简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

What is a Margin Call?

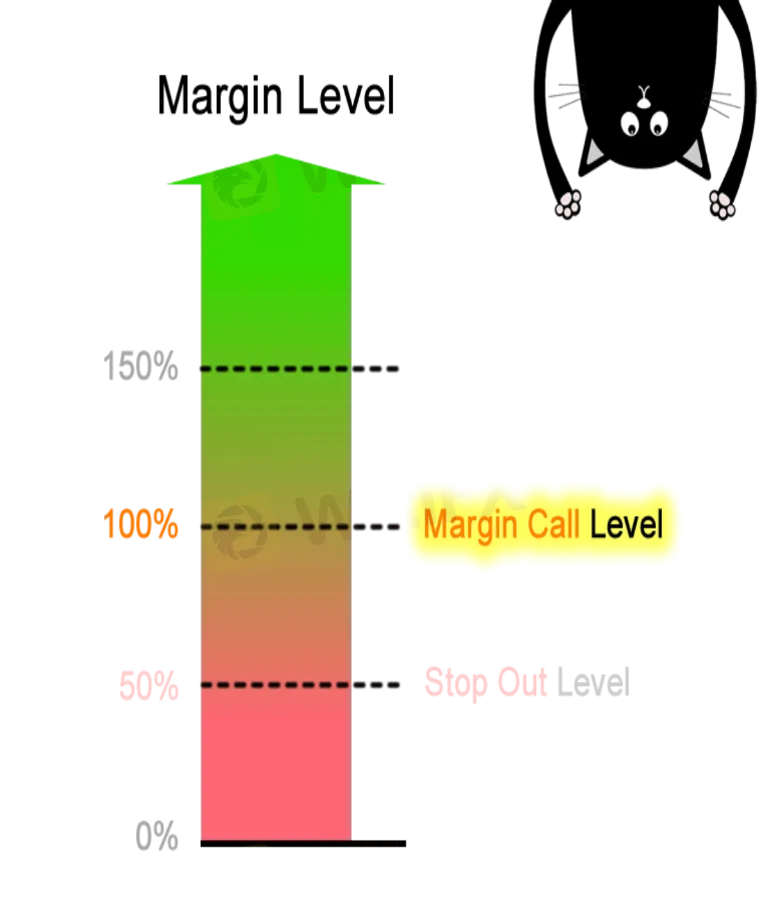

Abstract:The Margin Call level is the agreed minimum amount to which the Margin Level can fall before it triggers a Margin call.

What does “Margin Call Level” or “Margin Call” in forex mean?

The Margin Call level is the agreed minimum amount to which the Margin Level can fall before it triggers a Margin call.

Margin Level indicates how “healthy” your trading account is. It is the ratio of your Equity to the Used Margin of your open positions, indicated as a percentage.

The Margin Level is the “metric” and the “Margin Call Level” is a specific “value” of the metric (which is the Margin Level).

For example, you can get some forex brokers with a Margin Call Level of 100%.

Margin Call Level vs. Margin Call

Most of Traders tend to get confused between a Margin Call Level and Margin Call. Let's further discuss them here.

Margin call occurs when there are not enough funds in your trading account to open trades.

A margin call is the term used to describe the alert sent to a trader to notify them that the capital in their account has fallen below the minimum amount needed to keep a position open. The broker can make the notification to be an actual phone call, but in this days, its usually an email or text message. Trader may likely feel bothered by the notification. A margin call can mean that the trader has to put up more funds to balance the account, or close positions to reduce the maintenance margin required.

In brief the difference between margin call and level is:

• A “Margin Call Level” is a threshold set by your broker that will alarm a “Margin Call”. It is a specific percentage (%) value of the Margin Level. For example, when the Margin Level is 100%.

• A “Margin Call” is an event. When a Margin Call occurs, your broker takes some kinda action. Usually, the action is “to notify you”. But This action only occurs when the Margin Level falls below a certain value. This value is the Margin Call Level

Let's clearly take a boiled water as an example, for water to boil, it normally requires 100°C temperature. If you consider the margin level as equivalent of temperature. The temperature can vary to be of any number like 0°C, 49°C or 80°C. And the margin call Level also is equivalent to 100°C, which is the specific temperature.

The Margin Call is equivalent to water boiling, the action when the liquid changes into a vapor.

Let's take some examples

Example: Margin Call Level at 100%

Lets expect that your forex broker has a Margin Call Level at 100%.

This means that your trading platform will send you a warning alarm if your Margin Level reaches 100%.

Margin Call Level = Margin Level @ 100%

Exception to the alarm notification received from your broker, your trading will also be affected. If the Margin Level on your account reaches 100%, you will NOT be able to open another new positions, you can only close existing positions.

A Margin Call Level at 100% means that the total amount in your account is equal to or lower than your Used Margin. This occurs because you have open positions whose floating losses continue to INCREASE.

Lets say you have a $1,000 in the

account and you open a EUR/USD position with 1 mini lot (10,000 units) that has a $200 Required Margin.

Since you only open one position, Used Margin will also be as $200 (same as Required Margin).

So in this case, you still get at trading so right away, your trade immediately starts losing. It‘s therefore losing big time. (You really lost at trading.) You’re now down 800 pips.

At 1USD/pip, this means you have a floating loss of $800!

Which means you now have Equity of $200.

Equity = Balance + Floating P/L

$200 = $1000 - $800

Your Margin Level is now 100%.

Margin Level = (Equity / Used Margin) x 100%

100% = ($200 / $200) x 100%

As the Margin Level reaches 100%, you will NOT be able to open any additional positions unless one of the following conditions are meet:

. The market reverses back in your favor.

. Some of your total amount in the accountbecomes greater than your Used Margin

If conditions 1 doesnt happen, then conditions 2 is only possible if you:

• Deposit more funds into your account.

• Close out existing positions.

This mean to make that account be unable to open any other positions until the Margin Level increases to a level above 100%.

What happens if your sucky trade continues to go against you?

If this happens, the more your Margin Level falls further to ANOTHER specific level, then the broker will be forced to close your position.

The other specific level is named as the Stop Out Level and varies by broker.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Currency Calculator