It is important to note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

Pros and cons of Snapex FX

Pros:

Wide range of trading instruments including forex pairs, commodities, stocks, cryptocurrencies, and indices.

Multiple account types to suit different trading preferences and experience levels.

High leverage options available, with a maximum leverage of up to 1:1000 for the Premium account.

Convenient deposit and withdrawal methods, including bank wire transfer, credit card, debit card, Skrill, Neteller, and PayPal.

Availability of educational resources such as economic calendars, online courses, videos, articles, glossary, technical analysis, and fundamental analysis.

Cons:

Lack of regulation, as the company is not currently regulated by any effective regulatory body.

Limited account options, with only three account types available (Premium, Fixed, and Zero).

The Zero account incurs a commission of $4 per side per 100,000 traded.

Limited customer support channels, with only email, phone number, address, and live chat available.

Limited regulatory protection, as the company is not regulated, which may pose risks for traders.

What type of broker is Snapex FX?

Snapex FX is a Market Making (MM) broker, which means that it acts as a counterparty to its clients in trading operations. That is, instead of connecting directly to the market, Snapex FX acts as an intermediary and takes the opposite position to its clients. As such, it can offer faster order execution speed, tighter spreads and greater flexibility in terms of the leverage offered. However, this also means that Snapex FX has a certain conflict of interest with their clients, as their profits come from the difference between the bid and ask price of assets, which could lead to them making decisions that are not necessarily in the best interests of their clients. It is important for traders to be aware of this dynamic when trading with Snapex FX or any other MM broker.

General information and regulation of Snapex FX

Snapex FX is a forex brokerage company registered in Saint Vincent and the Grenadine. At present, it operates without effective regulation. With a relatively short establishment period of 1-2 years, Snapex FX offers a diverse range of trading instruments including forex pairs, commodities, stocks, cryptocurrencies, and indices. The company provides multiple account types to cater to different trading preferences, such as the Premium, Fixed, and Zero accounts. Clients can choose from popular trading platforms like MT4 and MT5. Deposits and withdrawals can be made through various methods including bank wire transfer, credit card, debit card, Skrill, Neteller, and PayPal. While Snapex FX offers high leverage of up to 1:1000, traders are advised to exercise caution. The company's customer service is available via email, phone, address, and live chat. However, it is important to note that Snapex FX currently lacks effective regulation, which may pose potential risks for traders.

In the following article, we will analyse the characteristics of this broker in all its dimensions, providing you with easy and well-organised information. If you are interested, read on.

Market instruments

Snapex FX offers traders a diverse range of trading instruments across multiple asset classes. Traders can engage in the forex market, trading major, minor, and exotic currency pairs. The inclusion of commodities provides opportunities to trade precious metals, energies, agricultural products, and more. The availability of stocks allows traders to participate in the equity markets and take advantage of price movements in individual companies. Additionally, the inclusion of cryptocurrencies enables traders to tap into the growing digital asset market and trade popular cryptocurrencies such as Bitcoin, Ethereum, and others. Lastly, the inclusion of indices allows traders to access a broader representation of specific markets and track the performance of various sectors or regions.

Spreads, commissions and other costs

Snapex FX offers a range of account types with different spreads and commission structures to accommodate various trading preferences. The Premium account features typical spreads starting from 1.0 pips, providing competitive pricing for traders. This account type does not charge any additional commissions, ensuring transparent and predictable trading costs. It is suitable for traders who prioritize low-cost trading and prefer a simple fee structure.

The Fixed account option provides traders with fixed spreads, ensuring consistency in trading costs regardless of market conditions. Similar to the Premium account, there are no commissions associated with this account type. Fixed spreads can be advantageous for traders who rely on stable trading costs and prefer to avoid potential spread fluctuations during high volatility periods.

The Zero account offers traders the tightest spreads with typical spreads starting from 0.0 pips. However, it comes with a commission of $4 per side per 100,000 traded. This commission-based structure allows traders to access highly competitive pricing, particularly for high-volume traders. While the commission may be a disadvantage for some traders, the tight spreads can help offset these costs, especially for those who engage in frequent trading.

Trading accounts available in Snapex FX

Snapex FX offers traders a variety of account types to cater to different trading preferences. The Premium account requires a minimum deposit of $50, providing accessibility for beginner traders. With a maximum leverage of 1:1000, traders can access higher position sizes relative to their account balance. The typical spreads starting from 1.0 pips offer competitive pricing, and the absence of commission helps keep trading costs lower. This account type is well-suited for traders who are new to the market and looking to start with a smaller initial investment.

The Fixed account option requires a minimum deposit of $250, offering a more intermediate level of trading. It provides a maximum leverage of 1:400 and fixed spreads, which can be advantageous for traders who prefer more predictable trading costs and want to avoid potential spread fluctuations. This account type does not charge any commissions, making it appealing to traders who value transparency in their trading expenses.

For scalpers, institutional traders, and day traders, the Zero account may be the preferred choice. With a minimum deposit of $100, it offers a maximum leverage of 1:250, allowing traders to access larger positions. The typical spreads starting from 0.0 pips ensure tight pricing, and a commission of $4 per side per 100,000 is applicable. This account type suits traders who execute frequent trades and require a more competitive cost structure.

Trading platform(s) that Snapex FX offers

Snapex FX offers its clients the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms. These platforms are widely recognized and trusted in the industry, providing traders with a reliable and efficient trading environment.

MT4 and MT5 platforms are known for their user-friendly interfaces, making them accessible to traders of all experience levels. The platforms offer a comprehensive range of technical analysis tools and indicators, allowing traders to conduct in-depth market analysis. Additionally, both platforms support automated trading through the use of Expert Advisors (EAs), enabling traders to execute trades based on pre-defined strategies.

Maximum leverage of Snapex FX

The maximum leverage offered by Snapex FX varies depending on the type of account. The Premium account provides a maximum leverage of 1:1000, the Fixed account offers a maximum leverage of 1:400, and the Zero account allows for a maximum leverage of 1:250.

High leverage provides traders with the ability to control larger positions in the market with a relatively small amount of capital. This can potentially amplify profits, as even small market movements can result in significant gains. Traders can take advantage of greater trading flexibility, allowing them to enter and exit positions more freely and capture various trading opportunities.

However, it's important to consider the potential disadvantages of high leverage.

