Overview of Loyal Trust Market

Loyal Trust Market, an unregulated forex and CFD broker registered in United Arab Emirates, was established in 2020. It offers a diverse selection of over 350 tradable instruments, including forex, share CFDs, commodities, indices, and metals. Loyal Trust Market provides two account types – Standard and ECN – each with unique features and benefits to cater to different trader preferences. The broker also offers PAMM and Copy Trade solutions. The broker utilizes the MetaTrader 5 (MT5) platform, a popular choice among traders for its advanced charting tools and technical indicators.

However, Loyal Trust Market's lack of regulatory oversight raises significant concerns about the safety of client funds and the broker's overall reliability. While the broker offers attractive features such as high leverage and swap-free accounts, potential traders should proceed with caution and carefully assess the risks involved before engaging with this platform.

Regulatory Status

The absence of regulatory oversight for Loyal Trust Market presents serious risks for potential clients. Without the supervision of a recognized financial authority, there is no guarantee that the company complies with ethical practices or adequately safeguards client assets. It raises concerns about the management of client funds, the potential for conflicts of interest, and the company's ability to manage risks effectively.

Individuals considering investing in Loyal Trust Market should carefully evaluate the risks involved and seek independent financial advice from a qualified professional. It is advisable to refrain from investing with unregulated entities unless you are fully aware of the risks and have conducted thorough due diligence.

Pros and Cons

Loyal Trust Market offers several advantages, including a wide range of tradable instruments, high leverage options for both account types, and swap-free trading on all accounts. The availability of PAMM and Copy Trade solutions caters to both experienced traders and those who prefer to follow successful strategies. Additionally, the broker provides the user-friendly MetaTrader 5 platform, which is known for its advanced charting tools and technical indicators.

However, there are also notable drawbacks to consider. The most significant concern is the lack of regulatory oversight, which raises questions about the safety of client funds and the broker's adherence to industry standards. Additionally, Loyal Trust Market offers limited account types compared to other brokers, and its educational resources are relatively basic. The lack of transparency regarding deposit and withdrawal processing times is another area of concern.

Market Instruments

Loyal Trust Market offers a diverse range of opportunities for traders.

Forex: Loyal Trust Market offers a wide range of currency pairs, including major, minor, and exotic pairs. Traders can leverage the high liquidity and volatility of the forex market to potentially generate profits. The broker claims to provide competitive pricing sourced from tier-1 banks and other liquidity providers.

Share CFDs: Loyal Trust Market provides access to CFDs on shares from various global markets. Traders can speculate on the price movements of company stocks without owning the underlying assets.

Commodities: The platform offers trading on various commodities, including precious metals like gold and silver, energy resources like Brent crude oil, and other commodities. Traders can take advantage of price fluctuations in these markets through CFD trading.

Indices: Loyal Trust Market provides access to major stock market indices through CFDs, allowing traders to speculate on the overall performance of specific markets or sectors.

Metals: The broker offers trading in precious metals like gold and silver through CFDs. These metals are often considered safe-haven assets and can be used for portfolio diversification.

Account Types

ECN Account: This account is designed for more experienced traders and requires a minimum deposit of $500. It offers leverage of up to 1:500, tighter spreads starting from 1.2 pips, and a commission of $4 per lot. This account type is ideal for traders who prioritize tighter spreads and are comfortable with a commission-based fee structure.

