Score

HTCF

Hong Kong|5-10 years|

Hong Kong|5-10 years| --

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

Hong Kong

Hong KongUsers who viewed HTCF also viewed..

FBS

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

ATFX

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Pepperstone

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Vantage

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Website

htcfhk.com

Server Location

United States

Website Domain Name

htcfhk.com

Server IP

209.99.40.222

Company Summary

| Aspect | Information |

|---|---|

| Company Name | HTCF |

| Registered Country/Area | Cayman Islands |

| Founded Year | 2010 |

| Regulatory Status | No licenses |

| Tradable Assets | Forex, Commodities, Indices, Shares |

| Account Types | Micro, Standard, VIP |

| Minimum Deposit | $100 |

| Maximum Leverage | 1:500 |

| Spreads | As low as 0.7 pips |

| Trading Platforms | MetaTrader 4, MetaTrader 5 |

| Customer Support | Phone at +852 59326333 andWeChat at ht-hwn |

| Deposit & Withdrawal | Wire Transfer, Credit Card, eWallets |

Overview of HTCF

HTCF, a forex broker established in 2010 in the Cayman Islands, provides a range of trading opportunities for its clientele. With a diverse array of tradable assets that include Forex, Commodities, Indices, and Shares, the company caters to varying trading needs through its Micro, Standard, and VIP account types. The firm is known for maintaining competitive conditions for trading, such as offering leverage up to 1:500 and spreads as low as 0.7 pips. Propelled by the renowned MetaTrader 4 and 5 platforms, HTCF also extends its support to new traders through a demo account, Supplementing its value proposition are the convenient deposit and withdrawal methods it provides, including wire transfer, credit card, and eWallets options.

Regulatory Authority

HTCF, based in the Cayman Islands, lacks explicit regulatory status disclosure. It's crucial for traders to verify a broker's regulation to ensure fund protection. Unregulated brokers may offer tempting features, but they pose risks, including potential loss of investments.

Traders must thoroughly research brokers, considering factors like regulation, history, and user reviews. Choosing a broker with a demo account, like HTCF, allows testing without real capital risk. Before live trading, ensure comfort with the platform and policies.

Pros and cons

| Pros | Cons |

|---|---|

| Wide range of tradable assets | Regulatory status not explicitly stated |

| Multiple account types | Potential risks associated with unregulated brokers |

| Competitive trading conditions | |

| Use of MetaTrader 4 and 5 platforms | |

| Availability of demo account |

Pros:

1. Wide range of tradable assets: HTCF provides its clients with a diverse array of tradable assets including Forex, Commodities, Indices, and Shares, which facilitates a more balanced and versatile trading portfolio.

2. Multiple account types: By offering account types such as Micro, Standard, and VIP, HTCF caters for a wide range of clientele, meeting the varied financial capacities and trading strategies of novice and experienced traders alike.

3. Competitive trading conditions: HTCF's competitive trading conditions, including leverage of up to 1:500 and spreads as low as 0.7 pips, provide traders with increased chances of maximising their profit returns.

4. Use of MetaTrader 4 and 5 platforms: The provision of these popular and reliable trading platforms allows users to benefit from a multitude of trading tools, charts, and analysis features that these platforms provide.

5. Availability of demo account: New and experienced traders can utilise HTCF's demo account to practice their trading strategies or become acquainted with the trading platforms without risking real capital.

6. Multiple deposit and withdrawal methods: With options such as Wire Transfer, Credit Card, and eWallets, HTCF provides a hassle-free and convenient process for depositing and withdrawing funds.

Cons:

1. Regulatory status not explicitly stated: The lack of clarity regarding HTCF's regulatory status may present potential risks. Traders should be wary of this, as unregulated brokers may lack the necessary safety measures to protect client funds and interests.

2. Potential risks associated with unregulated brokers: Traders dealing with unregulated brokers face potential risks including issues with fund withdrawals or even losing their entire investment in worst-case scenarios. It's crucial to choose a broker that is regulated by a reputational financial authority to ensure transparency and security of funds.

