Score

TR

China|5-10 years|

China|5-10 years| https://yihuiconsulting.com/en/login

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

- This broker has been verified to be illegal and all of its licences have expired, and it has been listed in WikiFX's Scam Brokers list. Please be aware of the risk!

Basic Information

China

ChinaUsers who viewed TR also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

FBS

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

HFM

- 10-15 years |

- Regulated in Cyprus |

- Market Maker (MM) |

- MT4 Full License

Exness

- 10-15 years |

- Regulated in Cyprus |

- Market Maker (MM) |

- MT4 Full License

Website

yihuiconsulting.com

Server Location

United States

Website Domain Name

yihuiconsulting.com

Server IP

3.33.130.189

rongshengsolution.com

Server Location

Singapore

Website Domain Name

rongshengsolution.com

Server IP

54.254.166.105

liubaosolution.com

Server Location

Singapore

Website Domain Name

liubaosolution.com

Server IP

3.0.120.52

Company Summary

Introduction:

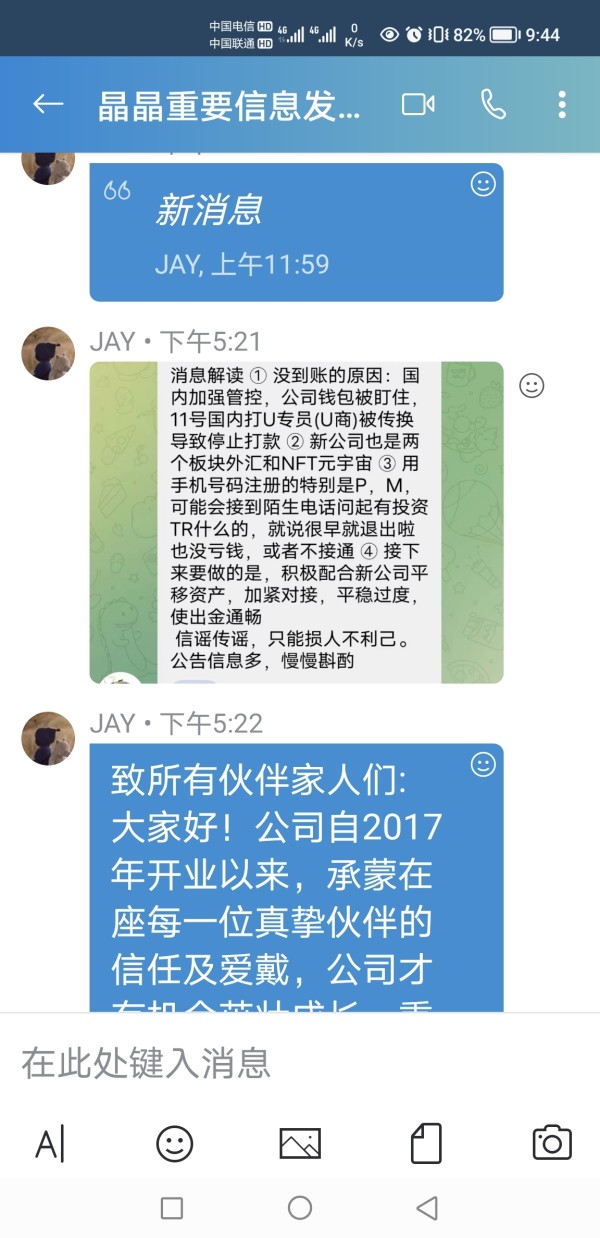

This comprehensive report provides an in-depth analysis and warning about TR Trading, a forex broker. Due to the unavailability of the official TR Trading website, the information presented here is gathered from various credible sources. TR Trading has been identified as an illegal and unregulated entity, with all its licenses expired. It has also been prominently listed in WikiFX's Scam Brokers list, indicating a high level of risk associated with this company. The purpose of this report is to highlight the fraudulent activities conducted by TR Trading, particularly its involvement in a Ponzi scheme. It is essential for potential investors and traders to be fully informed about the deceptive practices and potential financial harm associated with TR Trading in order to make informed decisions and protect their interests.

