

| Q 4: | Is Neptune Securities a good broker for beginners? |

| A 4: | No. It is not a good choice for beginners. Not only because of its unregulated condition, but also because of its lack of transparency. |

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- Suspicious Overrun

- High potential risk

Comment 7

Content you want to comment

Please enter...

Comment 7

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

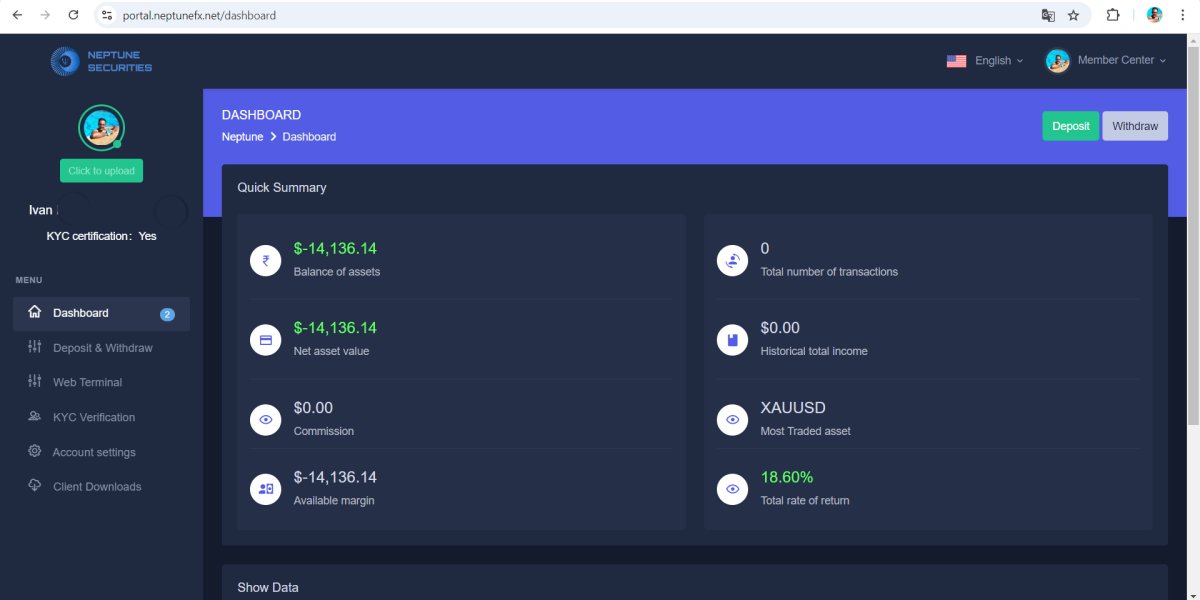

IVAN S

Italy

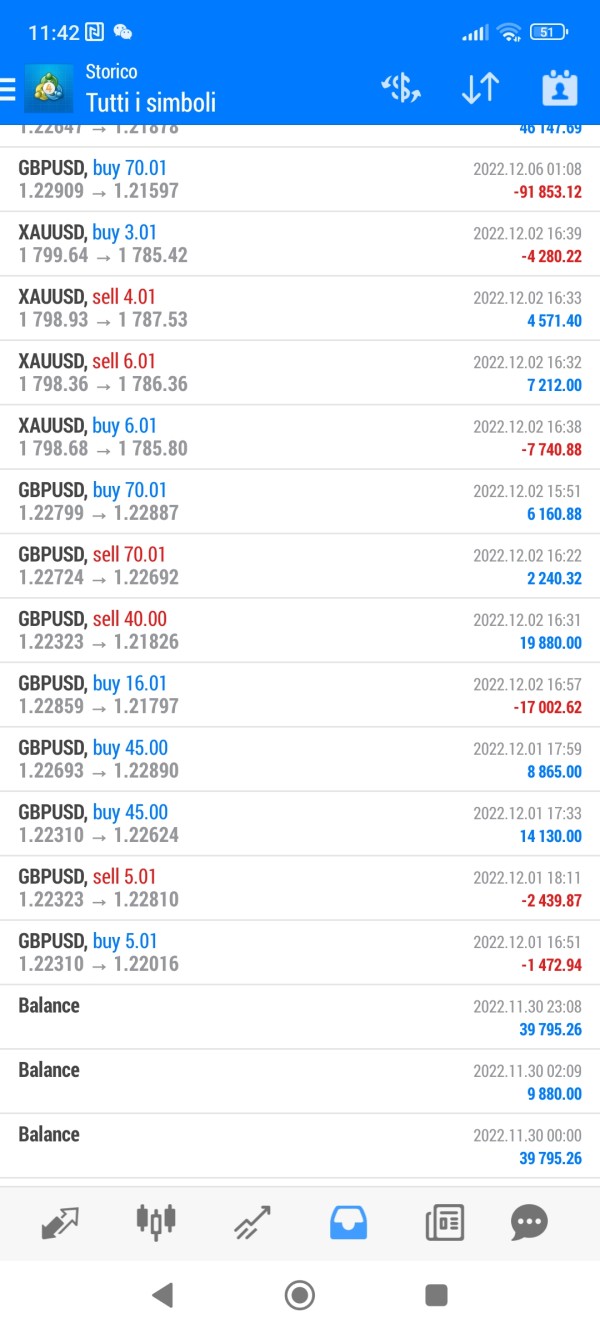

They stole my money. Read the webpage Unable to withdraw

Exposure

2024-09-08

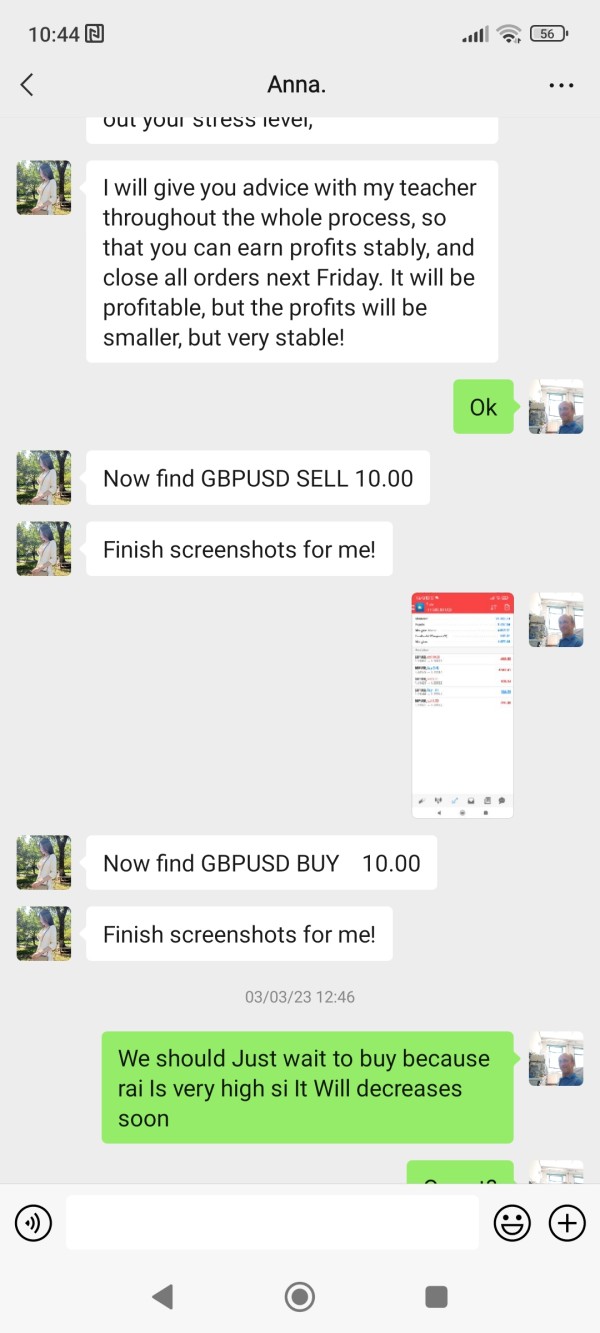

