Overview of FXtrade

FXtrade is an online foreign exchange and CFD trading broker that was founded in 2015 and headquartered in London, United Kingdom. FXtrade is unregulated , and this absence of regulation can pose substantial risks to traders. It provides access to over 50 currency pairs as well as CFDs on indices, commodities, stocks, and cryptocurrencies.

Traders can open accounts in USD, EUR, and GBP with minimum deposits starting from $100 for a standard account. FXtrade offers three main account types - Standard, Premium, and VIP - with varying spreads, commissions, and access to trading tools. The broker's proprietary web-based trading platform provides advanced charting, technical indicators, risk management features, and algorithmic trading options. Mobile apps are available for Android and iOS devices, enabling traders to manage their accounts and execute trades on the go.

Overall, FXtrade aims to offer competitive pricing, customer support, and a wide range of tradable products to meet the needs of active day traders and investors seeking diversity.

Regulatory Information

A significant point of concern for potential investors is the broker's unregulated status. It lacks oversight from major financial regulatory bodies. This absence of regulation can pose substantial risks to traders, as unregulated brokers often lack the stringent compliance and transparency standards set by established regulatory authorities.

Investors dealing with unregulated entities may face challenges in seeking recourse in case of disputes or malpractices. Thus, it's imperative for traders to exercise caution and conduct comprehensive due diligence before engaging with such brokers.

Pros and Cons

Pros:

High Leverage (up to 1:500): Allows controlling large positions with less capital

Competitive Spreads (from 0.4 pips): Helps reduce overall trading costs

Diverse Account Options: Standard, Premium, and VIP accounts suit different trader needs

Advanced Trading Platforms: Proprietary web, mobile apps, MT4 with helpful tools

24/5 Customer Support: Assistance is available when issues arise

Cons:

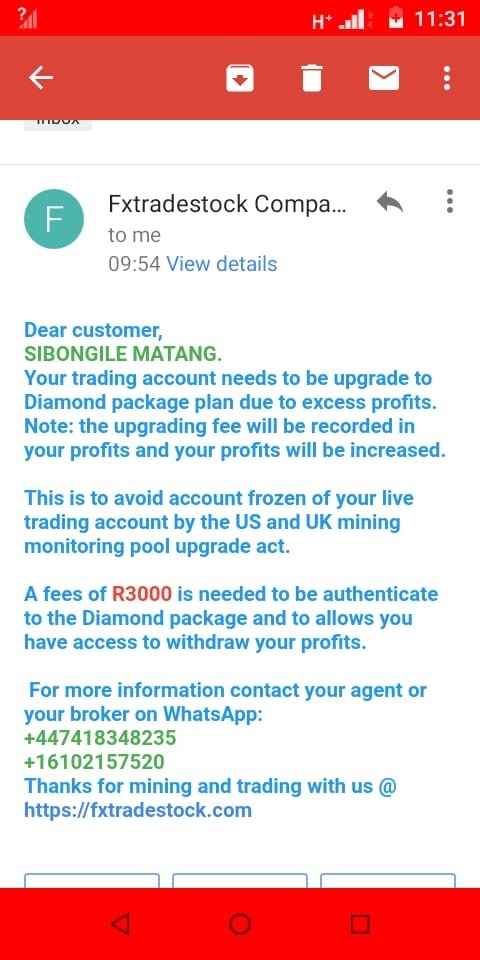

No Regulation: Lack of oversight and investor protections

Limited Trading Assets (50 FX pairs, 4 CFDs): Restricts ability to take advantage of opportunities

Ethical Concerns: Opaque pricing, withdrawal issues, aggressive sales tactics

Substandard Proprietary Platform: Lacks features offered on popular MT4/MT5 platforms

Unreliable Reputation: Questionable trustworthiness without regulation

Market Instruments

FXtrade offers CFD trading on 50 forex currency pairs, 15 global stock index CFDs, 4 commodity CFDs, and 3 crypto CFDs. No exchange-traded assets, ETFs, bonds, or other derivatives appear to be offered at this time. The product range is limited compared to regulated brokers.

