Score

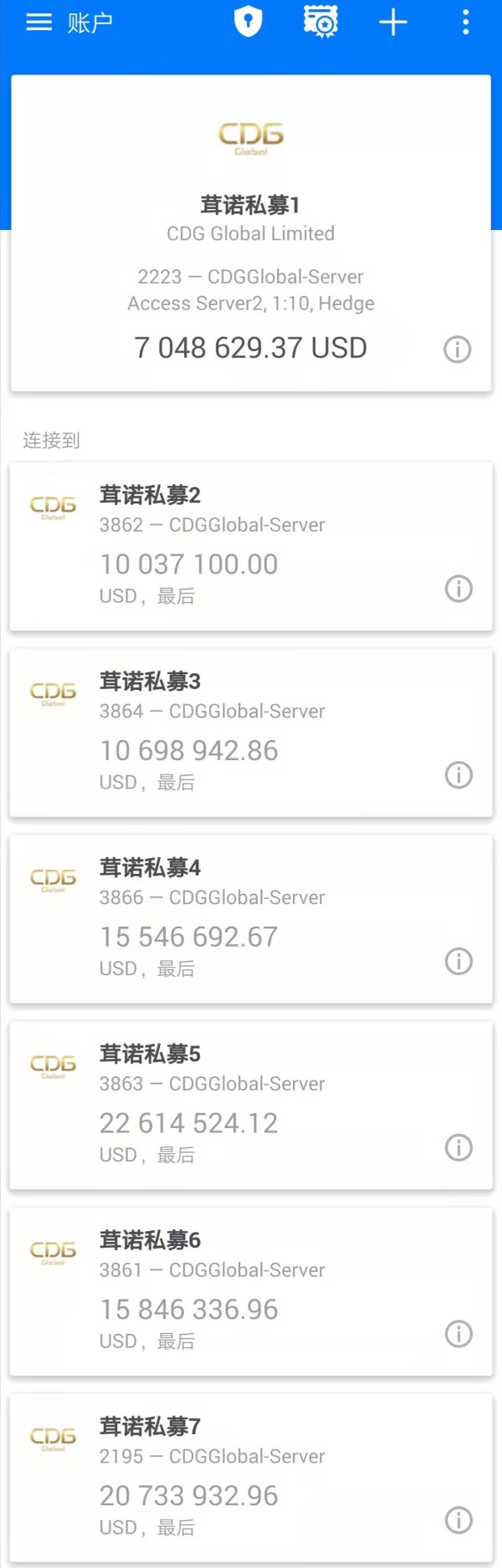

CDG Global

United States|2-5 years|

United States|2-5 years| https://www.cdgglobalfx.co/en/

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

United States

United StatesAccount Information

Users who viewed CDG Global also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

HFM

- 10-15 years |

- Regulated in Cyprus |

- Market Maker (MM) |

- MT4 Full License

Vantage

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

AvaTrade

- 15-20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Website

cdgglobalfx.co

Server Location

Hong Kong

Website Domain Name

cdgglobalfx.co

Server IP

43.135.13.97

cdgglobal.asia

Server Location

Malaysia

Website Domain Name

cdgglobal.asia

Server IP

47.254.254.27

Genealogy

VIP is not activated.

VIP is not activated.Relevant Enterprises

Company Summary

| Aspect | Information |

| Company Name | CDG Global |

| Registered Country/Area | Saint Vincent and the Grenadines |

| Founded Year | 2-5 years |

| Regulation | Unregulated |

| Market Instruments | Forex, CFDs, Metals, and Energies |

| Account Types | Micro, Standard, Pro, and VIP |

| Minimum Deposit | $100 |

| Maximum Leverage | 1:1000 |

| Spreads | starting from 0.4 pips |

| Trading Platforms | MetaTrader 4 and MetaTrader 5 |

| Demo Account | Yes |

| Customer Support | Email (cs@cdgglobalfx.com), Contact (+60 087504154), Twitter (https://twitter.com/cdg_global), Facebook (https://www.facebook.com/CDGGlobalMy/), and Instagram (https://www.instagram.com/cdgglobalfx/) |

| Deposit & Withdrawal | Credit/debit cards, E-wallets, and Bank transfers |

| Educational Resources | Webinars, Trading guides, Articles, and Videos |

Overview of CDG Global

CDG Global is an unregulated Forex brokerage based in Saint Vincent and the Grenadines, operating for 2-5 years. While it lacks regulation, it offers a variety of financial instruments, including Forex, CFDs, Metals, and Energies. Traders can choose from Micro, Standard, Pro, and VIP accounts with a minimum deposit of $100 and a generous maximum leverage of 1:1000.