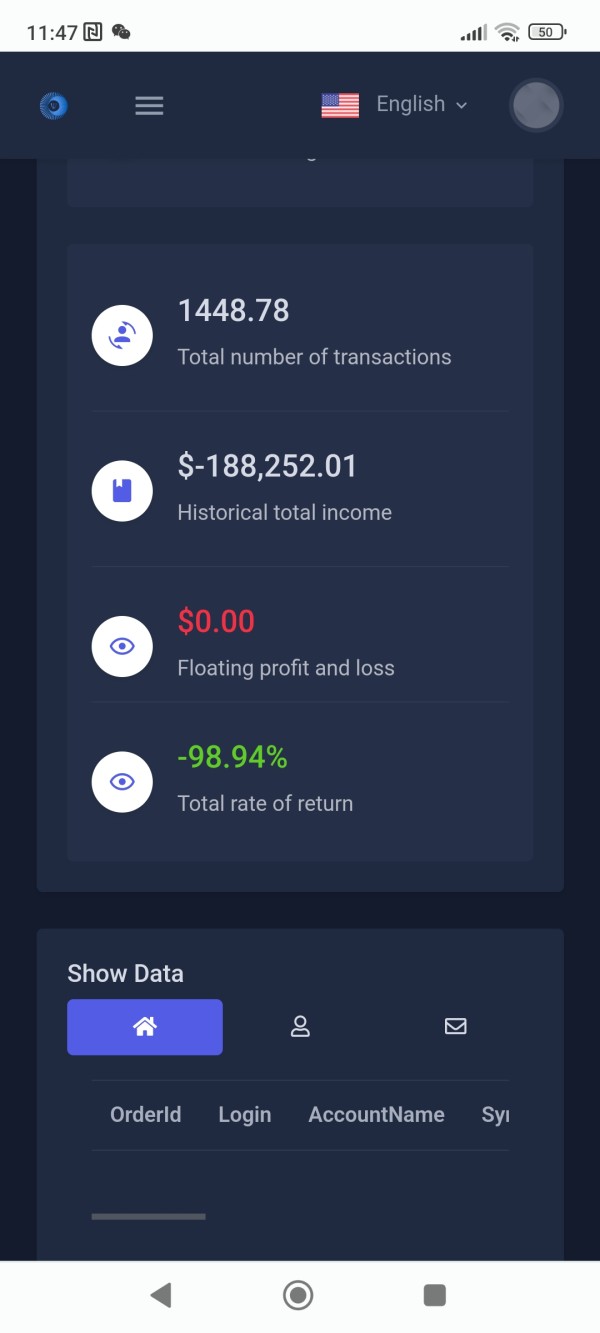

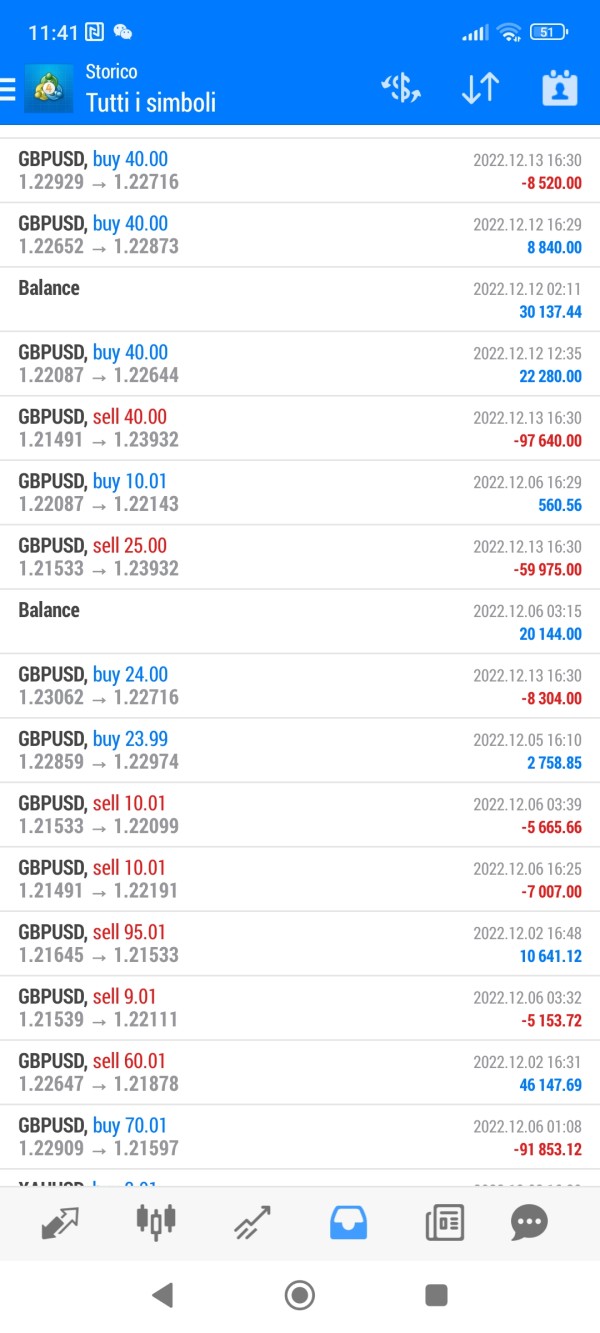

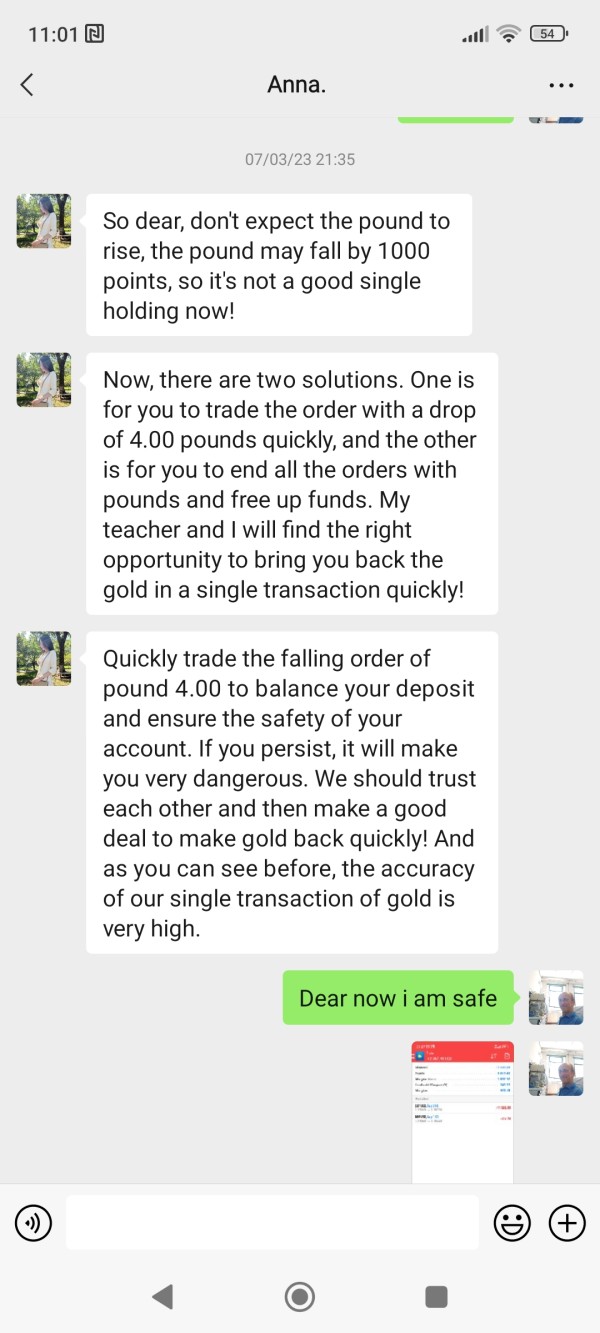

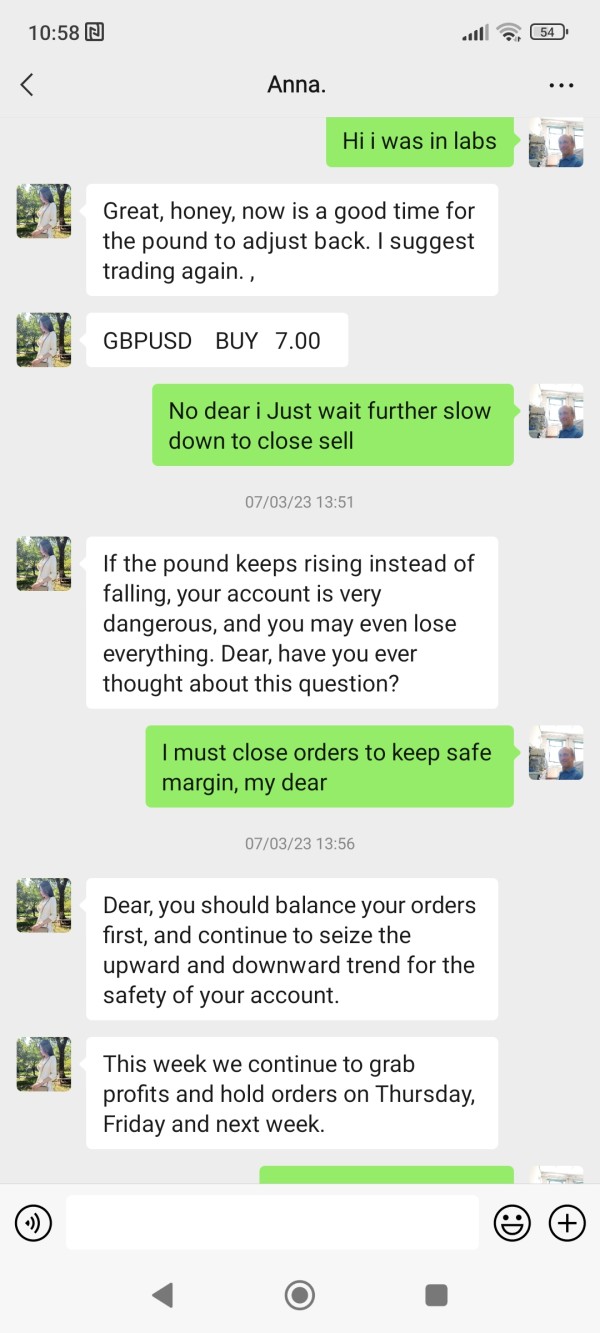

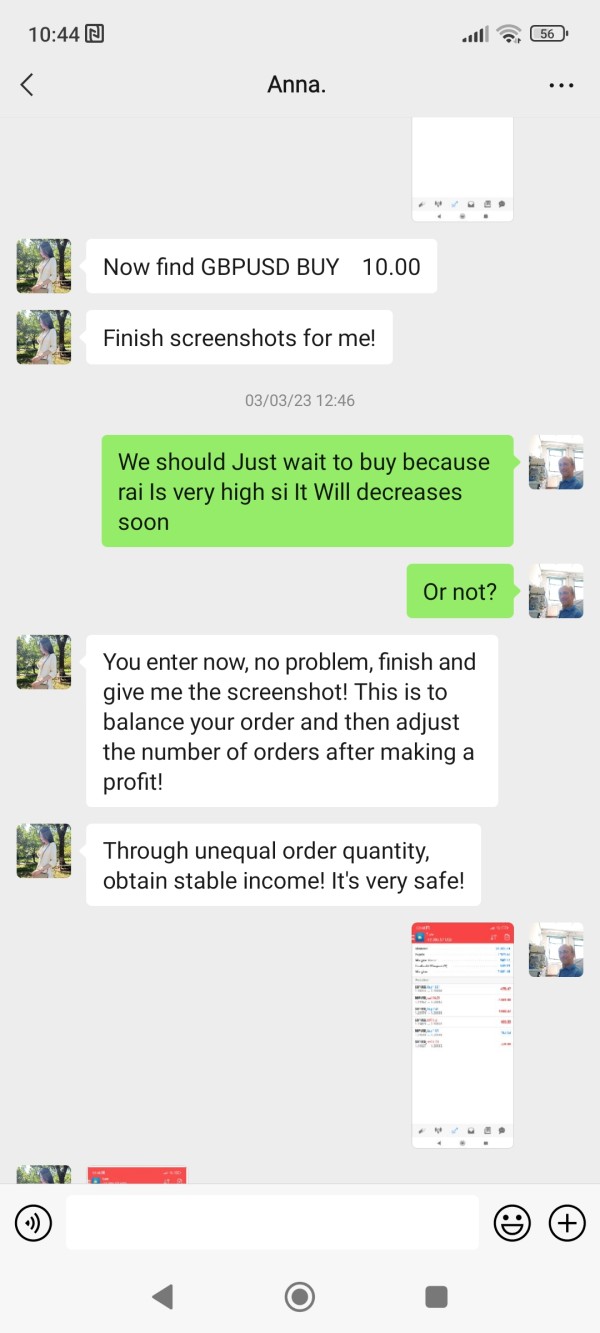

taihy

Hong Kong

Hello, I am a novice customer. Before making a deposit, I contacted my salesman to continuously promote their strategies. It is safe to follow them to trade. After making a deposit, I started to send me instructions to trade. Later I realized that this is a pair lock transaction! They didn't use the client's money to enter the market at all, they just caused the client to lose funds through induced transactions, which caused my account to be liquidated many times.

