Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

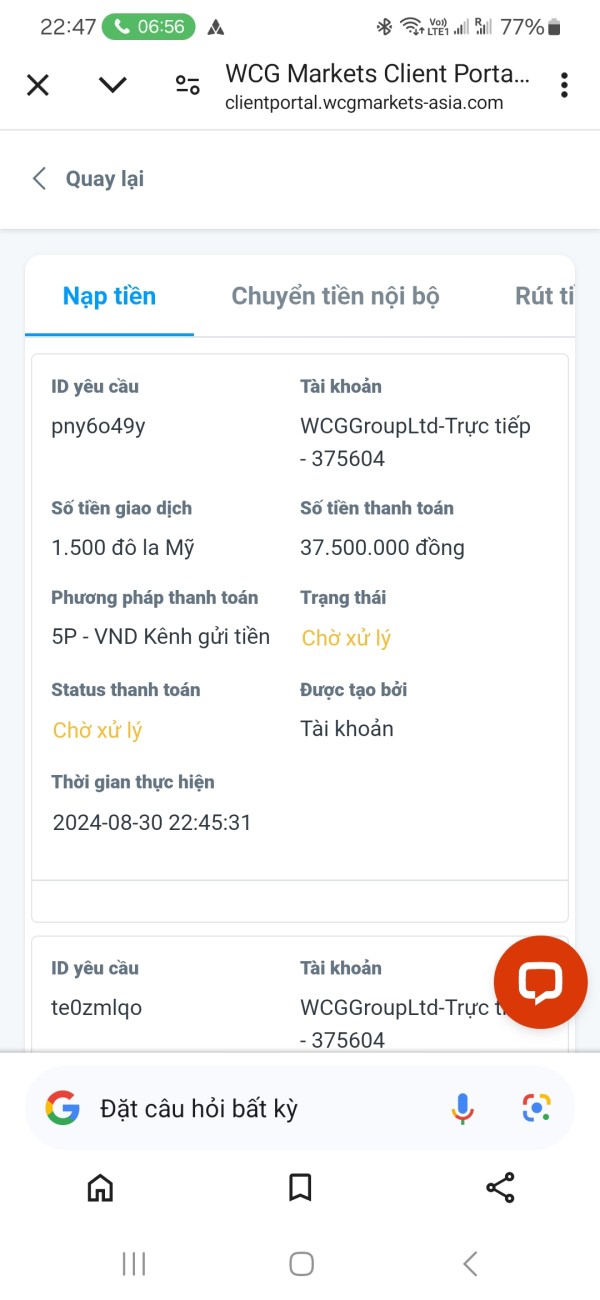

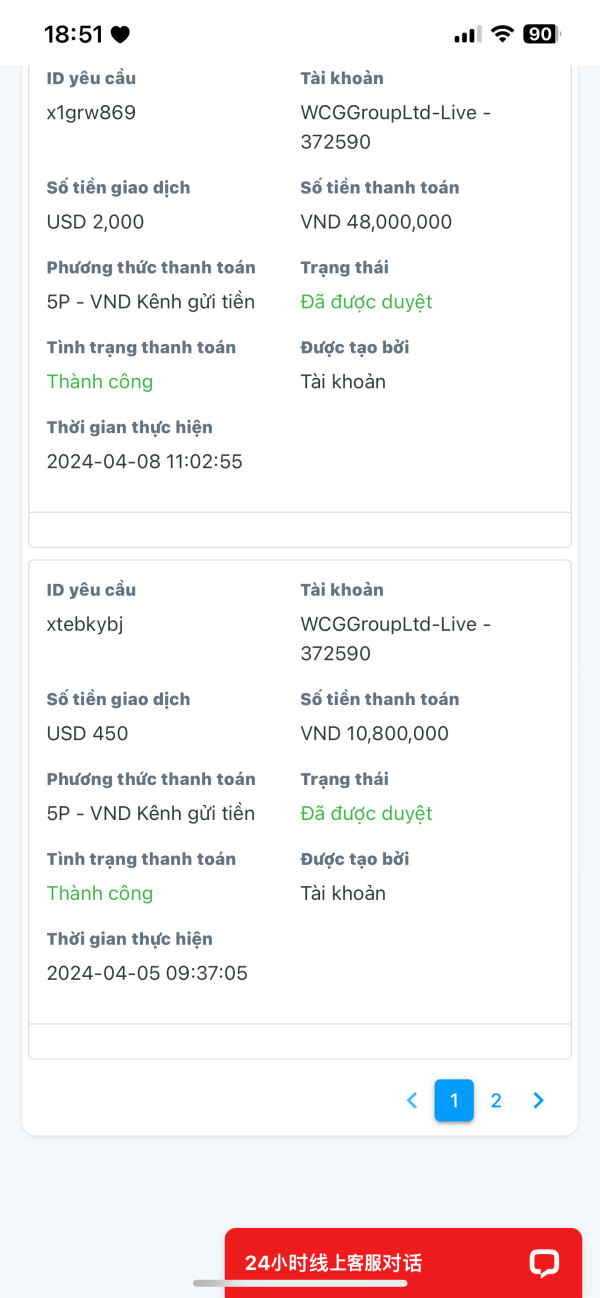

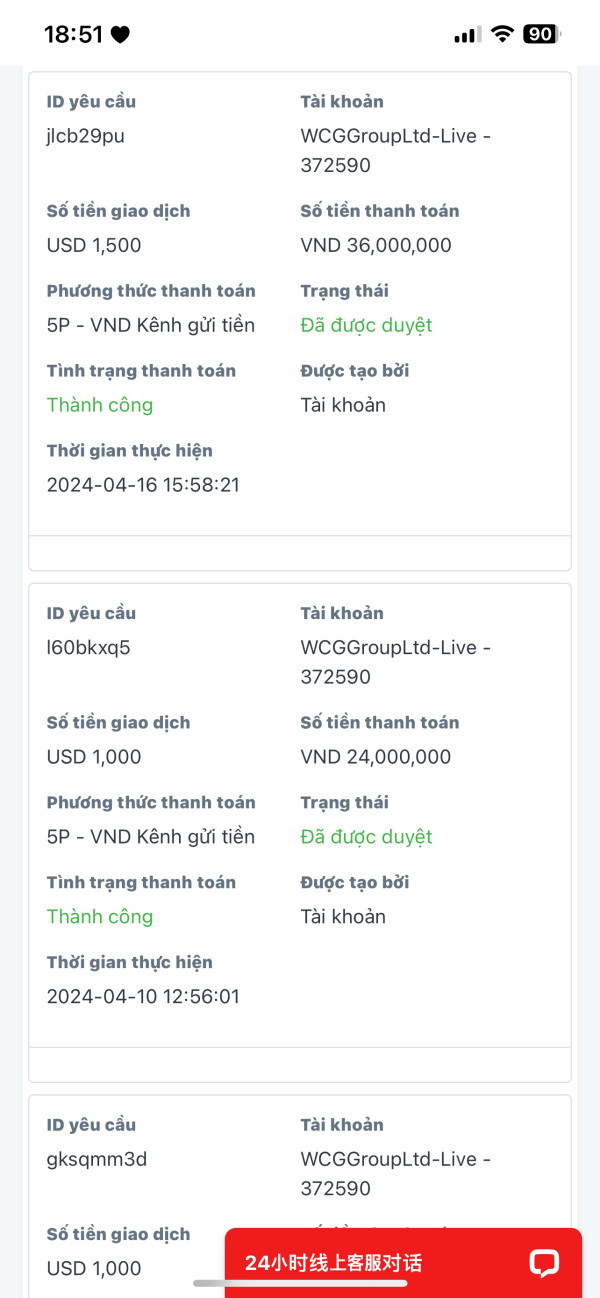

FX1091430465

Taiwan

Deposit not credited to account

Exposure

2024-10-24

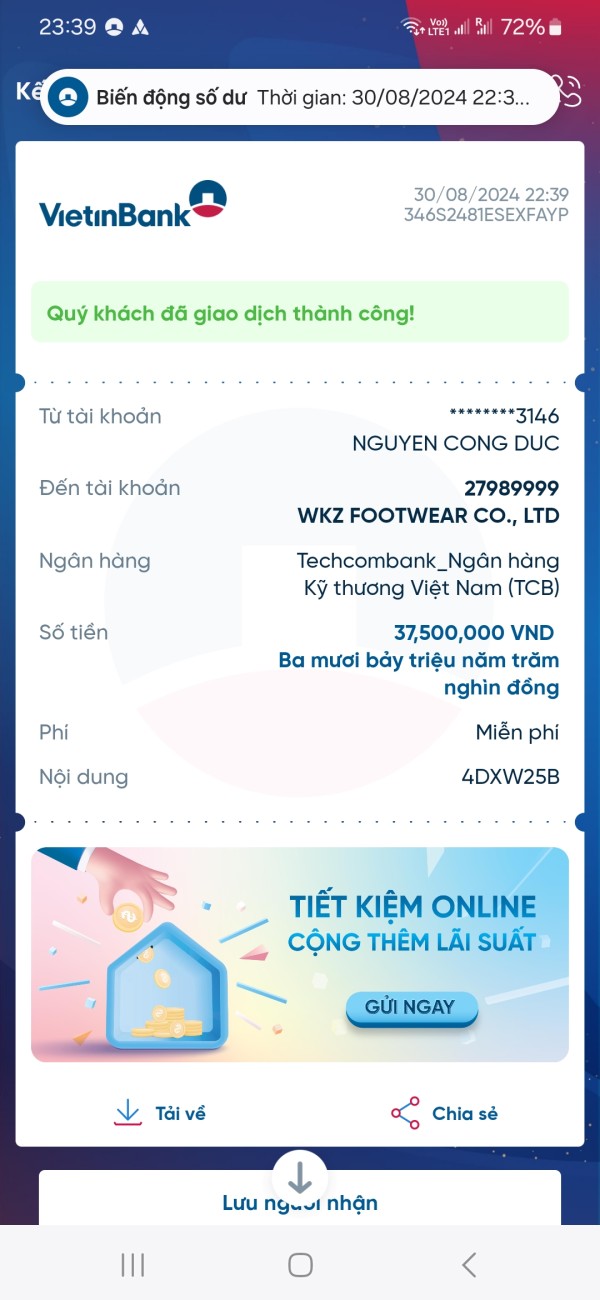

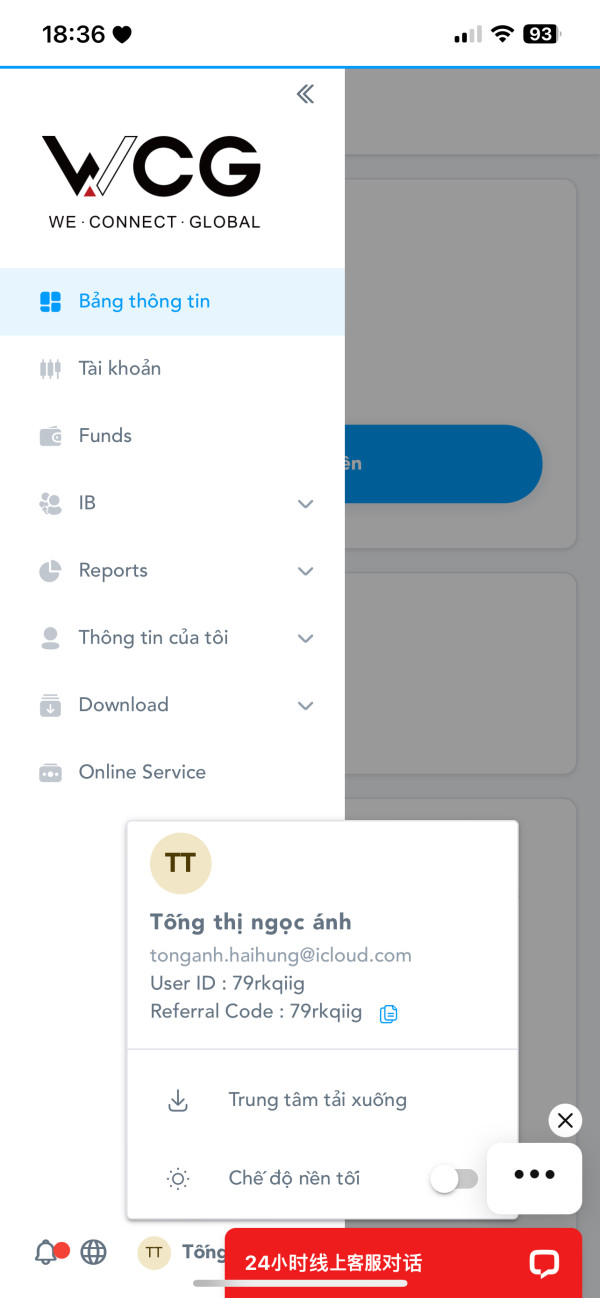

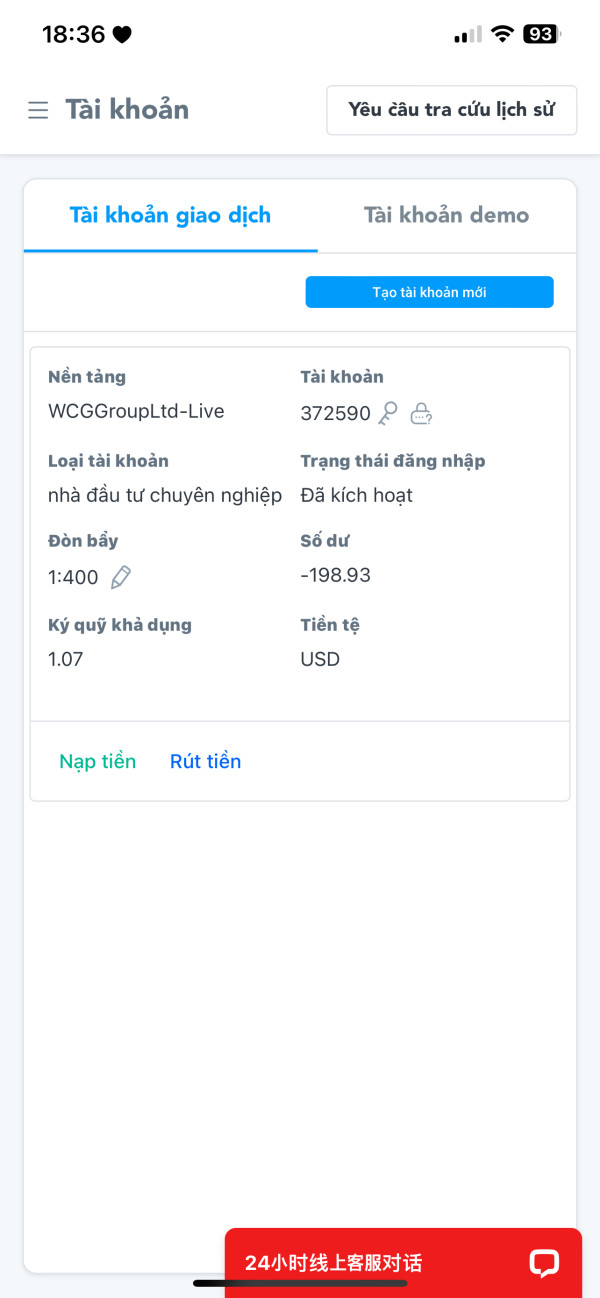

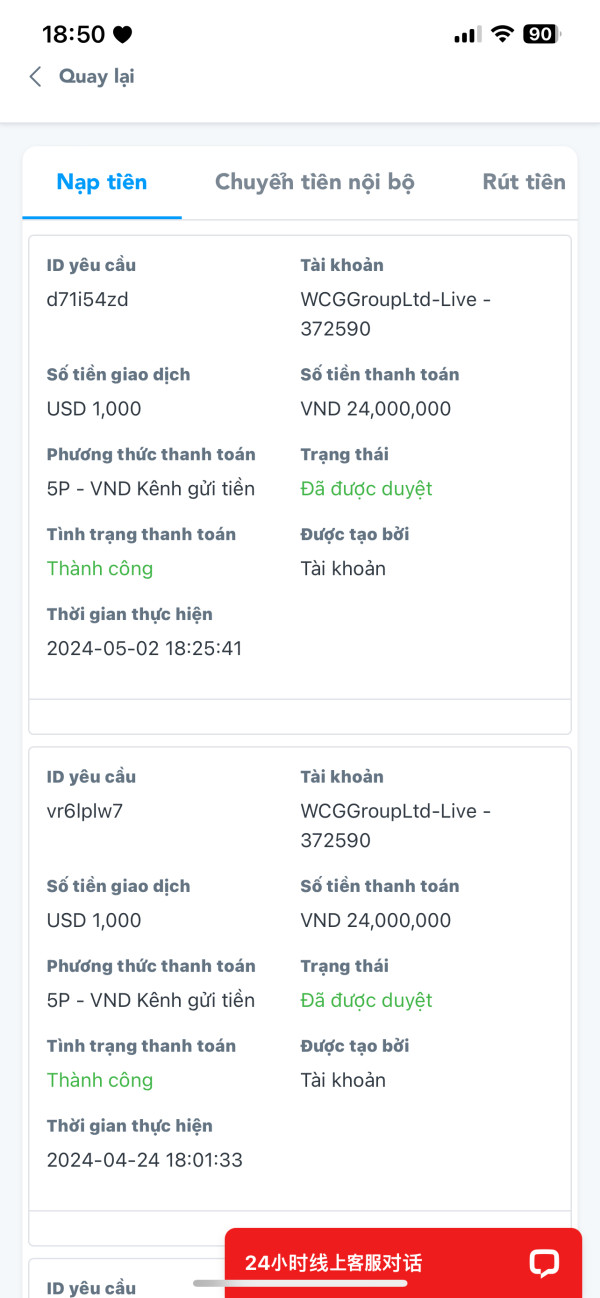

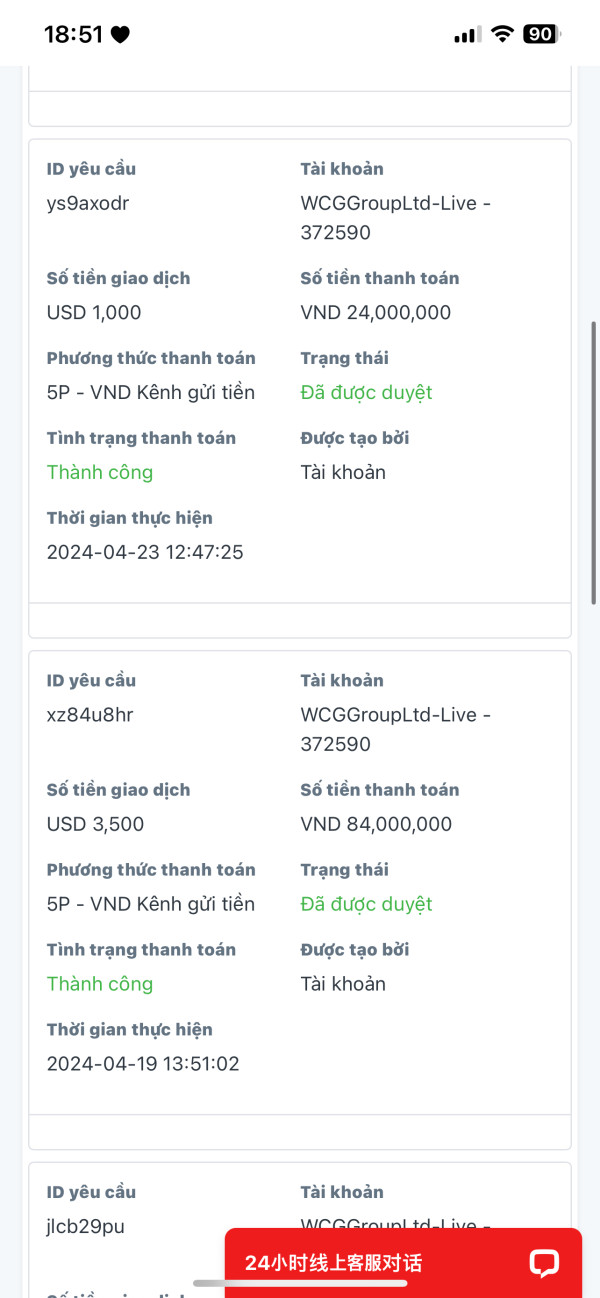

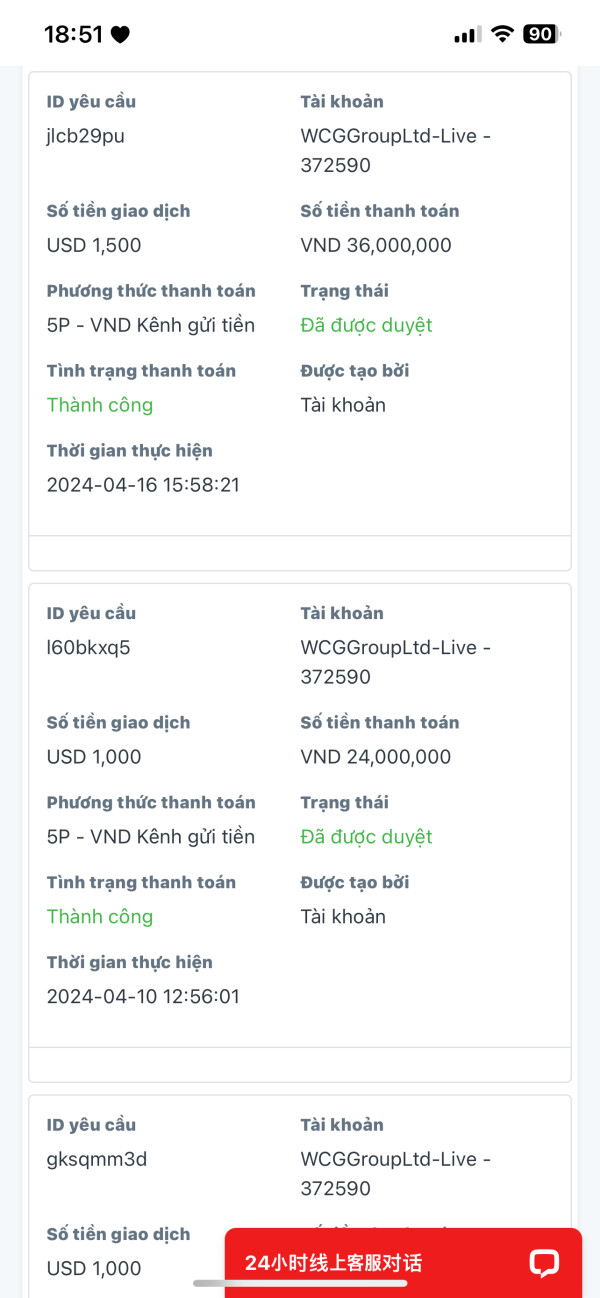

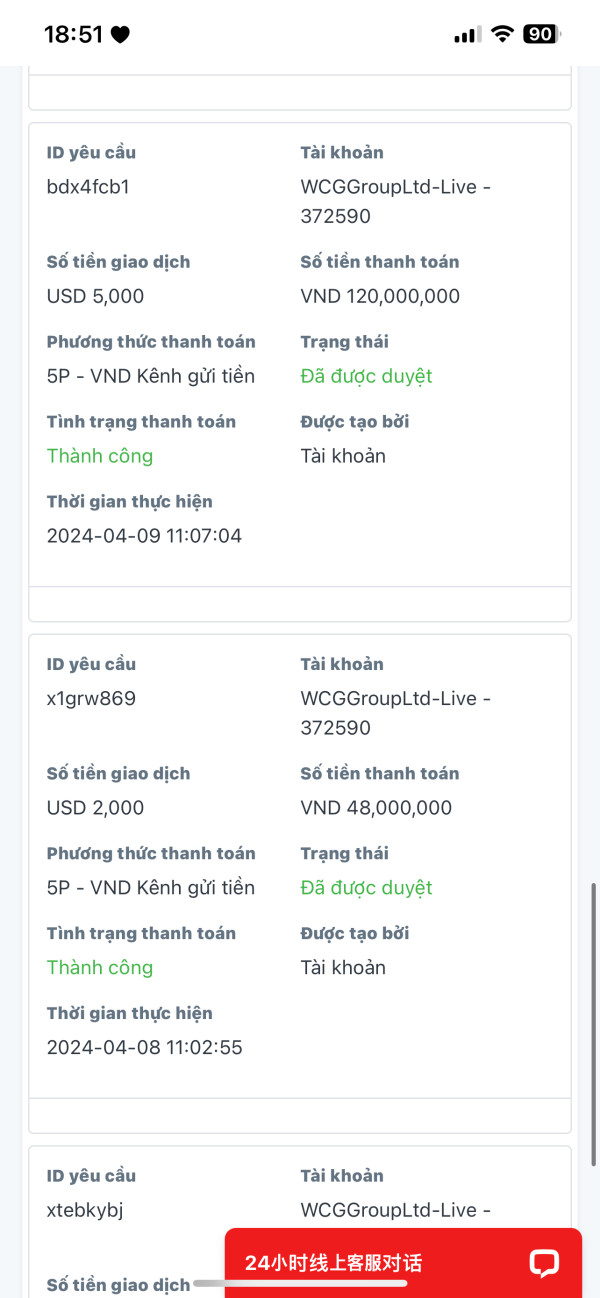

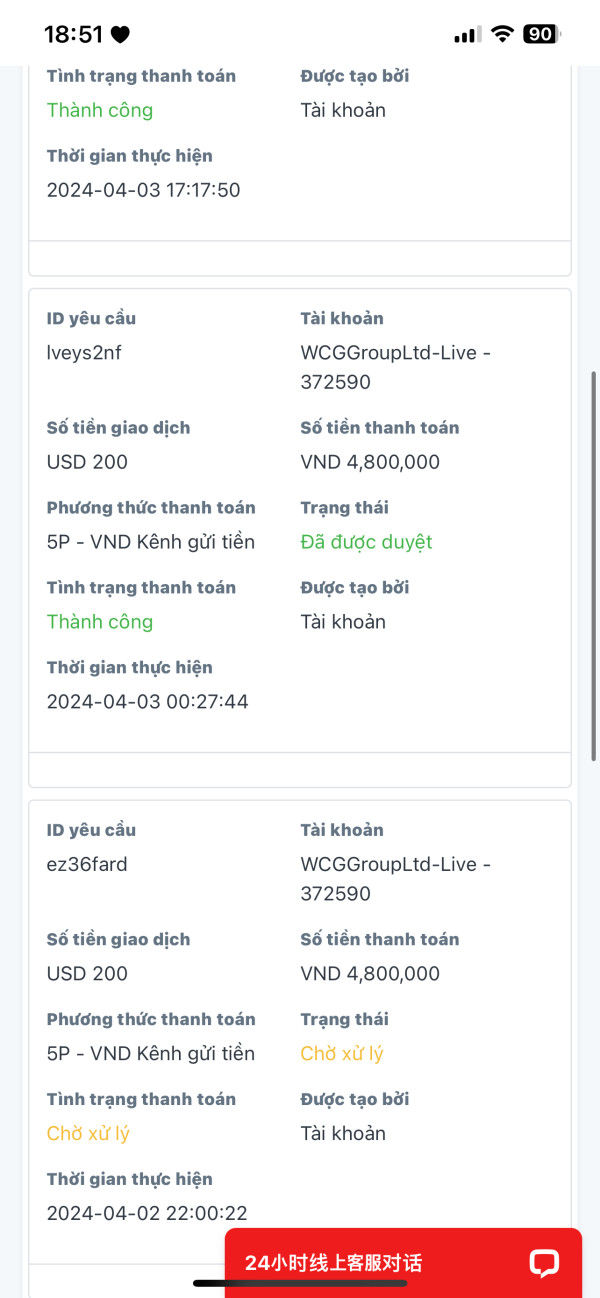

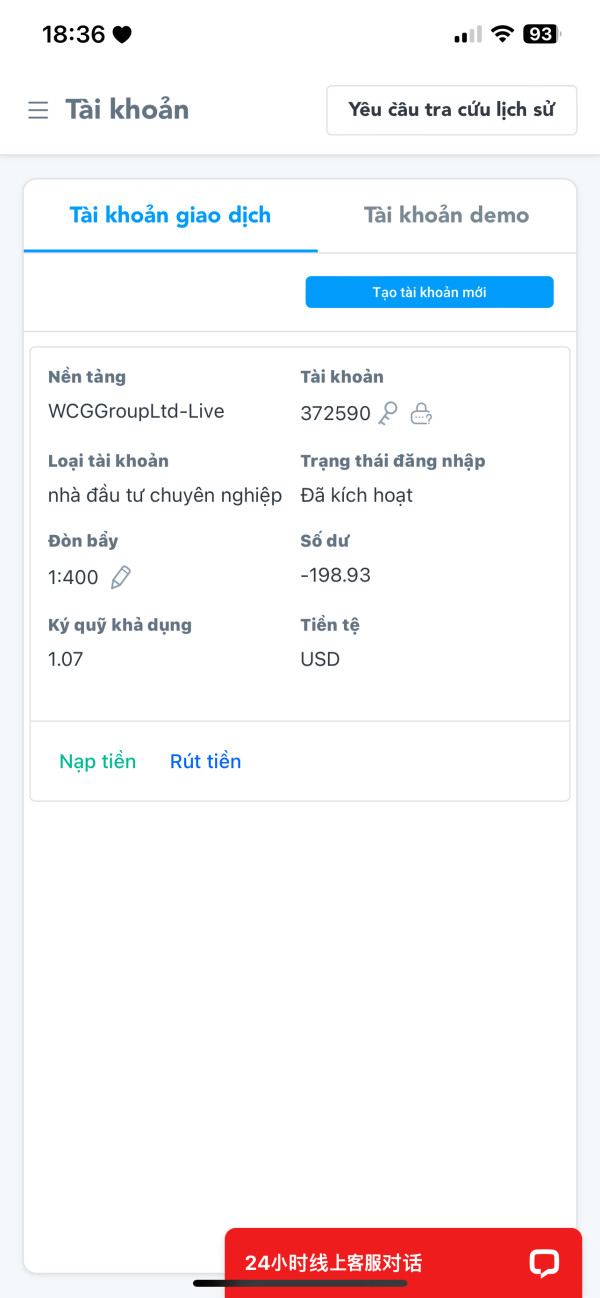