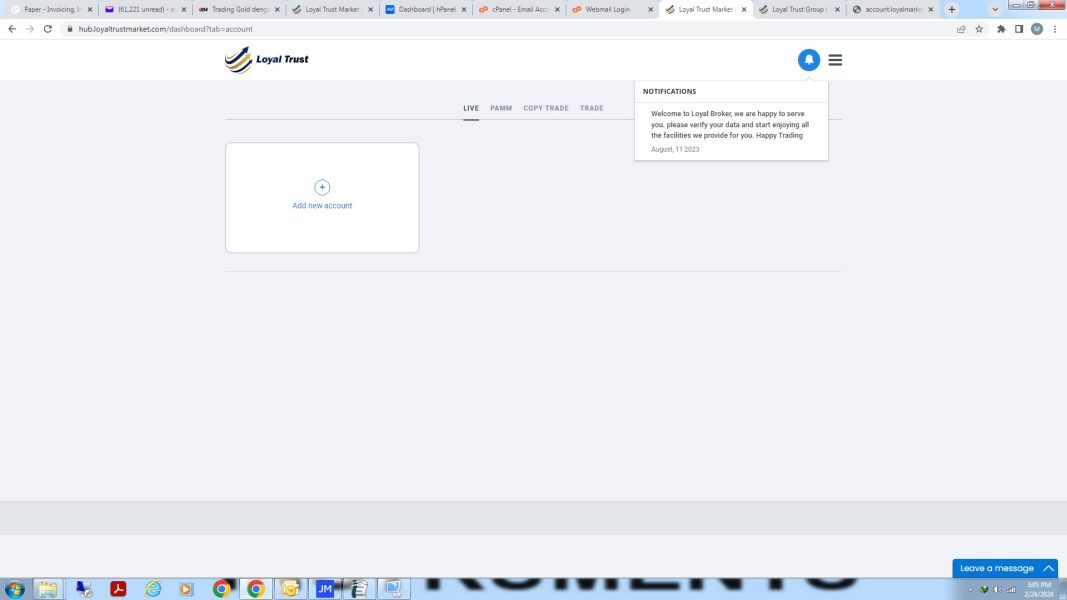

Account Opening Process

Opening an account with Loyal Trust Marketis a straightforward process that can be completed in a few simple steps:

Register: Enter your email address and create a password to start the registration process.

Complete Your Application: Fill out the secure application form with your personal and financial information.

Confirm Your ID: Verify your identity by submitting the required identification documents, such as a passport or driver's license.

Fund and Trade: Once your application is approved, fund your account using one of the available payment methods and start trading.

Leverage

Loyal Trust Market offers leverage up to 1:1000 for Standard Accounts and 1:500 for ECN Accounts. Leverage allows traders to control larger positions with a smaller amount of capital, potentially amplifying profits. However, it's important to remember that leverage also magnifies losses. Traders should use leverage cautiously and employ proper risk management techniques.

Trading Fees

LTM's Standard Account has spreads starting from 2.0 pips and no commission fees. The ECN Account offers tighter spreads from 1.2 pips but charges a $4 commission per lot. Both account types are swap-free, meaning there are no overnight financing charges for holding positions open.