Deposit and Withdrawal: methods and fees

Snapex FX offers a variety of deposit and withdrawal methods to cater to the needs of its clients. Traders can choose from options such as bank wire transfer, credit card, debit card, Skrill, Neteller, and PayPal.

One of the advantages of these payment methods is the convenience they offer. Credit and debit cards are widely accepted and commonly used for online transactions, making them easily accessible for many traders. E-wallets like Skrill, Neteller, and PayPal provide a secure and reliable way to transfer funds, offering an extra layer of protection for financial transactions.

Deposits and withdrawals through these methods are typically processed quickly, allowing traders to access their funds promptly. The flexibility to choose the preferred payment method gives traders the convenience and control they need to manage their accounts efficiently.

However, it's important to consider potential disadvantages as well.

Educational resources in Snapex FX

Snapex FX provides a range of educational resources to support traders in their learning and development journey. These resources include an economic calendar, online courses, videos, articles, a glossary, technical analysis tools, and fundamental analysis resources.

Customer service of Snapex FX

Snapex FX provides multiple customer care options to cater to the needs of its clients. Traders can reach out to the company through email, phone, live chat, and even visit their physical address. These various contact methods offer flexibility and convenience for customers to seek assistance and resolve any concerns they may have.

Conclusion

In conclusion, Snapex FX, a forex brokerage company registered in Saint Vincent and the Grenadine, offers a wide range of trading instruments including forex pairs, commodities, stocks, cryptocurrencies, and indices. With multiple account types and popular trading platforms like MT4 and MT5, the company caters to diverse trading preferences. While Snapex FX provides various deposit and withdrawal methods, it is important to note that the company operates without effective regulation at this time. Traders should exercise caution when considering the high leverage options available, as high leverage can amplify both profits and losses. The company's customer service can be reached through email, phone, address, and live chat, providing assistance and support to its clients. However, the lack of effective regulation raises concerns regarding the level of investor protection and oversight. Traders should carefully evaluate the risks associated with trading with an unregulated broker. It is recommended to conduct thorough research and consider alternative options that offer stronger regulatory frameworks for a safer trading environment.

Frequently asked questions about Snapex FX

Question: Is Snapex FX a regulated company?

Answer: No, Snapex FX is not regulated by any regulatory authority at this time.

Question: What trading instruments are available on Snapex FX?

Answer: Snapex FX offers a range of trading instruments including forex pairs, commodities, stocks, cryptocurrencies, and indices.

Question: What are the minimum initial deposits for the different account types?

Answer: The minimum initial deposits vary depending on the account type. The Premium account requires a minimum deposit of $50, the Fixed account requires a minimum deposit of $250, and the Zero account requires a minimum deposit of $100.

Question: What is the maximum leverage offered by Snapex FX?

Answer: Snapex FX provides different maximum leverage options based on the account type. The Premium account offers a maximum leverage of 1:1000, the Fixed account offers a maximum leverage of 1:400, and the Zero account offers a maximum leverage of 1:250.

Question: Are there any commissions on trades?

Answer: Snapex FX does not charge any commissions on trades for the Premium and Fixed accounts. However, the Zero account has a commission of $4 per side per 100,000 traded.

Question: What are the available deposit and withdrawal methods?

Answer: Snapex FX supports various deposit and withdrawal methods including bank wire transfer, credit card, debit card, Skrill, Neteller, and PayPal.

Question: Does Snapex FX offer educational resources for traders?

Answer: Yes, Snapex FX provides a range of educational resources including an economic calendar, online courses, videos, articles, a glossary, technical analysis, and fundamental analysis materials to help traders enhance their knowledge and trading skills.

