Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

What is Kayan Securities?

Kayan Securities is a fully disclosed broker dealer that facilitates the financial transacting of investment products for a retail and institutional clientele of investors through cash/margin accounts or DVP accounts. It offers some of the specific services such as stock and equity trading, bond and fixed income trading and so on. It also provides some trading tools for their traders. However, Kayan Securities has no regulation, which makes trade risky.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

Kayan Securities Alternative Brokers

There are many alternative brokers to Kayan Securities depending on the specific needs and preferences of the trader. Some popular options include:

Rakuten Securities - A leading online brokerage firm providing a wide range of financial services and investment options to clients globally.

ACY Securities - A trusted Australian-based online brokerage offering advanced trading technology, competitive spreads, and a diverse range of financial instruments.

Monex Securities – A reputable global brokerage firm offering comprehensive trading solutions, innovative platforms, and access to various markets for investors seeking a robust investment experience.

Is Kayan Securities Safe or Scam?

Kayan Securities currently has no valid regulation, which means that there is no government or financial authority oversighting their operations. It makes investing with them risky.

If you are considering investing with Kayan Securities, it is important to do your research thoroughly and weigh the potential risks against the potential rewards before making a decision. In general, it is recommended to invest with well-regulated brokers to ensure your funds are protected.

Products

Kayan Securities offers a variety of trading instruments across different asset classes, including equities, fixed income, bonds, mutual funds, tax shelters and select private placements.

Kayan Securities offers trading in equities, which represent shares of ownership in publicly listed companies. Clients can buy and sell stocks of companies listed on major stock exchanges, offering potential for capital appreciation and dividends.

Kayan Securities provides fixed income trading options, including government and corporate bonds. Fixed income instruments offer investors a fixed interest payment over a specific period, making them a reliable investment choice for generating regular income.

Kayan Securities offers a range of bonds, including government bonds, corporate bonds, and municipal bonds. Bonds are debt instruments issued by entities to raise capital and pay fixed interest to investors.

Kayan Securities offers access to a variety of mutual funds. These funds pool money from multiple investors to invest in a diversified portfolio of securities. Mutual funds are managed by professional fund managers and offer investors an opportunity to invest in a wide range of assets through a single investment.

Kayan Securities provides trading instruments related to tax shelters, which are investment vehicles designed to reduce tax liabilities. These instruments can include options like tax-exempt municipal bonds or investments in special tax-advantaged accounts.

Kayan Securities offers access to selective private placements. These are investment opportunities in privately held companies that are not available to the general public. Private placements often provide opportunities for high-net-worth individuals to invest in startups or established companies before they go public.