Market Instruments

HTCF offers its clients a variety of market instruments to trade with. These include Forex pairs, Commodities, Indices, and Shares. Such a wide choice allows every investor, regardless of experience and preference, to find suitable instruments for their trading portfolio.

Forex is one of the primary products offered by HTCF. This involves trading of currency pairs that involves buying one currency and selling another. This can be major, minor, and exotic pairs, depending on the currencies involved.

Commodities available for trading include the most popular and globally traded commodities in the market, including oil, gold, silver, etc. Commodity trading is considered a good method to diversify a trading portfolio.

The broker also provides Indices trading, allowing clients to speculate the price movements of groups of top performing companies in a specific country or region. This enables traders to gain broad market exposure in a single trade.

Shares are another type of tradable asset provided by HTCF. These are essentially the units of ownership in a company.

Account Types

HTCF offers three primary types of accounts to cater to different trading needs and experience levels. These include the Micro, Standard, and VIP accounts.

1. Micro Account: This serves as the entry-level account, designed primarily for novice traders or those with a limited investment capacity. The Micro account usually requires a minimal deposit, making it more accessible for beginners in the trading world to get started in forex trading without having to commit to a high initial investment.

2. Standard Account: This is the middle-level account type that HTCF offers. It's suitable for more experienced traders but still comes with reasonable deposit requirements. This account type may offer slightly tighter spreads compared to the Micro account and can include additional features or services.

3. VIP Account: The VIP account is designed for high-volume traders or professional traders. It usually requires a significantly higher minimum deposit compared to the other account types. In return, traders get benefits like even lower spreads, dedicated customer service, and other premium services.

How to Open an Account of HTCF?

1. Visit the HTCF website: The first step to opening an account with HTCF is to visit their official website. Look for the sign-up button or the open account section.

2. Complete the Registration Form: Click the sign-up button to access the registration form. Here, you will need to provide your personal details, such as your name, email address, phone number, and country of residence.

3. Verify Your Email Address: After you've completed the form and submitted it, HTCF will send you a verification email. Click the link in the email to verify your email address and continue with the registration process.

4. Provide Additional Information: You'll be required to provide additional personal information to complete the standard client profiling. You may need to provide details about your financial situation, your trading experience, and your investment objectives.

5. Submit Identification Documents: As part of the KYC (Know Your Customer) procedures, you'll be required to submit copies of identification documents. This typically includes a proof of identity (like passport or driver's license) and proof of address (like a bank statement or utility bill that's not more than three months old).

6. Wait for Account Approval: Once you've submitted all necessary information and documents, your account will be processed for approval. The timeframe for approval varies but usually takes a few days.

7. Make a Deposit: After your account has been approved, you can then fund your account using your preferred deposit method. HTCF offers a variety of deposit methods such as wire transfer, credit cards, and eWallets.

8. Start Trading: Once the deposited funds reflect in your account, you can start trading. It's a good idea to familiarise yourself with the trading platform with a demo account before you start live trading.

Leverage

HTCF offers a maximum leverage of 1:500. Leverage in forex trading is a tool that allows traders to open positions significantly larger than their account balance, up to the 500 times the initial investment with HTCF. While it can maximise potential profits, it also amplifies potential losses. Hence, it's important for traders to use leverage wisely and manage their risk effectively.

Spreads & Commissions

HTCF boasts competitive spreads, which can be as low as 0.7 pips. Spreads, the difference between the bid and ask price, impact the profitability of a trader's transactions and hence lower spreads are typically advantageous to the trader. It's worth noting that spreads can vary depending on the account type and the traded asset. The broker has not explicitly mentioned any commission charges, suggesting they may primarily operate on a spread-based pricing model. However, traders should always verify and understand all cost factors involved with a broker including spreads, commissions and any potential hidden charges before starting to trade.

Trading Platform

HTCF provides its clients with two of the most popular trading platforms in the industry, namely MetaTrader 4 and MetaTrader 5. These platforms are renowned for their advanced trading features and friendly user interface.

