It is important to note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

Pros and cons of OspreyFX

Pros:

Multiple account types and trading platforms to choose from

Competitive spreads starting from 0.8 pips

High maximum leverage of up to 1:500

Wide range of tradable instruments including forex, stocks, commodities, and cryptocurrencies

Multiple deposit and withdrawal methods with no fees

Efficient customer support with various options available

Cons:

Limited educational resources for traders

No regulatory oversight from major financial authorities such as the FCA or ASIC

Limited trading platforms, only offering MT4 and MT5

Inactivity fee charged after 60 days of no trading activity on the account

Commission charges on some account types

Limited transparency on company ownership and management

Limited deposit and withdrawal methods compared to some other brokers

What type of broker is OspreyFX?

OspreyFX is a Market Making (MM) broker, which means that it acts as a counterparty to its clients in trading operations. That is, instead of connecting directly to the market, OspreyFX acts as an intermediary and takes the opposite position to its clients. As such, it can offer faster order execution speed, tighter spreads and greater flexibility in terms of the leverage offered. However, this also means that OspreyFX has a certain conflict of interest with their clients, as their profits come from the difference between the bid and ask price of assets, which could lead to them making decisions that are not necessarily in the best interests of their clients. It is important for traders to be aware of this dynamic when trading with OspreyFX or any other MM broker.

General information and regulation of OspreyFX

OspreyFX is a forex and CFD broker founded in 2019 and based in St. Vincent and the Grenadines. The company offers trading services in various financial markets, including forex, stocks, commodities, indices, and cryptocurrencies, through its ECN account type. OspreyFX allows trading on the popular MT4 and MT5 trading platform and offers high leverage of up to 1:500. The company provides multiple deposit and withdrawal options, including cryptocurrencies, with no fees charged for transactions. OspreyFX offers customer support via various channels, including email, social media, and call back.

In the following article, we will analyze the characteristics of this broker in all its dimensions, providing you with easy and well-organized information. If you are interested, read on.

Market instruments

OspreyFX offers a total of 120+ instruments, including 55 forex pairs, 9 indices, 9 commodities, 37 stocks, and 31 cryptocurrencies. This wide range of trading options provides traders with the opportunity to diversify their portfolios and explore various markets. The large number of currency pairs available is a particular advantage for forex traders, as it allows them to trade in multiple global currencies. However, the limited number of available stocks and the relatively small selection of indices and commodities may be a disadvantage for traders looking for a wider range of options in these markets. Nonetheless, the opportunity to trade in a range of cryptocurrencies can be an advantage for traders interested in this asset class. Overall, the instrument dimension offered by OspreyFX provides traders with a diverse selection of options to explore, though there may be limitations in certain markets.

Spreads and commissions for trading with OspreyFX

OspreyFX offers a range of account types, each with its own spreads, commissions, and costs. The standard account type offers spreads from 0.8 and commission per lot of $7.00, while the PRO account type offers spreads from 0.4 and commission per lot of $8.00. The VAR account type has no commission and spreads start from 1.2, and the Mini account type has spreads from 1.0 and commission per lot of $1.00. While some account types have low spreads, others have high commissions, which may not be ideal for all traders. Additionally, inactivity fees are charged after 60 days of no trading activity, and swap fees are charged on positions held overnight. However, there are no hidden fees or charges, and traders have different account types to choose from depending on their needs.

Trading accounts available in OspreyFX

ECN account:

In terms of account types, OspreyFX offers four different types: Standard, PRO, VAR, and Mini, catering to various trading needs. The ECN account offers market execution and a wide range of instruments, including forex, indices, commodities, metals, stocks, and cryptocurrencies. The maximum leverage for all accounts is 1:500, and the minimum trade size is 0.01 lots. Spreads are competitive across all account types, with the PRO account offering spreads as low as 0.4 pips. Commission charges apply for the standard and PRO accounts, with the VAR account having no commission charges. However, the maximum trade size for the ECN account may be relatively small for some traders, and the lack of regulation may deter those who prioritize safety and security.

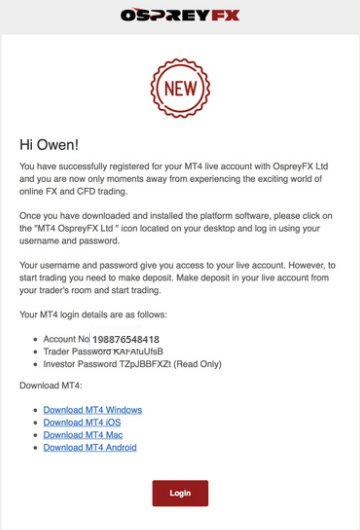

Trading platform(s) that OspreyFX offers

OspreyFX offers its clients access to two of the most popular trading platforms in the industry, MT4 and MT5. These platforms are widely used by traders and are known for their advanced charting capabilities, extensive range of technical analysis tools, and ability to run expert advisors (EAs). The platforms are available for download on desktop and Mac, as well as on Android and through webtrader. Traders can choose from multiple order types and execution modes and can access robust backtesting capabilities to test their trading strategies. However, there are also some disadvantages to using these platforms, such as the lack of customization options and news and research resources. Additionally, new traders may find the learning curve for using the platforms to be steep.

