Overview of Orbex

Orbex, a forex and CFD broker founded in 2019 and regulated by the Seychelles Financial Services Authority (FSA), provides a range of trading instruments and services catering to various experience levels. They offer three account types with a minimum deposit of $100 and high leverage of up to 1:500. Spreads are variable for the Starter account and start from 0.0 pips for Premium and Ultimate accounts. Different trading platforms are available, including MT4, MT5, and the Orbex Mobile App. A demo account allows for practice before trading with real capital. Customer support is available 24/7, and educational resources are offered to enhance trading knowledge.

However, some drawbacks exist, such as potential risks associated with high leverage, limited regulatory oversight, variable spreads on the Starter account, and the absence of PAMM accounts. Overall, Orbex offers a competitive platform with diverse features and resources, but it's crucial to weigh the pros and cons before making investment decisions.

Pros and Cons

Pros:

High leverage of up to 1:500: This can amplify potential profits, but it can also magnify losses significantly. Only experienced traders should consider using high leverage.

Wide range of trading instruments: Orbex offers forex, commodities, cryptocurrencies, stocks, and indices, allowing traders to diversify their portfolios.

Multiple trading platforms available: Choose between MetaTrader 4 (MT4), MetaTrader 5 (MT5), the Orbex Mobile App, or the FIX API to suit your trading style and preferences.

Demo account available: Practice trading and test strategies without risking real capital before diving into the live market.

24/7 customer support: Get assistance anytime via live chat, email, back office, or dealing desk.

Cons:

Leverage can be risky for inexperienced traders: High leverage can magnify both profits and losses, making it unsuitable for beginners.

Limited regulatory oversight compared to other brokers: Orbex is regulated by the Seychelles Financial Services Authority (FSA), which is considered a Tier-3 regulator with less stringent oversight than some other jurisdictions.

Variable spreads on Starter account can be high: Starter account users may experience wider spreads compared to Premium and Ultimate accounts, affecting their trading costs.

Withdrawal fees may apply depending on the method: Certain withdrawal methods may incur fees, which can eat into your profits.

No PAMM accounts available: PAMM accounts allow investors to pool funds and follow the trading strategies of experienced managers. Orbex does not currently offer this feature.

Regulatory Status

Orbex Limited is regulated by the Seychelles Financial Services Authority (FSA) under license number SD110. The FSA is a Tier-3 regulator, which means that it has a moderate level of regulatory oversight.

The FSA regulates a wide range of financial services in Seychelles, including forex trading, securities trading, and investment management. Orbex Limited is licensed to offer forex and CFD trading services to retail clients.

Market Instruments

Orbex offers a wide range of trading products for online investors. These include:

Forex: Also known as foreign exchange or FX, this involves trading the value of one currency against another, with spreads starting from 0 and up to 1:500 leverage.

Commodities: These refer to raw materials that can be bought or sold as physical assets. Commodities like energies and metals can be traded on the financial markets via Contracts for Difference (CFDs). These offer flexible leverage and competitive spreads.

Cryptocurrencies: These are encrypted, digital, and decentralized currencies based on blockchain technology. They are not regulated or managed by a central authority but rather by a peer-to-peer network. Cryptocurrencies can be traded with leverage of 1:2 and a commission of 0.5%.

Stocks: This involves the buying and selling of shares in a specific asset or company. A stock trader buys shares, owns them, and then sells them, depending on the market value of the stock. There are over 200+ Stock CFDs available with a commission starting from $0.

Indices: These standardize and track the performance of a group of assets or securities. They are also used as a benchmark to assess the general performance of other economic data such as inflation or interest rates. With Orbex, traders can trade 10 of the world's biggest indices and futures with a leverage of 1:100.

Moreover, Orbex offers 400+ trading instruments, ultra-fast execution, and negative balance protection. However, it is crucial to note that trading carries a high level of risk.