MetaTrader 4 (MT4) is highly regarded for its robust functionality and flexibility. It offers advanced charting capabilities, a multitude of available indicators, and supports automated trading by using Expert Advisors (EAs). This makes it an excellent choice for both novice and experienced traders.

MetaTrader 5 (MT5), the successor of MT4, offers all the power of MT4 with added features. It offers more timeframes, a larger number of pending orders, and a more advanced built-in indicator set. Additionally, MT5 also includes an integrated Economic Calendar and comes with an embedded chat feature.

Both platforms provide a strong suite of trading tools and features, including price charts, market indicators, real-time news feeds, and trade execution commands. They are also available on several operating systems, which includes Windows, iOS, and Android. Such accessibility helps traders with different trading routines and platforms settings to engage in trading activities more efficiently.

Deposit & Withdrawal

HTCF supports diverse payment methods to facilitate convenient transactions for its clients. These include wire transfers, credit card payments, and eWallets. The inclusion of such multiple deposit and withdrawal options promotes a hassle-free depositing and withdrawal process.

Customer Support

HTCF offers various means for customer contact. You can reach them by phone at +852 59326333 for direct assistance. Additionally, for alternative methods, they are accessible through WeChat with the handle “ht-hwn.” These options provide customers with flexibility in choosing their preferred communication channel, enhancing accessibility and convenience for inquiries or support.

Conclusion

HTCF is a forex broker that caters to a wide range of traders with its diverse tradable assets, multiple account types, and competitive trading conditions. It offers well-regarded platforms, MetaTrader 4 and MetaTrader 5, and provides 24/5 customer service. The availability of a demo account and comprehensive educational resources also make it an appealing choice for many. However, the potential risks associated with the lack of explicitly stated regulatory status can't be overlooked. Furthermore, the high maximum leverage may pose a significant risk, especially to inexperienced traders. In conclusion, while HTCF has many alluring features, traders should exercise caution and complete thorough due diligence, particularly considering the regulatory ambiguity.

FAQs

Q: What kind of assets can I trade with HTCF?

A: HTCF allows trading across Forex, Commodities, Indices, and Shares.

Q: What are the account types offered by HTCF?

A: HTCF offers three account types: Micro, Standard, and VIP, catering to different investment capacities and trading strategies.

Q: Which trading platforms does HTCF use?

A: HTCF provides MetaTrader 4 and MetaTrader 5 platforms for trading.

Q: What is the maximum leverage provided by HTCF?

A: HTCF offers a maximum leverage of 1:500.

Q: What are the deposit and withdrawal methods at HTCF?

A: HTCF supports multiple methods including wire transfer, credit card payments, and eWallets.

Risk Warning

Online trading poses substantial risks, with the potential for complete loss of invested capital, rendering it unsuitable for all traders. It is imperative to comprehend the inherent risks and acknowledge that the information provided in this review is subject to change due to continuous updates in the company's services and policies.

Additionally, the review's generation date is a critical consideration, as information may have evolved since then. Readers are strongly advised to verify updated details directly with the company before making any decisions, as the responsibility for utilizing the information herein rests solely with the reader.