Maximum leverage of OspreyFX

OspreyFX offers a maximum leverage of up to 1:500, which allows traders to increase their trading power and potentially earn higher profits with relatively small investments. However, high leverage also comes with significant risks, including the potential for significant losses that may even exceed the initial investment. Traders should exercise discipline and employ proper risk management strategies when using high leverage to avoid blowing their account. While the high leverage offered by OspreyFX can be attractive to some traders, it is important to recognize that it requires a cautious and disciplined approach to be successful.

Deposit and Withdrawal: methods and fees

Deposit methods:

Bitcoin (BTC)

Debit/Credit Card Direct via 3rd Party Platforms - Various Providers

(You will be purchasing Bitcoin with your card and transferring Bitcoin to us.)

Litecoin (LTC)

Ethereum (ETH)

USDT (ERC20)

USDT (TRC20)

USD Coin (TRC20)

Dogecoin (DOGE)

Ripple (XRP)

PayRedeem While depositing via this method, kindly note that PayRedeem deposits incur a 6.5% transaction fee.

Withdrawal methods:

Credit/Debit Card (3rd Party Platform)

If you have deposited using a credit/debit card via a 3rd party provider, then you would need to withdraw using Bitcoin.

Bitcoin (BTC)

Bitcoin deposits must be withdrawn back to Bitcoin but profits can be withdrawn via Bitcoin or an alternative method.

PayRedeem

If you have deposited through PayRedeem, you will need to withdraw back using the same method.

OspreyFX offers a variety of deposit and withdrawal methods to ensure that their clients can conveniently and easily fund their trading accounts and withdraw their profits. The wide range of payment methods, including cryptocurrencies such as Bitcoin, Litecoin, Ethereum, Ripple, DogeCoin, and stablecoins such as Tether (ERC20), Tether (TRC20), and USD Coin (TRC20), as well as credit/debit cards via various third-party providers, allows clients to choose the most suitable option for their needs. Additionally, OspreyFX does not charge any deposit or withdrawal fees, and the minimum deposit amount is relatively low. However, PayRedeem deposits incur a 6.5% transaction fee, and Bitcoin deposits must be withdrawn back to Bitcoin. It is also important to note that the withdrawal method is limited to the same method used for deposits, and credit/debit card withdrawals are only available for those who have deposited via a third-party provider. Overall, OspreyFX provides a convenient, flexible, and cost-effective deposit and withdrawal system for its clients.

How do I Fund my Account?

Login to your account or Sign Up with us if you do not have one already.

Navigate to the Deposit section.

Choose your Method, Wallet and Amount.

Click on the Redirect me to the Payments Page button.

How do I Withdraw my Funds from OspreyFX?

To process a withdrawal, kindly follow these steps:

Educational resources in OspreyFX

OspreyFX offers a limited selection of educational resources, with a FAQ section and news available to clients. While real-time spreads are available, there are no educational materials or courses, trading academy, or webinars provided by the broker. This can be a disadvantage for traders who are looking to expand their knowledge and improve their trading skills. However, the FAQ section and news can still provide some useful information and market insights. Overall, the broker could benefit from expanding their educational resources in order to better support their clients in their trading journey.

Customer service of OspreyFX

OspreyFX offers a few options for contacting their customer support team, including submitting a ticket, emailing support, and requesting a call back. They also have a presence on social media platforms like Facebook, Twitter, Instagram, and Telegram, though their support on these channels is limited. One advantage is that they have a dedicated ticket submission system, which can help ensure that customer inquiries are addressed promptly and efficiently. However, one disadvantage is that they do not offer 24/7 support, and their social media support is limited. They also do not have a live chat support option, which can be more convenient for customers who need quick assistance.

Conclusion

In conclusion, OspreyFX is a forex broker that offers a range of trading instruments including forex, indices, commodities, metals, stocks, and cryptocurrencies. The company's ECN account type offers market execution and ECN STP trading model, with a maximum leverage of 1:500. The platform is available on MT4 and MT5 for desktop, mac, android, and web trader. The company also offers various deposit and withdrawal methods with no fees attached. However, the company lacks educational resources for traders, and customer support options are limited. Overall, OspreyFX's competitive trading conditions and range of tradable instruments make it a suitable option for both novice and experienced traders.

Frequently asked questions about OspreyFX

Question: What is OspreyFX?

Answer: OspreyFX is a forex and CFD broker that provides traders with a range of trading instruments including forex, indices, commodities, metals, stocks, and cryptocurrencies.

Question: What trading platforms does OspreyFX offer?

