Score

CM Trade

France|2-5 years|

France|2-5 years| https://www.cmtrade.com

Website

Rating Index

MT4/5 Identification

MT4/5 Identification

White Label

Malaysia

MalaysiaContact

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

France

France

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Users who viewed CM Trade also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Exness

- 10-15 years |

- Regulated in Cyprus |

- Market Maker (MM) |

- MT4 Full License

IC Markets Global

- 15-20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Vantage

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Website

cmtrade.com

Server Location

United States

Website Domain Name

cmtrade.com

Server IP

18.65.168.115

Genealogy

VIP is not activated.

VIP is not activated.Relevant Enterprises

Company Summary

| CM Trade Review Summary | |

| Registered Country/Region | China |

| Regulation | VFSC (Suspicious clone) |

| Market Instruments | Forex, Commodity, Stock index, Cryptocurrencies |

| Demo Account | Available |

| Leverage | 1:833 |

| Minimum Floating Spreads (Forex) | from 1.4 pips (Mini account) |

| from 0.8 pips (Standard account) | |

| from 0.7 pips (Premium account) | |

| Trading Platform | MetaTrader4 |

| Minimum Deposit | $100 |

| Customer Support | Live chat (7/24 support) |

What is CM Trade?

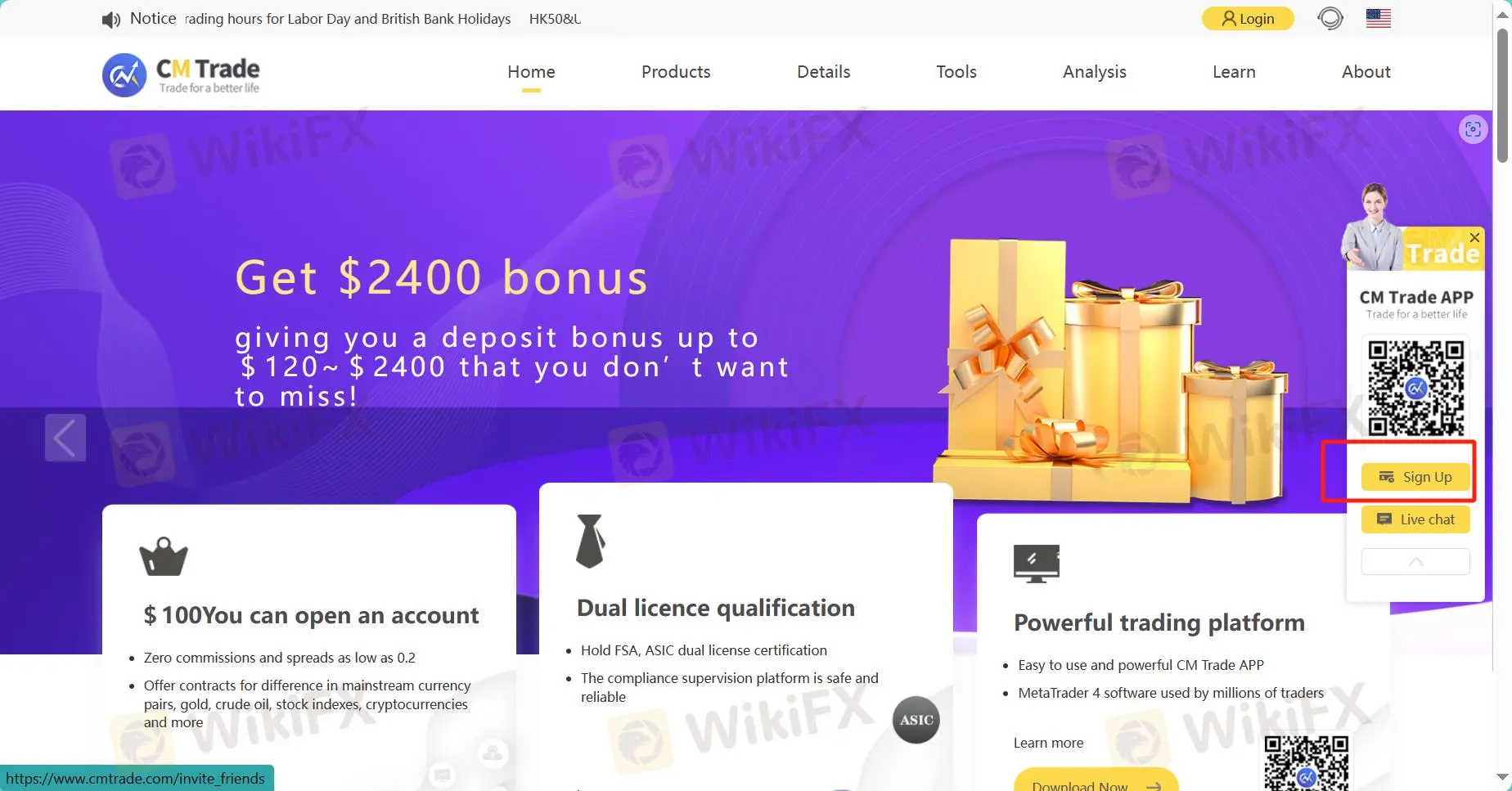

CM Trade is a financial services firm with a suspicious clone license based in China that offers online trading services to clients interested in forex, commodities, stock indices, and cryptocurrencies. The company provides access to a range of account types, each designed to meet the needs of traders at different levels of experience. CM Trade offers a variety of trading platforms, including the CM Trade APP and MetaTrader 4.

Pros & Cons

| Pros | Cons |

|

|

|

Pros:

Multiple Market Instruments: The platform offers diverse Market Instruments, including Forex, Commodity, Stock index, and Cryptocurrencies, catering to various trading needs and experience levels.

