简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Divergence on a regular basis

Abstract:A regular divergence can be seen as a hint of a trend reversal. Bullish and bearish regular divergences are the two forms of regular divergences.

What is the definition of a regular divergence?

A regular divergence can be seen as a hint of a trend reversal.

Bullish and bearish regular divergences are the two forms of regular divergences

Regular Bullish Divergence

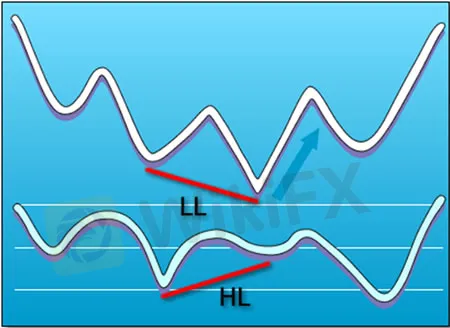

Regular bullish divergence is defined as when the price makes lower lows (LL) while the oscillator makes higher lows (HL).

This usually happens towards the bottom of a DOWNTREND.

If the oscillator fails to produce a new low after forming a second bottom, the price is likely to rise, as price and momentum are generally expected to move in lockstep.

A normal bullish divergence is depicted in the graphic below.

Regular Bearish Divergence

You get regular bearish divergence if the price makes a higher high (HH) but the oscillator makes a lower high (LH).

An UPTREND contains this form of divergence.

If the oscillator reaches a lower high after the price makes that second high, you should expect the price to reverse and plummet.

After making the second top, the price flips, as shown in the image below.

The regular divergence is best employed when trying to pick tops and bottoms, as shown in the figures above.

You're looking for a point where the price will come to a halt and then reverse.

The oscillator tells us that momentum is shifting, and that even though the price has hit a higher high (or lower low), it is unlikely to last.

Now that you've mastered conventional divergence, it's time to go on to the next level and learn about hidden divergence.

Don't worry, it's not as well hidden as the Chamber of Secrets, and it's not nearly as difficult to find.

It's dubbed “hidden” because it's hidden within the present trend.

In the following section, we'll go over everything in further detail. Continue reading!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Currency Calculator