Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

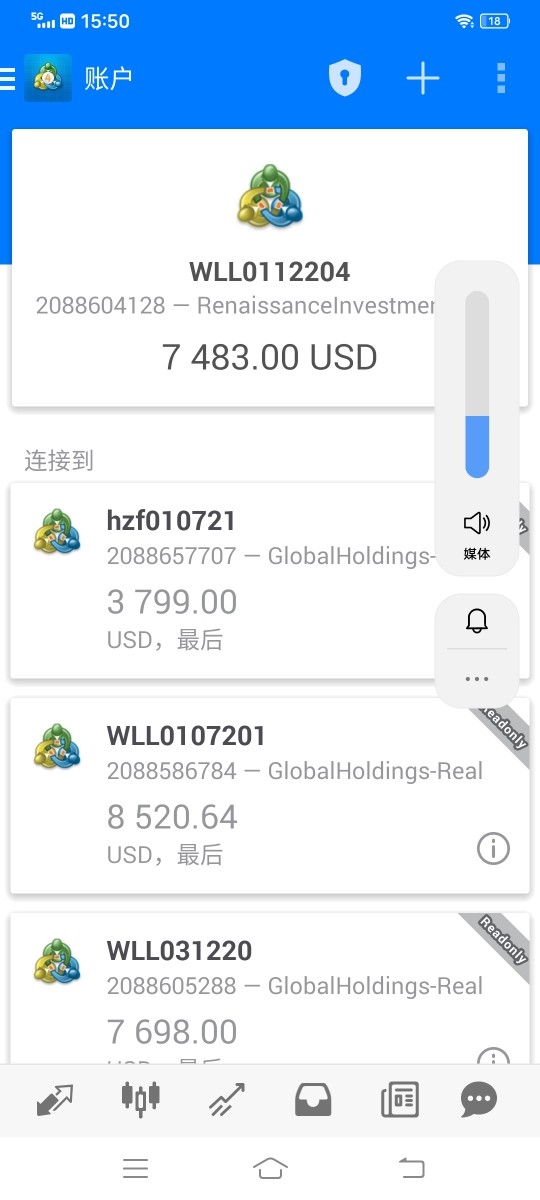

陈超10370

Hong Kong

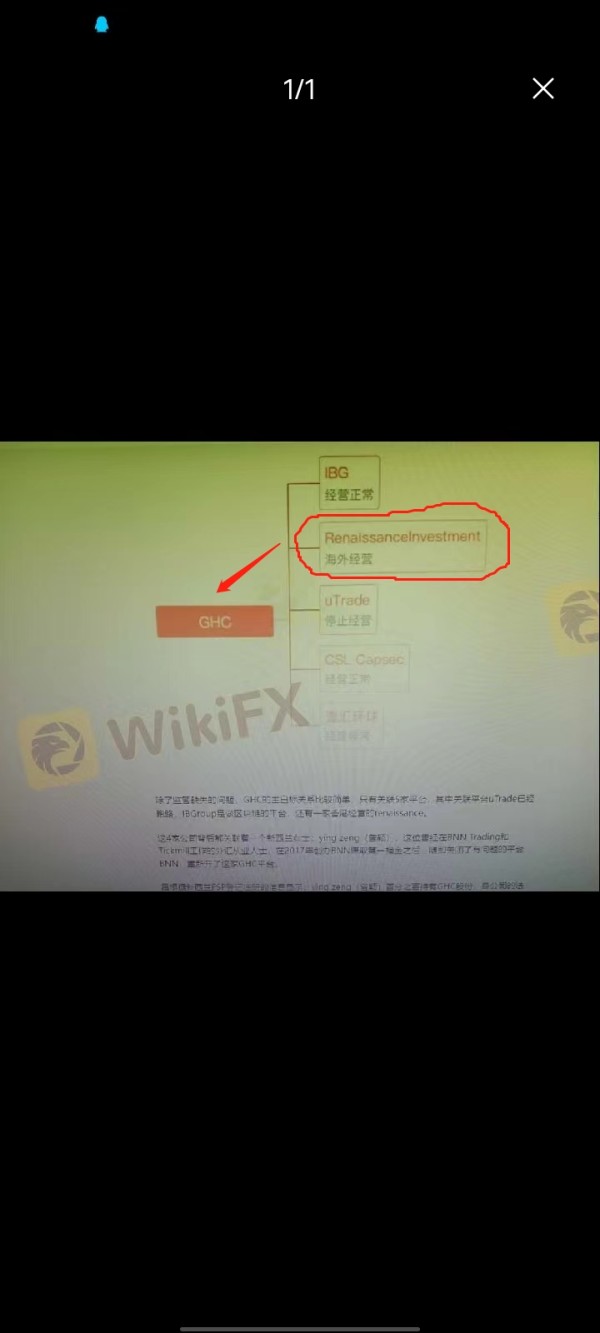

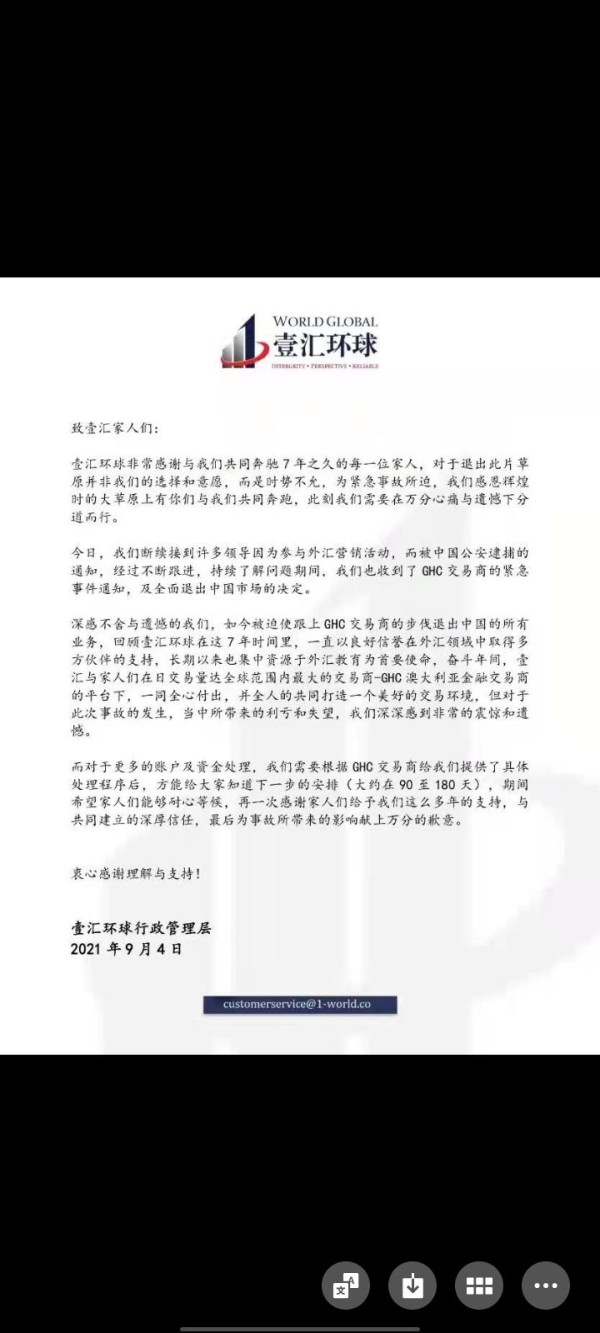

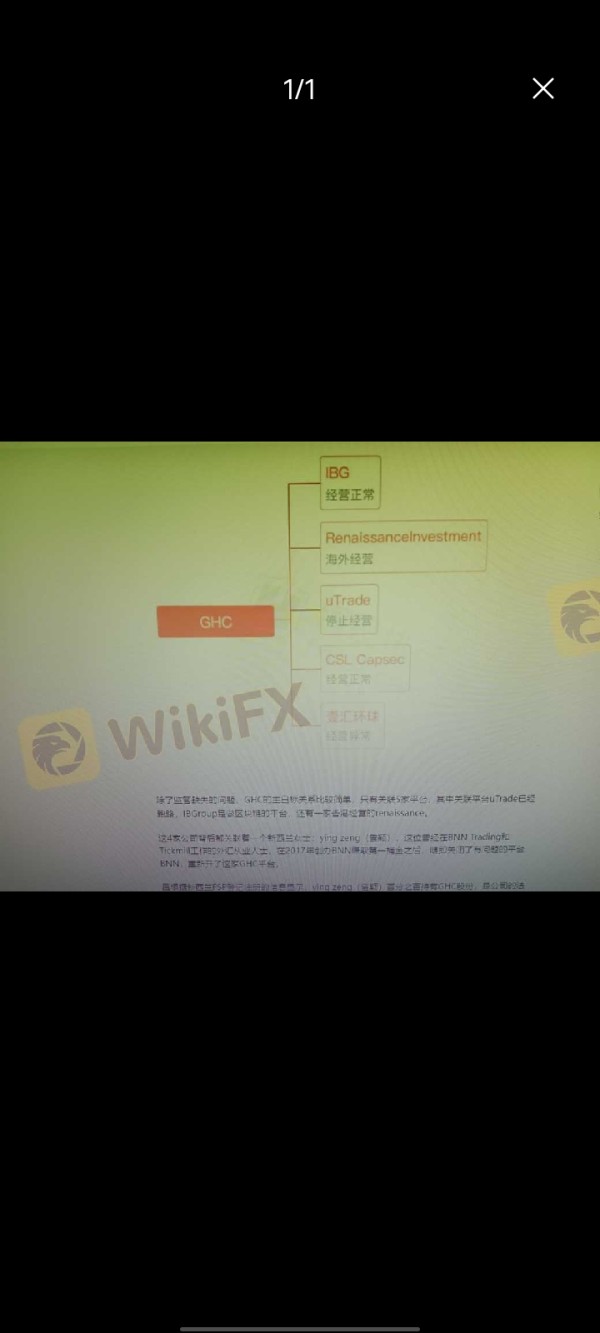

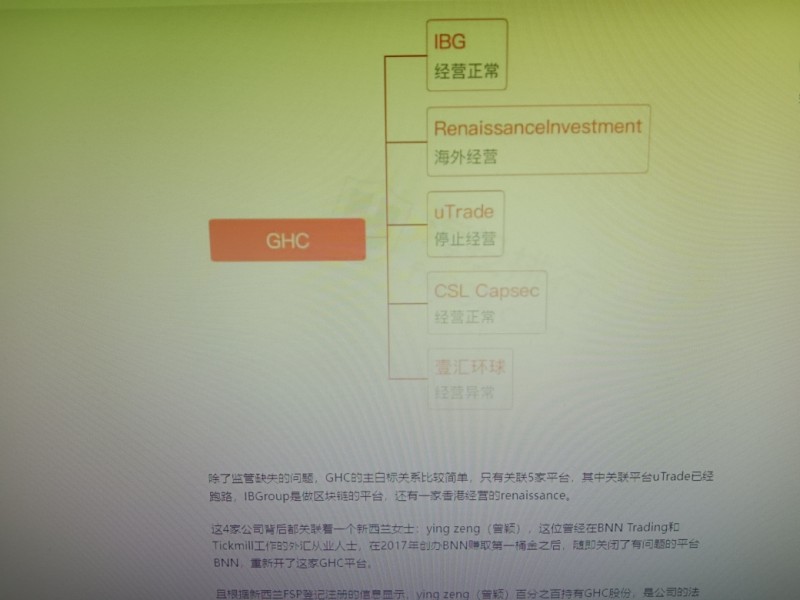

This is a change from GHC. The boss is Huang Xianrong, a Malaysian. It is a fake platform and does not allow withdrawals. When depositing money, it is claimed that the money is in a separate account with ANZ Bank and is subject to supervision. This is a lie.

Exposure

2024-01-19

羽翼&小辉43644

Hong Kong

I hope that the foreign exchange platform will not cover up this company. This is originally GHC, but it is just repackaged. Since it promised to refund the money, why not keep your word?

Exposure

2022-07-14

羽翼&小辉43644

Hong Kong

Ghc absconds in September and cannot withdraw till now. Everyone takes a look on screenshot

Exposure

2022-05-31

羽翼&小辉

Hong Kong

It is already said that you have connection with GHC. You had scammed so many people.

Exposure

2021-12-28

A天蓝蓝(牙医)

Hong Kong

From GHC again to this trader, the scammers continue to cheat. Only we Chinese investors take the result.

Exposure

2021-11-06

A天蓝蓝(牙医)

Hong Kong

On September 4th, the website could not be opened at the same time, and then GHC became this dealer, scammer.

Exposure

2021-11-06

壞丫头

Hong Kong

This was another name of GHC and continue to did scams.

Exposure

2021-10-10