Score

CMB

Hong Kong|15-20 years|

Hong Kong|15-20 years| http://www.cmbi.com.hk/en-US/

Website

Rating Index

Influence

Influence

C

Influence index NO.1

China 4.55

China 4.55Contact

Licenses

Licenses

Licensed Entity:CMB International Futures Limited

License No. ACQ651

Single Core

1G

40G

1M*ADSL

Basic Information

Hong Kong

Hong KongUsers who viewed CMB also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

AUS GLOBAL

- 10-15 years |

- Regulated in Cyprus |

- Market Maker (MM) |

- MT4 Full License

HFM

- 10-15 years |

- Regulated in Cyprus |

- Market Maker (MM) |

- MT4 Full License

Pepperstone

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Website

cmbi.com.hk

Server Location

China

Website Domain Name

cmbi.com.hk

Website

WHOIS.HKIRC.HK

Company

-

Server IP

210.83.231.48

Genealogy

VIP is not activated.

VIP is not activated.Relevant Enterprises

Company Summary

| Aspect | Information |

| Registered Country/Area | Hong Kong |

| Founded Year | 15-20 years ago |

| Company Name | CMB International Futures Limited (CMB) |

| Regulation | Regulated by the Securities and Futures Commission of Hong Kong |

| Minimum Deposit | Not specified |

| Maximum Leverage | Not specified |

| Spreads | Not specified |

| Trading Platforms | 1. Yat Lung GloBal (for iOS and Android) 2. CMBI on-line trading platform (Web) 3. QianLong trading platform (Windows) |

| Tradable Assets | Stocks, futures contracts (commodities), options contracts on various financial instruments |

| Account Types | Not specified |

| Service | Corporate Finance, Asset Management, Wealth Management, Global Markets, Structured Finance |

| Customer Support | Contact numbers provided for different locations, hotline for complaints and feedback |

| Payment Methods | Bank counters, internet transfers, withdrawal through forms or online trading system |

| Educational Tools | Daily Note, Market Strategy, Macroeconomics, Securities Analysis, Company News |

Overview of CMB

CMB International Futures Limited (CMB) is a regulated institution in Hong Kong authorized to deal with futures contracts. It operates under the supervision of the Securities and Futures Commission of Hong Kong and has been licensed since 2006. CMB offers various market instruments, including stock trading, futures trading, and options trading. They provide a platform for investors to trade shares, commodities, and options contracts.

In addition to their trading services, CMB offers a range of financial services. CMB International Capital Limited (CMBIC) specializes in corporate finance and capital market services, including IPO sponsorship, share placement, and financial advisory. CMB International Asset Management Limited (CMBIAM) provides asset management services to institutions, corporates, and high-net-worth individuals. CMBI serves high-net-worth individuals and corporate clients in wealth management, offering investment advisory and asset allocation services. They also have a global markets division and a structured finance team that provides trading services and financing support.

To open an account with CMB, applicants can apply online, visit their Hong Kong office in person, or submit an offline application by post. Fees and commissions vary depending on the type of trading service. Clients can deposit funds through bank counters or internet transfers and initiate withdrawals through various methods. CMB provides trading platforms for different devices, including mobile and desktop, and offers educational resources covering market updates, strategic viewpoints, macroeconomics, securities analysis, and company news. It's important to note that there have been negative reviews and complaints regarding CMB, suggesting issues with withdrawal difficulties and lack of transparency.

Pros and Cons

CMB, a regulated institution authorized for futures trading, offers a range of trading services including stocks, futures, and options. Additionally, it provides corporate finance and asset management services through its global markets division. With multiple trading platforms and accessible customer support, CMB helps cater to the needs of its clients. However, the company faces several drawbacks, such as reports of withdrawal difficulties and scams, which raise concerns about trustworthiness and transparency. There have been issues with fund withdrawals and payment requests, and the lack of information about account types and educational resources limits the clarity and guidance for users. Complaints regarding customer support further contribute to the challenges faced by CMB in providing a satisfactory trading experience.

| Pros | Cons |

| Regulated institution authorized for futures trading | Reports of withdrawal difficulties and scams |

| Offers stock, futures, and options trading | Lack of trustworthiness and transparency |

| Provides corporate finance and asset management services | Issues with fund withdrawals and payment requests |

| Global markets division offers a wide range of trading services | No information about account types available |

| Multiple trading platforms available | Lack of clear information on spreads and leverage |

| Accessible customer support | Complaints regarding customer support |

| Wealth management solutions | Limited information on educational resources |

Is CMB Legit?