Forex Currency Pairs

Major pairs: EUR/USD, USD/JPY, GBP/USD, USD/CHF

Minor pairs: EUR/GBP, EUR/CHF, GBP/JPY

Exotic pairs: USD/SEK, USD/NOK, USD/TRY, USD/MXN

A total of 50 currency pairs

Indices CFDs

Major indices: FTSE 100, S&P 500, Dow Jones, DAX 30, CAC 40

Asian indices: Nikkei 225, Shanghai Composite, Hang Seng

Total of 15 global stock index CFDs

Commodities CFDs

Precious metals: Gold, Silver

Energy: Crude Oil, Brent Oil

Total of 4 commodity CFD products

Cryptocurrency CFDs

Major cryptos: Bitcoin, Ethereum, Litecoin

Total of 3 crypto CFD products

Account Types

FXtrade offers Standard, Premium, and VIP account tiers with increasing minimum deposits, lower spreads, higher leverage, and additional features. The same tradable products are available across all accounts. Traders can select an account based on their deposit amount and desired tools and features.

How to Open an Account?

Opening an FXtrade account involves a quick online application, ID/address verification, and making an initial deposit to start trading. The process appears simple and can likely be completed fully online in a few minutes once documentation is prepared.

Step 1 - Fill Online Application

Step 2 - Verify Identity

Step 3 - Fund Your Account

Leverage

FXtrade provides high leverage levels up to 1:500, allowing traders to control large positions with a small amount of capital. However, leverage also amplifies losses when trades move against you.

Spreads and Commissions

Spreads vary based on account type and market conditions, but FXtrade does not charge any commissions. Overall, spreads are competitive compared to the industry average. Lower costs allow traders to retain more profit from winning trades.

Trading Platform

FXtrade provides its proprietary web and mobile platforms focusing on ease of use, as well as the advanced and highly customizable MT4 platform. This caters to both novice and experienced traders.

Web Platform

Advanced charting with 100+ indicators

Price alerts and risk management tools

Customizable layouts and timeframes

Automated trading via Expert Advisors

Available on desktop and mobile browser

Mobile Apps (iOS & Android)

Monitor positions and asset prices

Execute trades and manage orders

Advanced charting and indicators

Customizable alerts and notifications

Biometric logins for security

MetaTrader 4 (MT4)

Popular trading platform for technical analysis

Advanced charting packages and custom indicators

Trading automation via MQL4

Backtesting trading strategies

Access to Expert Advisors and copy trading tools

Deposit and Withdrawal

FXtrade offers a range of deposit and withdrawal methods with no deposit fees. Withdrawals carry some fees for e-wallet payouts but are free for bank wire transfers. Processing is fastest through e-wallets, while bank wires take up to several business days. Overall, FXtrade provides competitive funding options compared to the industry.

Customer Support

FXtrade provides 24/5 customer support via live chat, email, and phone in multiple languages.

24/5 multilingual live chat accessible from the trading platforms and website

Email support with guaranteed response within 24 hours

Toll-free phone support in over 15 countries

Dedicated account managers for VIP account holders

Educational Resources

FXtrade offers a suite of educational resources and trading tools to help clients improve their trading skills. The broker provides an extensive trading academy with beginner and advanced courses. Topics covered include technical and fundamental analysis, developing a trading plan, risk management, and psychology. Instruction is delivered through interactive e-courses, videos, quizzes, and webinars.

For the market analysis, FXtrade offers daily commentary, live trading sessions, an economic calendar, and sentiment tools. There is also a regularly updated trading blog with insights, tips, and research.

Comparison with Similar Brokers

FXtrade offers high leverage and competitive spreads but lacks regulation. XTB and Forex.com provide more transparency and oversight as regulated brokers, though spreads are slightly higher.

Conclusion

In conclusion, FXtrade provides traders access to forex, indices, commodities, and crypto markets through an unregulated CFD brokerage. Key features include high leverage up to 1:500, competitive spreads from 0.4 pips, and a choice of proprietary and MT4 trading platforms.

However, the lack of regulation means traders must conduct thorough due diligence regarding the broker's transparency, trustworthiness and risk management practices. While FXtrade advertises useful features for active trading, caution is warranted when dealing with an unregulated entity and assessing if the rewards outweigh the risks.

FAQs

Q: What is the maximum leverage available on crypto CFDs?

A: The maximum leverage on crypto CFDs like Bitcoin is 1:20.

Q: Does FXtrade allow hedging of positions?