Exposure

2023-04-26

Thomas05

Cyprus

Very easy to use, and friendly interface, using Neptune securities for 3 years, never had any issue

Positive

2023-08-04

Kev922

United States

When I first heard about Neptune Securities trading platform, I have to admit I was a bit hesitant. However, my colleague at work assured me that they had a positive experience, so I decided to give it a chance. With a cautious start of just $100, I managed to make a small profit of $2, which I withdrew to test the platform. Even though the withdrawal process went smoothly, I still had some thoughts in the back of my mind. I decided to take a bit of step and invested $4000 in the platform. At the beginning, I faced some losses, and it made me a little uneasy. But as time passed and by the end of the month, I was able to make $7000. When it came time to withdraw the $7000, I have to admit I felt a bit anxious. The first two days passed without any response, and I started to worry. But then, on the third day, the money finally arrived in my account. It might have taken a bit longer than expected, but the important thing was that I received my funds. So I don't know about others but for me I have been able to trade and make withdrawal with the platform

Positive

2023-08-04

polina

Cyprus

Neptune Securities like every other Financial Institution do not control the market. One thing I can attest to is their ability to advise on almost accurate trade signals. People should understand that trading is all gambling before crying Foul or Scam. Neptune Securities has been handling my Investment account for about 3 months, have I made losses? Yes I have? But I have also made massive profits. They are no scam as I have full control of my investment accounts and profits as well.

Positive

2023-06-24

范志华

Hong Kong

Choosing a trading brand wasn’t easy for me. I had several parameters that were super important to me, and there was no way I would have given up on them. The first was the availability of the Mac version of MT4. The second was a variety in the assets list. The third was an efficient customer service staff. Neptune Securities has all these three, and that’s why I chose them.

Positive

2023-02-15

忘92966

United Kingdom

I have been working with Neptune Securities for one year and wanna say that they are perfect. Their execution is so fast and I have not faced any problems so far. The trading costs are also very low.

Positive

2022-12-16