CMB International Futures Limited (CMB) is a regulated institution in Hong Kong authorized to engage in dealing with futures contracts. It operates under the supervision of the Securities and Futures Commission of Hong Kong. CMB has been licensed since July 21, 2006, and its license type does not involve sharing. The company's address is located at 45/F, Champion Tower, 3 Garden Road, Central, Hong Kong. For further information, you can visit their website at http://www.cmbi.com.hk or contact them via email at licensing@cmbi.com.hk.

Market Instruments

STOCK TRADING: CMB offers stock trading services, allowing investors to buy and sell shares of various companies listed on the stock exchange. Investors can trade stocks of well-known companies such as Hong Kong stock, China B Stock, China-stock-connect market, US stock, global stock, among others.

FUTURES TRADING: CMB facilitates futures trading, enabling investors to participate in the futures market. Futures contracts on commodities such as crude oil, gold, and wheat are available for trading. Investors can take positions on the price movement of these underlying assets, providing opportunities for speculation or hedging purposes.

OPTIONS TRADING: CMB provides options trading services, allowing investors to trade options contracts. Options give investors the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified time frame. CMB offers options contracts on various financial instruments, such as stocks, indices, and currencies, providing investors with a range of trading possibilities.

Pros and Cons

| Pros | Cons |

| Stock trading allows investors to trade shares of various companies listed on the stock exchange. | Limited types of instruments |

| Futures trading provides opportunities for speculation or hedging purposes on commodities like crude oil, gold, and wheat. | |

| Options trading offers investors the ability to trade options contracts on various financial instruments. |

Service & Business

Corporate Finance: CMB International Capital Limited (CMBIC) provides a comprehensive range of high-standard corporate finance and capital market services. They offer services such as Hong Kong IPO sponsorship and underwriting, share placement and rights issue for listed companies, financial advisors, and bonds issuance services. With their in-depth understanding of domestic and foreign capital markets, a professional team, and distribution channels, CMBIC has become one of the most active and fastest-growing financial institutions in the Hong Kong market.

Asset Management: CMB International Asset Management Limited (CMBIAM) provides quality investment products and professional investment advisory services to institutions, corporates, and high-net-worth individuals. They leverage their expertise in Asia Pacific markets and offer customized asset management services, including cross-border investments, listed equities and bonds, private equity, fund of funds, and discretionary accounts. CMBIAM focuses on delivering comprehensive solutions and catering to various risk profiles of their clients.

Wealth Management: CMBI serves high-net-worth individuals and corporate clients by providing international-level investment advisory and asset allocation services. Leveraging their expertise in asset management, corporate finance, global markets, and structured finance, they deliver customized solutions for wealth management. Their services include holistic wealth solutions, asset allocation, investment advisory services, strategy research, a comprehensive product platform, trading platform, and value-added services such as art appreciation and immigration planning saloons.

Global Markets: CMBI's global markets division offers a wide range of trading services for Hong Kong and global exchange products. They provide services such as securities trading, stock options, China Connect, global securities, futures and options, margin financing, and OTC products.

Structured Finance: CMBI's structured finance team provides senior and mezzanine debt financing support and professional advisory services for various stages of company development. They offer innovative credit products and capital structures, including letter of credit, asset-backed financing, share-backed financing, bridge loans, M&A loans, and convertible bonds.

How to Open an Account?

To open an account with CMB:

Online application: Apply through the “壹隆环球” mobile app or visit the provided website.