Multiple Account Types: The platform offers diverse account types, including the Mini account, the Standard account, and the Premium account, catering to various trading needs and experience levels.

Cons:

Suspicious Clone VFSC License: The lack of valid regulation raises significant safety and trust concerns, as regulatory oversight is crucial for ensuring customer protection and platform transparency. It's very likely to be a scam.

Is CM Trade Legit or a Scam?

Regulatory sight: Presently, CM Trade has the sole authority of a suspicious clone license under the Vanuatu Financial Services Commission (VFSC), bearing the license number 40452. This type of license, which allows a company to mimic the services of a legitimate financial entity, raises concerns about the legitimacy and trustworthiness of the company's operations.

Market Instruments

Forex Trading: CM Trade offers a comprehensive selection of currency pairs for Forex trading, allowing clients to speculate on the exchange rate movements of major, minor, and exotic currency pairs.

Commodity Trading: Traders can access a variety of commodities through CM Trade, including precious metals like gold and silver, as well as energy resources such as crude oil and natural gas, providing opportunities to diversify their portfolios and hedge against inflation and geopolitical uncertainties.

Stock Index Trading: CM Trade facilitates trading in global equity markets by offering access to a range of stock indices, including popular benchmarks like the S&P 500, NASDAQ, and FTSE 100. This allows traders to participate in broad market movements and capitalize on global economic trends.

Cryptocurrency Trading: With the rising popularity of cryptocurrencies, CM Trade provides trading options in digital assets such as Bitcoin, Ethereum, and Ripple, enabling clients to take advantage of the volatility and returns offered by the crypto market.