Account Types

Orbex offers a variety of account types to cater to different trading styles and experience levels. Each account features unique specifications and benefits to suit your individual needs.

Starter Account:

This entry-level account is perfect for beginners or those with limited capital. With a minimum investment of $100, you can access a wide range of trading instruments with variable spreads. The Starter Account also offers high leverage of up to 1:500, allowing you to amplify your potential profits.

Premium Account:

For experienced traders seeking tighter spreads and premium benefits, the Premium Account is ideal. With a minimum investment of $500, you gain access to raw spreads starting from 0.0 pips, offering significant cost savings. Additionally, the account includes access to Trading Central signals, webinars, and monthly exclusive training sessions.

Ultimate Account:

For high-volume traders and professionals, the Ultimate Account provides the most advanced trading conditions. This account requires a minimum investment of $25,000 and features raw spreads from 0.0 pips, a dedicated account manager, and access to a virtual private server (VPS). Additionally, you receive exclusive 1-on-1 training sessions and advanced educational resources.

All Orbex accounts include negative balance protection, ensuring you never lose more than your deposited funds. You can choose to fund your account in USD, EUR, GBP, or PLN. Please note that PAMM Accounts are only available in USD.

Orbex Account Comparison Table

How to Open an Account?

Opening an account with Orbex is a straightforward process that involves three steps:

Sign up: To get started, create an account on the Orbex platform. This step should take only a few minutes. During this process, you will need to upload relevant personal documents for verification.

Fund your account: Once your account is verified, you can deposit funds into your Orbex Wallet. Deposits can be made via debit card, wire transfer, or your preferred online payment method. Orbex provides instant deposits to allow you to start trading as soon as possible.

Start trading: After funding your account, you can commence trading. Download your preferred trading platform onto your device of choice. Once installed, you can begin trading on the various markets that Orbex offers.

Spreads & Commissions

Orbex provides a range of competitive spreads and commissions tailored to different trading instruments, with specific rates contingent upon the chosen account type and the asset being traded. For the Starter Account, variable spreads are applicable, while the Premium and Ultimate Accounts offer raw spreads starting from 0.0 pips.

In terms of commissions, the Starter Account incurs $0 commission, while the Premium Account has a commission of $8 per round turn lot traded, and the Ultimate Account carries a commission of $5 per round turn lot traded.

All accounts share a common minimum trade size of 0.01 lots, promoting flexibility in trading. It's important to note that spreads and commissions are subject to potential adjustments based on market conditions, reflecting Orbex's commitment to adapting to dynamic financial landscapes.

Here's a table summarizing the information:

Leverage

Orbex offers a maximum leverage of 1:500 on certain instruments and account types. This high leverage allows you to control a larger position size with a smaller initial deposit, potentially amplifying your profits. However, it is crucial to remember that leverage is a double-edged sword and can magnify both your gains and losses.

Trading Platform

Orbex offers multiple trading platforms to give you the freedom to trade anywhere, at any time, and on any device.

MetaTrader 4 (MT4) and MetaTrader 5 (MT5): These are multi-award-winning platforms that are reliable and user-friendly. Having operated in the market for over 15 years, MetaTrader platforms have gained global recognition and have become the first choice for many traders globally. These platforms assure fast and efficient execution of trades across a wide range of assets, catering to traders of all levels.

Orbex MT4 and MT5 are also very convenient. This adaptability extends to mobile devices, allowing traders to execute trades on the go using Android or iOS systems. Moreover, desktop traders are not left out - they can access the platforms on both Windows and macOS.

Orbex Mobile App: This allows you to register, set up, and manage your trading account from anywhere. The app is easily available on the App Store for iOS users and Google Play for Android users.

FIX API: The Financial Information Exchange (FIX) is a high-speed technology that provides secure online trading. This standard protocol is used to exchange financial information in a secure and fast-paced trading environment.

In summary, Orbexs range of platforms ensures that traders have access to user-friendly, convenient, and secure trading options.