Offline application: a. In person: Visit CMBI Hong Kong office, submit the required documents, and have your signature witnessed. b. By post: Complete the application form, get it witnessed, and mail it with the required documents.

Account opening for China Merchants Bank clients: Contact the provided phone number or email.

Bank Securities transfer: Use the joint service for easy fund transfer between bank and securities accounts.

Fees & Commissions

Fees and commissions charged by CMB (China Merchants Bank) for various trading services are as follows:

Hong Kong Stock Business - Market Data:

CMB International provides real-time quote services for Hong Kong stocks. The mobile app “壹隆环球” offers unlimited access to real-time quotes at no monthly fee. The online trading platform provides 1000 monthly quotes for free. Additional Hong Kong stocks live streaming quotation, charts, and information services are available at preferential prices from service providers like AAstock and Chief.

HK Stock Business - Commission Fees:

For HK stock trading, the commission fees vary based on the type of order placement. For telephone orders, including Grey Market transactions, the trading commission fee is 0.25% of the transaction value with a minimum fee of HK$100/RMB88. For online trading, the trading commission fee is 0.20% of the transaction value with a minimum fee of HK$80/RMB68. There are no platform usage fees.

Scrip Handling and Settlement-Related Services:

CMB charges various fees for services related to scrip handling and settlement. These include fees for physical scrip deposit and withdrawal, settlement instructions (SI) fee, stock clearing fee, handling charge, investor settlement instruction (ISI) fee, compulsory buy-in penalty, and fees for nominee services and corporate actions. The fees vary based on the specific service provided.

Margin financing service:

CMB provides margin financing services for stock trading. The service includes an interest rate based on a prime interest rate plus 3% per annum. Fees and charges related to margin financing are determined by the specific market and security being traded.

Deposit & Withdrawal

Deposit & Withdrawal - CMB (China Merchants Bank):

In accordance with the Guideline on Anti-Money Laundering and Counter-Terrorist Financing, CMB International Securities Limited and CMB International Global Markets Limited do not accept cash or third-party deposits or withdrawals. This includes transfers, remittances, and cheque deposits or withdrawals. If any cash or third-party deposits are identified, the funds will be returned to the depositor/originated bank account, and applicable bank charges may be deducted.

Fund In:

Clients have several ways to deposit funds into their accounts. They can visit bank counters and deposit funds to the designated bank accounts of CMBI or CMBIGM. Alternatively, clients can transfer funds via internet transfer services offered by different banks to the designated bank accounts. It is essential for clients to notify the company through specified means when using these methods. The company can only update the client's account balance upon verification of the provided instructions. The designated bank accounts for deposits are listed, including account numbers and relevant SWIFT codes.

Fund Out:

To withdraw funds, clients can submit the completed “Fund Withdrawal Instruction Form” through various methods, such as by post, fax, or email. Clients who have successfully applied for internet trading services can also initiate withdrawals through the online trading system. It is important to note that withdrawal instructions should be submitted before 12:00 p.m. on a working day. Clients can also instruct CMBI or CMBIGM to deposit cheques on their behalf into a bank account under their name. For TT (Telegraphic Transfer) of funds to an overseas account, clients must present the original copy of their overseas payment instruction form and cover the associated charges.

Pros and Cons

| Pros | Cons |

| Multiple deposit options available | Restriction on cash or third-party deposits/withdrawals |

| Online withdrawal through the system | Withdrawal instructions must be submitted before 12:00 p.m. |

| Option to deposit cheques on behalf of clients | Original copy of overseas payment instruction form required for TT |

Trading Platforms

1. Yat Lung GloBal:

Yat Lung GloBal is a trading platform offered by CMB (China Merchants Bank) that caters to both iOS and Android users. It provides an accessible way for users to engage in trading activities. The platform can be easily downloaded by scanning the provided QR code or through the respective app stores. With Yat Lung GloBal, users can access a range of trading features and functionalities.