Trading Platform and Tools

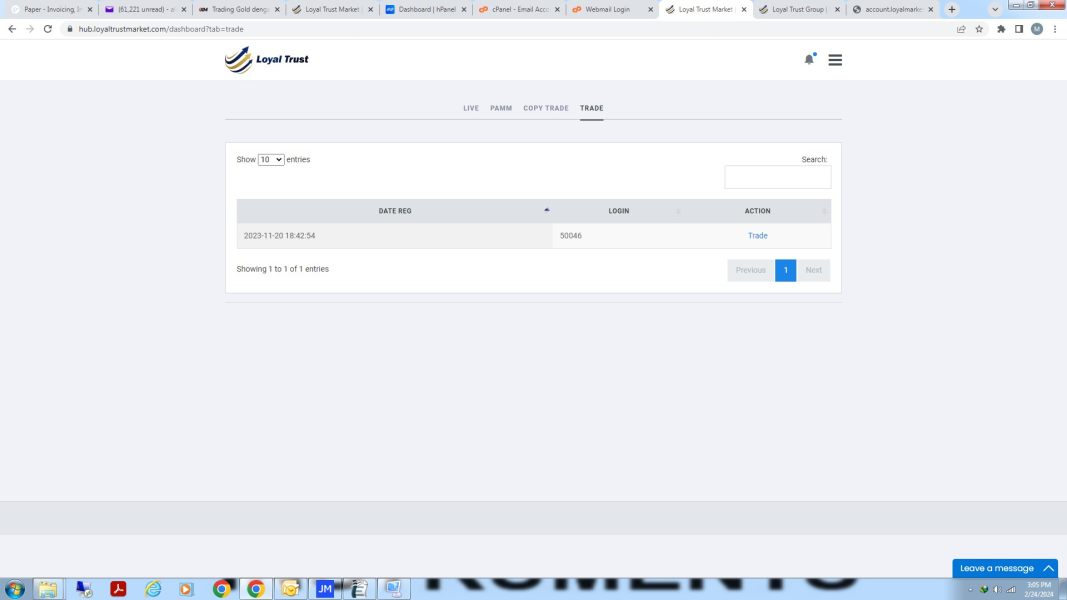

Loyal Trust Market offers the MetaTrader 5 (MT5) platform for trading. MT5 is a popular and powerful multi-asset trading platform known for its advanced features and capabilities. It is available in the following formats:

MT5 Mobile: The mobile app allows traders to trade on the go, offering a convenient and accessible trading experience. It provides access to various order types, real-time quotes, technical indicators, and charting tools.

MT5 Desktop: The desktop version of MT5 offers a comprehensive trading experience with advanced features and tools. It includes a wide range of technical indicators, charting tools, and the ability to develop and use automated trading strategies (Expert Advisors).