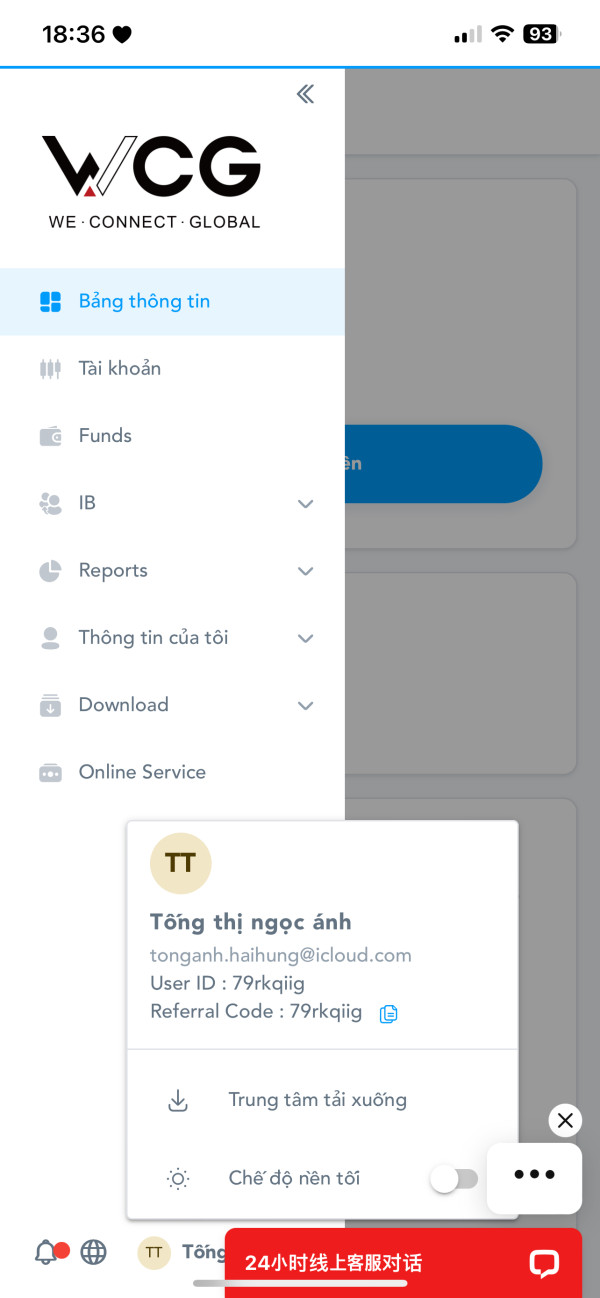

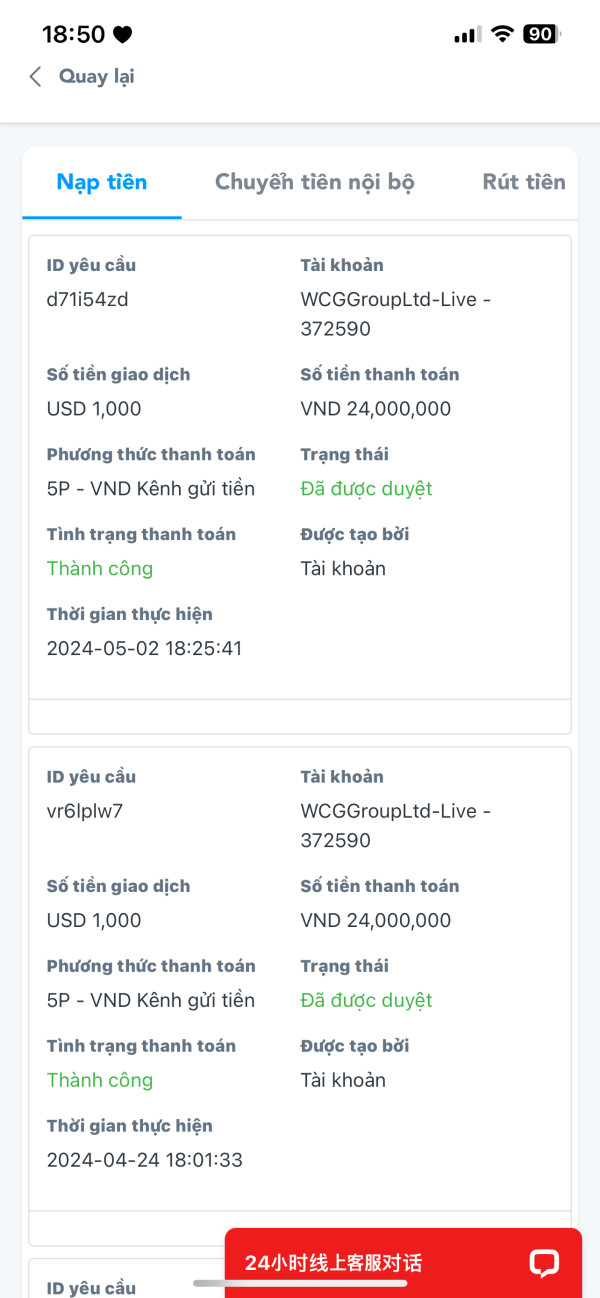

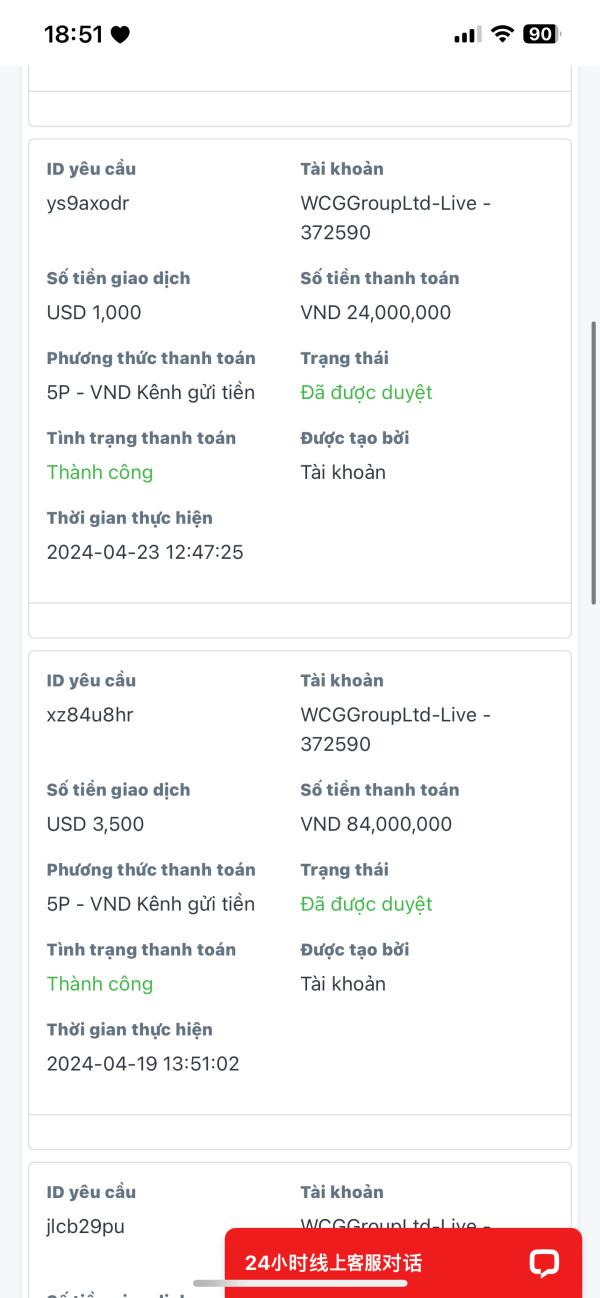

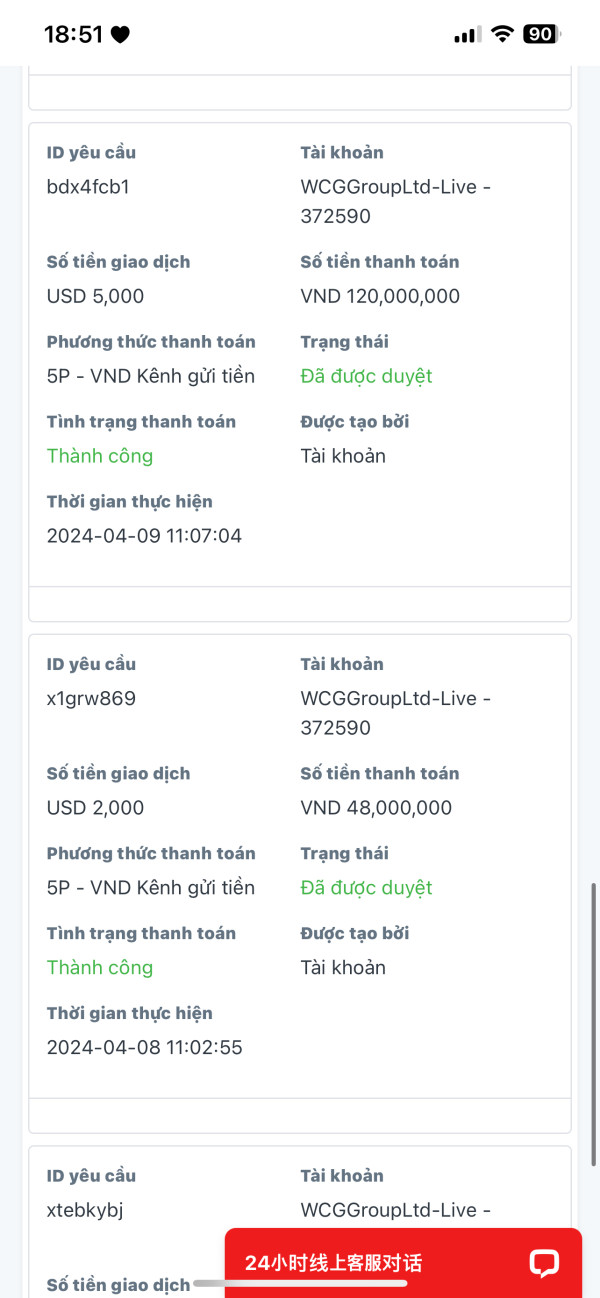

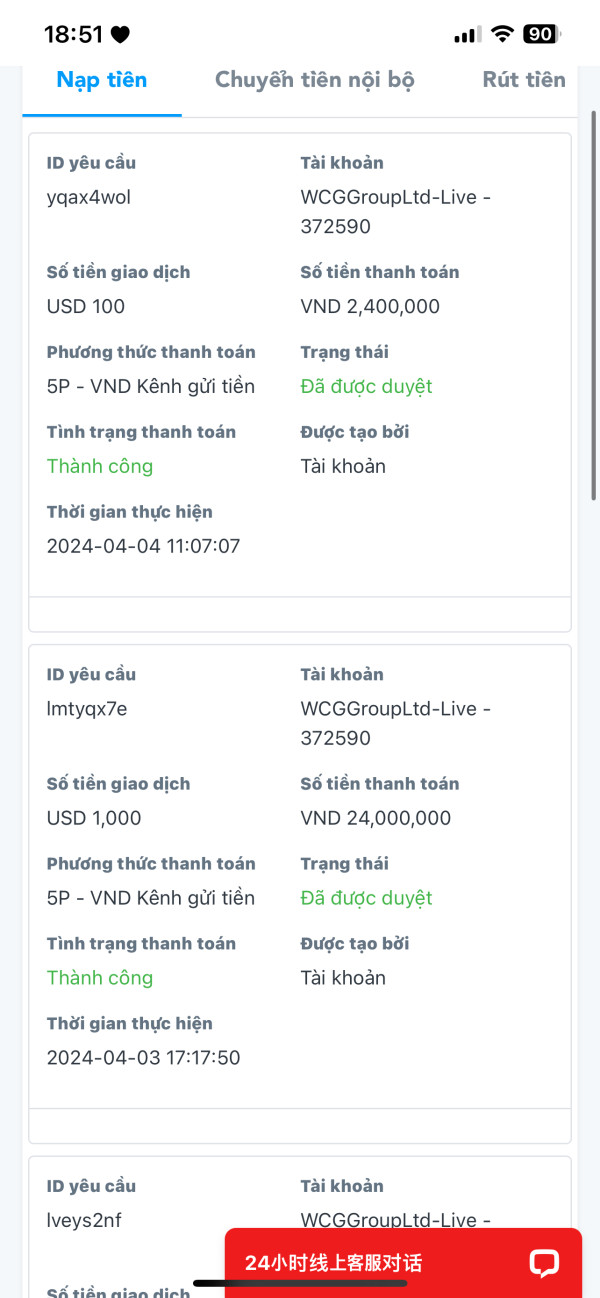

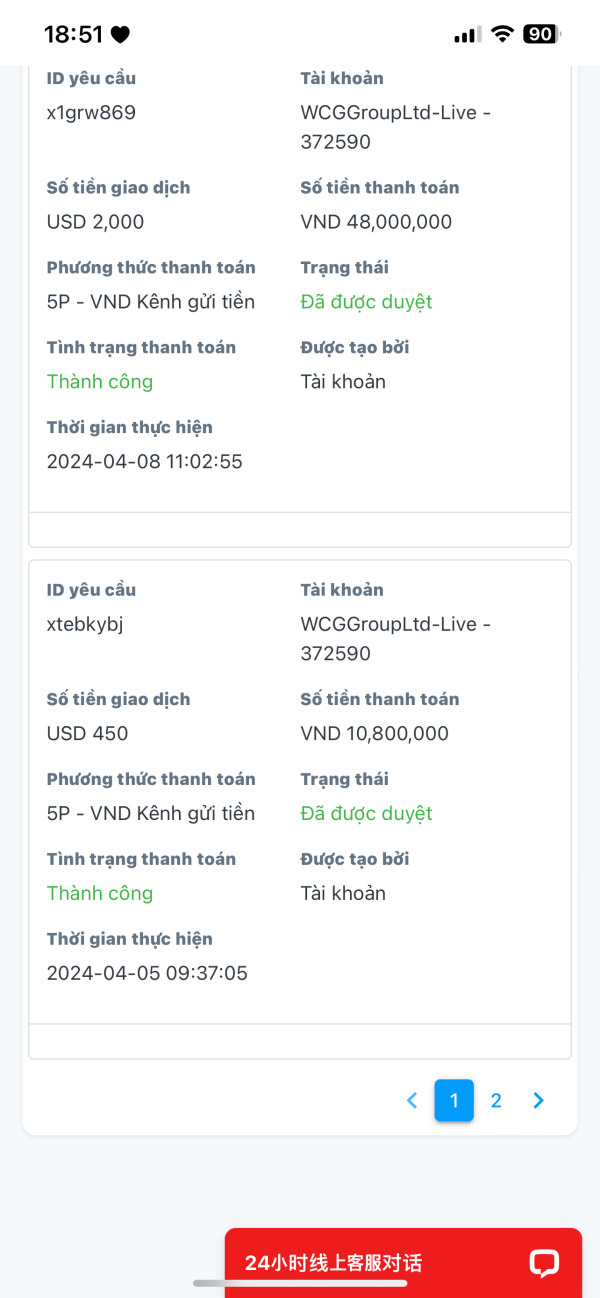

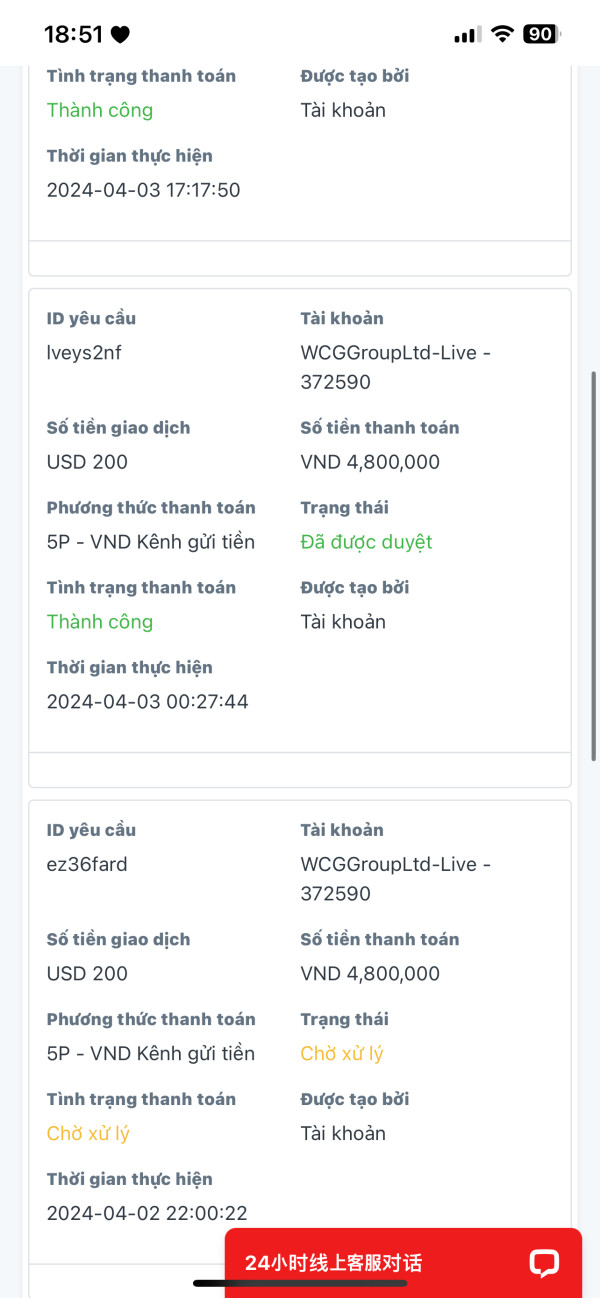

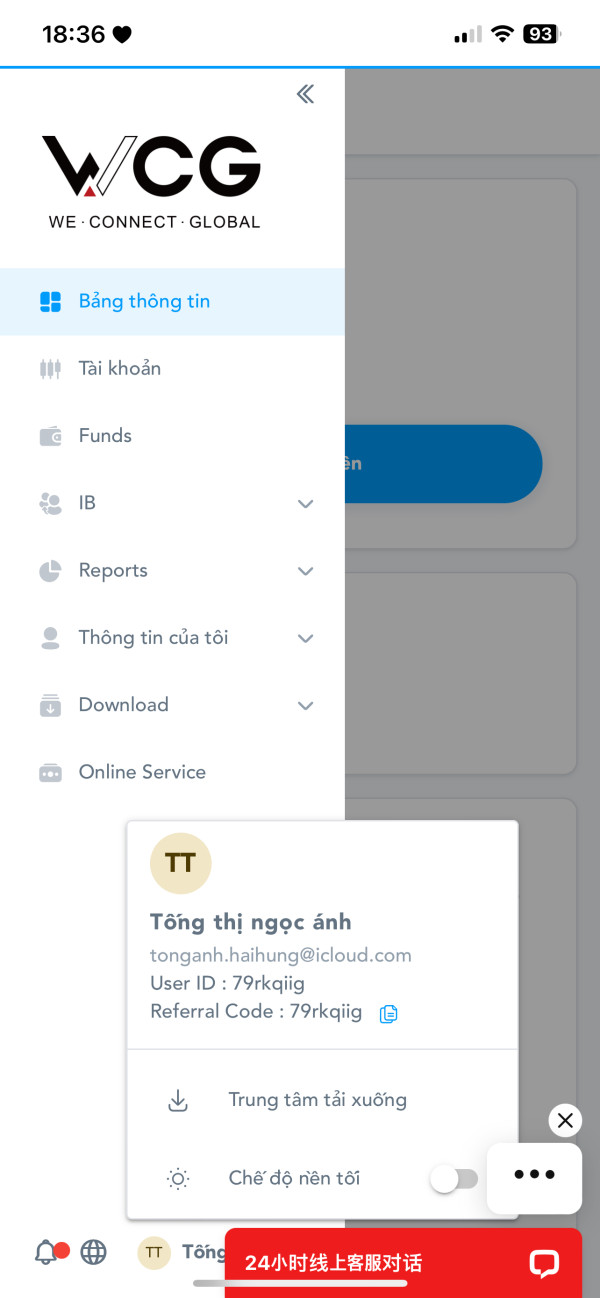

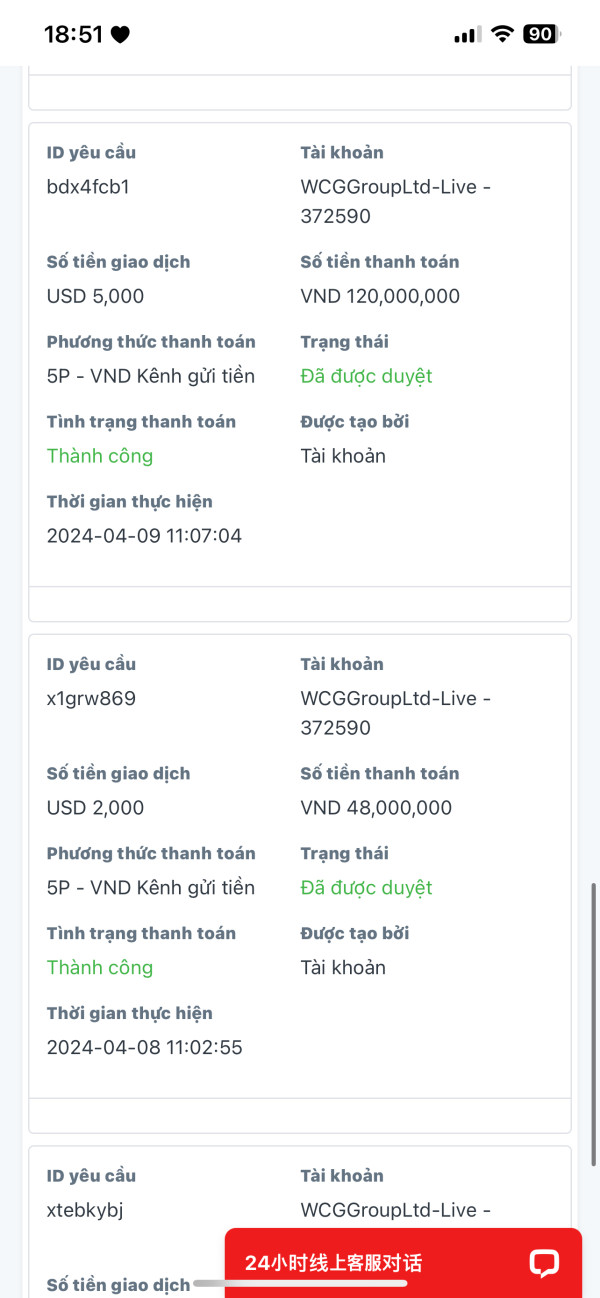

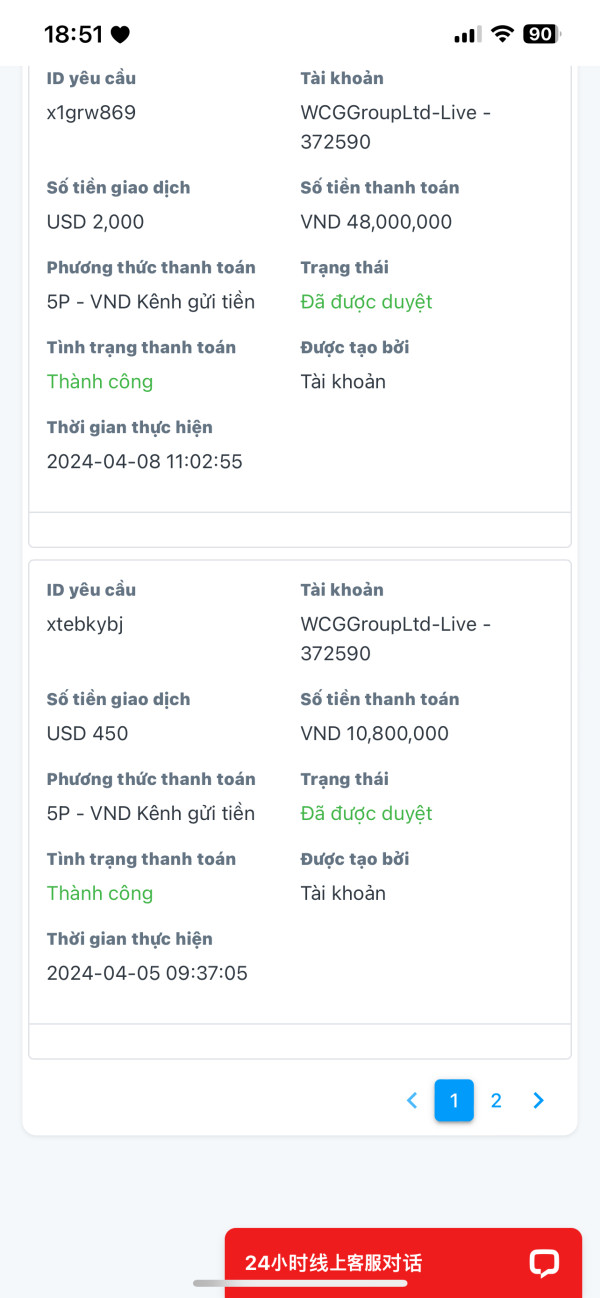

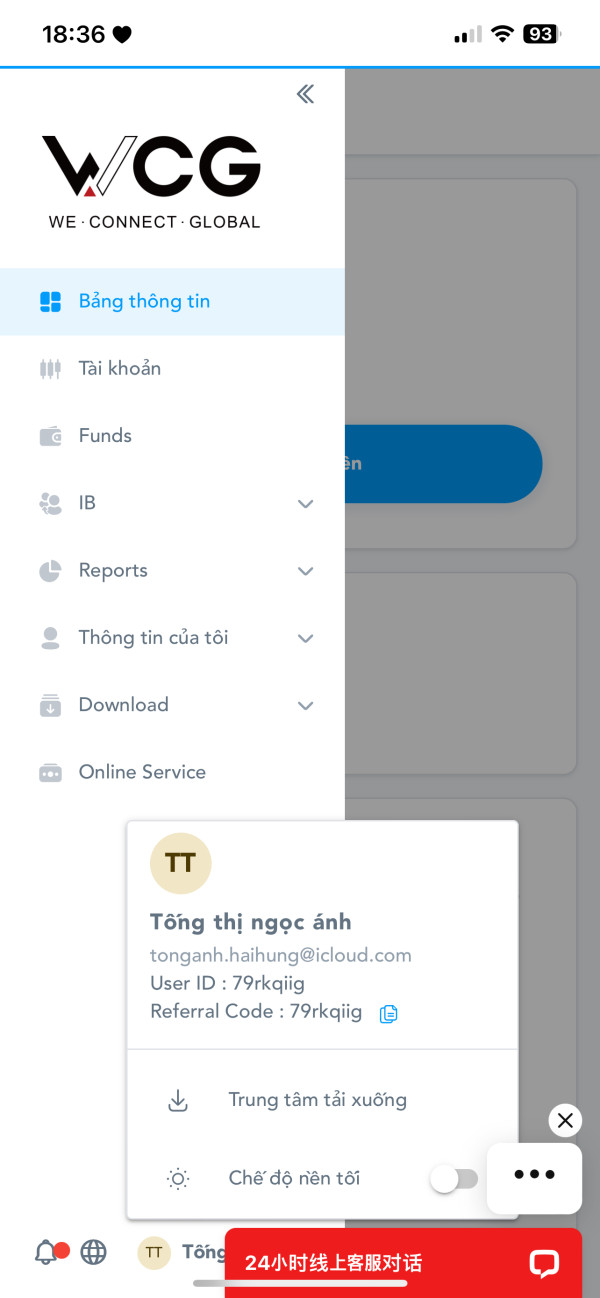

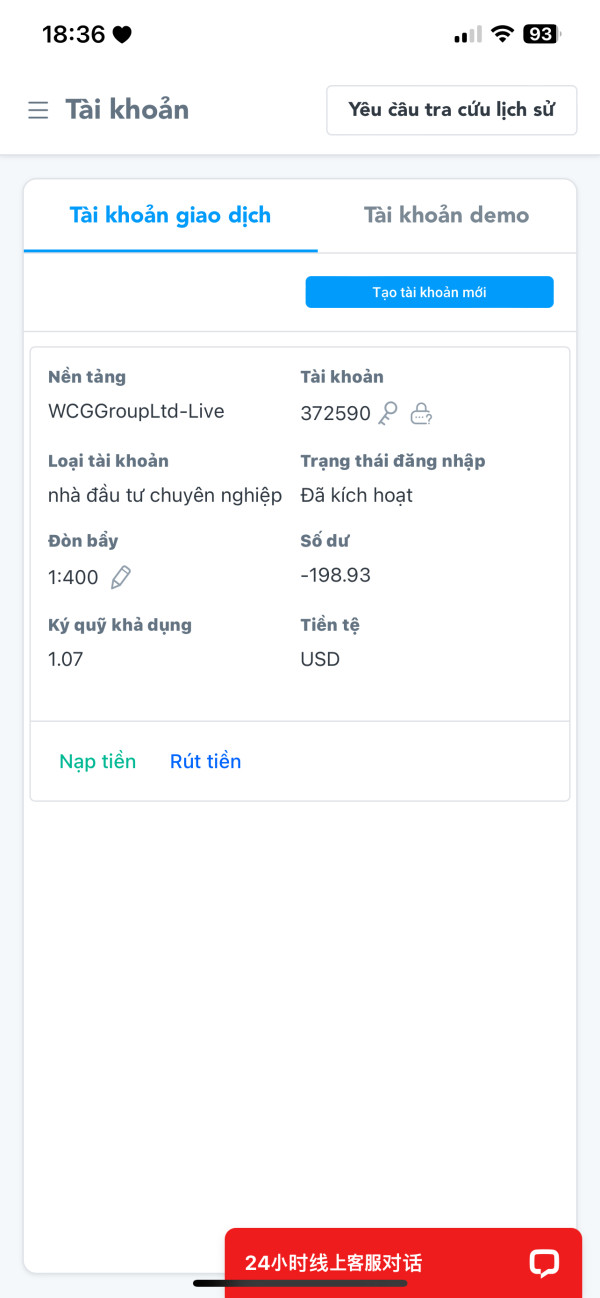

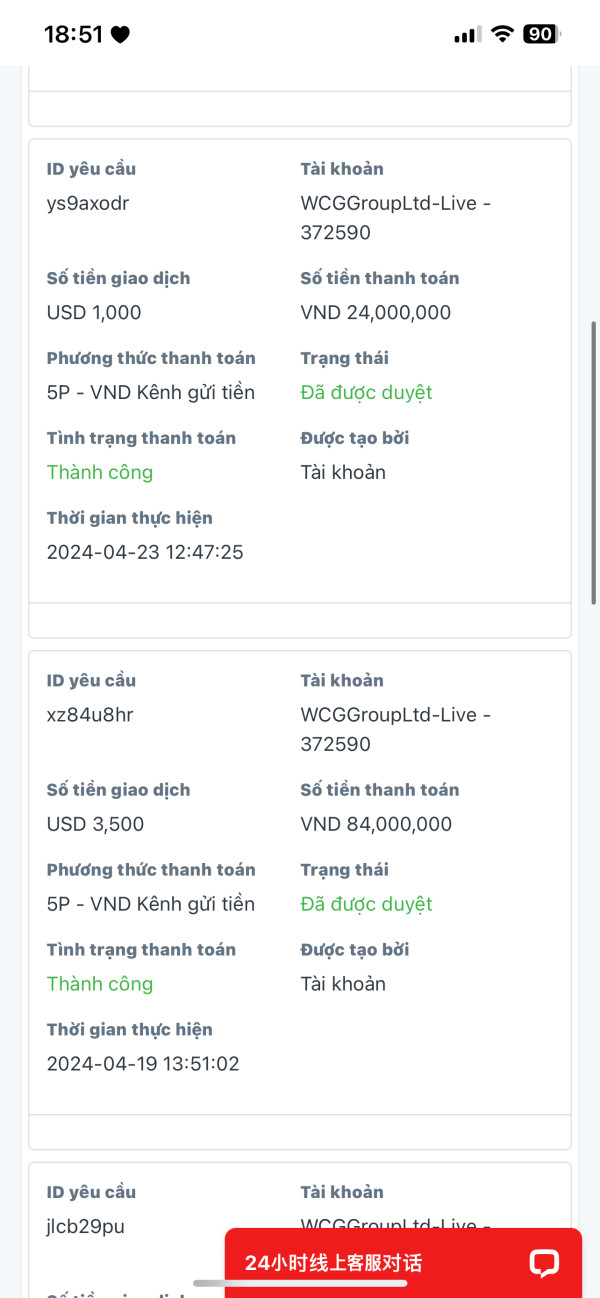

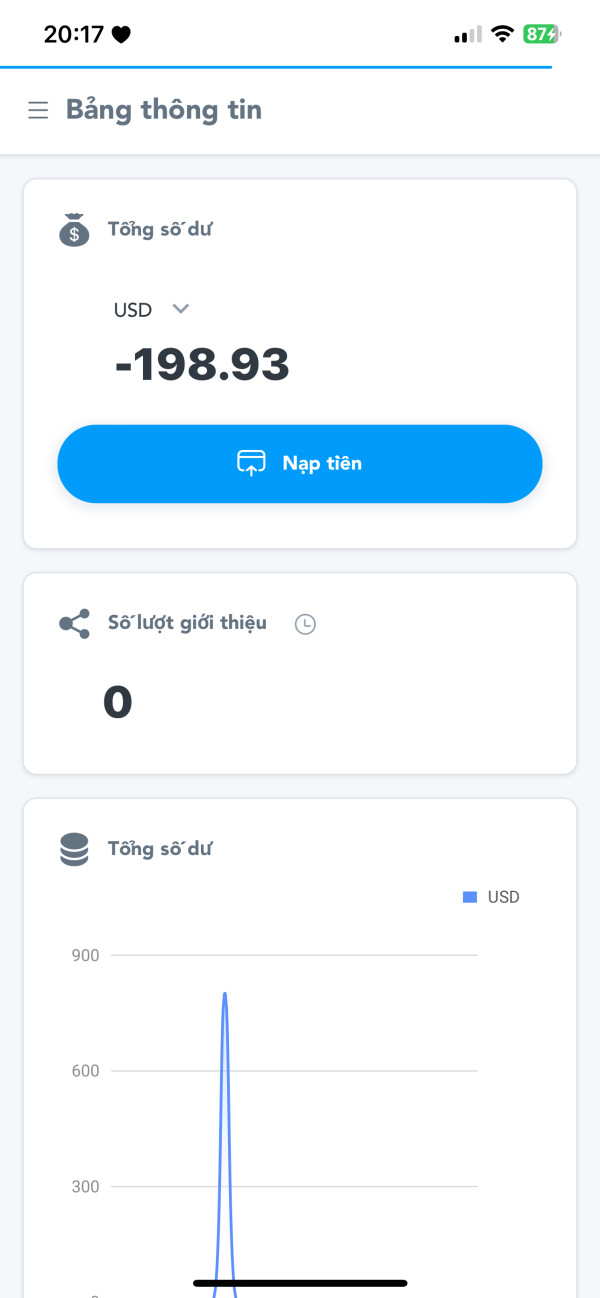

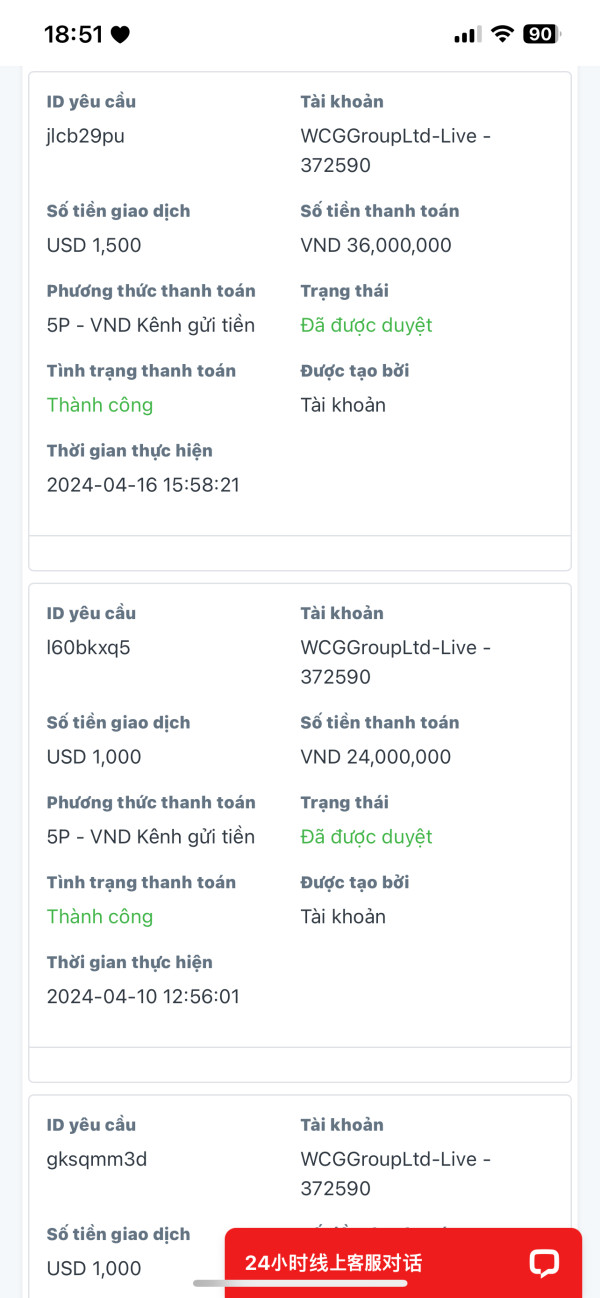

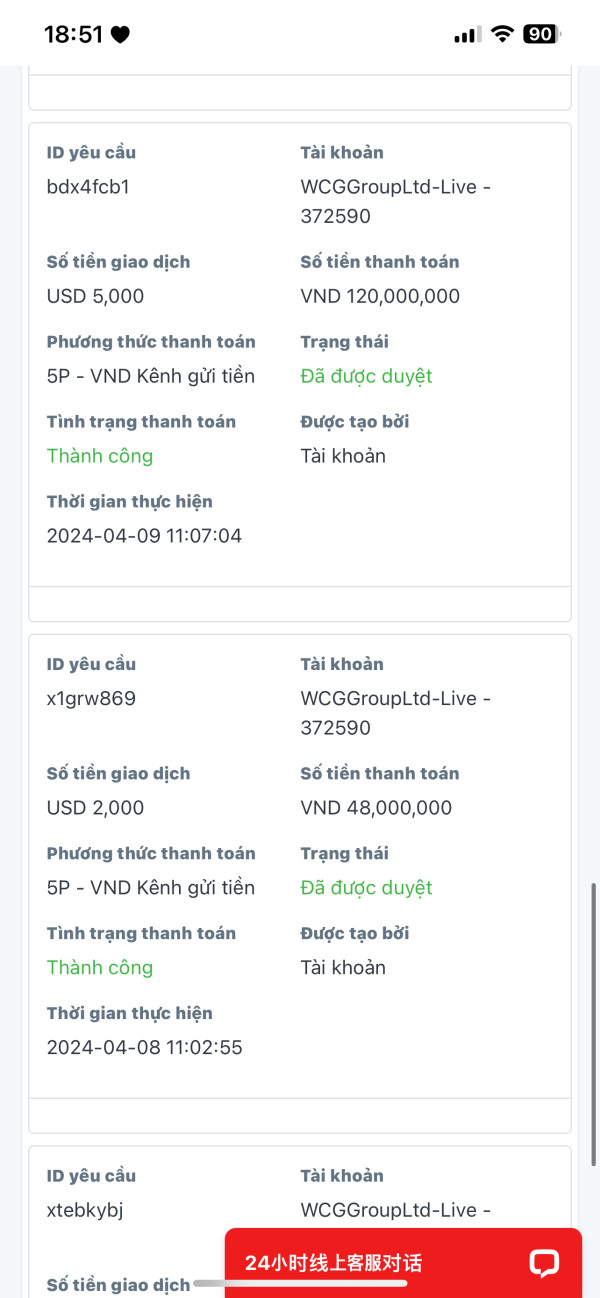