Account Types

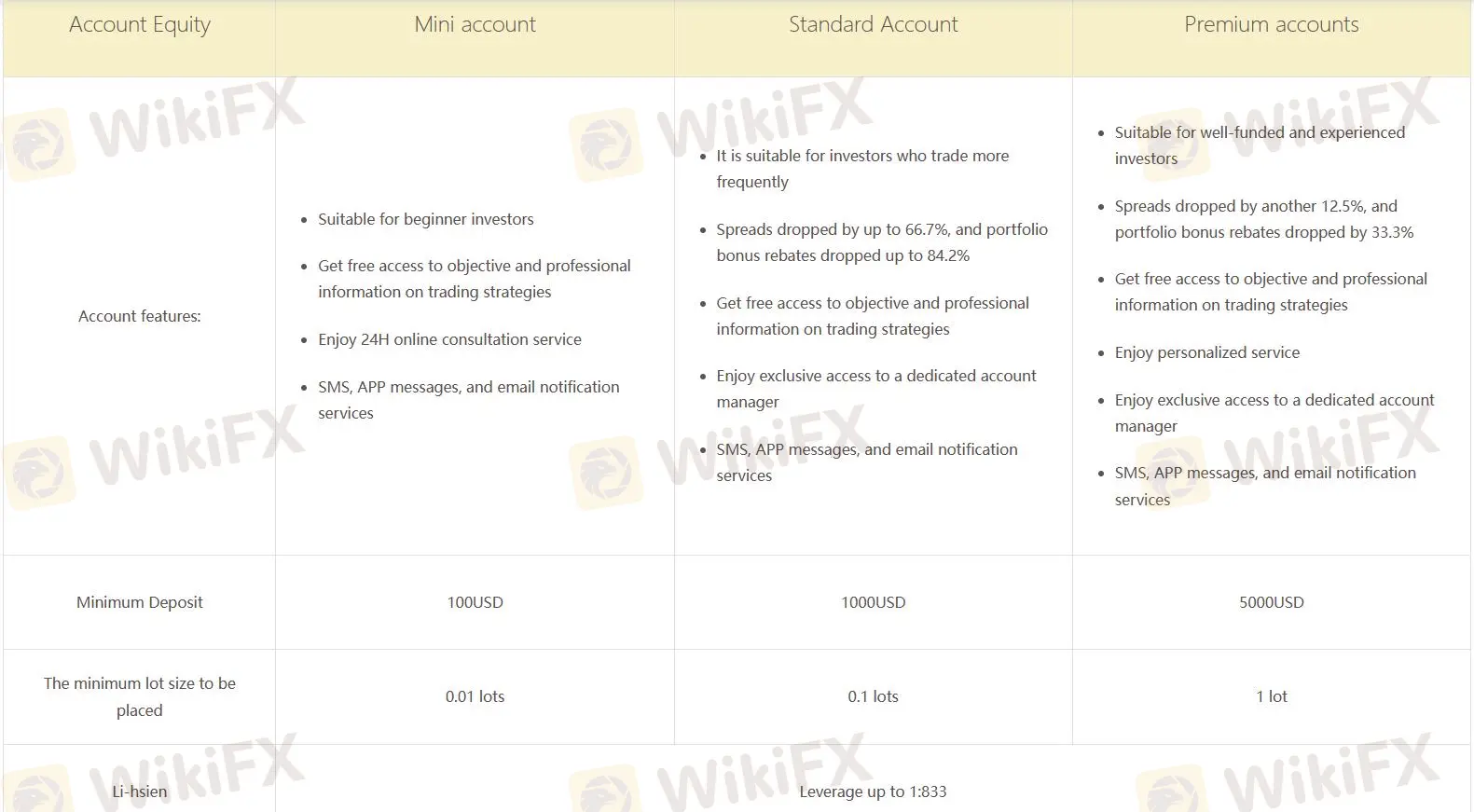

CM Trade caters to traders of varying experience levels and investment preferences through its range of account types, each designed to meet specific trading needs.

With a minimum deposit requirement of $100, the Mini account offers a low barrier to entry for novice traders looking to dip their toes into the financial markets.

For those seeking more advanced features and trading conditions, the Standard account, requiring a deposit of $1,000, provides access to enhanced services and tools.

Meanwhile, the Premium account, with a minimum deposit of $5,000, is tailored to experienced traders and high-net-worth individuals, offering premium benefits, personalized support, and competitive trading conditions.

How to Open an Account?