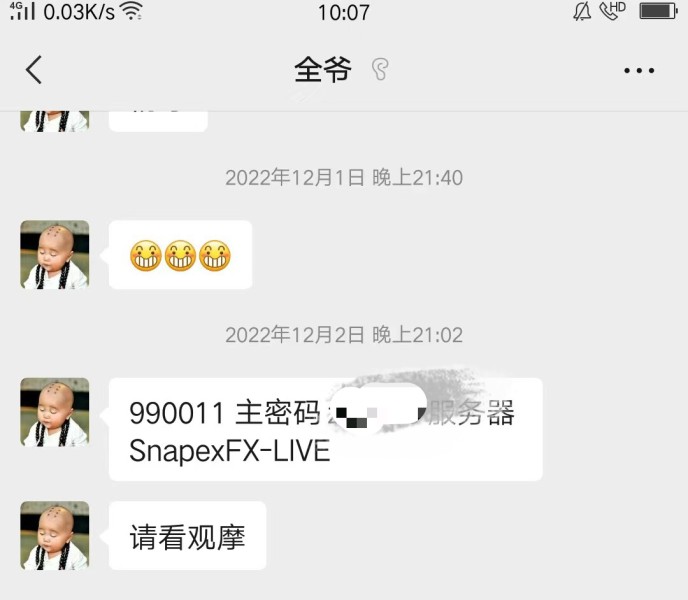

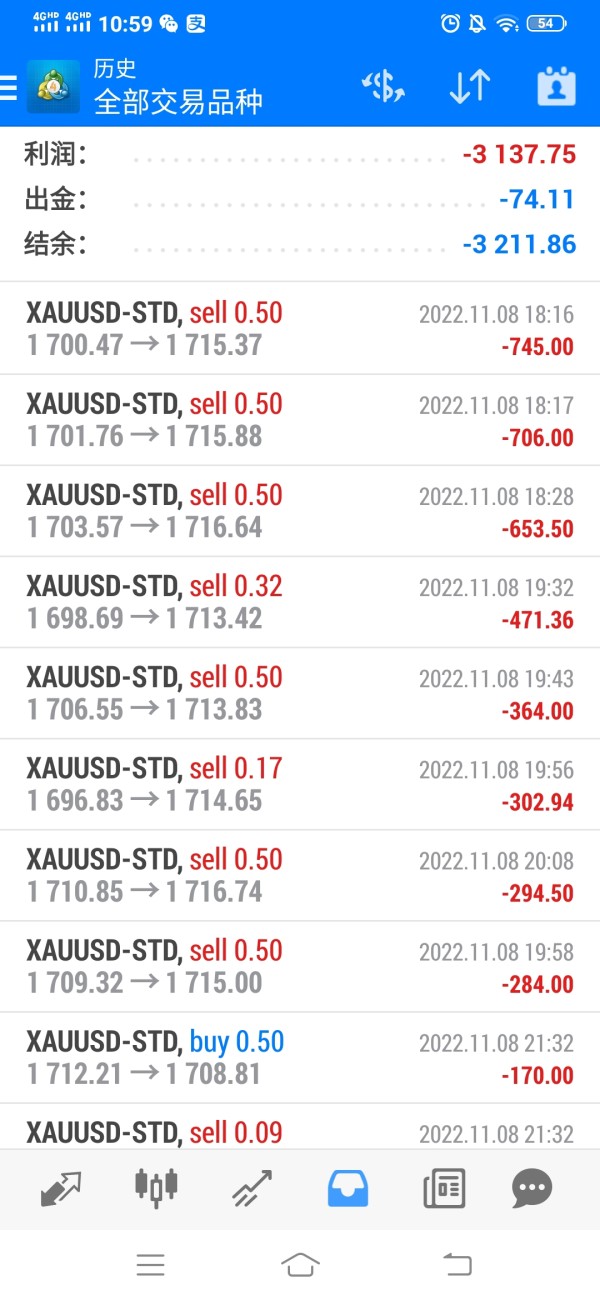

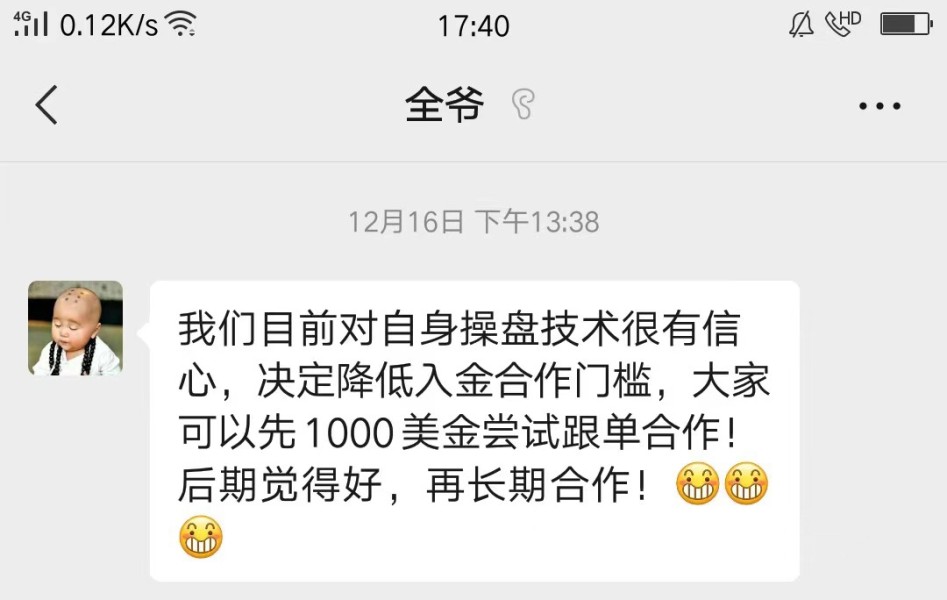

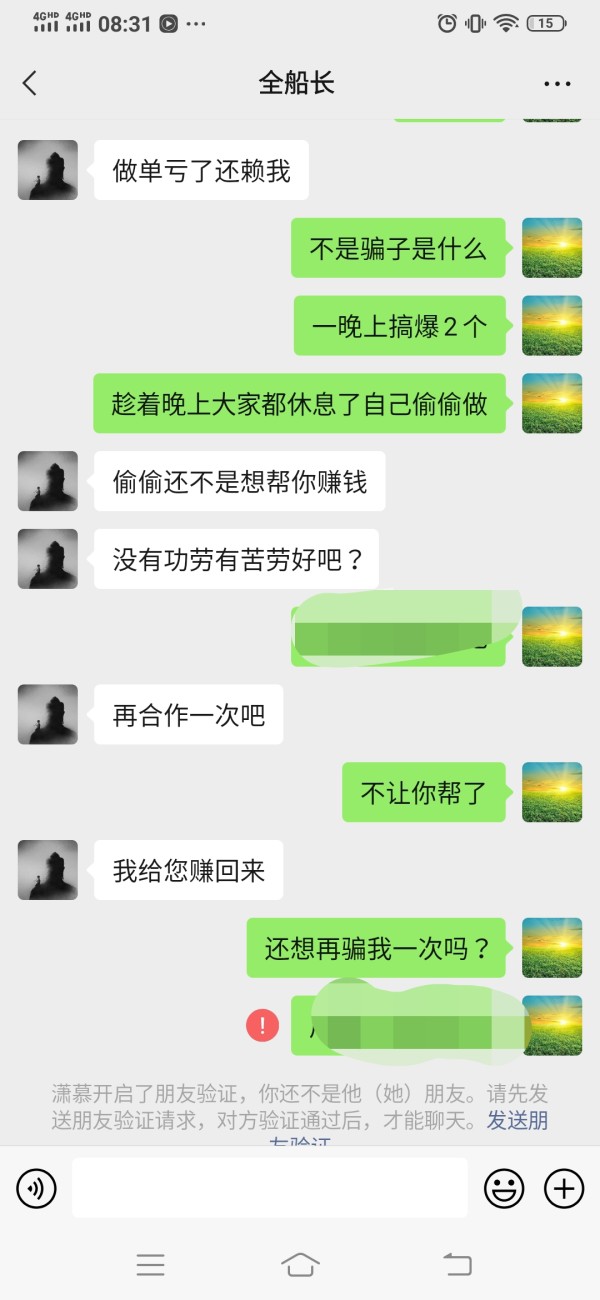

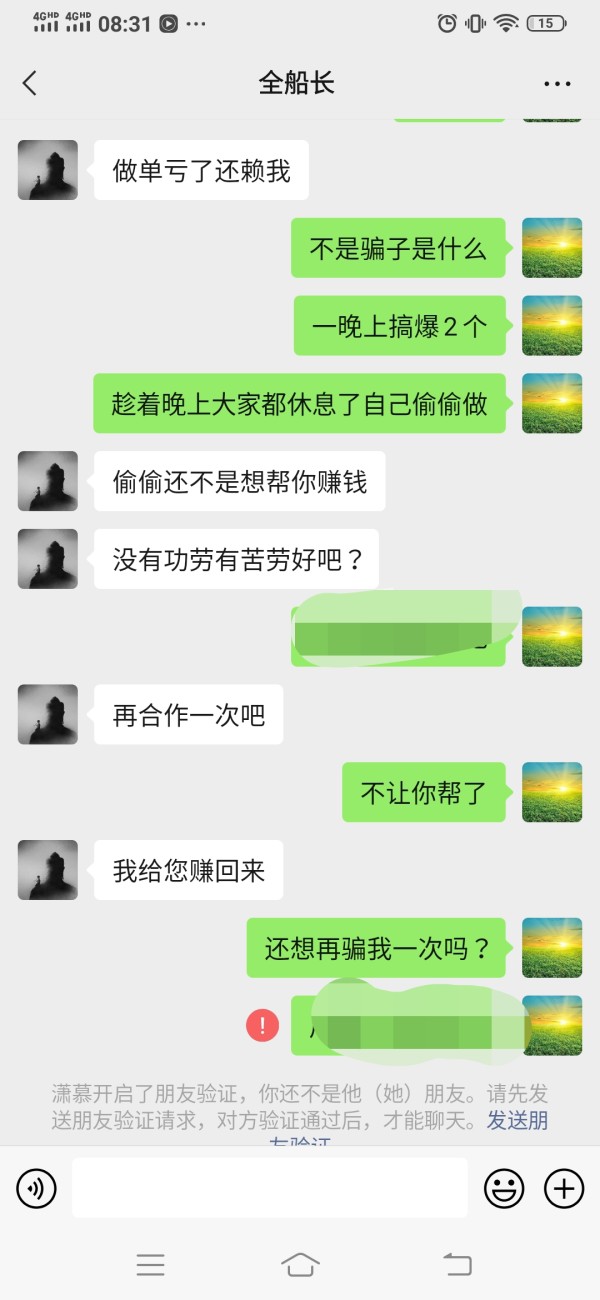

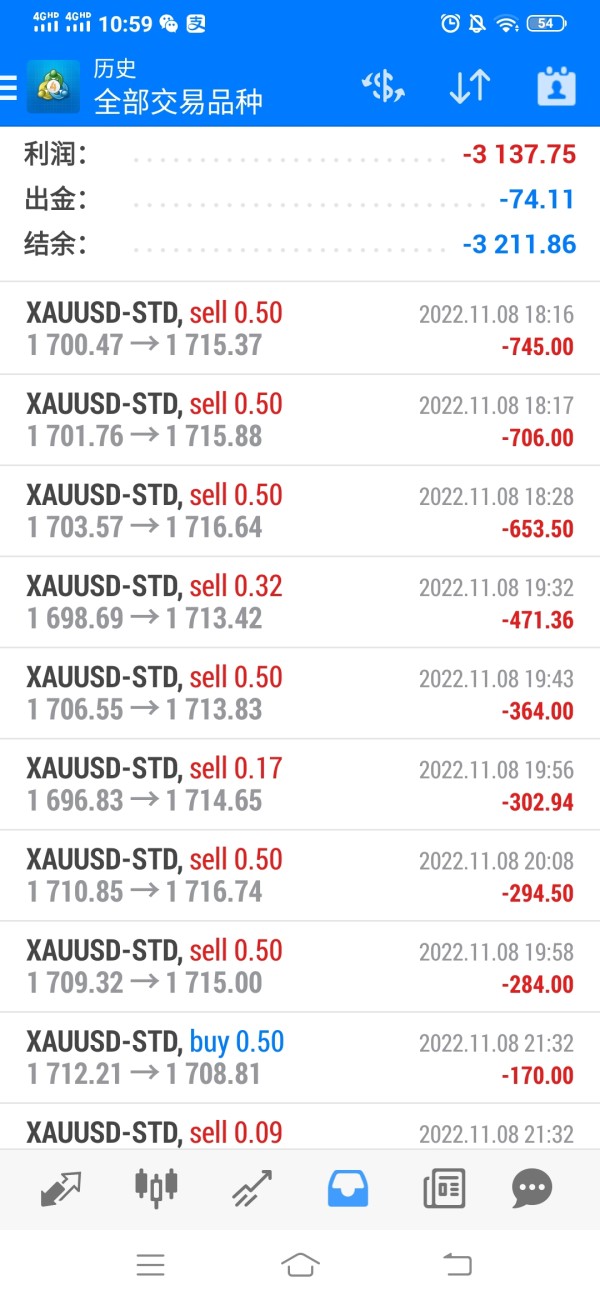