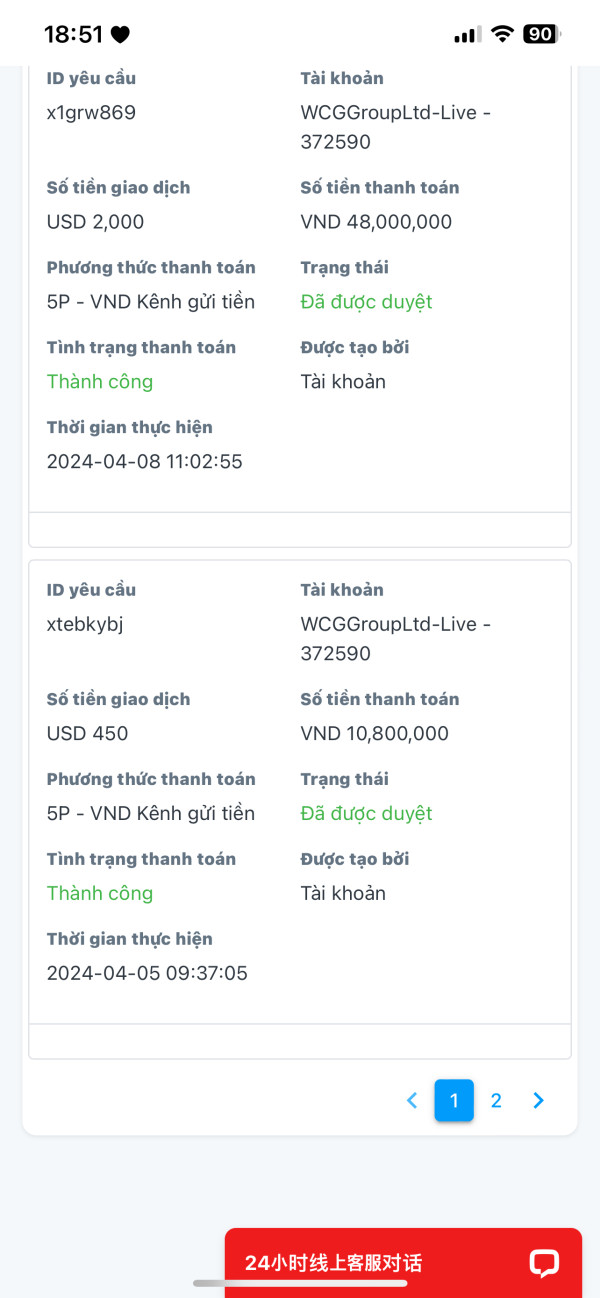

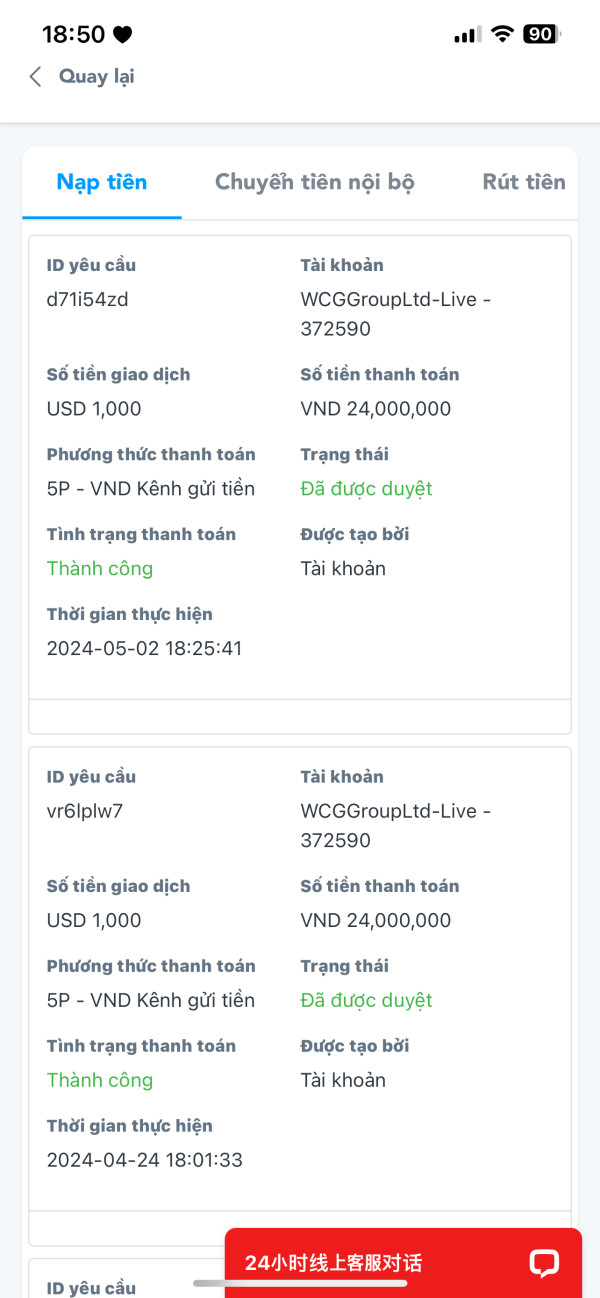

Tống Ánh

Singapore

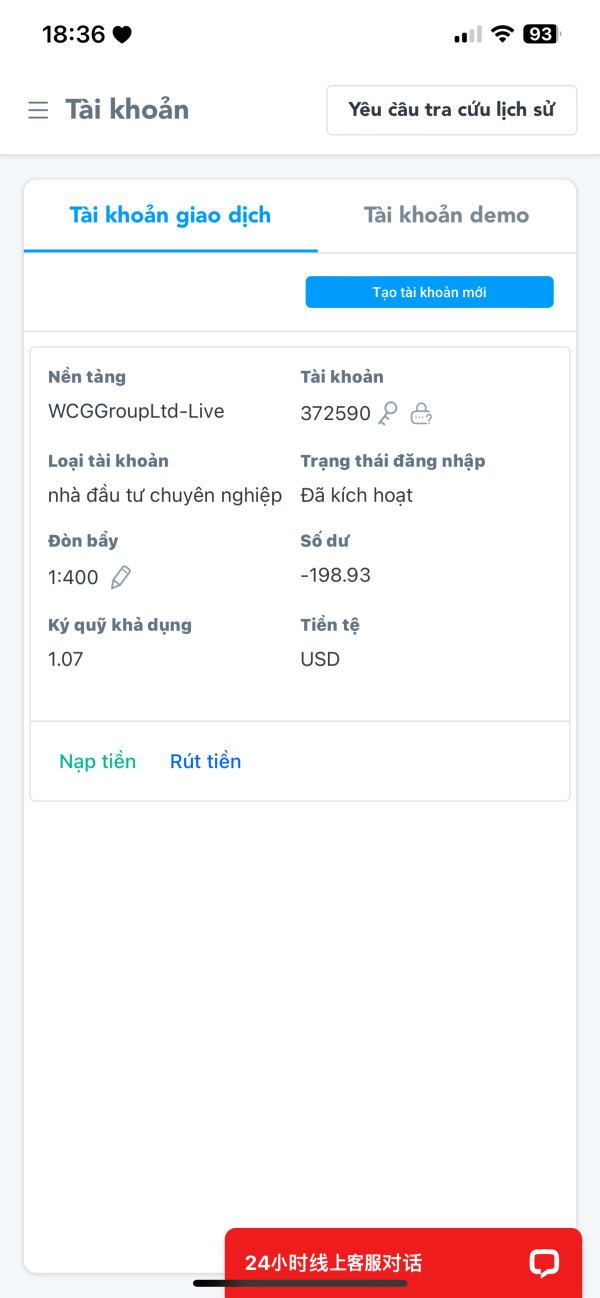

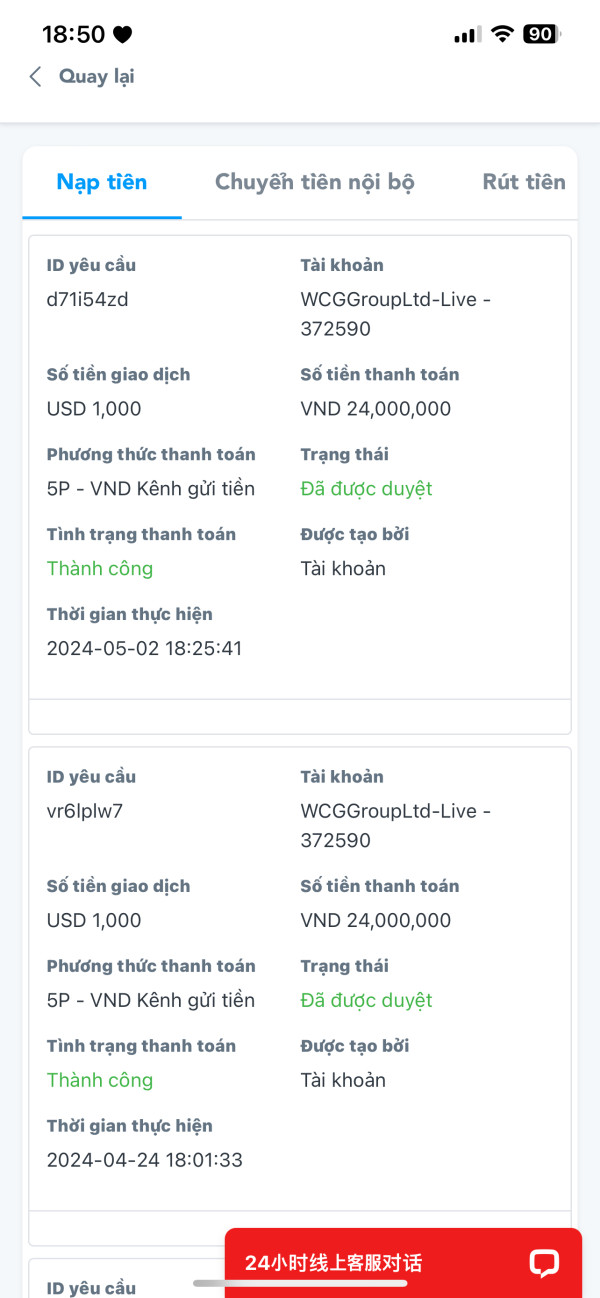

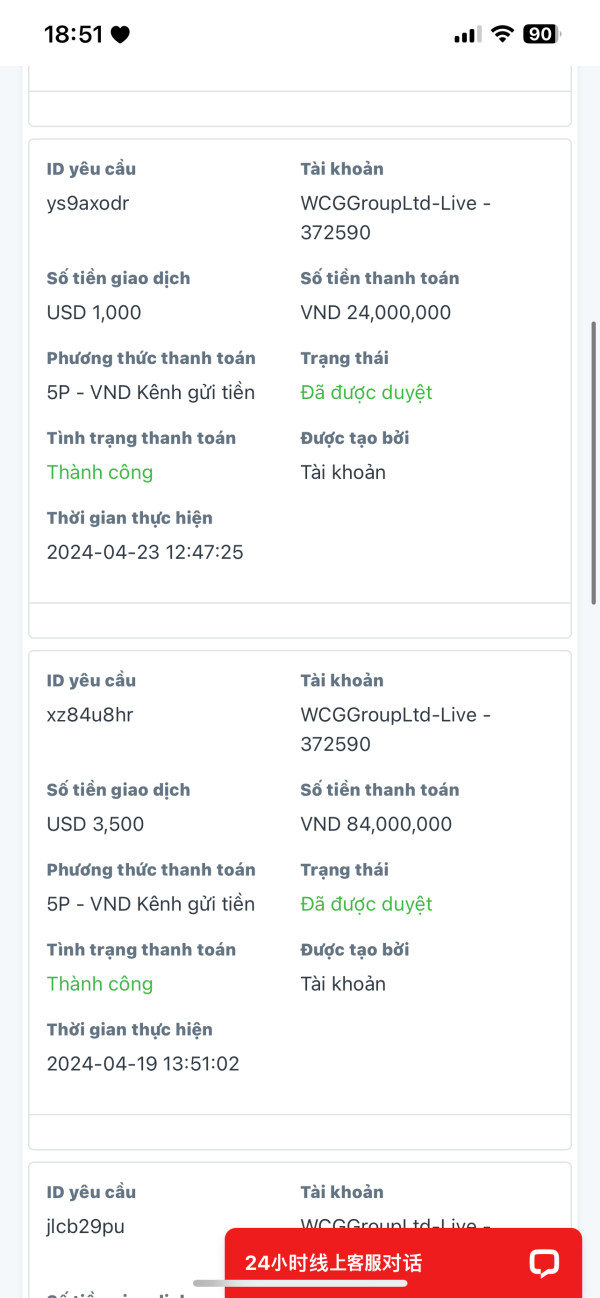

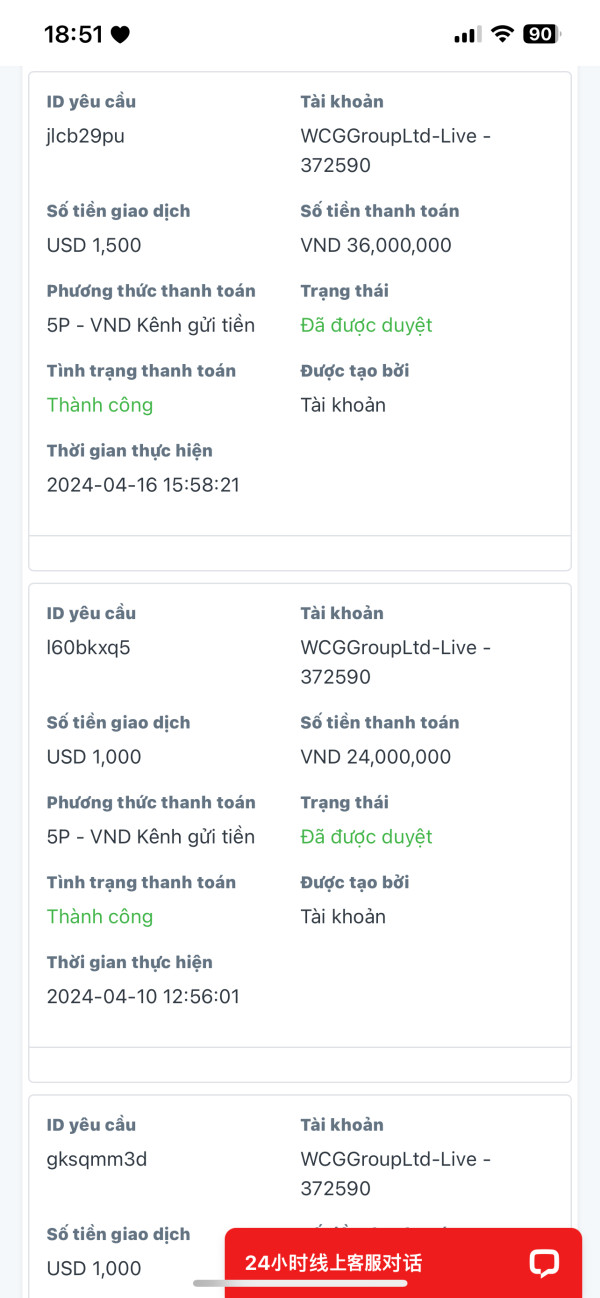

I deposited into WCGGroupLtd platform-Live account 372590 18000 USD, then could not withdraw and lost all the money in the account.

Exposure

2024-06-14

Tống Ánh

Singapore

I loaded into the WCGGroupLtd platform-Live account 372590 18000USD then couldn't withdraw and lost all the money in the account.

Exposure

2024-06-11

Tống Ánh

Singapore

