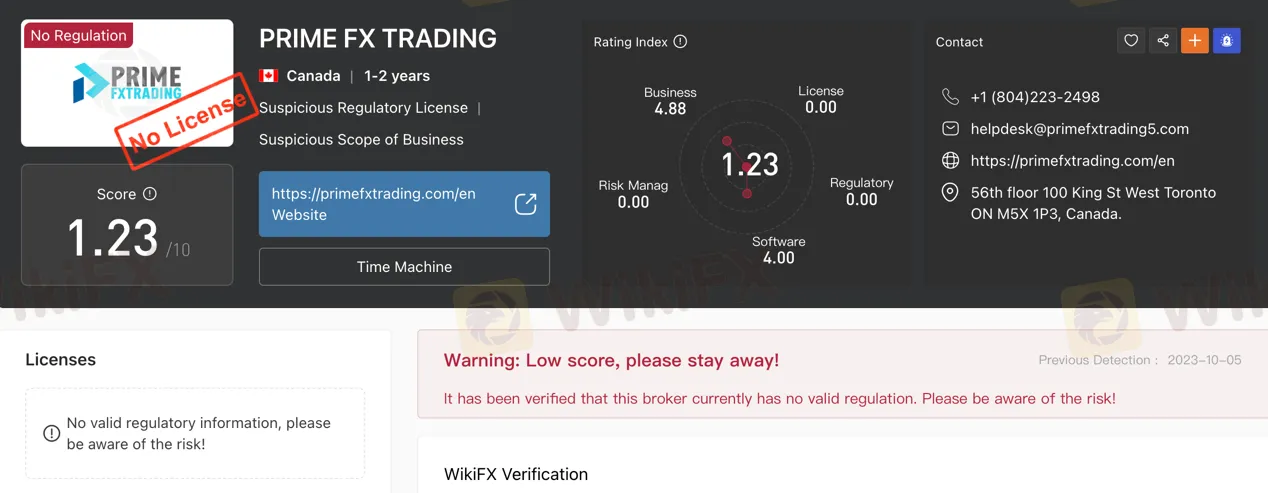

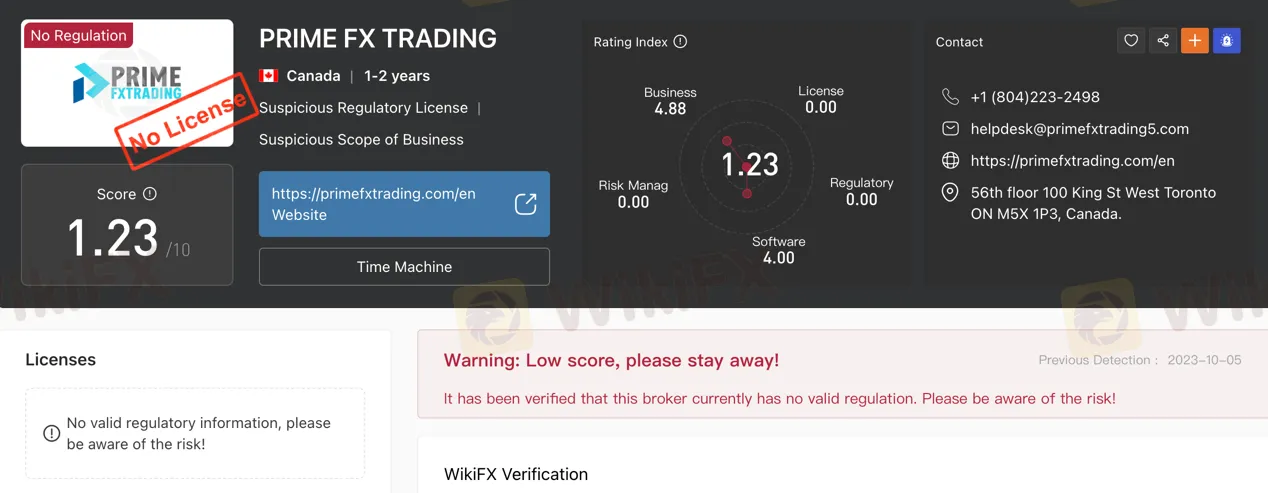

Overview of PRIME FX TRADING

PRIME FX TRADING, based in Canada and established within the last 1-2 years, presents both advantages and disadvantages for prospective traders. Notably, the absence of proper regulation casts doubts on the safety and transparency of its operations, necessitating caution when considering this broker.