Keywords

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

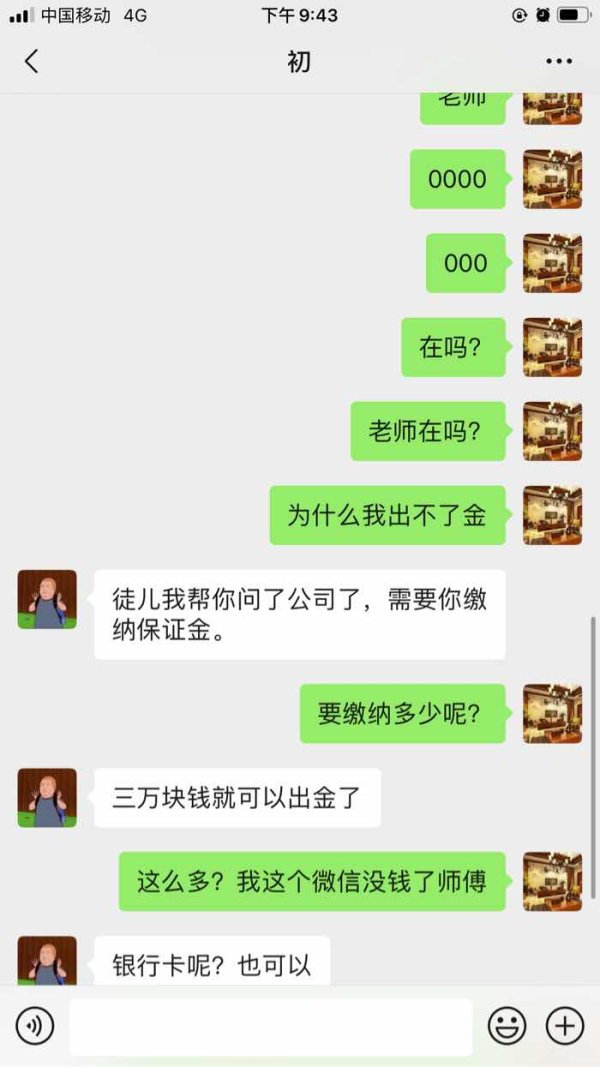

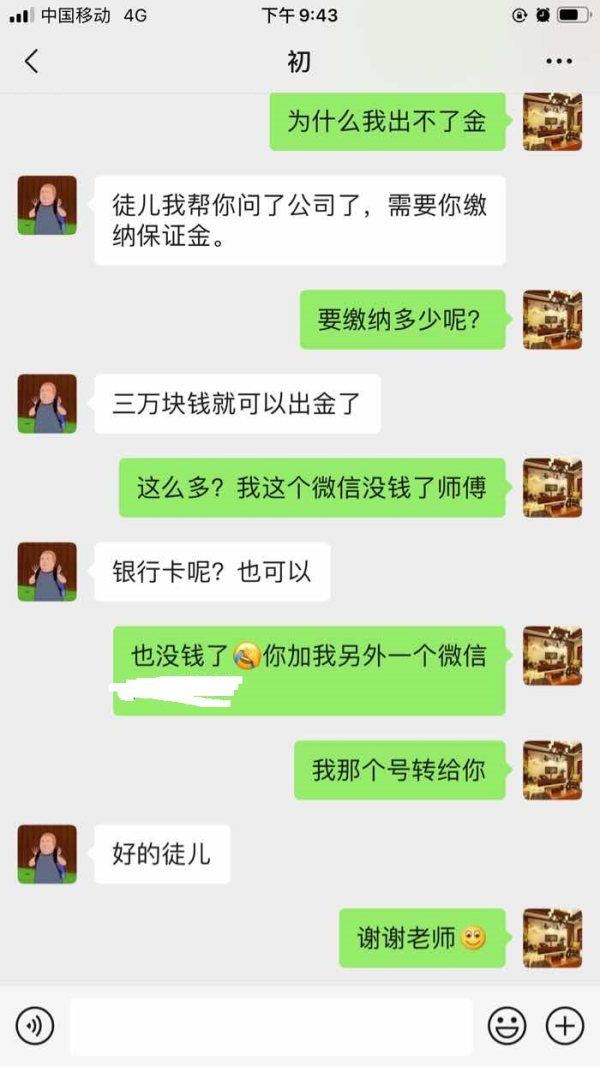