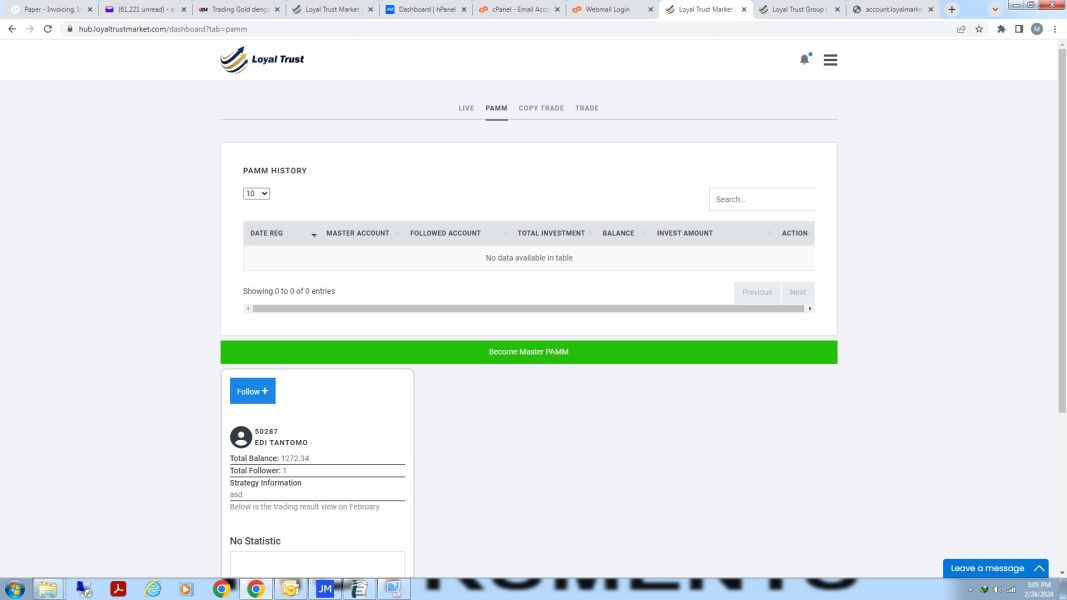

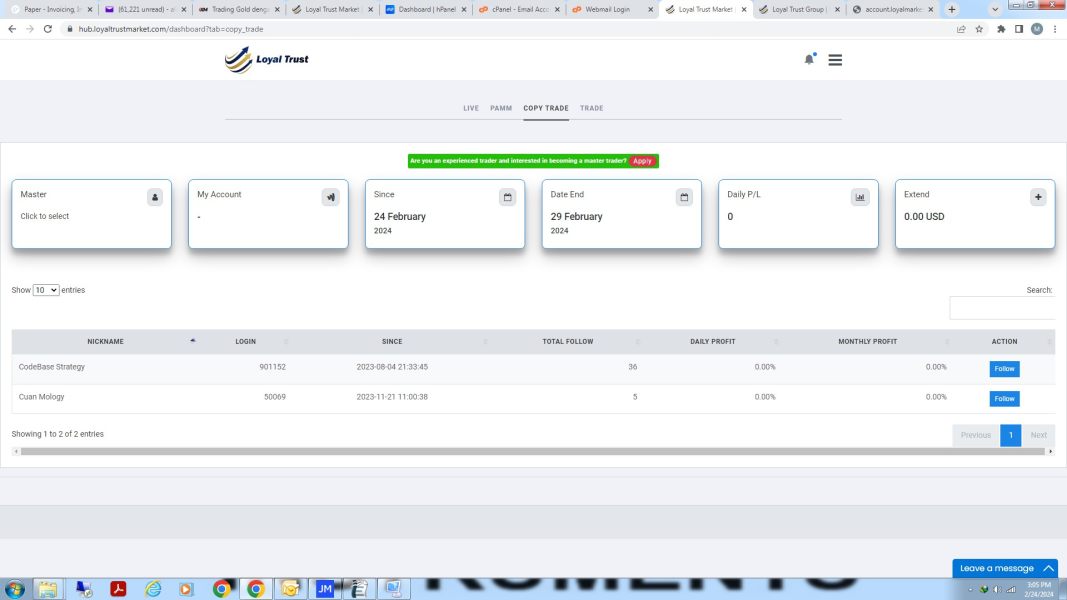

Additionally, Loyal Trust Market provides PAMM (Percentage Allocation Management Module) and Copy Trade solutions.

PAMM: Percentage Allocation Management Module (PAMM) is an innovative account management system that enables experienced traders to manage multiple accounts simultaneously and conveniently.

Copy Trader: Copy trading is a popular way for less experienced traders to enter the market, as it allows them to benefit from the experience and knowledge of successful investors. However, it is important to note that copy trading is not without its risks.