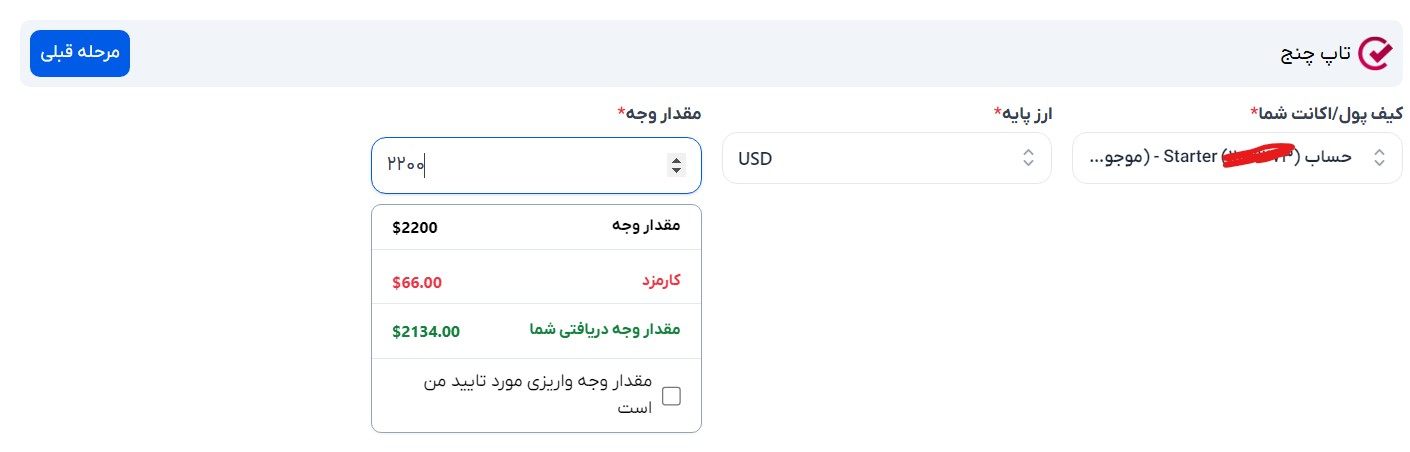

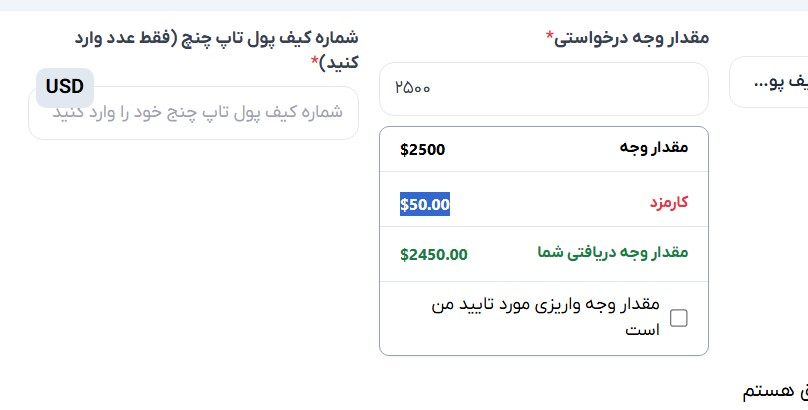

Deposit & Withdrawal

Orbex provides a comprehensive range of payment methods to facilitate both deposits and withdrawals for its users. Clients can choose from various options, including Debit/Credit Cards (Visa, Mastercard), eWallets (Skrill, Neteller, Perfect Money, UnionPay, ENet, Fasapay, Poli, Knet), Crypto Payments (USDT), and Bank Transfers (Wire transfer).

For depositing funds, all deposit methods incur 0% fees, except for Crypto Payments (USDT), which may be subject to payment processor fees for deposits under the equivalent of 50 USDT. The processing time for deposits is generally immediate or near-instant for most methods, except for bank transfers, which may take 3-5 business days.