Scam Warning:

TR Trading has been thoroughly investigated and verified to be an illegal operation. All of its licenses have expired, further raising concerns about its legitimacy and credibility. Notably, TR Trading has been prominently listed in WikiFX's Scam Brokers list, indicating a significant risk to individuals who may consider engaging with this company.

Of particular concern is TR Trading's involvement in a Ponzi scheme. This fraudulent scheme operates by employing the “principle of value multiplication,” where funds from new members are used to pay returns to existing participants. In essence, TR Trading functions as a pyramid scheme, characterized by its hidden, deceptive, and socially harmful nature. Fraudsters within the platform capitalize on people's innate desire for financial gain, clandestinely raising funds through underground means. It is important to recognize that these types of platforms often disappear within one to two years, making their fundraising model unsustainable in the long run.

Given these alarming details, it is crucial for potential investors and traders to exercise extreme caution and be fully aware of the risks associated with TR Trading. Engaging with this company can result in significant financial losses and other adverse consequences. It is strongly advised to refrain from any dealings with TR Trading to protect one's financial well-being and avoid falling victim to this scam.

Additionally, it is important to note that TR Trading currently lacks valid regulation, further exacerbating the risks involved in engaging with this broker. The absence of proper oversight and compliance raises serious concerns about the safety of investors' funds and the transparency of TR Trading's operations.

In summary, TR Trading is an illegal operation, involved in a Ponzi scheme and lacking valid regulation. Its inclusion in the WikiFX's Scam Brokers list serves as a prominent warning sign for potential investors. To safeguard their financial interests, individuals must exercise utmost caution, refrain from engaging with TR Trading, and explore reputable and regulated alternatives in the forex trading industry.

Ponzi Scheme Characteristics:

TR Trading operates as a highly deceptive and socially harmful Ponzi scheme, exploiting unsuspecting individuals' desire for financial gain. This scheme revolves around the “principle of value multiplication,” where funds are circulated in a rolling or static manner. The scheme functions by using the money from new members to pay returns to existing participants, creating an illusion of profitability.

At its core, TR Trading's Ponzi scheme resembles a pyramid scheme, but with distinct features that make it even more insidious. The platform utilizes hidden tactics and deceptive practices to manipulate and entice individuals into investing their funds. By capitalizing on the common desire for wealth accumulation, fraudsters within the platform engage in underground fundraising activities.

The longevity of such platforms is inherently limited. Typically, Ponzi schemes like TR Trading tend to abscond within a relatively short period, often one to two years. This brief lifespan is a direct consequence of the unsustainable nature of the fundraising model employed by these schemes.

Participants in the TR Trading Ponzi scheme are lured with promises of high returns and an effortless pathway to financial success. The initial display of successful deals creates a false sense of security, enticing investors to deposit more funds in the pursuit of greater profits. Moreover, participants may be incentivized with additional rewards for referring friends and family to the platform, further expanding the scheme's reach and its potential victims.

It is crucial to recognize the inherent risks and devastating consequences associated with participating in a Ponzi scheme like TR Trading. Individuals who fall prey to such schemes face significant financial losses, as the inevitable collapse of the scheme leaves most participants empty-handed. The deceptive and socially harmful nature of TR Trading's Ponzi scheme underscores the urgency for individuals to exercise extreme caution and refrain from any involvement with this fraudulent operation.

Therefore, it is imperative for potential investors and traders to remain vigilant, educate themselves about the workings of Ponzi schemes, and seek out regulated and reputable investment opportunities to protect their financial well-being and avoid becoming victims of such deceptive practices.