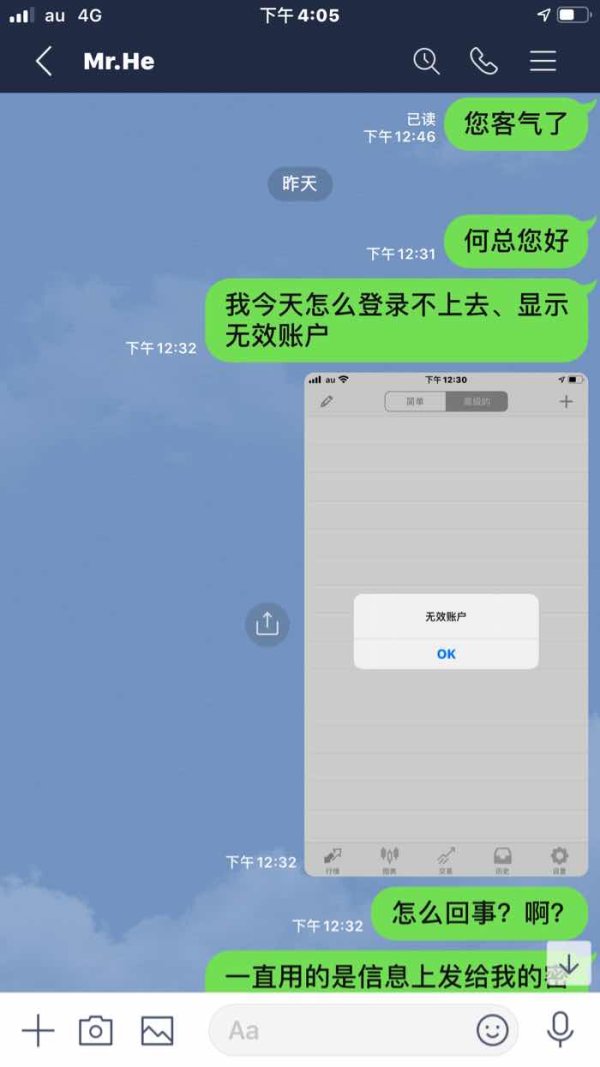

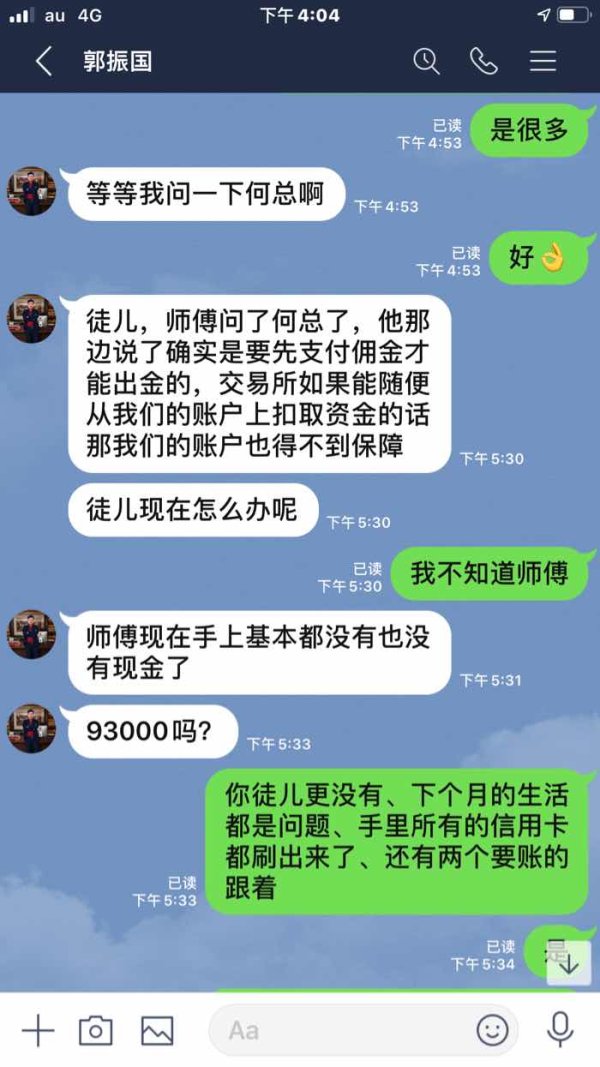

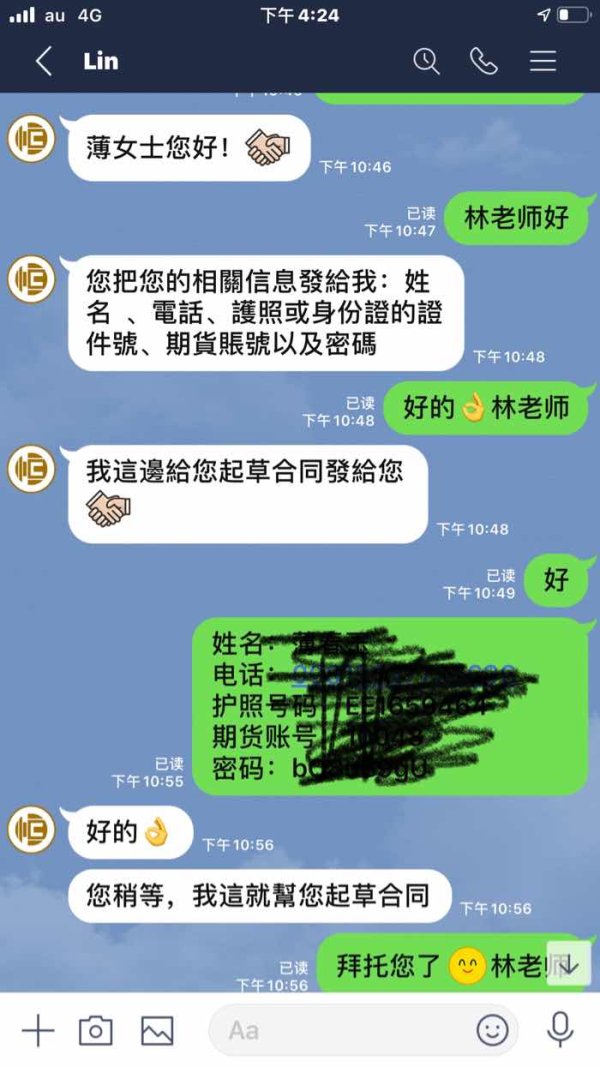