I deposited 18,000USD into the exchange and could not withdraw it, then the amount was automatically deducted by the exchange and there is no history of deduction.

Exposure

2024-06-03

Tống Ánh

Singapore

I deposited 18000 USD into the WCGGroupLtd-Live platform account: 372590 and after that I could not withdraw and the amount was automatically deducted for no reason.

Exposure

2024-05-31

Tống Ánh

Singapore

I deposited a total of 18,000USD but could not withdraw any money and the exchange automatically deducted my money.

Exposure

2024-05-27

Tống Ánh

Singapore

I deposited 18,000 USD and couldn't withdraw it. After that, all the money in the exchange was deducted. Fraud in the exchange.

Exposure

2024-05-25

Tống Ánh

Singapore

I deposited 18,000 USD then couldn't withdraw and lost all my money in my account. I don't know why.

Exposure

2024-05-24

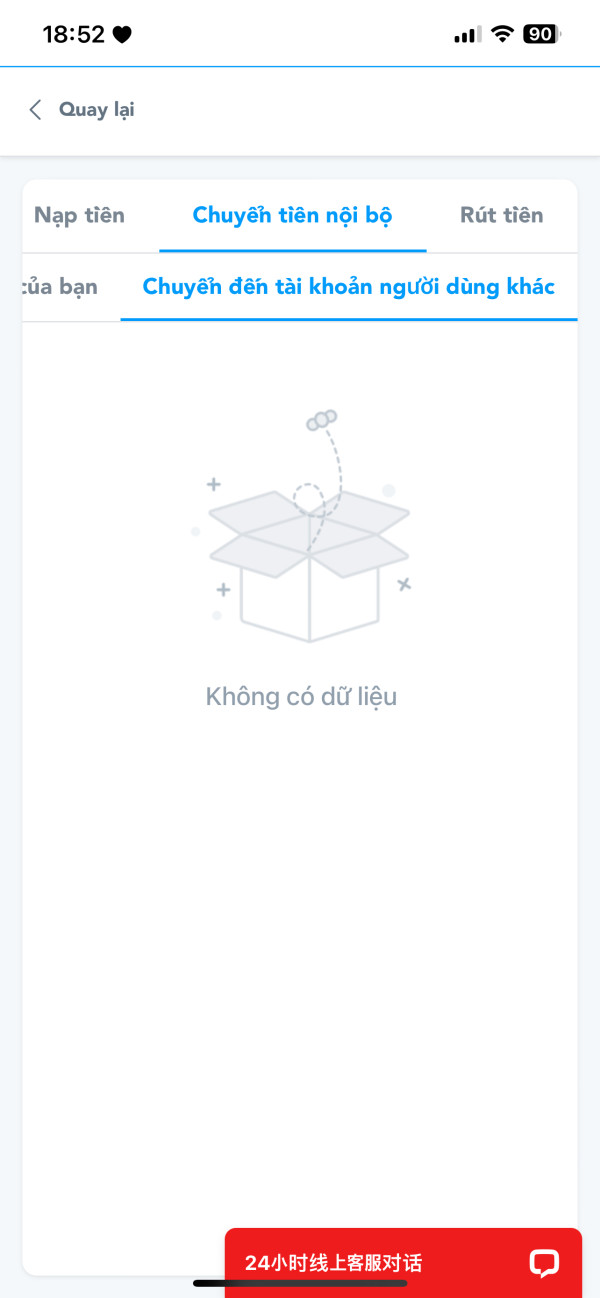

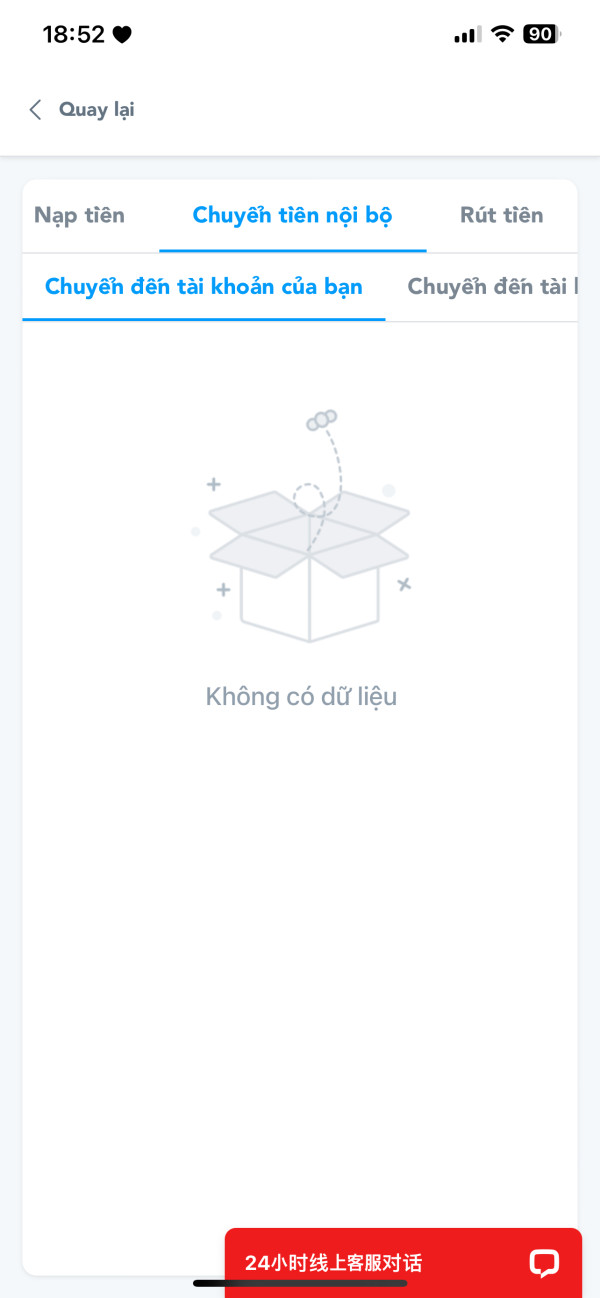

Tống Ánh

Singapore

Deposited money to be withdrawn internally, and cannot withdraw money. Forced to pay tax when withdrawing. Fraudulent brokers. Create a fake gmail of the exchange for texting.

Exposure

2024-05-16

Tống Ánh

Singapore