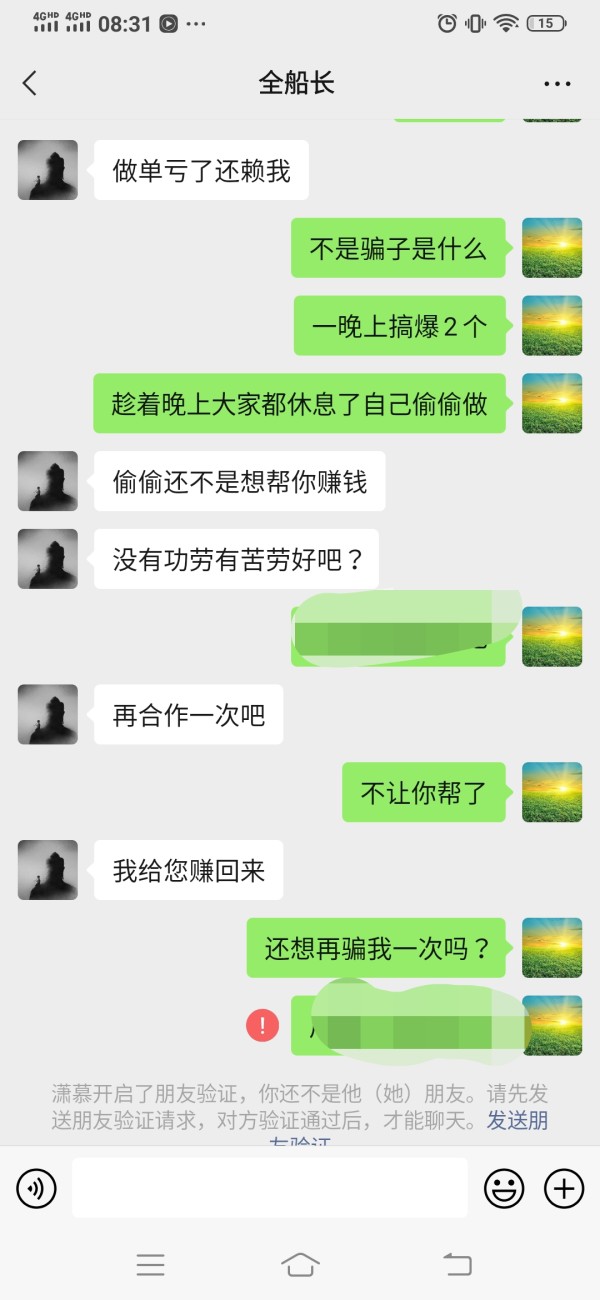

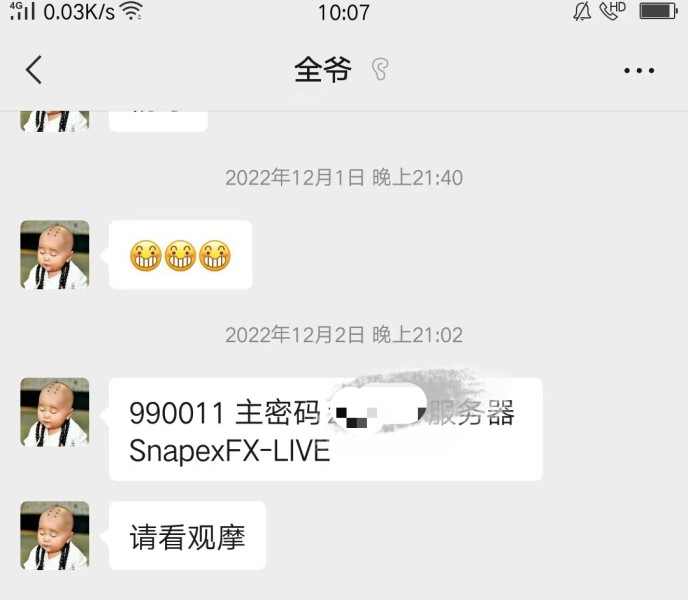

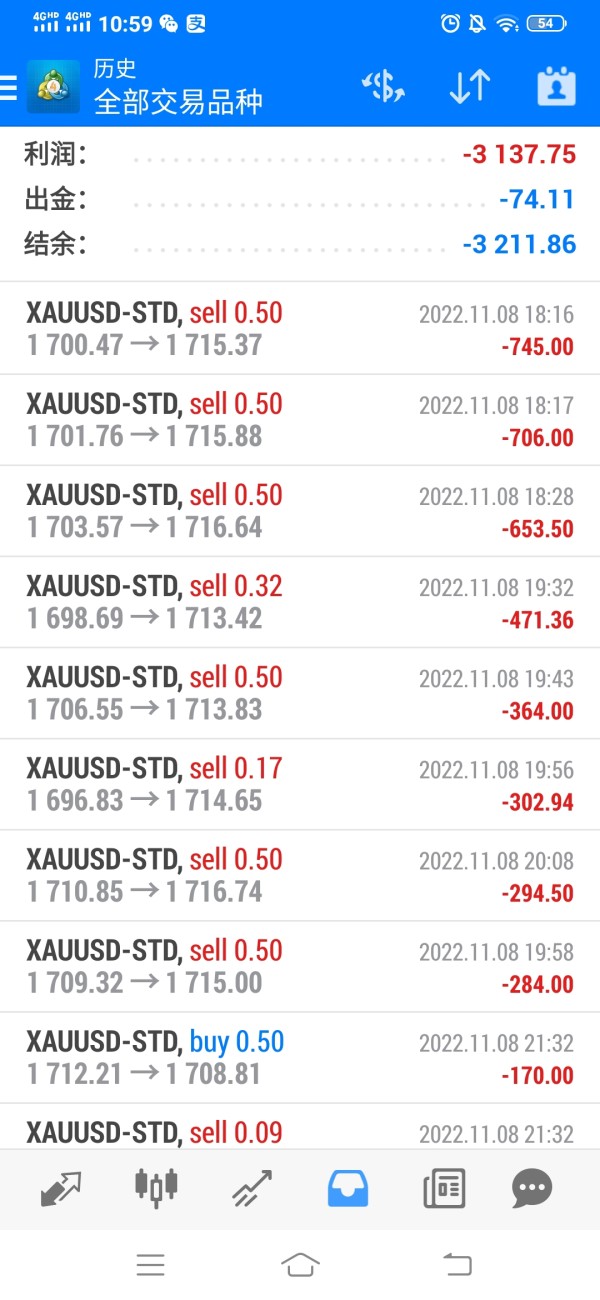

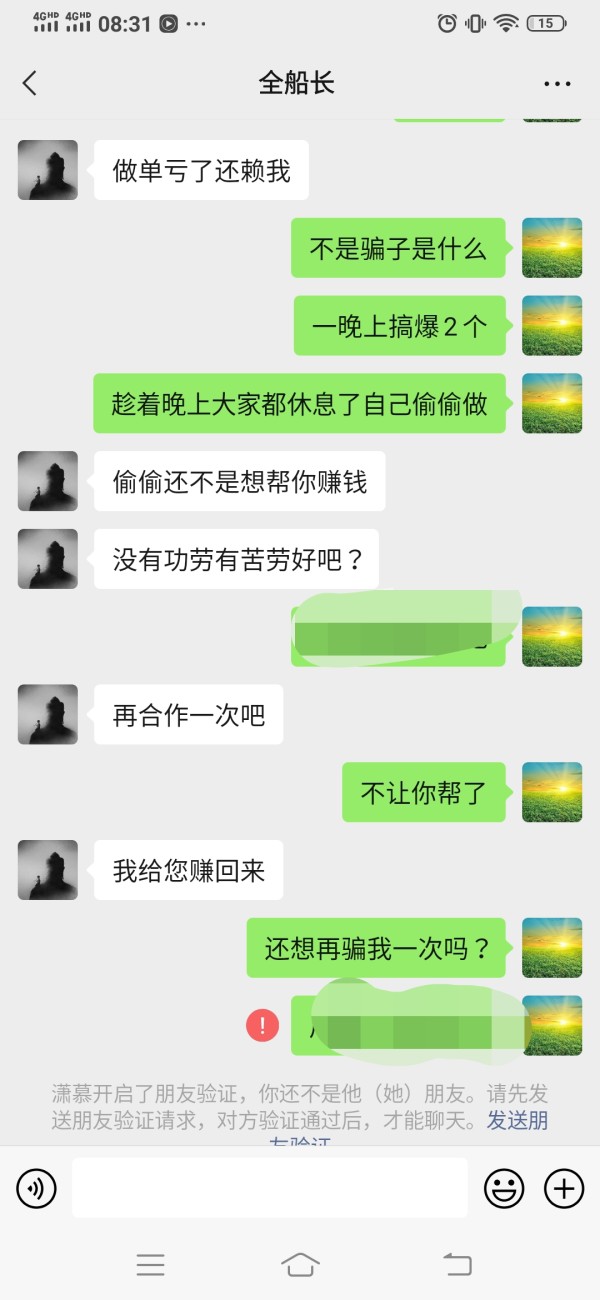

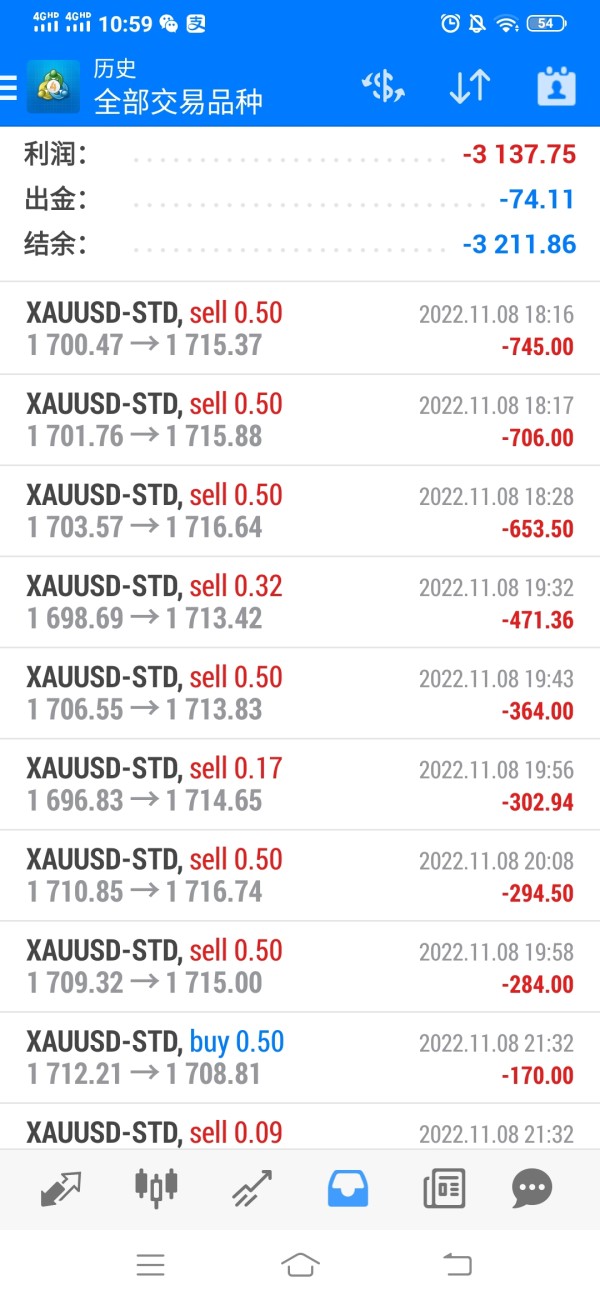

万信齐发

Hong Kong

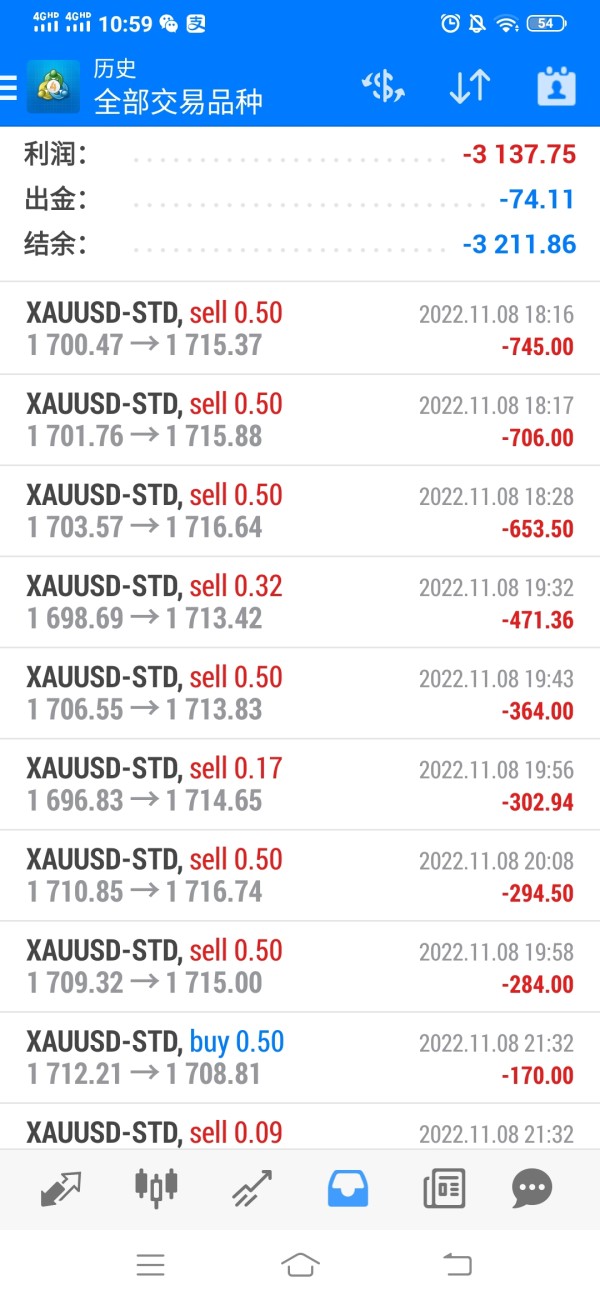

