Score

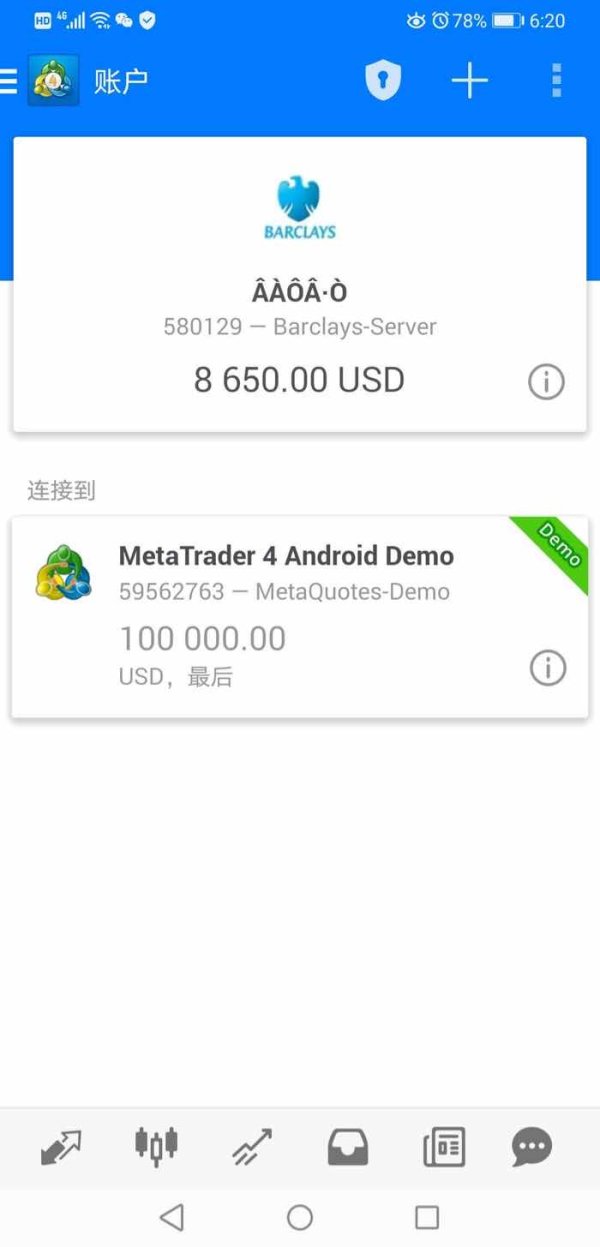

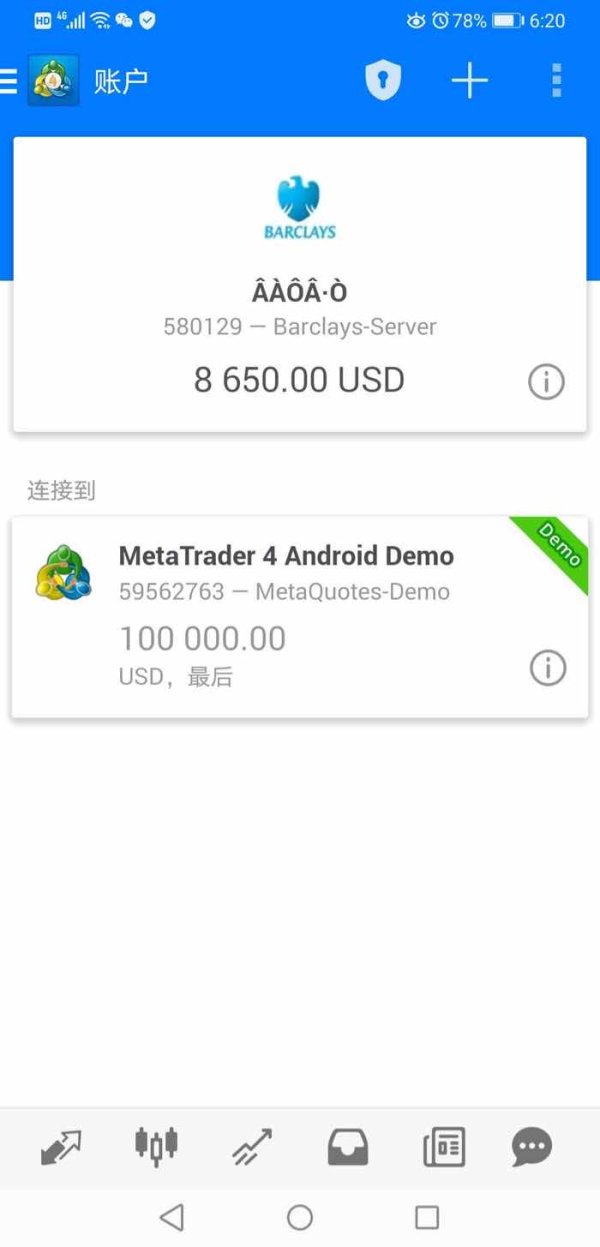

BARCLAYS

Hong Kong|Above 20 years|

Hong Kong|Above 20 years| https://www.home.barclays/

Website

Rating Index

Influence

Influence

AA

Influence index NO.1

United States 8.14

United States 8.14Contact

Licenses

Licenses

Licensed Entity:Barclays Capital Asia Limited

License No. AAC257

Basic Information

Hong Kong

Hong KongUsers who viewed BARCLAYS also viewed..