With competitive spreads starting from 0.4 pips, CDG Global aims to keep trading costs reasonable. The platform supports MetaTrader 4 and MetaTrader 5, providing a familiar interface for traders. A demo account is also available for risk-free practice.

In addition to trading services, CDG Global provides its clients with webinars, trading guides, articles, and videos. These resources empower traders to make informed decisions in the financial markets.

Regulatory Status

CDG Global operates as an unregulated trading platform, meaning it does not fall under the oversight of any financial regulatory authority. Traders and investors should be aware that the absence of regulatory supervision may entail additional risk.

In unregulated environments, clients may have limited recourse and protection in the event of disputes or unforeseen issues. It's essential for individuals considering CDG Global to exercise caution and carefully assess their risk tolerance when engaging with an unregulated broker.

Pros and Cons

| Pros | Cons |

| Competitive Spreads | High Maximum Leverage |

| Wide Range of Market Instruments | Limited Educational Resources |

| Access to Global Markets | Higher Minimum Deposit for Standard Account |

| Fractional Trading | Mixed Reviews of Customer Support |

Pros:

Competitive Spreads: CDG Global offers competitive spreads on a wide range of market instruments, keeping trading costs low and maximizing profit potential.

Wide Range of Market Instruments: Traders can access a diverse selection of market instruments, including forex, CFDs, metals, and energies, providing ample opportunities for diversification and strategy implementation.

Access to Global Markets: Traders can access and capitalize on opportunities in a wide range of global markets, including forex, CFDs, metals, and energies.

Fractional Trading: CDG Global offers fractional trading, enabling traders to purchase fractions of shares, expand investment options, and cater to traders with limited funds.

Cons:

High Maximum Leverage: CDG Global offers high maximum leverage, which can amplify both profits and losses, making it crucial for traders to employ risk management strategies carefully.

Limited Educational Resources: CDG Global's educational resources may not be as comprehensive as those offered by some other brokers, potentially disadvantaging beginners seeking in-depth guidance.

Higher Minimum Deposit for Standard Account: The minimum deposit for a Standard account at CDG Global is $500, which is higher than some other brokers, potentially limiting accessibility for certain traders.

Mixed Reviews of Customer Support: Customer support reviews for CDG Global are mixed, with some traders reporting slow or unresponsive support.

Market Instruments

CDG Global offers a wide variety of trading instruments, including Forex, CFDs, Metals, and Energies.

Forex (Foreign Exchange): Forex, or the foreign exchange market, is the global marketplace where currencies are traded. It's the largest and most liquid financial market globally, involving the buying and selling of currencies. In Forex, traders aim to profit from the fluctuations in exchange rates between different currencies. This market operates 24 hours a day, five days a week, reflecting the different time zones of major financial centers.

CFDs (Contracts for Difference): CFDs, or Contracts for Difference, are financial derivatives that allow traders to speculate on the price movements of various assets without actually owning them. These assets can include stocks, indices, commodities, and currencies. With CFDs, traders can potentially profit from both rising and falling markets. It's important to note that CFD trading involves risks, and traders should be aware of the possibility of losing more than their initial investment.

Metals: Metals trading involves buying and selling commodities such as gold, silver, platinum, and palladium. Precious metals like gold and silver are often sought as safe-haven assets, especially during times of economic uncertainty. Metal trading provides opportunities for investors to diversify their portfolios and hedge against inflation or currency fluctuations.

Energies: Energies trading involves the buying and selling of energy commodities, including crude oil, natural gas, and other related products. Crude oil, in particular, is a major global commodity that impacts various industries. Trading energies allows investors to take advantage of price movements in the energy markets, influenced by factors such as geopolitical events, supply and demand dynamics, and economic trends.