2. CMBI on-line trading platform (Web):

CMBI on-line trading platform is a web-based trading platform offered by CMB. It allows users to access trading services through their web browsers without the need for any additional software installation. The platform offers a user-friendly interface that facilitates easy navigation and trading operations. It provides essential trading tools and features to support users in their trading activities.

3. QianLong trading platform (Windows):

QianLong trading platform is a Windows-based trading platform provided by CMB. It offers a desktop application for users who prefer to conduct their trading activities on Windows operating systems. The platform can be downloaded by clicking on the provided link. QianLong trading platform provides a comprehensive set of tools and features to assist users in executing trades.

Pros and Cons

| Pros | Cons |

| Can be accessed on mobile devices, web browsers, and Windows operating systems. | Not as many features as some other trading platforms. |

| Provides a range of trading tools and features, including charting, technical analysis, and order management. | Some of the tools are not as user-friendly as others. |

| Offers 24/7 customer support via phone, email, and live chat. | Customer support can be slow to respond at times. |

Payment Method

CMB (China Merchants Bank) does not accept cash or third-party deposits or withdrawals. Clients can deposit funds through bank counters or internet transfers, and withdrawals can be made via submission of a form or through the online trading system. Withdrawal instructions should be submitted before 12:00 p.m. on a working day, and clients can also deposit cheques or transfer funds overseas with certain requirements.

Educational Resources

The Daily Note section offers updates on fixed income markets and market trends. It includes daily market updates and commentary on topics such as artificial intelligence conferences, the Chinese automotive industry, Alibaba, China Duty-Free Group, CR Beer, and more. These notes provide insights into the market and keep readers up to date with the latest developments.

Market Strategy provides strategic viewpoints and focus lists. The viewpoints cover topics such as China's policy easing, recovery expectations, and inflation trends. The focus lists highlight high conviction stock ideas, offering investment recommendations and insights into potential investment opportunities.

The Macroeconomics section focuses on China's economy, policies, and growth prospects. It offers economic perspectives, macro monitors, and insights into China's economic conditions. Topics covered include weak growth, policy easing, credit policy, deflation risks, and more. These resources provide a comprehensive understanding of China's macroeconomic landscape.

Securities Analysis offers in-depth analysis of specific companies and sectors. It includes research reports on companies like Alibaba, CR Beer, CTGDF, and sectors like China's internet industry and auto sector. These reports provide fundamental analysis and evaluations, helping investors assess the performance and potential of specific securities.

Company News provides updates on CMB's achievements and activities. It includes news about awards received, publications, and involvement in various financial transactions, such as acting as a joint bookrunner for IPOs. This section offers insights into CMB's business operations and its contributions to the financial industry.

Customer Support

CMB's customer support can be reached at various locations. In Hong Kong, their contact numbers are (+852) 3900 0888 and (+852) 3761 8788. In Shenzhen, the numbers are (+86755) 8637 8978 and (+86755) 8637 8959. For Singapore, the contact numbers are (+65) 6350 4400 and (+65) 6244 4374. In Beijing, the number is (+8610) 8332 6088, and in Shanghai, it is (+8621) 3893 4888. Complaints and feedback can be submitted via the hotline at +852-39161734, email at complainthandling@cmbi.com.hk, or by post to 46/F, Champion Tower, 3 Garden Road, Central, Hong Kong.