Answer: OspreyFX offers MetaTrader 4 and MetaTrader 5 trading platforms for desktop, mobile, and web.

Question: What is the minimum deposit required to open an account with OspreyFX?

Answer: The minimum deposit required to open an account with OspreyFX is $25 for the Mini account type.

Question: Does OspreyFX charge any fees for deposits or withdrawals?

Answer: No, OspreyFX does not charge any fees for deposits or withdrawals.

Question: What is the maximum leverage offered by OspreyFX?

Answer: OspreyFX offers a maximum leverage of up to 1:500.

Question: What is the customer support options available at OspreyFX?

Answer: OspreyFX offers customer support via submit a ticket, Facebook, Twitter, Instagram, Telegram, email (support@ospreyfx.com) and call back.

Question: What educational resources are available at OspreyFX?

Answer: OspreyFX provides traders with a FAQ section, news, and real-time spreads. However, there are no significant educational resources such as webinars, courses, or trading guides.

FX3739673730

Philippines

They will promise that withdrawals are simple, but in reality it is impossible. I'm sure they are good to some customers to stay effective, but they stole my money directly and did the same to many others. They even changed my password to clear my account and acted as if nothing happened. More than 50 emails, still no solution.

Exposure

2021-09-18

逸金

Hong Kong

Don't information. This platform is a liar

Exposure

2020-10-14

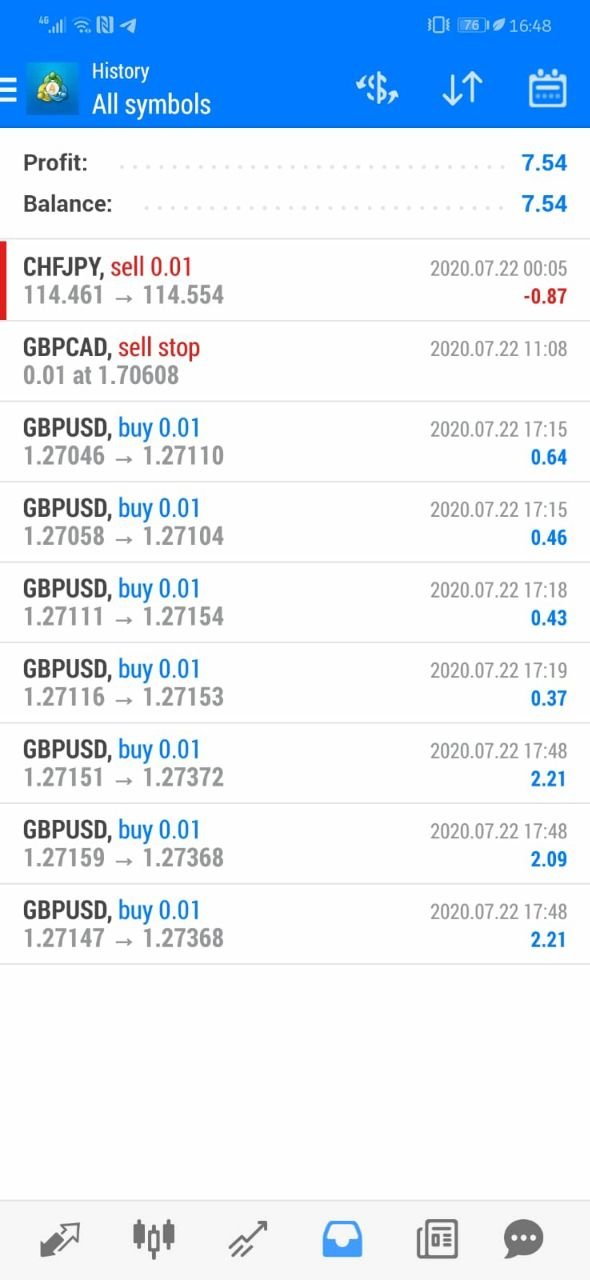

FX5994775392

Canada

This image is OspreyFX compared with a legit broker at the same time! You can see the difference in market price. They manipulate spread anyhow they want, they’ll either blame news event (even though there’s no news) or market volatility. Beware guys

Exposure

2019-11-26

泉水45282

Singapore

osprey forex has cheat my friend out of almost 6k USD by suspending her account. According to osprey, she violated the AML policy, buy that's totally nonsense!

Neutral

2023-02-15

呵呵61923

Australia

however, compared with this so-called reward, one's inner motivation is more significant, which can bring us great desire to lear, arouse our passion for the promising future and help them keep moving forward.

Neutral

2022-12-20

FX1220277098

Nigeria

I have been trading with OspreyFX for two weeks and so far, I haven’t met any problems. I especially love its customer service, always available to give me assistance.

Positive

2023-02-22

struggle11307

Colombia

OspreyFX is registered in Saint Vincent and the Grenadines and does not have any regulatory license. I do not recommend anyone to trade with this company.

Positive

2022-12-20