A: Yes, FXtrade allows traders to hedge positions and hold both buy and sell trades on the same instrument.

Q: What trading platforms are available for algorithmic trading?

A: The MT4 platform supports algorithmic trading through Expert Advisors and MQL4.

Q: How can I become a liquidity provider on the ECN account?

A: You will need a minimum account balance of $100K to qualify as a liquidity provider.

Q: What is the minimum and maximum trade size allowed?

A: The minimum is 0.01 lots and the maximum is 500 lots per single trade.

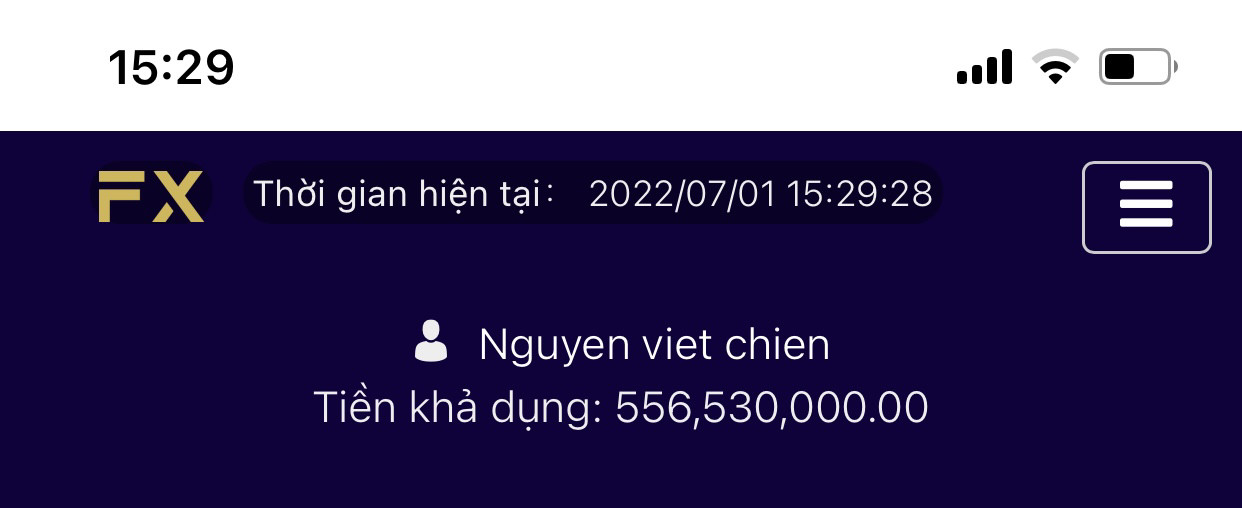

FX3682557505

Vietnam

I have withdrawn money to my bank account but the withdrawal order is not approved. And they locked my account. Currently the amount in my account is too large.