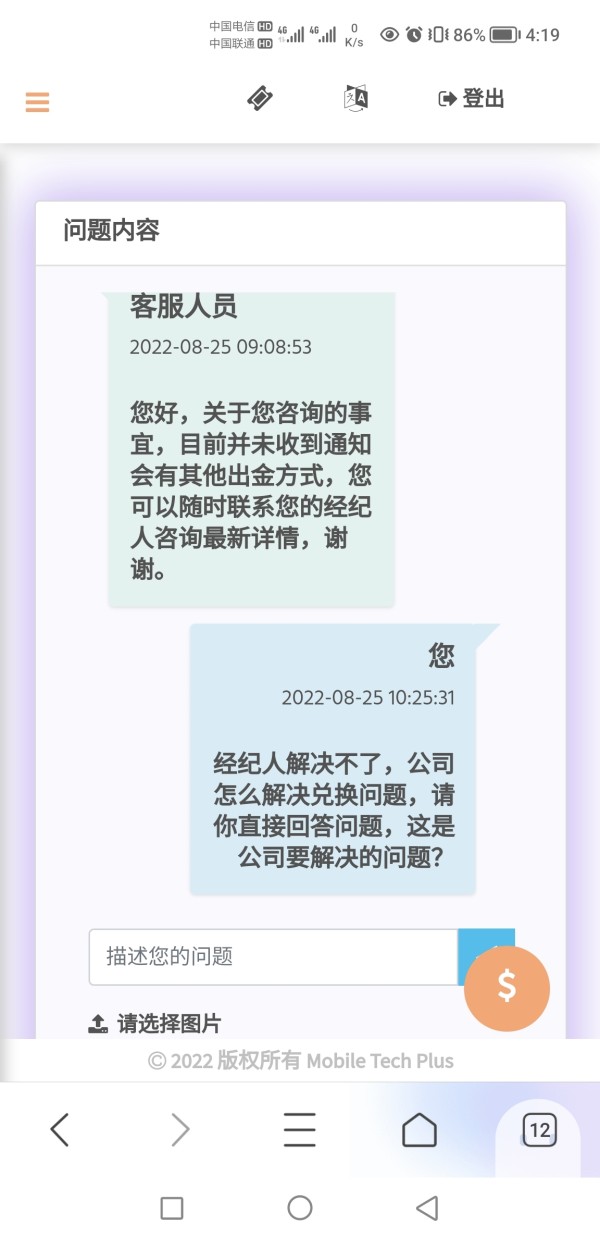

Complaints and Lack of Regulation:

TR Trading has garnered a significant number of complaints, signaling a pattern of dissatisfaction and potential fraudulent activities. Over the past three months alone, WikiFX has received 190 complaints regarding this broker. Such a substantial volume of complaints underscores the gravity of the issues associated with TR Trading and serves as a clear warning sign to potential investors.

Furthermore, TR Trading operates without valid regulation, which exacerbates the risks and raises serious concerns about the company's transparency and adherence to ethical and legal standards. The lack of regulatory oversight means that TR Trading operates outside the framework of established regulatory bodies, leaving investors vulnerable to fraudulent practices and potential misconduct. The absence of proper regulation further undermines the safety and security of investors' funds and leaves them without proper recourse in the event of any disputes or issues with the broker.

Investors should be aware that engaging with an unregulated broker like TR Trading significantly increases the likelihood of financial loss and reduces the chances of receiving fair treatment or compensation in case of any malpractice. Regulatory oversight plays a crucial role in protecting the interests of investors, ensuring fair market practices, and upholding industry standards. By choosing to operate without proper regulation, TR Trading raises serious doubts about its credibility and integrity.

It is essential for individuals considering forex trading or any investment activity to prioritize working with regulated brokers. Regulated brokers are subject to scrutiny, must meet stringent requirements, and are held accountable for their actions. Engaging with a regulated broker helps to mitigate risks and provides investors with a level of assurance and legal protection.

In conclusion, the significant number of complaints received by WikiFX and the lack of regulation associated with TR Trading are red flags for potential investors. These factors indicate a heightened risk of fraudulent activities and the potential for financial loss. To safeguard their interests, investors should exercise extreme caution, opt for regulated brokers, and conduct thorough due diligence before engaging with any forex broker or investment opportunity.

Conclusion

Based on the available information, TR Trading is a forex broker involved in fraudulent activities, operating as a Ponzi scheme. The company's licenses have expired, and it has been listed as a scam broker by reliable sources. The numerous complaints received and the absence of valid regulation highlight the risks involved in dealing with TR Trading. It is crucial to exercise extreme caution and avoid any engagement with this broker to mitigate the risk of financial loss and other negative consequences associated with such scams.