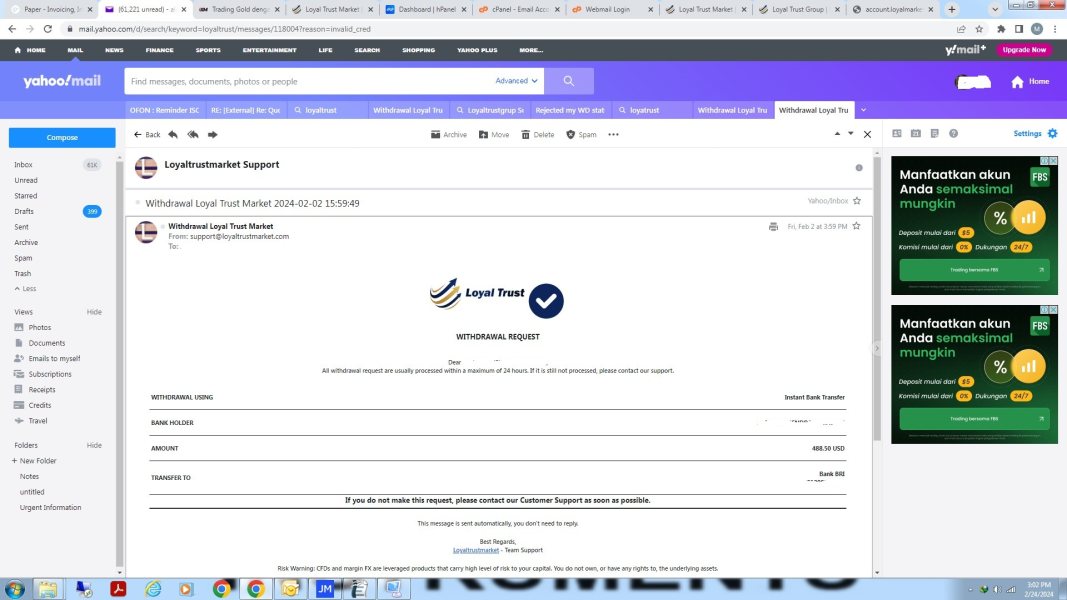

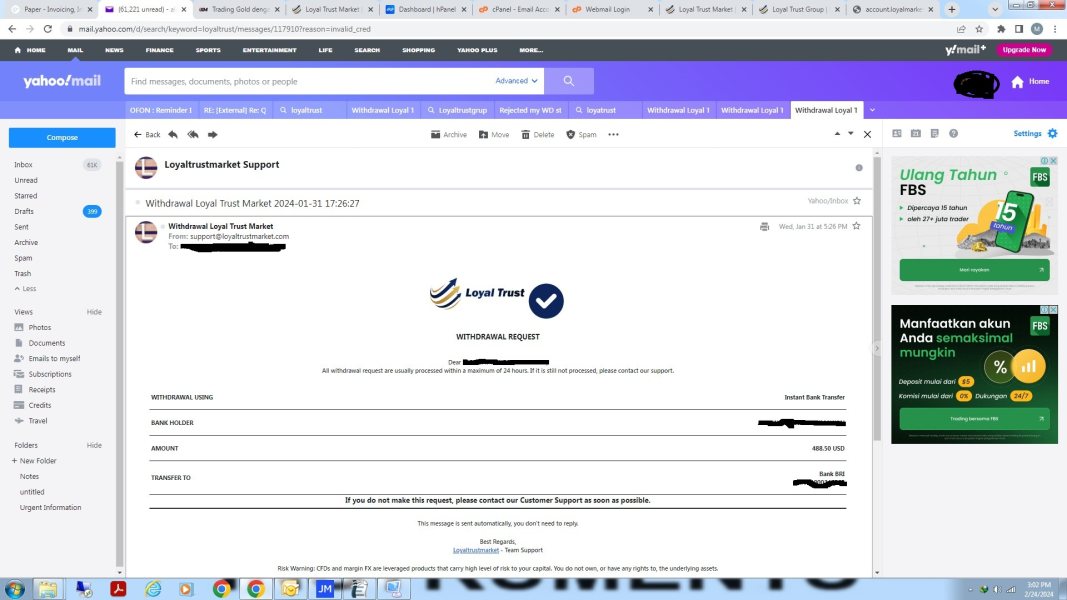

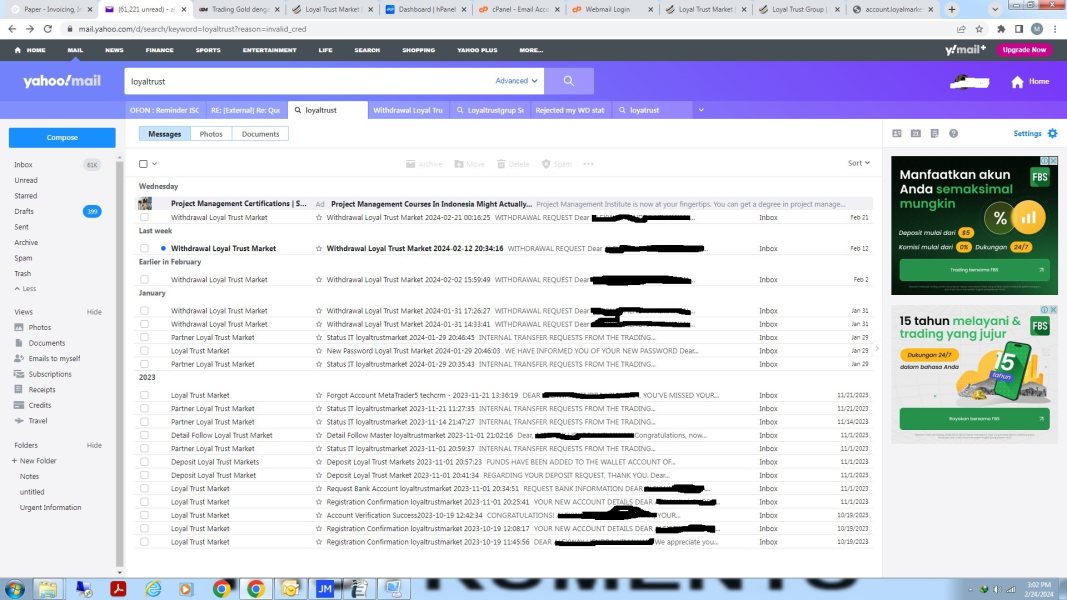

Deposit and Withdrawal

Deposit: Loyal Trust Market accepts deposits via Wire Transfer, Crypto, Indonesia Local Bank, Skrill, Neteller, MasterCard, and Visa. The minimum deposit for a Standard Account is $10, and for an ECN Account, it is $500. However, the broker does not provide information on deposit processing times.

Withdrawal: Withdrawals can be made using the same method used for deposits. However, the minimum withdrawal amount and processing times are not specified on the broker's website.

Customer Support

Trust Market provides customer support via phone and email. Unfortunately, Loyal Trust Market doesn't offer other customer service options. Although there are Twitter and Facebook icons on their website, they do not link to any active pages and the broker cannot be found on social media.

Phone: Traders can contact customer support by phone at +971 4 515 1858. The broker does not specify the hours of operation for phone support.

Email: Customer inquiries can be sent via email to support@loyaltrustmarket.com. The broker does not provide information on the average response time for email inquiries.

Educational Resources

Loyal Trust Market provides daily news and business analysis for educational resources. Regrettably, it seems that Loyal Trust Market provides no other options to assist clients with different needs. There is no sign of videos and other popular trading features. This is not very friendly for beginners and traders with different demands for educational resources.