Exposure

2022-07-01

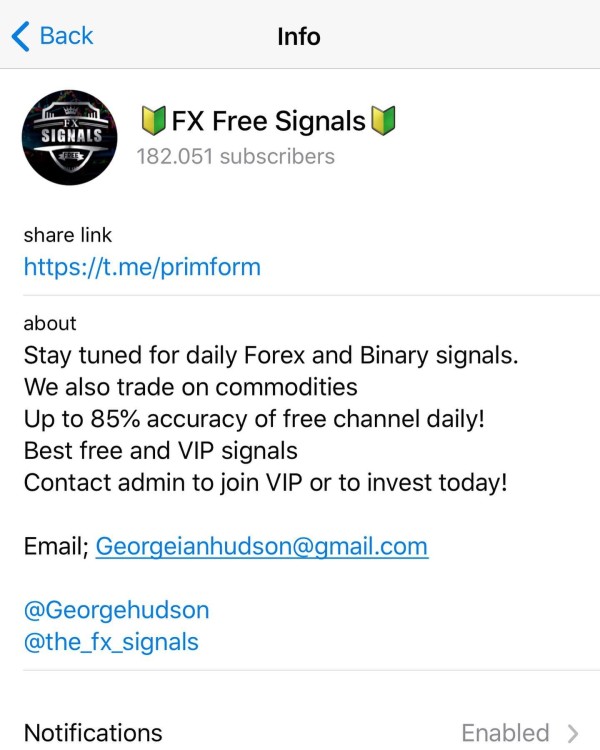

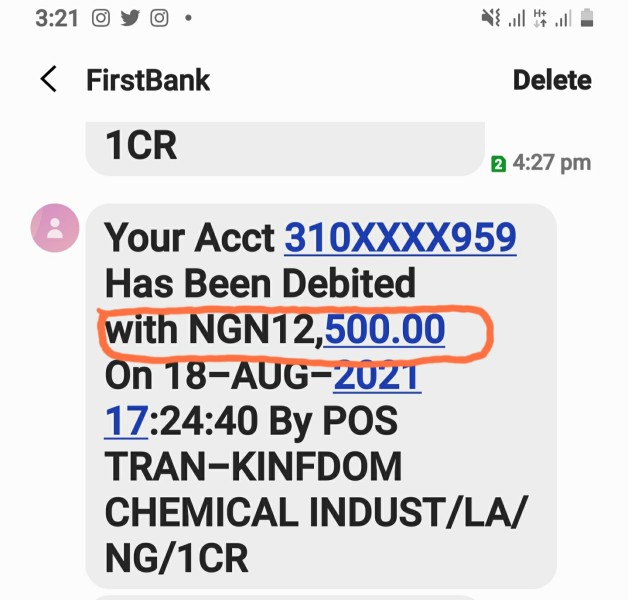

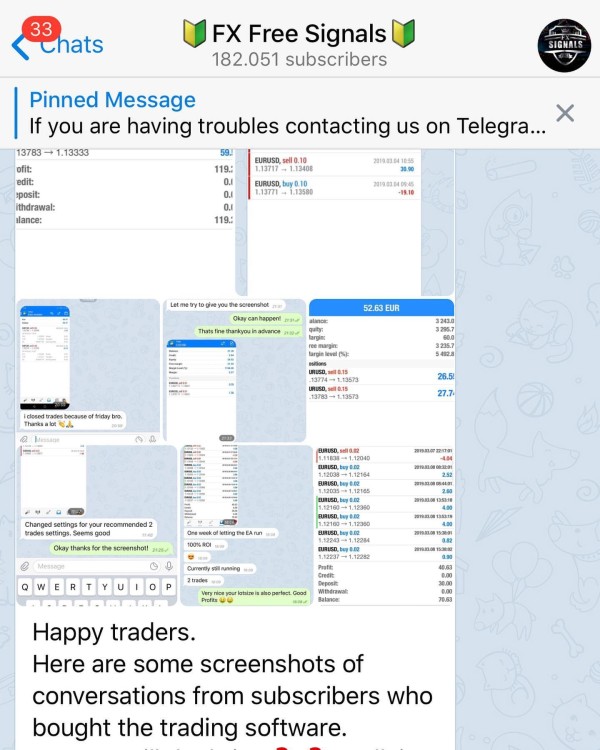

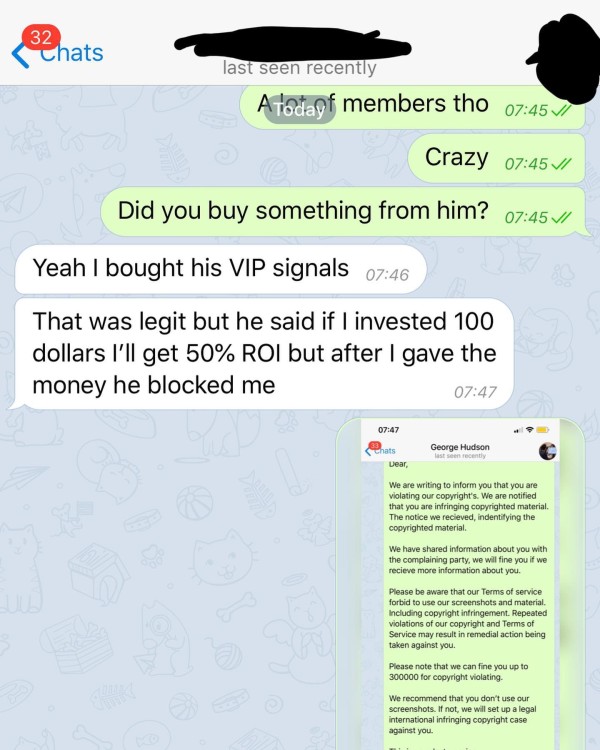

FX2009639799

Nigeria

ScamAlert Another channel that is scamming on people. He is using screenshots and signals from other channels. Once he recieved the client payment he is blocking them right away. Don’t invest with this scammer. See screenshots for more info.