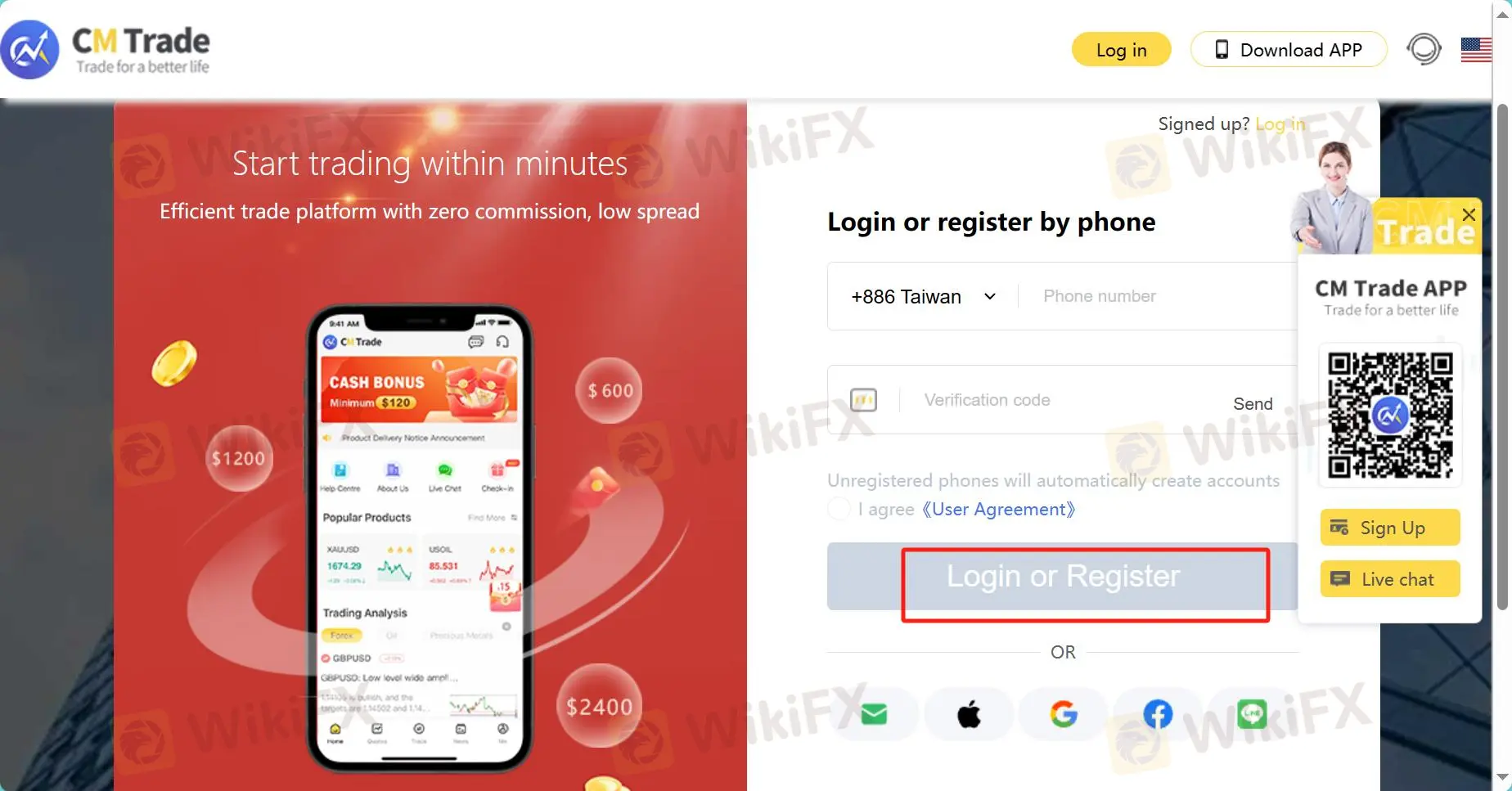

Step 1: Click the button ''Sign Up'' on the homepage.

Step 2: Follow the on-screen instructions to input your personal and contact details.

Step 3: Click on the ''Register'' option to finalize the creation of your account.

Step 4: A message will typically be sent to your registered phone to verify your account.

Step 5: Click on the link received in the verification email to activate your account.

Leverage

CM Trade empowers traders with the flexibility to amplify their trading positions through its generous maximum leverage of 1:833. This high leverage ratio allows traders to control larger positions in the market with a relatively small amount of capital, magnifying both profits and losses. With such leverage, traders can capitalize on even small market movements to enhance their returns.

However, while leverage can amplify profits, it also increases the risk of significant losses, especially if trades move against the trader's expectations.