Reviews

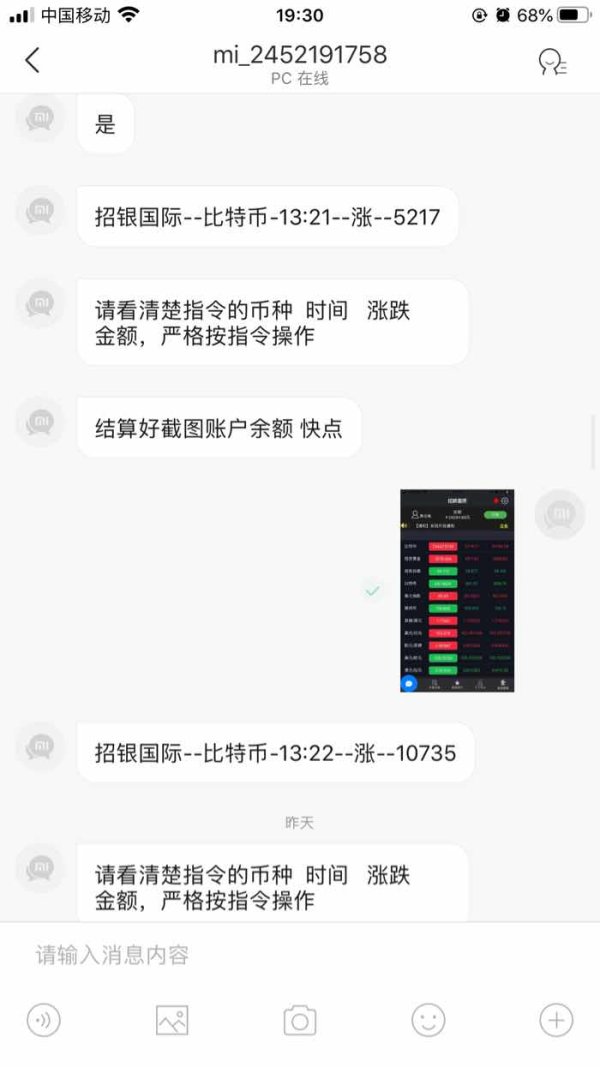

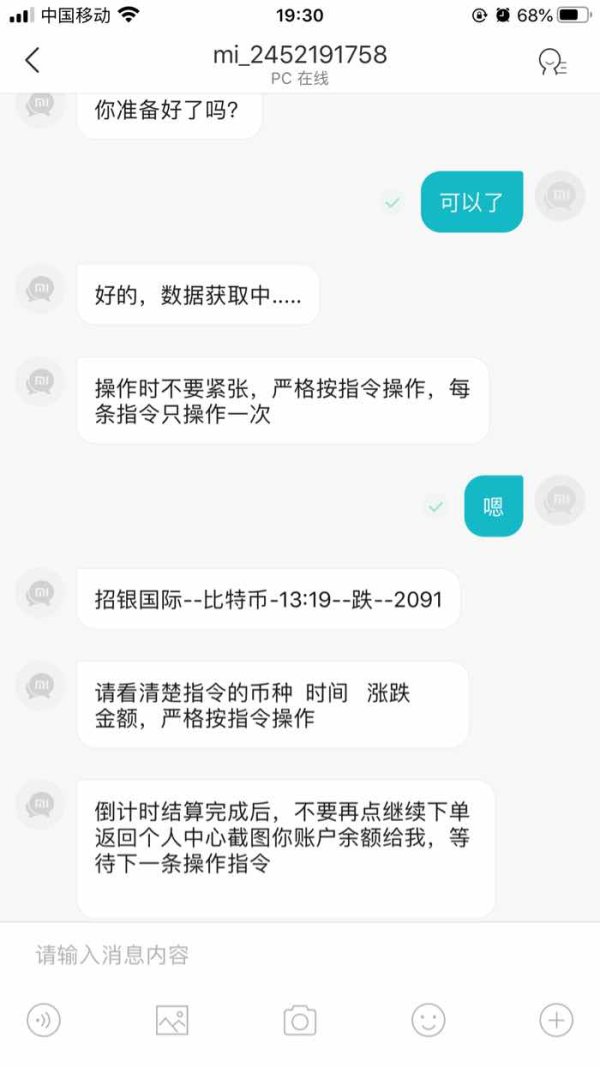

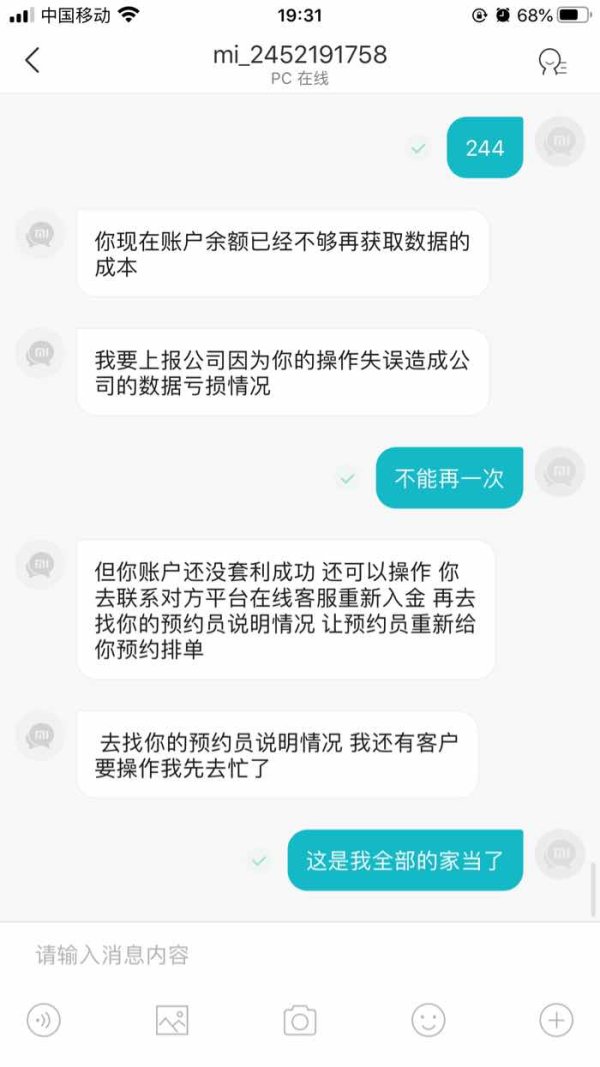

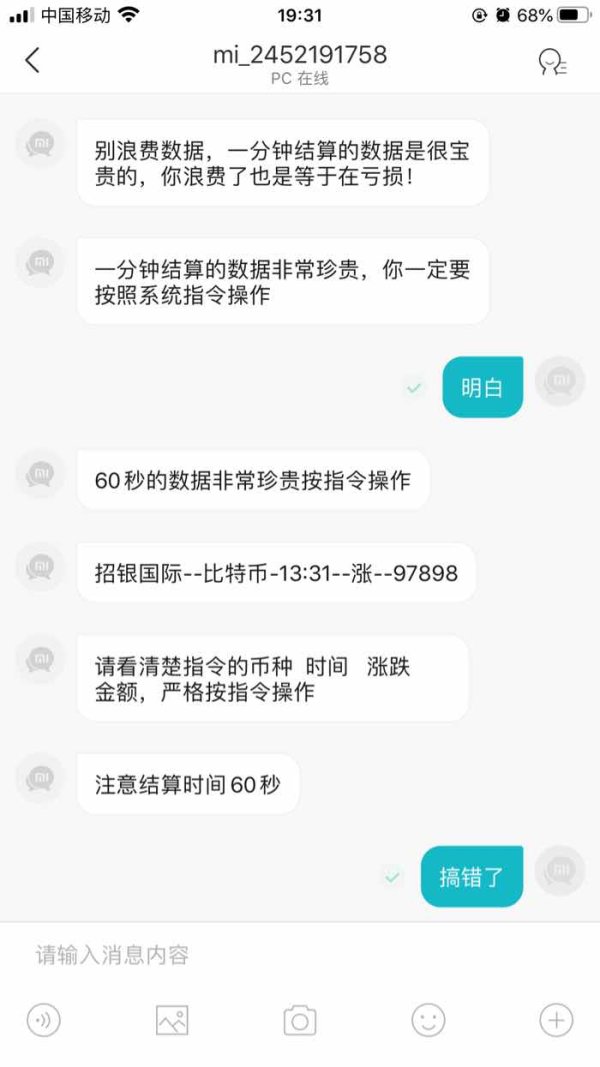

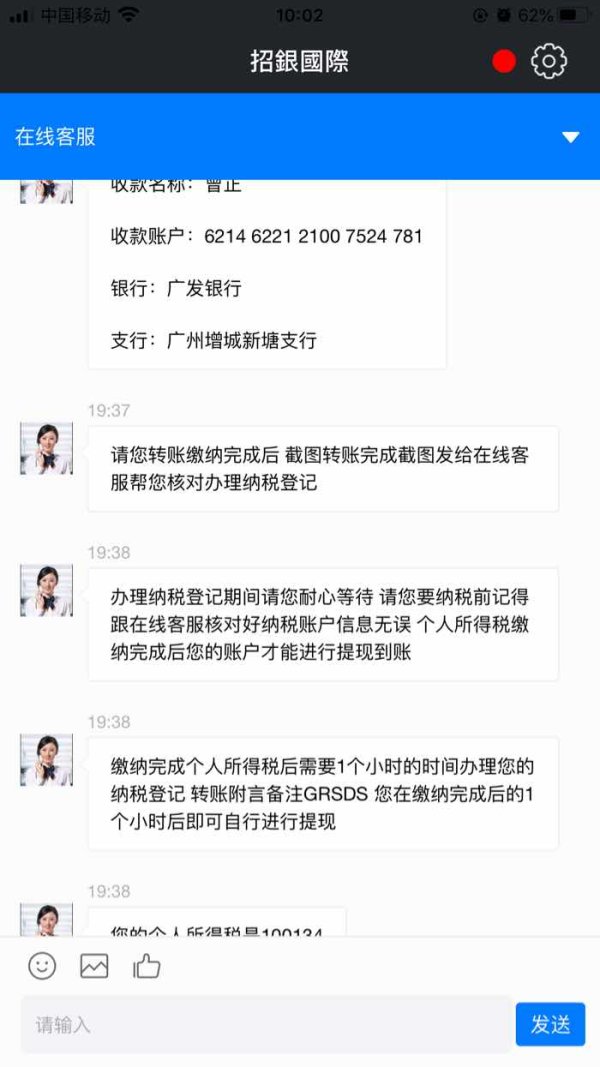

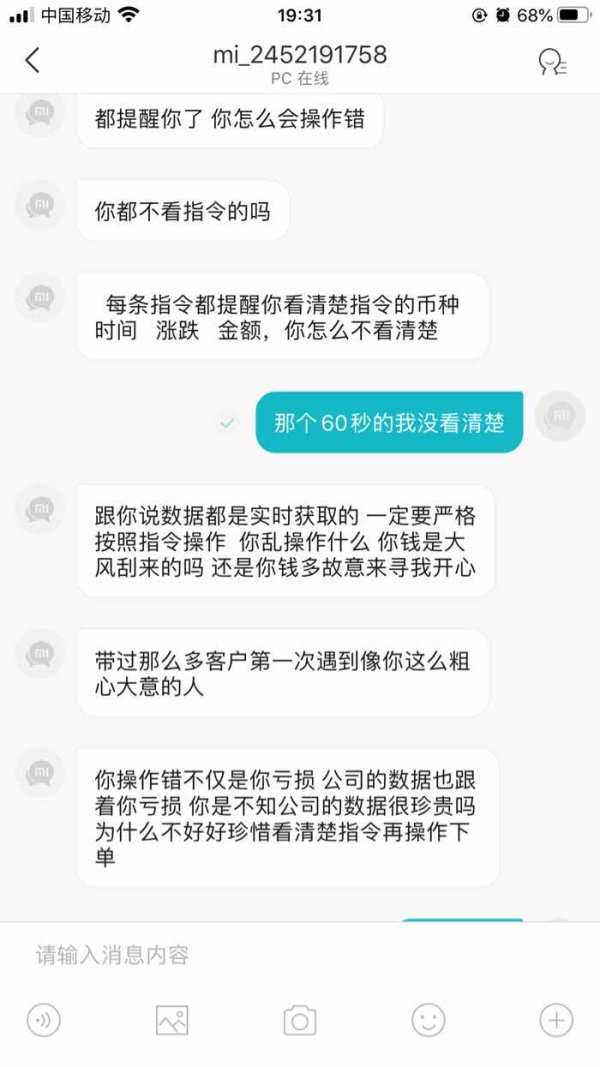

According to reviews on WikiFX, customers have reported issues with CMB regarding withdrawal difficulties and being asked to pay money with various excuses without being able to withdraw funds in the end. Some reviewers mentioned experiencing scams and fraudulent activities, where the broker offered bonuses for transactions but later prevented them from withdrawing funds. In some cases, customers were guided to invest by programmers, asked to deposit funds if they incurred losses, and required to pay individual income tax to withdraw profits. These reviews suggest a lack of trustworthiness and transparency in CMB's operations.

Conclusion

In conclusion, CMB International Futures Limited (CMB) is a regulated institution in Hong Kong that offers stock trading, futures trading, and options trading services. The company provides a range of services such as corporate finance, asset