Exposure

2021-08-28

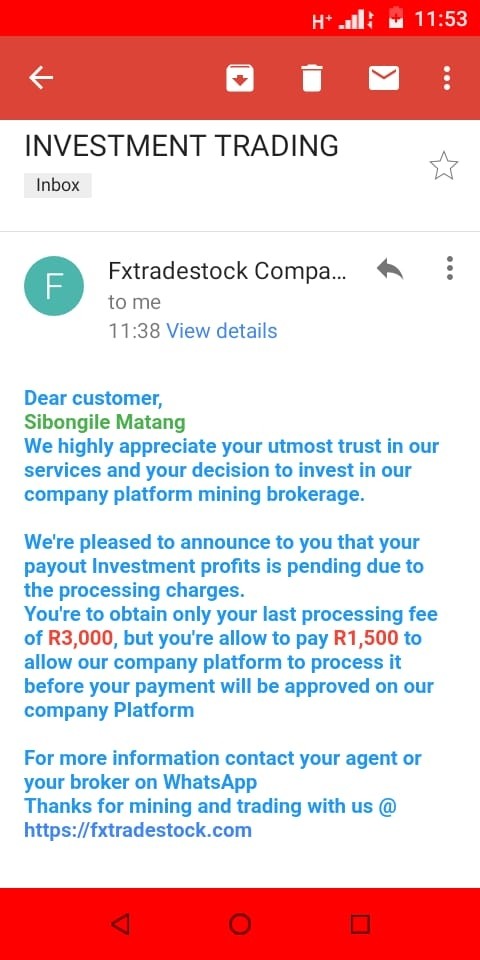

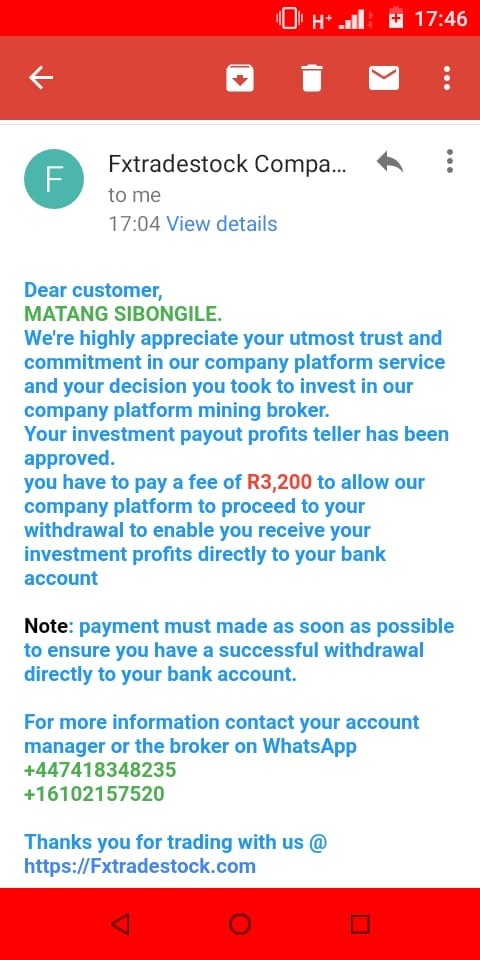

FX3771580176

South Africa

I met this lady on Facebook and she introduced her self as Jennifer Scott she told me about her company and how it works and she sent me a list of amount I can choose to start trading with.then I chose 1000 for profits of 10 000 then she gave me the account number to deposit the money I deposited 1000 and she gave me the link to create an account and check how live trading is going then I did that then I received an e-mail from the platform that I must deposit 2500 I did then more...

Exposure

2021-08-27

FX3048664588

Pakistan

Website is always not repsonding properly since investment

Exposure

2020-09-23

Mr.付

Hong Kong

Scary, this FXTrade website can’t be opened, and there are still some victims complaining on wikifx...but I see that their problems have not been resolved. Can wikifx help them recover their funds?

Neutral

2022-12-14