In terms of market offerings, PRIME FX TRADING provides a range of instruments, including various foreign exchange (FX) pairs, derivatives like spot FX forwards and currency swaps, and contract for differences (CFDs) on assets such as currency pairs, indices, and commodities. Account options are diverse, catering to different trading preferences and capital levels. These include the Standard Account, Cent Account, ECN Account, Prime Account, and a Demo Account, each with varying minimum deposit requirements, leverage ratios, spreads, and commission structures.

Despite these options, potential traders should weigh the lack of regulation against the available benefits, and conduct thorough due diligence before engaging with PRIME FX TRADING, keeping risk mitigation in mind.

Pros and Cons

PRIME FX TRADING presents several advantages, including a diverse range of account types, low spreads starting from 0.1 pips, a wide variety of tradable assets, high leverage options, and the availability of the widely-used MT4 trading platform. However, potential drawbacks include the lack of proper regulation, fluctuating spreads and commissions, occasional unavailability of their main website, withdrawal fees associated with certain methods, and limited contact options.

Is PRIME FX TRADING Legit?

PRIME FX TRADING lacks proper regulation, which raises concerns about the safety and transparency of its operations. Traders should exercise caution when considering this broker due to the potential risks associated with unregulated entities.

Market Instruments

FOREIGN EXCHANGE (FX): PRIME FX TRADING offers a variety of FX instruments, including major currency pairs such as EUR/USD, USD/JPY, and GBP/USD. They also provide access to minor currency pairs like AUD/USD and NZD/USD, as well as exotic currency pairs like TRY/USD, RUB/USD, and CNH/USD.

DERIVATIVES: In the DERIVATIVES category, PRIME FX TRADING offers several options, including Spot FX forwards, Non-deliverable forwards, Currency swaps, and Currency options. These derivatives allow traders to manage risk and diversify their portfolios.

CFDs: PRIME FX TRADING offers CFDs on various assets, including major and minor currency pairs, major indices like S&P 500, FTSE 100, and Nikkei 225, as well as major commodities like gold, oil, and silver. CFDs provide traders with the opportunity to speculate on price movements without owning the underlying assets, offering flexibility in trading strategies.

Pros and Cons

Account Types

STANDARD ACCOUNT

The Standard Account offered by PRIME FX TRADING requires a minimum deposit of $500, offers leverage up to 1:500, and features spreads starting from 0.7 pips. There is no commission applied to this account type. It provides access to various markets, including Forex, CFDs on indices, stocks, commodities, and cryptocurrencies.

CENT ACCOUNT

PRIME FX TRADING's Cent Account demands a minimum deposit of $50, offers leverage up to 1:200, and presents spreads starting from 2 pips. Similar to the Standard Account, there is no commission associated with this account type. It also allows trading across Forex, CFDs on indices, stocks, commodities, and cryptocurrencies.

ECN ACCOUNT

For the ECN Account, a minimum deposit of $5000 is required, with leverage options extending up to 1:500. Spreads start from 0.1 pips, and a commission is applicable. This account type provides access to the same range of markets as the Standard Account, including Forex, CFDs on indices, stocks, commodities, and cryptocurrencies.