management, wealth management, global markets, and structured finance. CMB offers multiple trading platforms for access to trading activities. However, there have been customer complaints regarding withdrawal difficulties and potential fraudulent activities, raising concerns about the trustworthiness and transparency of CMB's operations.

FAQs

Q: Is CMB a legitimate institution?

A: Yes, CMB International Futures Limited is a regulated institution authorized by the Securities and Futures Commission of Hong Kong.

Q: What market instruments does CMB offer?

A: CMB offers stock trading, futures trading, and options trading services.

Q: What are the pros of CMB's services?

A: CMB offers corporate finance, asset management, wealth management, global markets, and structured finance services.

Q: How can I open an account with CMB?

A: You can apply online or visit their office in Hong Kong. There are also options for existing China Merchants Bank clients and bank securities transfer.

Q: What are the fees and commissions for CMB's trading services?

A: Fees and commissions vary based on the type of trading service, such as stock trading, scrip handling, settlement-related services, and margin financing.

Q: How can I deposit and withdraw funds with CMB?

A: Funds can be deposited through bank counters or internet transfers. Withdrawals can be made through various methods, including submission of a form or using the online trading system.

Q: What are the available trading platforms provided by CMB?

A: CMB offers Yat Lung GloBal for iOS and Android users, CMBI online trading platform for web browsers, and QianLong trading platform for Windows.

Q: Are there educational resources available from CMB?

A: Yes, CMB provides daily market updates, market strategy viewpoints, macroeconomic insights, securities analysis reports, and company news.

Q: How can I contact CMB's customer support?

A: Customer support can be reached through various contact numbers in different locations or by submitting complaints and feedback via hotline, email, or post.

Q: What do customer reviews suggest about CMB?

A: Some customer reviews have raised concerns about withdrawal difficulties and potential scams, indicating a lack of trustworthiness and transparency in CMB's operations.

Keywords

- 15-20 years

- Regulated in Hong Kong

- Dealing in futures contracts

Comment 4

Content you want to comment

Please enter...

Comment 4

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

สมพง พระประแดง

Thailand

The broker said that there was bonus for transactions. While I could not witdhraw funds after trading for some time. They said that their staff had covid. So I've waited since last year

Exposure

2021-06-24

龙瑞

Hong Kong

Ask u to pay money with varied excuses. But u can’t withdraw funds in the end.

Exposure

2020-12-23

龙瑞

Hong Kong

The so-called programmers guided u to invest with instructions. If u lose, they will ask u to deposit funds. After u profit, u should pay individual income tax to withdraw funds. The reality is ruthless

Exposure

2020-12-21

西风古道

Peru

CMB is one of the most legit finance companies I've come across. I've traded stocks and done some financial trading on their platform and the fees are pretty transparent. Plus, the trading environment is fair, no shady stuff going on. And the customer service reps are on point, always professional and know their stuff.

Positive

2023-03-27