Conclusion

Loyal Trust Market offers a range of features that may appeal to traders, such as a diverse selection of market instruments, high leverage, swap-free accounts, and the MT5 platform. However, the broker's unregulated status and lack of transparency regarding deposit/withdrawal processes raise significant concerns. Additionally, limited account types may be a drawback for traders seeking specialized accounts or advanced trading features. And in comparison to other brokers, LTM's educational resources may fall short in terms of comprehensiveness and depth. Potential users should carefully consider these risks before choosing to trade with Loyal Trust Market.

FAQs

Q: Is Loyal Trust Market a regulated broker?

A: No, Loyal Trust Market is not regulated by any major financial authority.

Q: What account types does Loyal Trust Market offer?

A: Loyal Trust Market offers two account types: Standard and ECN.

Q: What is the minimum deposit required to open an account with Loyal Trust Market?

A: The minimum deposit for a Standard Account is $10, and for an ECN Account, it is $500.

Q: What trading platform does Loyal Trust Market provide?

A: Loyal Trust Market provides the MetaTrader 5 (MT5) platform for trading.

Q: Does Loyal Trust Market offer leverage?

A: Yes, Loyal Trust Market offers leverage of up to 1:1000 for Standard Accounts and 1:500 for ECN Accounts.

Q: What are the trading fees for Loyal Trust Market accounts?

A: The Standard Account has spreads starting from 2.0 pips and no commission fees. The ECN Account has spreads starting from 1.2 pips and a $4 commission per lot. Both accounts are swap-free.