Spreads & Commissions

CM Trade provides competitive minimum floating spreads across its range of account types, catering to traders with varying preferences and trading styles. With spreads starting from as low as 1.4 pips for Mini accounts, 0.8 pips for Standard accounts, and 0.7 pips for Premium accounts, traders can benefit from cost-effective trading conditions designed to enhance profitability.

Additionally, CM Trade distinguishes itself by offering zero commissions for all account types, further optimizing trading costs for its clients. This transparent fee structure ensures that traders can focus on executing their trading strategies without being burdened by additional commission charges.

| Account Type | Commission | Spreads |

| Mini | $0 | From 1.4 pips |

| Standard | $0 | From 0.8 pips |

| Premium | $0 | From 0.7 pips |

Trading Platforms

CM Trade provides its clients with a choice between two robust trading platforms: theCM Trade APP and MetaTrader 4 (MT4).

With the CM Trade APP, clients can access the financial markets directly from their mobile devices, offering convenience and flexibility for trading on the go. This user-friendly app is designed to provide a seamless trading experience, allowing clients to execute trades, monitor their portfolios, and access real-time market data with ease.

On the other hand, MetaTrader 4 is a widely acclaimed platform known for its advanced charting tools, customizable interface, and comprehensive range of trading features. MT4 offers a desktop-based solution for traders who prefer a more traditional approach to trading, providing access to a wide range of assets, including forex, stocks, indices, and commodities.

Deposits & Withdrawals

Deposits:

Customers can deposit funds online through the PC website, mobile website, or APP.

Upon entering the amount, the system automatically converts it into the corresponding currency based on the day's exchange rate.

Only debit cards held by the customer are supported for deposits.

Customers should take note of the single and daily payment limits for their card.

Withdrawals:

Before initiating a withdrawal, customers must complete real-name authentication, and the bank card used for authentication will be the receiving bank card. Contact customer service if any modifications are needed.

Withdrawals are subject to review as per anti-money laundering rules, with a review time typically not exceeding 24 hours.

Trading Bonuses:

Customers may receive bonuses from the platform upon opening an account, depositing funds, and trading, based on the deposit level.

Bonuses can only be withdrawn if they meet specific conditions, typically involving a fixed number of trading lots.

Precautions for Withdrawals:

Generally, withdrawal fees are waived by the company. However, certain circumstances may incur fees:

If 50% of the deposit amount hasn't been used to open a position, a 6% handling fee applies at the time of withdrawal.

Withdrawals less than $50 in a single transaction incur a $3 handling fee.

More than 4 withdrawals per month result in a 5% deduction from the 5th transaction as a handling fee.

Customer Service

CM Trade offers a convenient and accessible customer service experience through their 24/7 live chat feature. This allows customers to seek immediate assistance at any time. Whether you have a quick question or require more in-depth support, you can connect with either a smart robot for automated responses or speak directly with a human representative for personalized help. This dual approach ensures that CM Trade customers receive prompt and efficient service whenever needed.

Conclusion

In conclusion, CM Trade offers an extensive range of trading instruments, various account types, a high maximum leverage, multiple trading platforms, and a wide range of accepted payment methods, making it an advantageous platform for various investors with varying investment styles and goals. However, the lack of valid regulation raises significant concerns about the safety and trustworthiness of the platform.

Frequently Asked Questions (FAQs)

| Question 1: | Is CM Trade regulated? |

| Answer 1: | No. It currently only holds a suspicious clone VFSC license. |

| Question 2: | Does CM Trade offer demo accounts? |

| Answer 2: | Yes. |

| Question 3: | What is the minimum deposit for CM Trade? |

| Answer 3: | The minimum initial deposit to open an account is $100. |

| Question 4: | What is the maximum leverage available at CM Trade? |

| Answer 4: | 1:833. |

| Question 5: | Is CM Trade a good broker for beginners? |

| Answer 5: | No. It is not a good choice for beginners because of its unregulated condition. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

Keywords

- 2-5 years

- Suspicious Regulatory License

- White label MT4

- Regional Brokers

- High potential risk

Content you want to comment

Please enter...

Comment 1

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now