Accounts

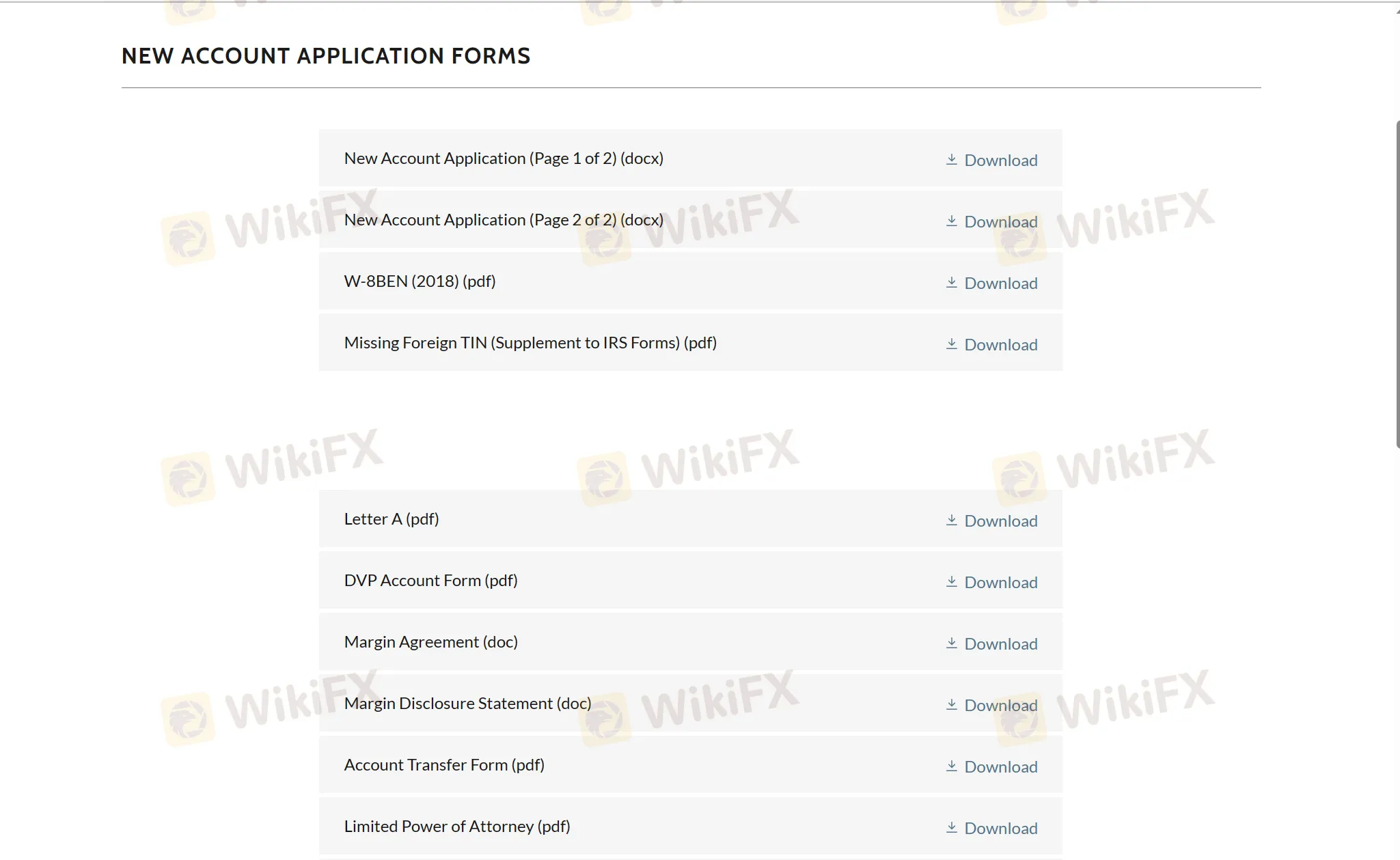

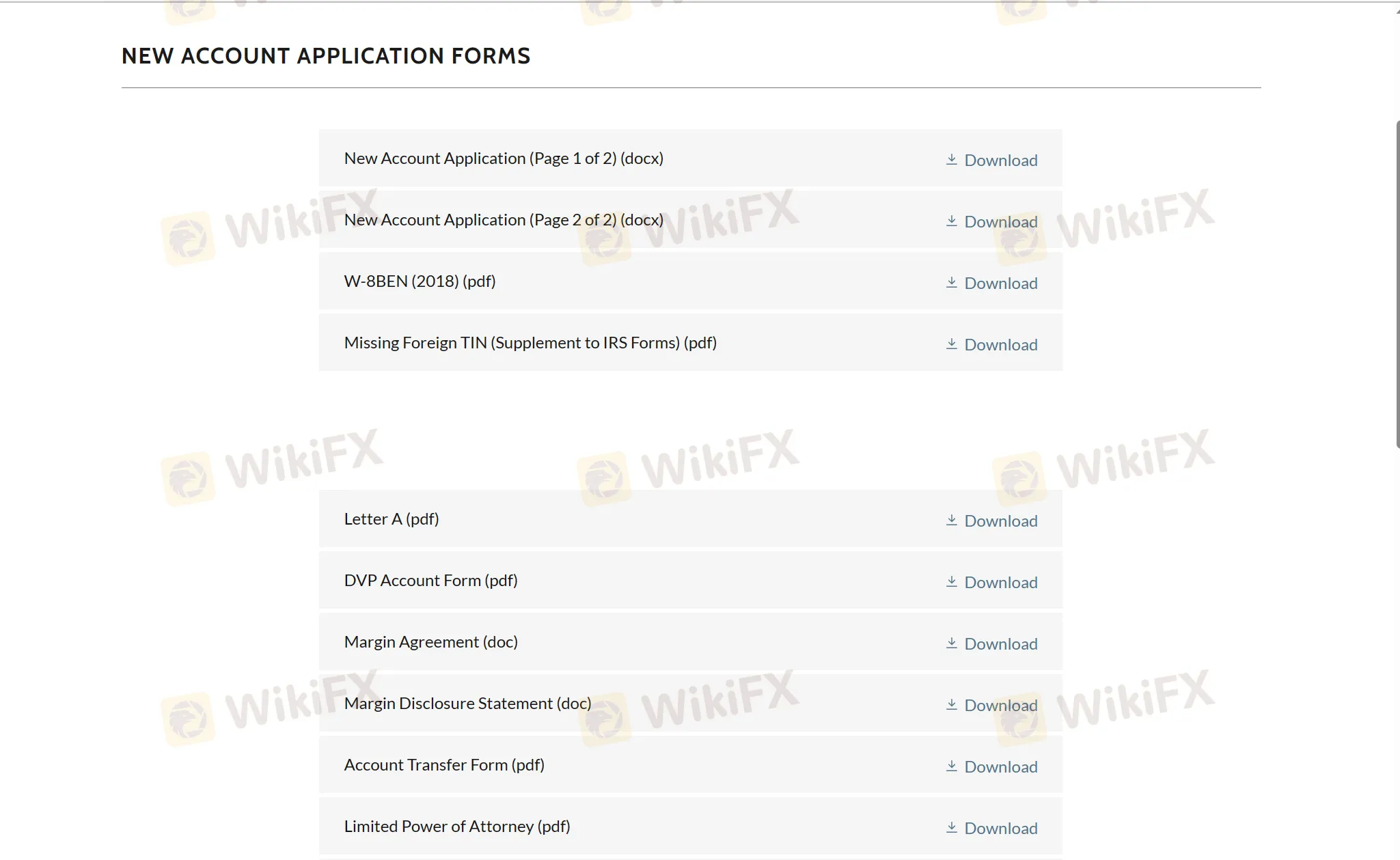

Kayan Securities provides account application forms for these different account types, allowing clients to choose the appropriate form based on their specific needs and fill it out accordingly.

- Individual: An individual account is opened by a single person. It is suitable for individuals who want to manage their personal investments separately from any joint ownership or organizational structure.

- Joint Rights of Survivorship: This type of account is opened by two or more individuals. In the event of the death of one account holder, the ownership rights transfer to the surviving account holder(s) automatically.

-Joint Tenancy in Common: Similar to joint rights of survivorship, this account is also opened by multiple individuals. However, in this case, each account holder has a specified ownership percentage, and in the event of their death, their ownership share passes to their estate rather than the surviving account holder(s).

-Community Property: This account type is designed for married or registered domestic partners residing in community property states. It treats assets acquired during the marriage or partnership as jointly owned by both individuals, providing equal ownership rights.

-Custodial: A custodial account is established for a minor, with an adult acting as the custodian of the account until the minor reaches the age of majority. The custodian manages the account on behalf of the minor.

-Corporate: A corporate account is opened in the name of a business entity, allowing it to trade and invest in various financial instruments. The account requires proper documentation and information regarding the business entity.

-Trust: A trust account is opened for the purpose of managing assets and investments held in a trust. The account is controlled by the trustee, who manages the investments according to the terms and conditions of the trust agreement.

-Investment Club: An investment club account is opened for a group of individuals who pool their money together to make joint investment decisions. The members share profits and losses according to their contribution percentages.

-Partnership: A partnership account is opened in the name of a partnership, allowing partners to manage joint investments and trading activities. The account requires relevant partnership documentation.

-Non-Profit/Charitable/Religious: This type of account is opened by non-profit organizations, charitable foundations, or religious institutions. It allows them to manage their investments in accordance with their specific objectives and regulations.

Trading Tools

Kayan Securities offers many trading tools to its clients, including:

Yahoo! Finance: This tool provides real-time quotes, news, and analysis for a wide range of stocks, bonds, and other financial instruments.

Google Finance: This tool is similar to Yahoo! Finance, but it also offers a variety of other features, such as a portfolio tracker and a stock screener.

Bloomberg: This tool is a more advanced trading platform that offers a wider range of features, such as real-time streaming data, charting tools, and technical analysis.