FAQs:

Q: Is TR Trading a regulated forex broker?

A: No, TR Trading is not regulated.

Q: What risks are associated with TR Trading?

A: Engaging with TR Trading poses a high risk of financial loss due to its involvement in a Ponzi scheme and lack of regulation.

Q: Has TR Trading received any complaints?

A: Yes, TR Trading has received numerous complaints, indicating potential fraudulent activities.

Q: Are there any valid licenses held by TR Trading?

A: No, all licenses held by TR Trading have expired.

Q: What should I do if I have invested with TR Trading?

A: If you have invested with TR Trading, it is advisable to contact relevant authorities and seek guidance on reporting the situation and protecting your interests.

Keywords

- Scam Brokers

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Comment 241

Content you want to comment

Please enter...

Comment 241

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

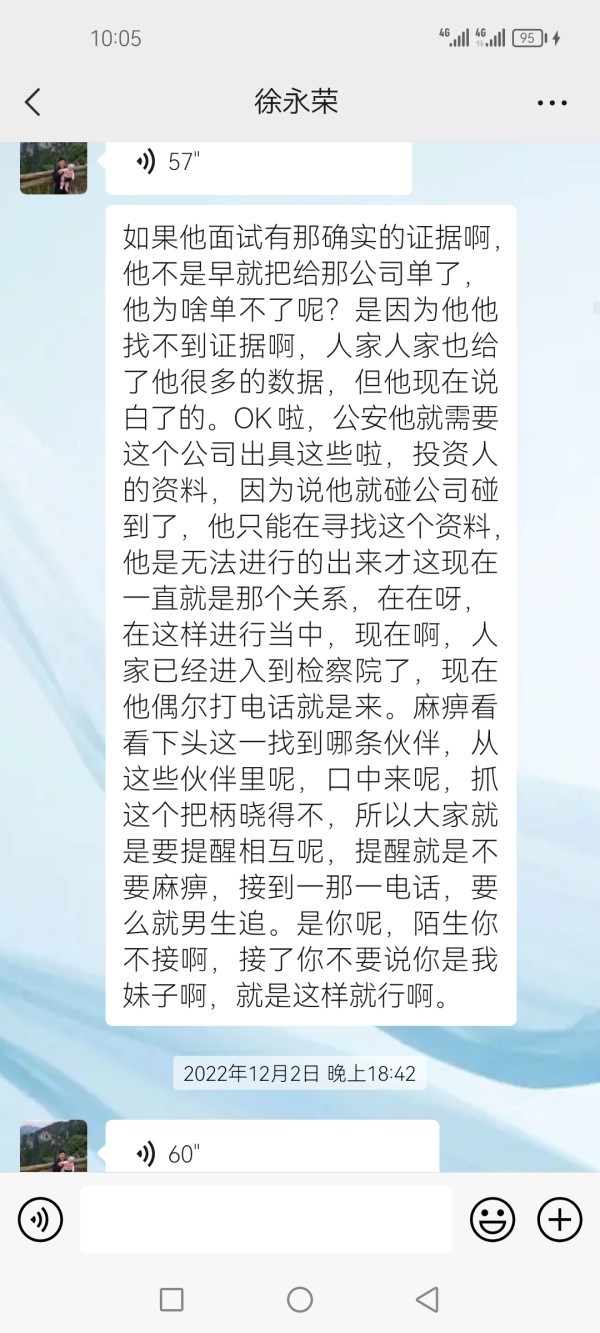

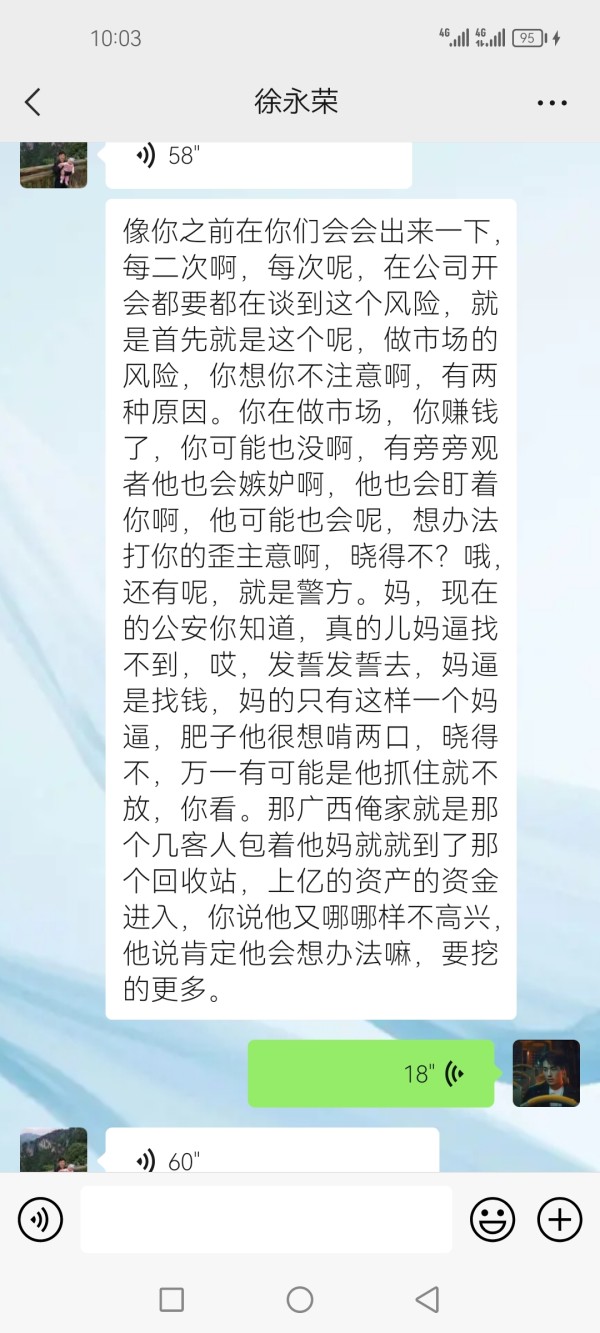

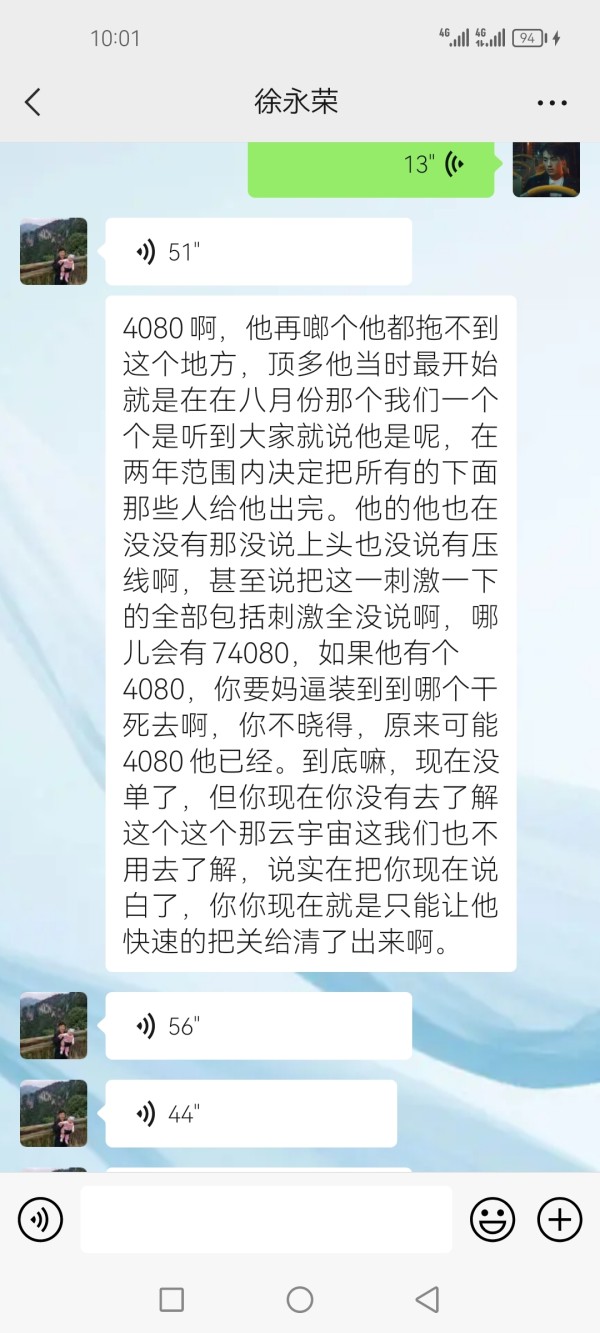

sxw393

Hong Kong