When it comes to withdrawals, Orbex offers a seamless experience with 0% fees across all withdrawal methods. Withdrawal processing times can vary, ranging from 24 hours to several business days, depending on the chosen method. Users are encouraged to review the specific fees and processing times associated with their selected payment method before initiating transactions.

It's worth noting that the Orbex Wallet serves as a central hub for managing funds, streamlining the funding and withdrawal processes. Clients have the flexibility to choose from a variety of currencies to fund and maintain their accounts. Orbex prioritizes fast and secure transactions, aiming to ensure a smooth trading experience for its users. Always exercise due diligence by reviewing the details of your chosen payment method to make informed financial decisions.

Here's a table summarizing the information:

Customer Support

Orbex provides comprehensive customer support to attend to the diverse needs of their clients.

Customer Support: This service is available 24 hours from Monday to Friday. Communication can be made via email at support@orbex.com for any general inquiries or assistance.

Back Office: Also available 24 hours from Monday to Friday. This department can be contacted via backoffice@orbex.com.

Dealing Desk: For more detailed trading inquiries, clients can contact the dealing desk 24 hours from Monday to Friday using the email dealing@orbex.com.

Moreover, Orbex provides a live chat feature for real-time assistance without the need for an email. In addition, Orbex offers a Help Center with various categories including Getting Started, Orbex Mobile App, MyOrbex Area, Payment Methods, and several trading related categories. This serves as a useful resource for self-help and informational needs.

Educational Resources

Orbex provides several educational resources for its clients:

Forex Trading Education: Orbex offers a comprehensive suite of educational resources and materials focused on forex trading. This is beneficial for both beginners who are new to the forex market and experienced traders wanting to expand their knowledge.

Live FX Webinars: These are interactive webinars conducted in real-time where traders can learn and interact directly with forex experts. This resource gives a unique opportunity to ask questions and gain insights from experienced professionals.

Seminars: Orbex organizes seminars that offer valuable information about the Forex market and trading strategies. These seminars are beneficial for traders who prefer face-to-face learning and interaction with industry professionals.

Forex Trading Glossary: This is a comprehensive list of key terms and vocabulary relevant to forex trading. This resource is useful for all traders to understand complex jargon and specialized language frequently used in the Forex market.

Conclusion

In conclusion, Orbex offers a diverse platform with competitive features like high leverage, a wide range of instruments, and multiple trading platforms. However, it's crucial to consider potential downsides like limited regulation, variable spreads, and withdrawal fees. Ultimately, Orbex presents a viable option for experienced traders seeking a comprehensive trading experience, while beginners might benefit from a platform with stricter regulation and more extensive educational resources.

FAQs

Q: Is Orbex a safe and regulated broker?

A: Orbex is regulated by the Seychelles Financial Services Authority (FSA), which is a Tier-3 regulator. While this isn't the most stringent oversight, Orbex provides various security features and adheres to strict client fund segregation rules.

Q: What trading platforms does Orbex offer?

A: Orbex offers the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, along with their own Orbex Mobile App and the FIX API for advanced trading.

Q: How much leverage does Orbex offer?

A: Orbex offers leverage of up to 1:500, which can be beneficial for experienced traders but should be handled with caution by beginners due to the potential for significant losses.

Q: What are the minimum deposit requirements?

A: The minimum deposit required to open an account with Orbex is $100. This makes it accessible for new traders who want to start with a smaller investment.

Q: What fees does Orbex charge?

A: Orbex offers competitive spreads, especially for Premium and Ultimate accounts with raw spreads starting from 0.0 pips. However, some withdrawal methods may incur fees, and the Starter account has variable spreads which may be wider.

Q: Does Orbex offer a demo account?

A: Yes, Orbex provides a free demo account with virtual funds so you can practice trading and test different strategies before risking real capital.