Scam platform. Deposit cannot be withdrawn. Send an email and they will contact the introducer. Deposited 18,000 USD and was withdrawn internally within the exchange without a single response to the customer.

Exposure

2024-05-14

le thi cam tu

Singapore

I deposited $1000 to register as a member but the platform said my account was suspended. And now I paid another $500 to reactivate my account and all the money has stopped appearing. Recommend consideration and handling.

Exposure

2024-05-10

Tống Ánh

Singapore

Required to pay tax to withdraw but can't withdraw until tax payment. Waited 1 week with no response. Deposited $18,000, was withdrawn internally within the exchange.

Exposure

2024-05-09

Tống Ánh

Singapore

Cannot withdraw money. Tax must be paid when withdrawing

Exposure

2024-05-08

FX2803845122

Saudi Arabia

The first thing I deposited money was $3,700 and I traded the yen and my profits reached $59,000. Then I spoke to Hamad and Hisham. I wanted to withdraw my profits. They were not approved and I was banned and will never be responded to. It’s just a scam.

Exposure

2024-02-04

Hendrik G

Netherlands

I have to say, QCG's customer support team is great, always responsive and helpful. Besides, its MT4 trading platform is the best one I've used.

Positive

2024-06-28

Mohd Ali bin Abdullah

Malaysia

Trade execution is transparent and fair. Solid trading signals and technical analysis are quite helpful. Truly, it is a reliable choice for trading.

Positive

2024-06-26

caca落B

Malaysia

Deposits are very smooth, the platform is stable, and withdrawals are smooth.

Positive

2024-06-12

Henz

United Kingdom

This broker is one of the best broker I have ever seen

Positive

2022-12-07

201955405

Colombia

So far, I think that the service provided by this company is satisfactory for me, and I can trade the financial instruments that I like! When I trade, I tend to choose a platform that provides MT4 services, and WCG fulfills this need of mine.

Positive

2022-11-23