Account Types

CDG Global offers four types of accounts including Micro Account, Standard Account, Pro Account, and VIP Account.The Micro Account requires a minimum deposit of $100 with leverage up to 1:1,000, while the VIP Account, with a minimum deposit of $20,000, offers leverage up to 1:500.

| Feature | Micro | Standard | Pro | VIP |

| Minimum Deposit | $100 | $500 | $5,000 | $20,000 |

| Maximum Leverage | 1:1000 | 1:1000 | 1:1000 | 1:500 |

| Inactivity Fee | $10/month | $5/month | None | None |

How to Open an Account?

Opening an account with CDG Global is a straightforward process that can be completed online in a matter of minutes. Here's a breakdown of the steps involved:

Choose your account type: CDG Global offers three account types, each tailored to different experience levels and trading needs.

Visit the CDG Global website and click “Open Account.”

Fill out the online application form: The form will request your personal information, financial details, and trading experience. Be sure to have your identification documents (passport or ID card) and proof of address handy for uploading.

Fund your account: CDG Global offers various deposit methods, including bank transfers, credit/debit cards, and e-wallets. Choose your preferred method and follow the instructions to complete the deposit.

Verify your account: Once your account is funded, you'll need to verify your identity and address. This typically involves submitting scanned copies of your ID documents and proof of address.

Start trading: Once your account is verified, you're ready to explore the CDG Global trading platform and start making trades.

Leverage

CDG Global offers up to 1:1000 leverage on all account types. Leverage allows traders to control a larger position size with a smaller amount of margin. For example, if you have a leverage of 1:100, you can control a position of $100,000 with a deposit of $100.

Leverage can amplify your profits, but it can also amplify your losses. It is important to use leverage wisely and to understand the risks involved.

Spreads & Commissions

CDG Global offers different spreads and commissions depending on the chosen account type. Here's a detailed breakdown:

| Feature | Micro | Standard | Pro | VIP |

| Spread (EUR/USD) | from 1.5 pips | from 1.2 pips | from 1.0 pip | from 0.8 pip |

| Commission | None | None | 0.005% per trade | 0.003% per trade |

Trading Platform

CDG Global provides traders with a choice of three distinct trading platforms, each tailored to meet diverse trading styles and preferences.

MetaTrader 4 (MT4): a widely acknowledged and versatile trading interface. MT4 is renowned for its user-friendly design, advanced charting tools, and extensive customization options. Its popularity among forex traders is attributed to its comprehensive technical analysis capabilities and robust support for automated trading through Expert Advisors (EAs).

MetaTrader 5 (MT5): the successor to MT4, introduces advanced features tailored to meet the evolving needs of traders. It supports an expanded range of financial instruments, encompassing stocks, commodities, cryptocurrencies, and more. MT5 offers enhanced charting tools and timeframes for in-depth technical analysis. Traders benefit from an integrated economic calendar and news features to stay informed about market events. With the MQL5 programming language, MT5 allows the development of sophisticated trading algorithms and Expert Advisors, offering greater flexibility in strategy implementation.

Deposit & Withdrawal

CDG Global makes it simple to move your money from place to place. They provide a range of account funding and account withdrawal options in multiple base currencies.

| Method | Deposit Fee | Withdrawal Fee | Minimum Deposit | Minimum Withdrawal | Processing Time |

| Credit/Debit Cards: | 2.50% | 2.50% | $100 | $50 | Instant |

| E-wallets: (e.g., Skrill, Neteller) | 2.00% | 2.00% | $100 | $50 | Instant |

| Bank Transfers: (Domestic) | Free | $15 | $100 | $50 | 1-3 business days |

| Bank Transfers: (International) | $20 | $25 | $500 | $250 | 3-5 business days |

Customer Support

CDG Global prioritizes responsive and accessible customer support and offers five primary channels: Email (cs@cdgglobalfx.com), Contact (+60 087504154), Twitter (https://twitter.com/cdg_global), Facebook (https://www.facebook.com/CDGGlobalMy/), and Instagram (https://www.instagram.com/cdgglobalfx/). While different in their approach, both channels efficiently address customer inquiries and provide valuable assistance.

Email (cs@cdgglobalfx.com): You can reach CDG Global's customer support team via email at cs@cdgglobalfx.com. This is a convenient way to communicate and seek assistance for any inquiries or concerns you may have.

Contact Number (+60 087504154): For direct and immediate assistance, you can contact CDG Global's customer support team by phone at +60 087504154. This allows you to speak with a representative and get real-time support for your queries.