PRIME ACCOUNT

The PRIME ACCOUNT, with a minimum deposit requirement of $50000, offers leverage up to 1:500 and features exceptionally low spreads starting from 0.05 pips. A commission is applicable to trades made through this account type. It provides access to the same markets as the Standard Account, including Forex, CFDs on indices, stocks, commodities, and cryptocurrencies.

DEMO ACCOUNT

PRIME FX TRADING's Demo Account is accessible with no minimum deposit requirement. It offers leverage up to 1:500 and typical market spreads. There is no commission associated with this account type, and it mirrors the available markets of the Standard Account, including Forex, CFDs on indices, stocks, commodities, and cryptocurrencies.

Leverage

PRIME FX TRADING provides leverage options ranging from 1:200 to 1:500 across its different account types.

Spreads & Commissions

PRIME FX TRADING offers spreads that vary across its account types, with the lowest spreads starting from 0.05 pips for the PRIME ACCOUNT, 0.1 pips for the ECN ACCOUNT, 0.7 pips for the STANDARD ACCOUNT, and 2 pips for the CENT ACCOUNT. Additionally, while the STANDARD, CENT, and DEMO ACCOUNTS have no commission charges, the ECN and PRIME ACCOUNTS come with commission fees.

Minimum Deposit

PRIME FX TRADING has different minimum deposit requirements for its account types, ranging from $50 to $50,000.

Deposit & Withdrawal

Prime FX Trading offers deposit and withdrawal methods via bank transfer, credit/debit card, and e-wallets. There are no deposit fees, and withdrawal fees are waived for bank transfers and e-wallets. Minimum withdrawal is USD 100. Processing time for withdrawals is 1-3 business days.

Trading Platforms

MT4 (MetaTrader 4): PRIME FX TRADING offers the MT4 trading platform, a widely recognized and commonly used platform in the industry. MT4 provides a range of trading tools and features, including charting capabilities, technical analysis indicators, and automated trading through Expert Advisors (EAs). It allows traders to execute orders, manage positions, and access historical data. This platform is known for its stability and versatility, making it a popular choice among traders.

Customer Support

PRIME FX TRADING offers customer support through a phone contact at +1 (804) 223-2498. Their physical address is located on the 56th floor at 100 King St West, Toronto, ON M5X 1P3, Canada. For inquiries and assistance, you can also reach out to their customer service via email at helpdesk@primefxtrading5.com.

Conclusion

In conclusion, PRIME FX TRADING presents certain considerations for potential traders. On the positive side, it offers a variety of market instruments, account types with diverse minimum deposit requirements, and leverage options. The availability of the widely recognized MT4 trading platform is another notable aspect. However, it should be noted that the lack of proper regulation raises concerns about the safety and transparency of its operations. Additionally, the spread and commission structures vary across account types, and traders should carefully assess these factors when making their decisions. Overall, due diligence and caution are advised when dealing with PRIME FX TRADING.

FAQs

Q1: Is PRIME FX TRADING a reputable broker?

A1: PRIME FX TRADING lacks proper regulation, which raises concerns about its legitimacy and transparency. Caution is advised when considering this broker.

Q2: What financial instruments can I trade with PRIME FX TRADING?

A2: PRIME FX TRADING offers Forex, derivatives, and CFDs, providing access to a wide range of assets, including currency pairs, indices, stocks, commodities, and cryptocurrencies.

Q3: What are the account types available at PRIME FX TRADING?

A3: PRIME FX TRADING offers Standard, Cent, ECN, Prime, and Demo accounts, each with varying minimum deposits, leverage, spreads, and commission structures.

Q4: What leverage options does PRIME FX TRADING offer?

A4: PRIME FX TRADING provides leverage options ranging from 1:200 to 1:500, depending on the chosen account type.

Q5: What are the deposit and withdrawal options at PRIME FX TRADING?

A5: PRIME FX TRADING allows deposits and withdrawals through bank transfers, credit/debit cards, and e-wallets, with no deposit fees and waived withdrawal fees for certain methods. The minimum withdrawal amount is USD 100.