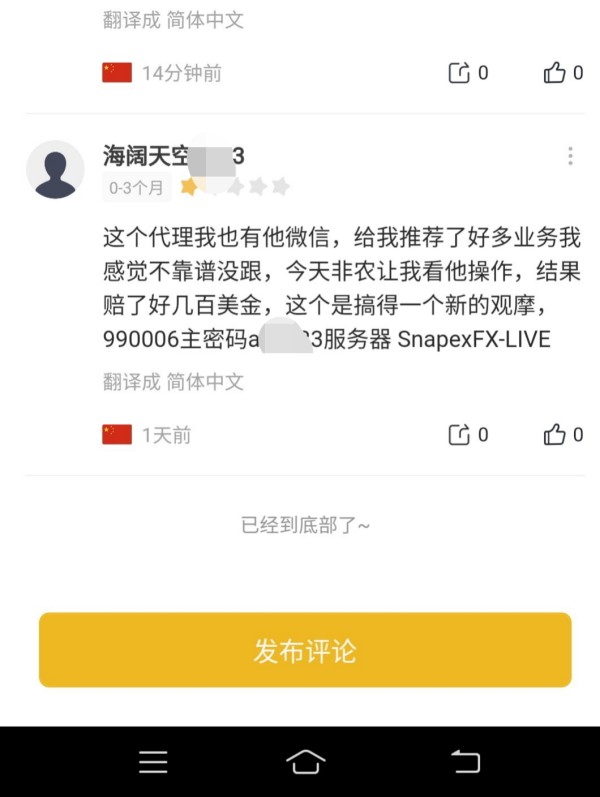

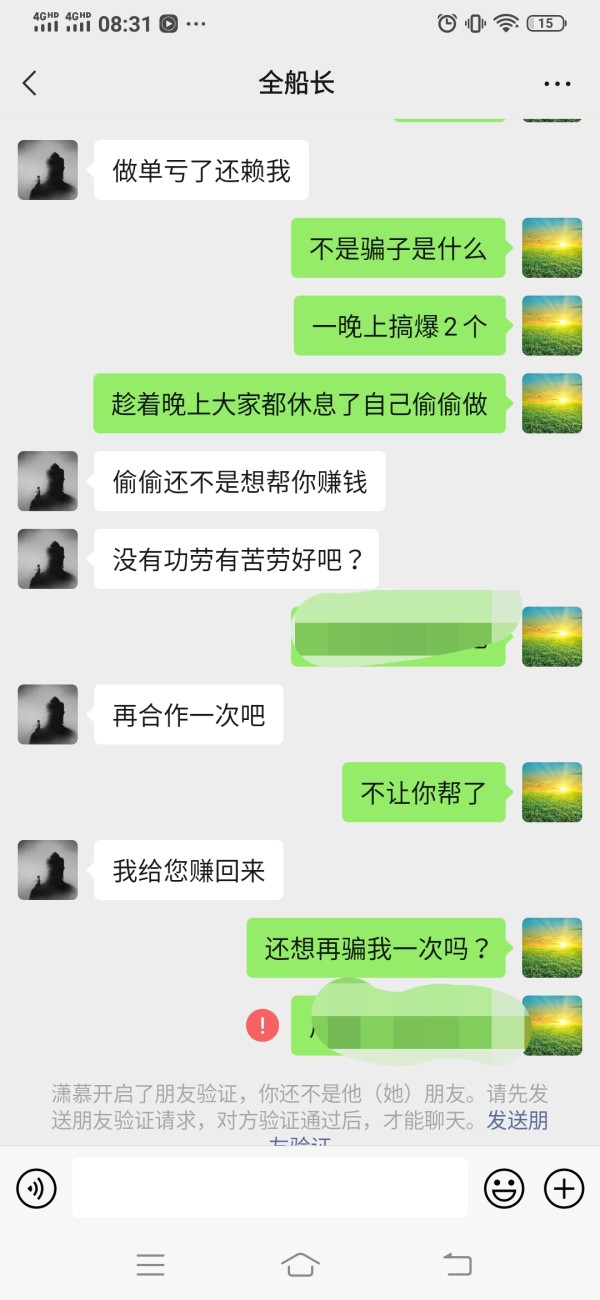

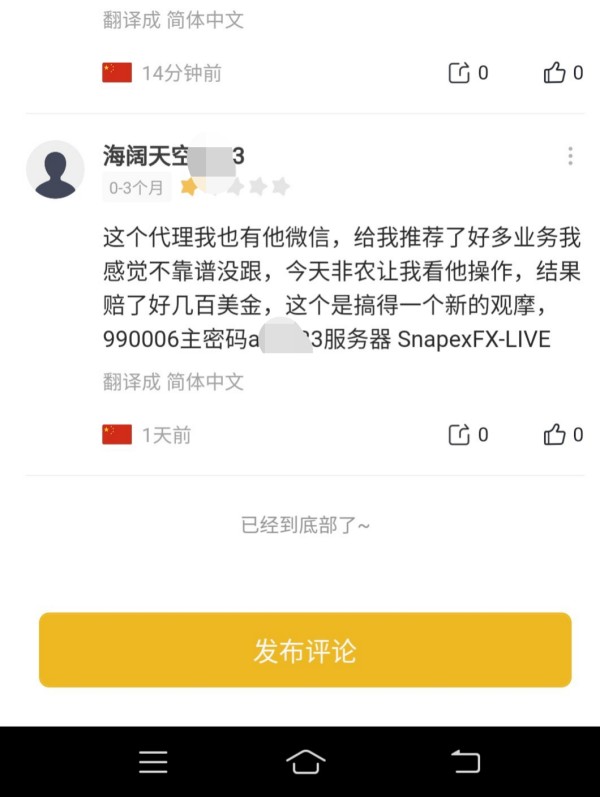

This unscrupulous agent operates the account with a deposit of 1,000 US dollars. After the profit is shared, he opened multiple observation accounts, because the background can be controlled so that you can see the profit, and the deposit will be liquidated. Don't be cheated. At the same time, he changed his WeChat name many times, once using Xiaomu, and Quan Ye. Now it's time to call Captain Quan on WeChat again.

Exposure

2023-03-10

万信齐发

Hong Kong

This agent posts 1000 dollars for cooperation in Moment and posts a watching account. Scamming on many platforms. Do not be scammed. It will be liquidated once you deposit. Be careful with an avatar. He changes his avatar and names many times.