Customer Service

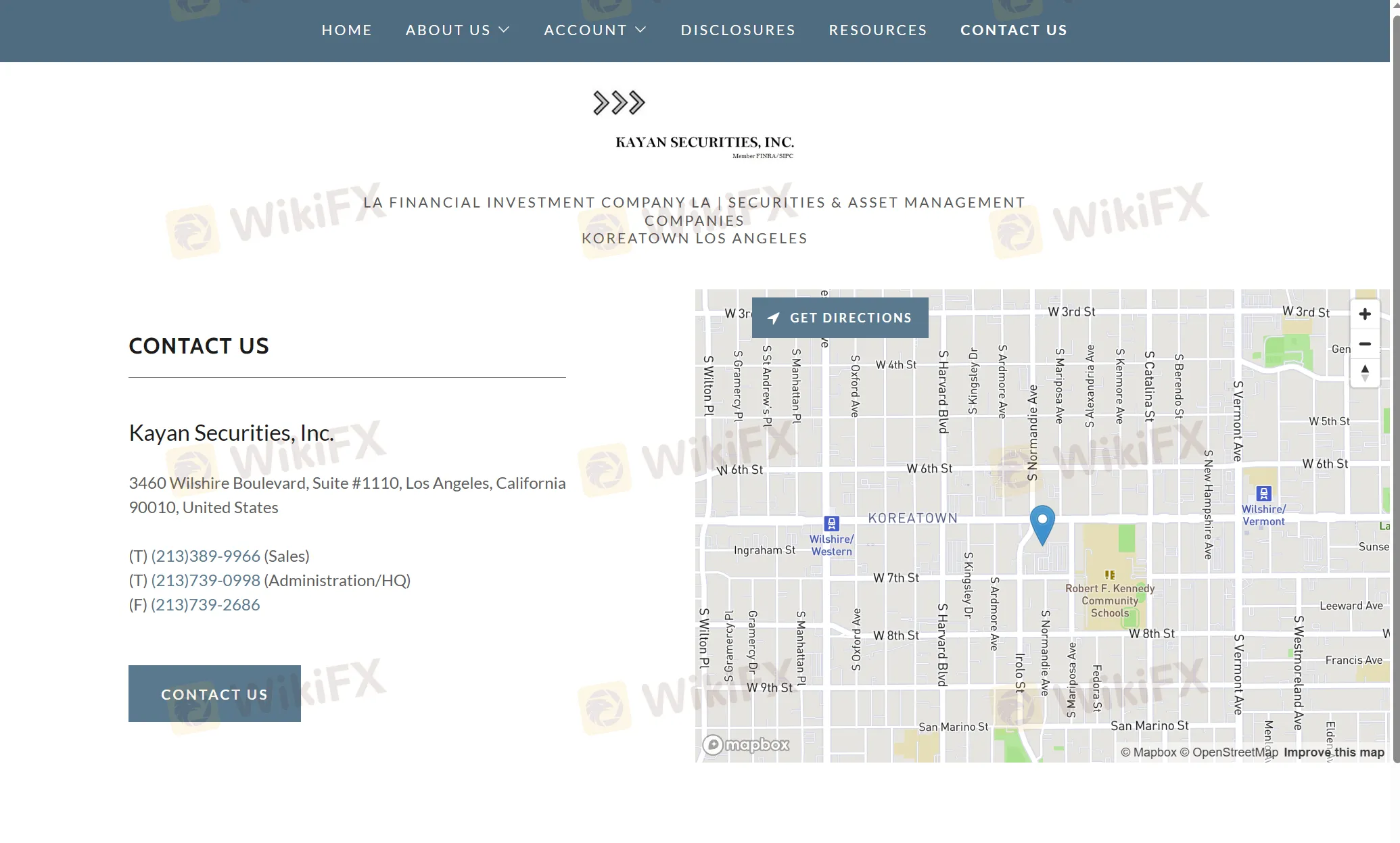

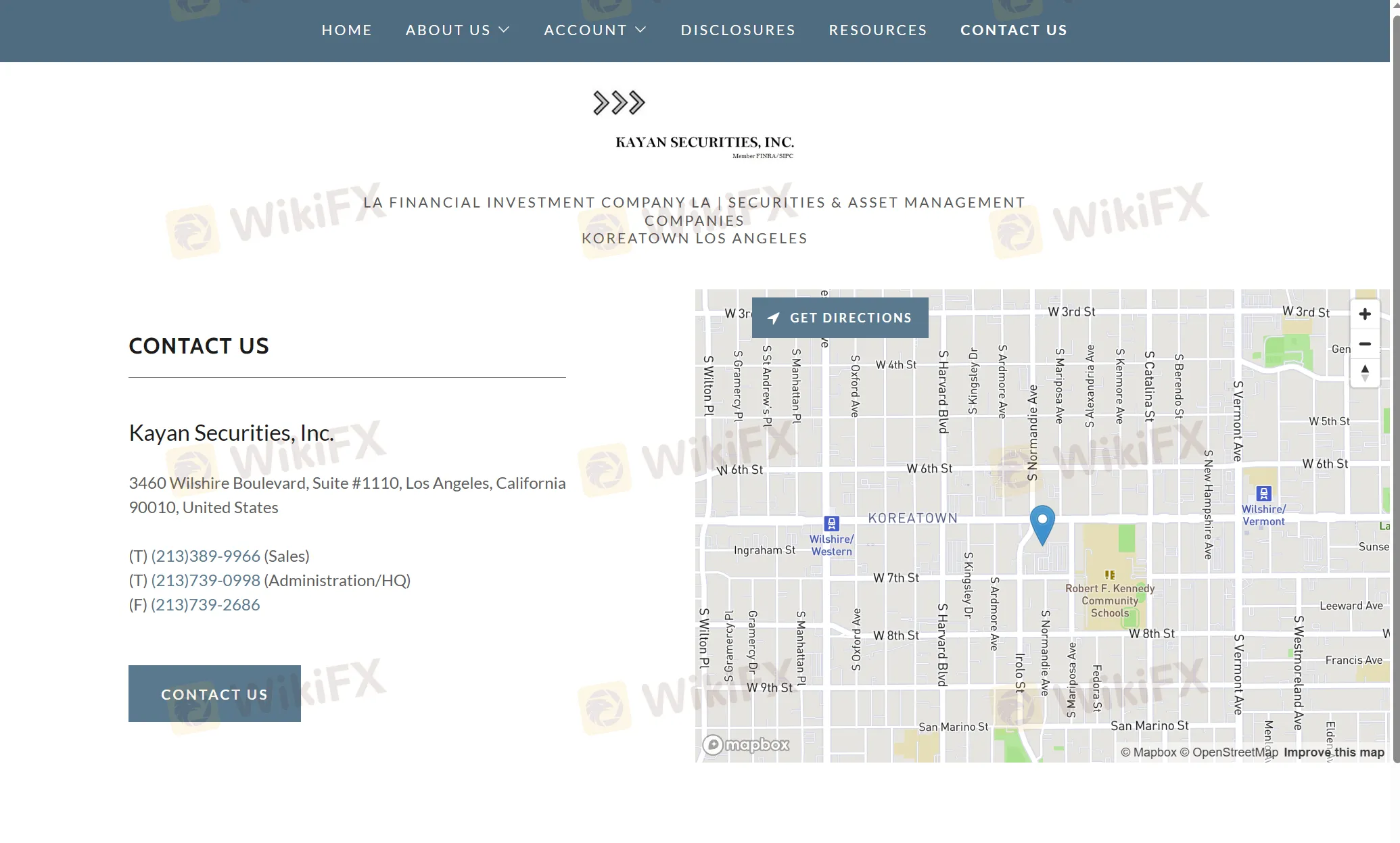

Customers can visit their office or get in touch with customer service line using the information provided below:

Telephone: (T) (213)389-9966 (Sales)

(T) (213)739-0998 (Administration/HQ)

(F) (213)739-2686

Address: 3460 Wilshire Boulevard, Suite #1110, Los Angeles, California 90010, United States

Note: These pros and cons are subjective and may vary depending on the individual's experience with Kayan Securities's customer service.

Conclusion

In conclusion, Kayan Securities is a trading platform that offers a range of services to its clients. The platform provides access to various financial markets, allowing traders to diversify their portfolios and capitalize on different trading opportunities.

However, Kayan Securities has many problems. First, it doesn‘t have regulation. Second, the relevant information doesn’t be provided, which makes trade not transparent enough. Therefore, traders should verify the regulatory status of Kayan Securities or any broker they choose to work with to ensure compliance with industry standards and regulatory requirements.

Frequently Asked Questions (FAQs)