Twitter (https://twitter.com/cdg_global):Stay updated and connect with CDG Global on Twitter through their handle @cdg_global. Social media platforms like Twitter often serve as channels for announcements, updates, and a means for customers to engage with the company.

Facebook (https://www.facebook.com/CDGGlobalMy/):Follow CDG Global on Facebook at https://www.facebook.com/CDGGlobalMy/ for a mix of updates, educational content, and the opportunity to engage with the community. Facebook can be a platform for discussions and staying informed about the company's activities.

Instagram (https://www.instagram.com/cdgglobalfx/):Explore the visual side of CDG Global on Instagram at https://www.instagram.com/cdgglobalfx/. Instagram often features visual content, making it a platform where you can discover more about the company's offerings and possibly interact through comments and direct messages.

These channels collectively form the customer support network of CDG Global, offering various options for reaching out and staying connected with the company. Whether through email, phone, or social media, customers can choose the platform that suits their preferences for communication and engagement.

Educational Resources

CDG Global extends a robust array of educational resources to empower its users:

Webinars: CDG Global offers interactive webinars, providing a dynamic learning experience for traders. These online sessions cover a range of topics, from market analysis and trading strategies to risk management. Webinars allow participants to engage with experts, ask questions in real time, and gain practical insights into the world of trading.

Trading Guides: For comprehensive and structured learning, CDG Global provides trading guides that cater to traders at different skill levels. These guides offer step-by-step instructions, explanations of trading concepts, and practical tips. Traders can refer to these guides to deepen their understanding of the markets and refine their trading skills.

Articles: CDG Global's educational articles serve as valuable resources for staying informed about market trends, economic events, and trading techniques. Written by experts, these articles cover a wide range of topics, making them accessible to both novice and experienced traders. The goal is to provide relevant and up-to-date information to empower traders in making informed decisions.

Videos: Visual learners can benefit from CDG Global's video content, which includes tutorials, market analyses, and trading insights. These videos offer a dynamic and engaging way to grasp complex concepts, observe real-time market scenarios, and learn from experienced traders. Whether it's understanding chart patterns or navigating trading platforms, the video content adds a practical dimension to the educational resources.

These educational resources collectively form a robust learning ecosystem at CDG Global, catering to diverse learning preferences and ensuring that traders have access to the knowledge and skills necessary to navigate the financial markets successfully.

Conclusion

CDG Global has its strengths, offering competitive spreads on various markets, a broad range of tradable instruments, and access to global markets. Fractional trading is a notable perk, enabling flexibility for traders with limited funds.

However, there are considerations. The high maximum leverage demands careful risk management, and the educational resources might not be as extensive, potentially challenging for beginners. The $500 minimum deposit for a Standard account might be higher than some other platforms, limiting accessibility. Mixed reviews on customer support suggest room for improvement.

In summary, CDG Global provides appealing features, but improvements in educational resources and customer support could enhance the overall trading experience. Traders should weigh these factors based on their preferences and needs.

FAQs

Q: What markets can I trade on CDG Global?

A: CDG Global offers a diverse range of markets, including forex, CFDs, metals, and energies. This provides traders with ample opportunities for diversification.

Q: Does CDG Global support fractional trading?

A: Yes, CDG Global supports fractional trading, allowing traders to buy fractions of shares. This enhances flexibility, particularly for those with limited funds.

Q: What is the minimum deposit for a Standard account on CDG Global?

A: The minimum deposit for a Standard account on CDG Global is $500. It's advisable to review account types and their associated requirements.

Q: Can I access global markets on CDG Global?

A: Yes, CDG Global provides access to a wide range of global markets, enabling traders to capitalize on opportunities worldwide.

Q: How does CDG Global address risk management with high leverage?

A: CDG Global offers high maximum leverage, and it's crucial for traders to employ effective risk management strategies to navigate potential amplified profits and losses.

Q: Can I trade with CDG Global if I have a smaller budget?

A: While CDG Global offers fractional trading, the $500 minimum deposit for a Standard account might be higher than some other platforms. Traders should consider their budget and preferences.

Q: Is CDG Global suitable for beginners?

A: CDG Global caters to traders of various skill levels. However, beginners seeking more extensive educational guidance might find other brokers with more comprehensive resources.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Content you want to comment

Please enter...

Comment 1

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now