in 2023, there will be no one to manage it, and no money will be withdrawn. hundreds of thousands of investors across the coun TRy will lose all their money. i heard that they are still building a shopping mall recently, and they will start to at TRact people again.

Exposure

2023-12-22

立威

Hong Kong

Customers were played for suckers in 2022, so why are there still people being deceived in 2023?

Exposure

2023-12-05

侯哥3419

Hong Kong

It induces and deceives victims and promotes it under the guise of legality. It claims to be regulated by the British FCA and is the world's first margin trade with a high rate of return. It cannot withdraw money for exchange for various reasons. It keeps changing the website and server for various reasons. The victims are waiting hard, unable to exchange, and have suffered heavy losses. The impact of this incident is terrible, with so many victims and the amount of money. We hope that the origin and location of the source can be investigated in time, the fraud leader Chen Rizun can be caught, and the victims' hard-earned money can be returned!

Exposure

2023-09-21

史晗

Hong Kong

I have been unable to withdraw money, and then I cannot log in to the platform. It has been more than a year. Everyone, be careful of being deceived. I can’t withdraw the 140,000 yuan. Don’t be fooled again!

Exposure

2023-08-31

FX3159033610

Hong Kong

What is said that the AB Book has safe hedging and will never lose money. Now I directly lost the B-book, and the data returned to me in the A-book is still a piece of data, and don’t give me a channel to exchange it for money

Exposure

2023-08-15

ilove

Taiwan

It deleted his IG conversation before it was too late! There are really many and rampant love scams nowadays, everyone should pay attention. Don't trust people who talk to you about true feelings in two or three days, and they are also very handsome. They are all from China mainland and create a luxurious life. During the process, he also told me that his father passed away, which aroused my sympathy, and in the middle, he would say that he had some trauma in his heart and could not answer my phone calls. I have been talking to you about foreign exchange trading since then, and brainwashed me by saying how profitable it is, so that I can make money during the process of entering market, so I am also very relieved. Until yesterday, I still had a remittance, but today the boy disappeared, and the platform was unable to withdraw money. I am now telling everyone to be careful, not to be scammed.