Exposure

2023-02-25

万信齐发

Hong Kong

Under the guise of a senior foreign exchange analyst, this unscrupulous agent operates with a deposit of 1,000 US dollars. After making a profit, he cooperates and publishes multiple observation accounts. Because it is a black platform background that can modify the account and let you see the profit, as long as you make a deposit, you will be liquidated. I can't get in touch with them. This unscrupulous agent changed his avatar and WeChat name many times to evade responsibility and deceived more people. He successively used Xiaomu, Quan Ye, and now this WeChat name, and bluffed and deceived on several platforms. Be careful not to be scammed.

Exposure

2023-02-23

万信齐发

Hong Kong

This fraud agent scams on many platforms and change its avatar. Xiaomu, Quanye are all his former nickname. Start to cooperate by depositing 1000 dollars and open many accounts. The fraud platform can modify data and let you see the profit. Liquidate your position once you deposit. Do not be scammed.

Exposure

2023-02-21

万信齐发

Hong Kong

This fraud agent post 1000 dollars profit in Moments to induce cooperation. Because it is a fraud platform, they can modify data from backend. Account will be liquidated once you deposit. Be careful with the avatar and do not be scammed. This agent scams on various platform and change its avatar and nickname many times. He used Xiaomu, Quanye. It is the new avatar and nickname

Exposure

2023-02-20

ᯤ19637

Hong Kong

Withdrawal has not been approved Dear Customer, Hello! We regret to inform you that your Withdrawal application has not been approved. Reason: Dear Mr. Robin Chen, we have received your Withdrawal request, but since it is your first time to withdraw and the number of lots traded is less than 50 standard lots, please be informed that due to the access fee, a 500USD access fee has to be deducted. If you insist on withdrawing your funds, we will pay you the additional amount of 500 USD deducted from the access fee, and we will not charge you any withdrawal fee if you have traded 50 standard lots. We apologize for the rejection of your withdrawal request and ask for your understanding. If you are aware of the above information and still want to withdraw your funds, please resubmit your withdrawal request.

Exposure

2023-02-16

万信齐发

Hong Kong

This agent posted on Moment for cooperation. Fraud platform. They can change data from the backend. It will be liquidated once you deposit. Do not believe it. Do not be scammed. Be careful with avatar

Exposure

2023-02-15

万信齐发

Hong Kong

He opened several accounts for observation and promoted for cooperation. It is a black platform and secretly modify the data to make you profitable. If you deposit money, your position will be liquidated. After you lost all money, they block your account and contact. There is no bottom line for him in doing things, and the partner platform is not reliable. Look for his profile photo and don't be deceived.

Exposure

2023-01-25

万信齐发

Hong Kong

The fraud agent uses a deposit of 1,000 as a bait to show you the account and let you see the profit. Because it is a fraud platform, the background can modify the data. As long as you deposit money, you will be forced to liquidate your position. Be deceived, pay attention to the avatar.

Exposure

2023-01-11

万信齐发

Hong Kong

The fraud agent uses a deposit of 1,000 as a bait to show you the account and let you see the profit. Because it is a fraud platform, the background can modify the data. As long as you deposit money, you will be forced to liquidate your position. Be deceived, pay attention to the avatar.

Exposure

2023-01-10

万信齐发

Hong Kong

This person paid 1,000 US dollars to experience, and cooperated after posting profit on WeChat Moments and gave an account number for observation, because this is a black platform, the background can modify the data, so that you can see the profit, the deposit will be liquidated, and the money will be lost, and then block you and you can't be contacted. Recognize the avatar and don't be deceived.

Exposure

2023-01-09

万信齐发

Hong Kong

This kind of scum uses 1,000 US dollars of cooperation as a bait, sends a message in WeChat Moments, sees a profitable cooperation, and gives you an account to watch. The background of the black platform can modify the data, and the deposit will be liquidated. No, don't be fooled by seeing the avatar

Exposure

2023-01-08

万信齐发

Hong Kong

This person sent 1,000 US dollars to experience profitable cooperation in the WeChat moments, and also sent an observation account. Because it is a fraud platform, the background can modify the data to let you see the profit. If you deposit money, your position will be liquidated. Pay attention to the avatar not to be deceived

Exposure

2023-01-07

万信齐发

Hong Kong

The fraud agent uses a deposit of 1,000 as a bait to show you the account and let you see the profit. Because it is a fraud platform, the background can modify the data. As long as you deposit money, you will be forced to liquidate your position. Be deceived, pay attention to the avatar.

Exposure

2023-01-06

万信齐发

Hong Kong

The fraud agent uses a deposit of 1,000 as a bait to let you look at the account and see the profitable cooperation. It is actually fake. The background can modify the account to let you see the profit. As long as you deposit, you will be forced to liquidate your position and they can’t be contacted. Pay attention to the avatar. Don’t be deceived.

Exposure

2023-01-05

万信齐发

Hong Kong

This unscrupulous agent sent a message in WeChat Moments and use 1,000 as a bait, and first let you see the profitable cooperation. In fact, the background can modify the data, as long as you deposit, you will be forced to liquidate. You lose all your money, and then block you and you can’t be contacted. What you see is profit, and what he cares about is your principal. Remember the black proxy avatar and don't be fooled.

Exposure

2023-01-04

万信齐发

Hong Kong

In the WeChat moment, they used 1000 cash as bait to make profits. In fact, it is to modify the background data. If you dare to make money, you will break your position, blackout and lose contact. Lose all your money. Identify your avatar. Don't be cheated

Exposure

2023-01-03

万信齐发

Hong Kong

This black-hearted agent in the circle of friends group sent a deposit of 1000 as bait, profit cooperation, so that you can see the profit, in fact, is the background modified data, dare to deposit money called you burst, after pulling black, can not be contacted, remember the avatar do not be cheated, may change to other WeChat name. Den Quan, Xiaomu ......

Exposure

2023-01-02

万信齐发

Hong Kong

The fraud agent to 1000 as bait, see the profit after the cooperation share, modify the background data, so that customers see the profit, as long as the deposit will burst the position so that you lost all your money, WeChat black, can not be contacted to remember the black-hearted agent WeChat avatar, do not fall for the scam.

Exposure

2023-01-01

万信齐发

Hong Kong

The unscrupulous agent uses 1000 as a bait in WeChat, and cooperates after making a profit. In fact, the background data can be modified to let you see the profit. cheat.

Exposure

2022-12-30