AvaTrade

- 15-20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

VT Markets

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Taurex

- 5-10 years |

- Regulated in United Kingdom |

- Market Maker (MM) |

- MT4 Full License

STARTRADER

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Sources

Language

Mkt. Analysis

Creatives

Website

barclays.com

Server Location

United Kingdom

Website Domain Name

barclays.com

Website

WHOIS.ASCIO.COM

Company

ASCIO TECHNOLOGIES, INC

Domain Effective Date

0001-01-01

Server IP

141.228.141.86

Genealogy

VIP is not activated.

VIP is not activated.Relevant Enterprises

Company Summary

| BARCLAYS Review Summary | |

| Founded | 1690 |

| Registered Country/Region | United Kingdom |

| Regulation | SFC |

| Services | Personal banking, business banking, investment bank, corporate banking, US consumer bank, private bank, international bank, wealth management, etc |

| Customer Support | Registered address: 1 Churchill Place, London E14 5HP |

| Contact details about each business unit: https://www.barclays.co.uk/help/contact-us/online-banking/ | |

| Contact details for each branch: https://www.barclays.co.uk/branch-finder/ | |

BARCLAYS Information

BARCLAYS traces its ancestry back to two goldsmith bankers who started doing business in London in 1690. The company is a reputable bank with comprehensive financial services and branches all over the world. Their services include personal banking, business banking, investment bank, corporate banking, US consumer bank, private bank, international bank and wealth management, etc.

For business banking services, the bank offers guaranteed protection of up to £85,000 by the FSCS if the bank goes out of business.

Not only does the bank have a long history, but also a strong regulatory background: it's decently regulated by SFC (Securities and Futures Commission of Hong Kong).