Exposure

2023-07-10

阿男

Hong Kong

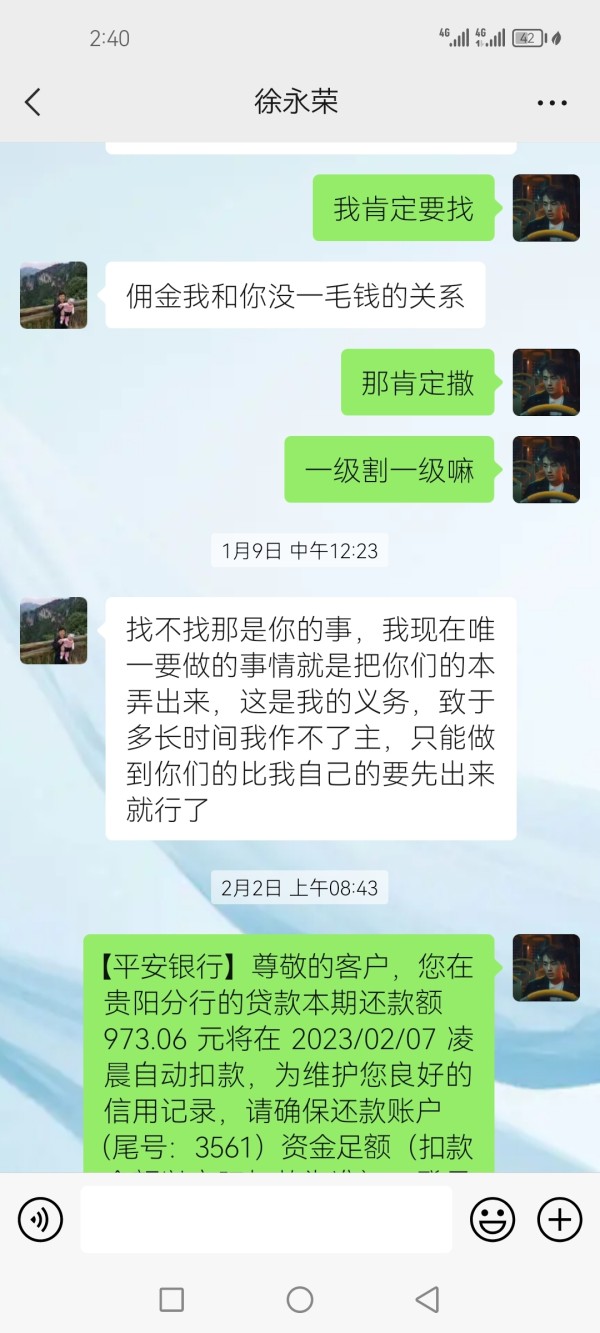

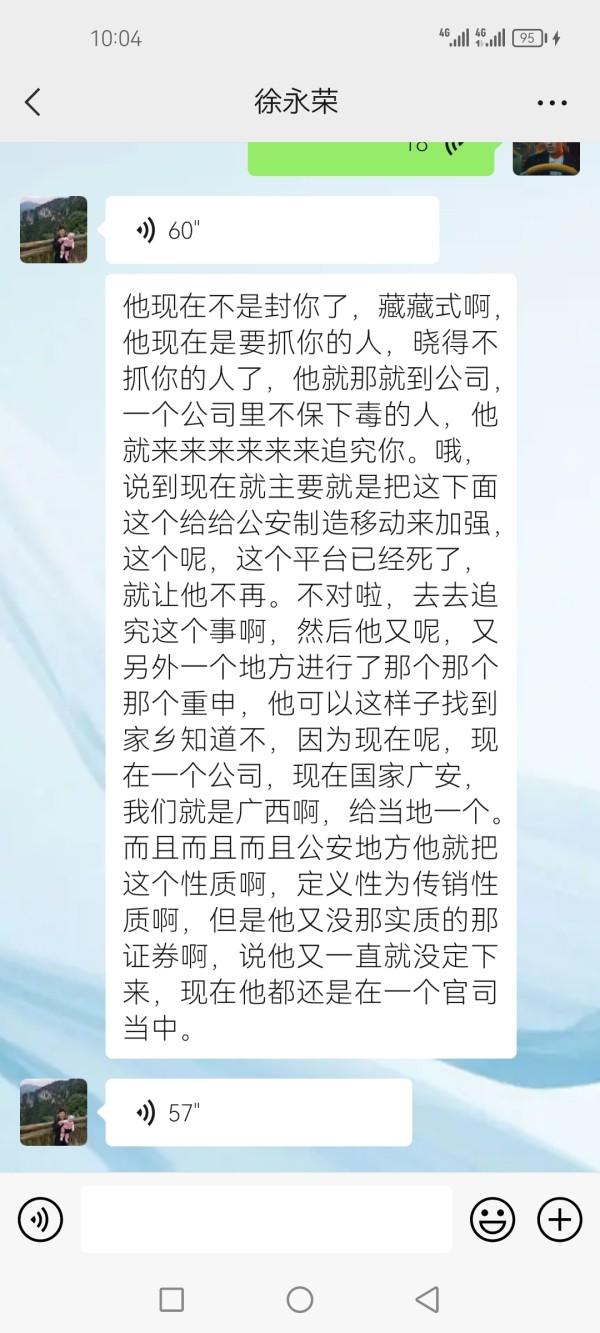

I haven't withdrawn funds for more than half a year, and you keep saying that I can't withdraw funds because the case has not been closed and forcibly converted the funds into NFT. Using Various inducements to invest in loans.