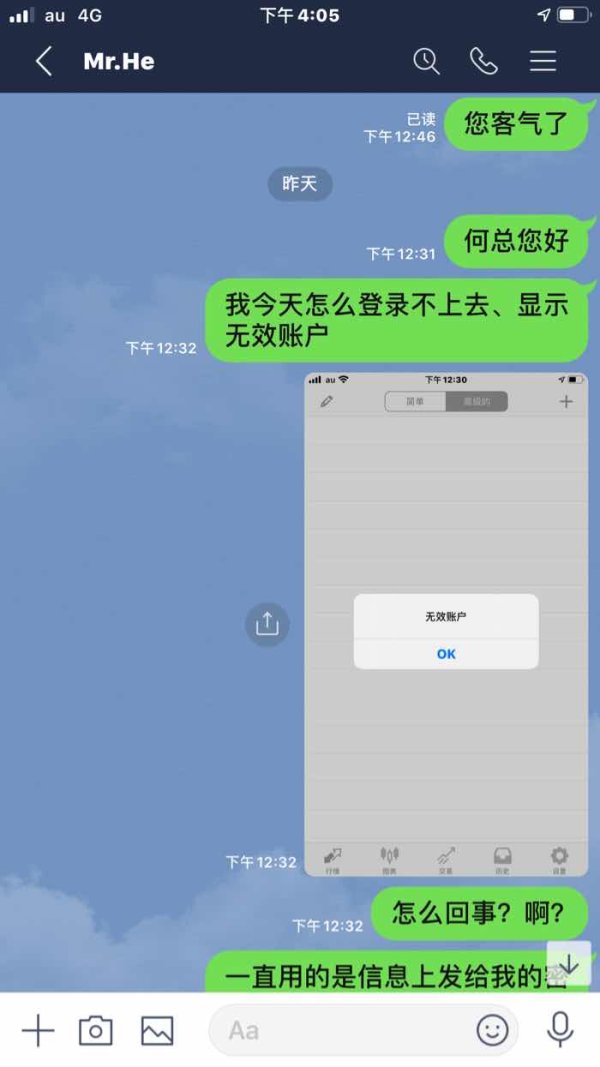

Comment 2

Content you want to comment

Please enter...

Comment 2

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now