Pros and Cons

| Pros | Cons |

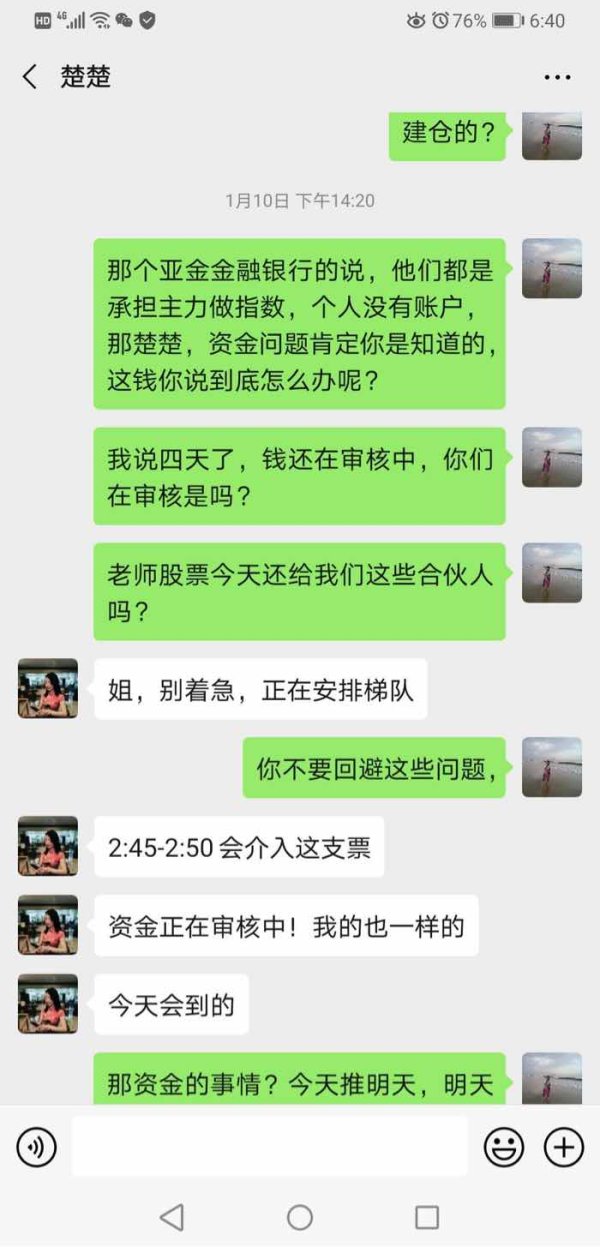

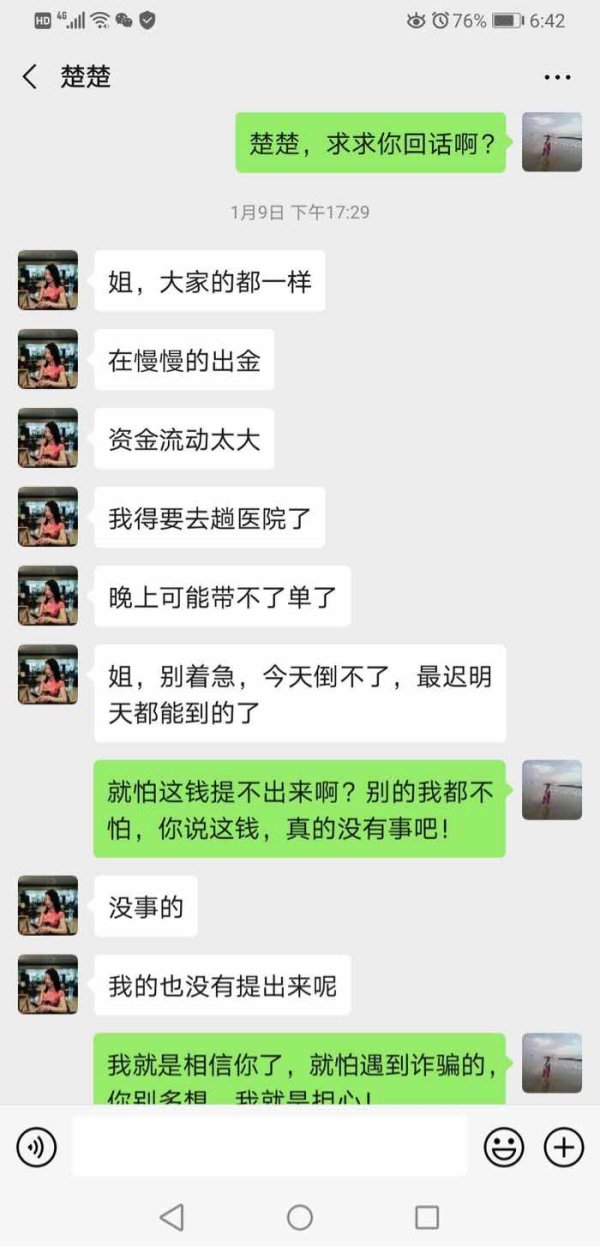

| Long history in the financial industry | WikiFX exposures |

| SFC regulated | |

| FSCS insurance | |

| Global reach | |

| 24/7 business support |

Is BARCLAYS Legit?

BARCLAYS is officially regulated by SFC (Securities and Futures Commission of Hong Kong) with licenses numbering at AAC257.

| Regulated Country | Regulator | Regulatory Status | Regulated Entity | License Type | License Number |

| SFC | Regulated | Barclays Capital Asia Limited | Dealing in futures contracts | AAC257 |

Services

Barclays provides a wide range of banking and financial services across key sector to global clients, these include:

- Personal Banking: Offers current accounts, credit cards, savings, loans, mortgages, insurance, and investments, with exclusive app-based perks.

- Business Banking: Supports startups and established firms with fee-free accounts, growth planning, international trade, and expert guidance.

- Corporate Banking: Provides corporate lending, liquidity management, trade solutions, and digital platforms like Barclays iPortal.

- Private Banking: Tailored wealth management, including personalized investments, lending, and banking solutions for high-net-worth clients.

- International Banking: Multi-currency accounts, savings, mortgages, and bespoke investment services for seamless global banking.

- Wealth Management: Comprehensive wealth planning, investment products, and borrowing options to meet financial objectives.

- US Consumer Bank: Features credit cards, personal loans, and high-yield savings, including the AAdvantage® Aviator® Red World Elite Mastercard®.

Account Type

Barclays offers current accounts, savings accounts, and cash ISAs, allowing customers to manage their money, save, and invest in a tax-efficient manner.

- Current AccountsBarclays provides a range of current accounts to meet everyday banking needs. Customers can benefit from tools such as debit cards, online access, mobile payments, and overdraft options. They can also subscribe to the Blue Rewards program for added perks.

- Savings AccountsThese accounts allow customers to save for rainy days or future financial goals. Barclays provides instant-access savings and specialized savings products with competitive rates, including options for Rainy Day Saver, Everyday Saver, and Blue Rewards Saver.

- Cash ISAsBarclays offers Cash ISAs to help customers save in a tax-efficient way. Customers can earn tax-free interest on savings up to the ISA allowance (£20,000 annually). Options include Instant Cash ISA, Reward ISA, and Fixed-rate Cash ISAs, depending on savings goals and needs.

Fees

Barclays accounts come with varying fees depending on account type and the features selected:

| Account Type | Monthly Fee |

| Barclays Bank Account | ❌ |

| Barclays Bank Account with Blue Rewards | £5/month |

| Premier Current Account | ❌ |

Interest Rates

Barclays offers a range of savings products with competitive interest rates. Rates depend on savings amount, account type, and whether savings are withdrawn monthly:

| Account Type | Rate % AER/gross per year |

| Rainy Day Saver (up to £5,000) | 5.12% |

| Everyday Saver (£1 - £10,000) | 1.51% |

| Blue Rewards Saver | 3.41% in months with no withdrawals |

| Instant Cash ISA (£1 - £10,000) | 1.51% (tax-free) |

| Reward ISA | 2.75% in months with no withdrawals |

Keywords

- Above 20 years

- Regulated in Hong Kong

- Dealing in futures contracts

- Global Business

Comment 2

Content you want to comment

Please enter...

Comment 2

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now