Exposure

2023-06-26

mingwanhui

Hong Kong

I don't even know how I got cheated, their scheme is too deep, I am still falling into this trap despite all the precautions.

Exposure

2023-06-13

I DO69880

Hong Kong

Doesn't it hurt your conscience to spend other people's money, and you still pretend to be charitable, because you are afraid of retribution?

Exposure

2023-05-21

FX3754194487

Hong Kong

TR is a purely fraud platform. In most regions of Hubei and other provinces, hundreds of thousands of people have been deceived, and their money has been lost. The money owed to banks has been overdue for a long time, and the police have called the police, but they still let the fraudsters go unpunished. We should take it seriously, and they don't know what the law is for. They always remind the people how to prevent it. The saying goes that the law is one foot high, the devil is one foot high, and the fraudsters are all elites, There are many tricks, how can ordinary people find a way out? The sadness of society.

Exposure

2023-05-07

日落星辰

Hong Kong

Unable to withdraw. Isn’t this the new platform that TR’s foreign exchange fraud funds reopened and continued to scam money? Since last July, I can’t withdraw money until now, and I plan to call the police.

Exposure

2023-03-01

日落星辰

Hong Kong

Cannot withdraw since Jun 2022. Keep delaying it. The bank loan is also overdue and there is no updates now.

Exposure

2023-02-28

mahakalia

Netherlands

I'm writing a review about Rock-west broker. I got 40 usd bonus by depositing 10 usd. They gave me only one 44 usd withdrawal and when i generated 40 usd profit againand request withdraw 2nd time, they did not withdraw my profit and blocked my account's withdrawal. Then they offered me a 2nd account with 40 usd which Igenerated from bonus funds and closing of bonus account but they did not fulfil their promise and just put 10.62 usd in my 2nd account and close my 1st deposit bonus account. This broker is a scam and cheater. Don't invest with this broker.

Exposure

2023-02-03

555563

Hong Kong

Unable to withdraw. Keep waiting siince April and it has not been sovled till now. It is clearly a fraud.

Exposure

2022-11-28

辉煌7122

Hong Kong

It is a romance scam that induce people to invest and deny your withdrawal

Exposure

2022-11-09

TR害人不浅

Hong Kong

Investors, stop being brainwashed, wake up! Flaunt wealth by various means such as take investor's money to drive a luxury car, live in palatial villa, go on vacation, being exploited once and once again, still insanely brainwashed by him. and re-purchase the identity. Obviously, it was already impossible to withdraw money on April. but he encourage investors to borrow millions of dollars for six or seven loans by blocking the news! What is your intention? Where is the conscience? Do whatever it takes for hedging, even use own money. Truely lost his conscience.

Exposure

2022-10-05

TR害人不浅

Hong Kong

Wang Jing, you know that you can't withdraw money, but you also deliberately blocked the news and let investors take out a lot of loans and deposit money to hedge against you! Where is your conscience? When you ask people to participate in investment, you give them a pat on the chest to assure them that you have visited Malaysia many times, it is true and safe, and you take the simple trust of your old family in you, how do you treat everyone's trust in you? I will gradually expose your ugly deeds step by step! Don't be fooled anymore! wake up……

Exposure

2022-09-30

FX3622275839

Hong Kong

It has been more than two months, and I can't withdraw the money. I asked the regulatory authorities for help.

Exposure

2022-09-06

你好。

Hong Kong

Completely screwed. If you can't withdraw, you're a liar, pay me back my hard-earned money

Exposure

2022-08-31

雷洲

Hong Kong

Forced join into the NFT and will not allow you to withdraw , and the B position has not been traded back to the B position for 3 months. No matter what, you will not be allowed to withdraw. It is a complete fraud.

Exposure

2022-08-28