简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

5 Reasons Why Factoring In Currency Correlations Help You Trade Better

Abstract:Over time, currency correlation informs us whether two currency pairings move in the same, opposing, or completely random directions. It's vital to remember when trading currencies that because they're exchanged in pairs, no one currency pair is ever completely isolated.

Over time, currency correlation informs us whether two currency pairings move in the same, opposing, or completely random directions.

It's vital to remember when trading currencies that because they're exchanged in pairs, no one currency pair is ever completely isolated.

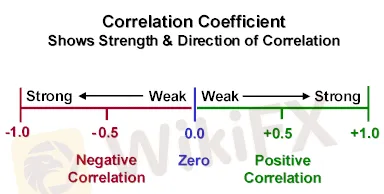

The correlation coefficient, which varies between -1 and +1, is used to calculate correlation.

The following is a help to understanding the various currency correlation coefficient values.

| -1.0 | Perfect inverse correlation |

| -0.8 | Very strong inverse correlation |

| -0.6 | Strong, high inverse correlation |

| -0.4 | Moderate inverse correlation |

| -0.2 | Weak, low inverse correlation |

| 0 | No correlation. Totally random. |

| 0.2 | Very weak, insignificant correlation |

| 0.4 | Weak, low correlation |

| 0.6 | Moderate correlation |

| 0.8 | Strong, high correlation |

| 1.0 | Perfect correlation |

You now understand what currency correlation is and how to read it from a fancy chart.

But we're sure you're asking how currency correlations can help you improve your trading results.

Why do you need this amazing talent in your toolbox as a trader?

There are several causes for this:

1. Eliminate counterproductive trading

Correlations might assist you in avoiding positions that cancel each other out.

We already know that EUR/USD and USD/CHF move in nearly opposing directions, as demonstrated in the last lesson.

Opening a long EUR/USD AND long USD/CHF position is so unnecessary and occasionally costly. In addition to having to pay for the spread twice, any price change would cause one pair to rise and the other to fall.

We want something tangible to show for our efforts!

2. Leverage profits

Profits or losses can be leveraged! You have the option of doubling up on trades to increase your winnings. Let's look at the EUR/USD and GBP/USD 1-week relationships from the previous lesson's example once again.

GBP/USD and EUR/USD have a high positive connection, with GBP/USD trailing EUR/USD almost step for step.

Opening a long position for each pair would be equivalent to tripling your position in EUR/USD.

You'd essentially be using leverage! If everything goes well, you'll make a lot of money, but if something goes wrong, you'll lose a lot of money!

3. Diversify risk

Understanding the existence of correlations helps you to employ multiple currency pairs while maintaining your point of view.

You can diversify your risk among two pairings that move in the same direction rather than trading a single currency pair all of the time.

Choose couples with a strong to extremely strong association (around 0.7). EUR/USD and GBP/USD, for example, tend to move in lockstep.

Because of the faulty connection between these two currency pairings, you may diversify your portfolio and lower your risk. Let's pretend you're a USD bull.

Instead of establishing two EUR/USD short bets, you may open one EUR/USD and one GBP/USD short position, which would reduce risk and diversify your entire position.

In the event that the US dollar falls in value, the euro may be less affected than the pound.

4. Hedge risk

Although hedging might result in lower income, it can also assist to reduce losses.

If a long EUR/USD trade goes against you, take a minor long position in a pair that swings in the opposite direction, such as USD/CHF.

Major setbacks avoided!

You may profit from the various pip values for each currency pair.

While EUR/USD and USD/CHF have an almost perfect -1.0 inverse correlation, their pip values are not the same.

One pip for EUR/USD = $1, and one pip for USD/CHF equals $0.93, assuming you trade a 10,000 mini lot.

You can HEDGE your transaction by buying one mini lot of USD/CHF if you buy one mini lot of EUR/USD. You will lose $10 if EUR/USD falls 10 pips. Your USD/CHF transaction, on the other hand, would be up to $9.30.

Rather of being down $10, you're now just down $0.70!

Hedging has significant drawbacks, despite the fact that it seems like the best thing since sliced bread.

Because of the losses from your USD/CHF position, your profit is limited if the EUR/USD rises.

Furthermore, the association might deteriorate at any time. Consider what happens if EUR/USD drops 10 pips but USD/CHF merely rises 5 pips, stays level, or declines.

Your account will be as crimson as the Red Wedding from Game of Thrones.

So use caution when hedging!

5. Confirm breakouts and avoid fakeouts

Currency correlations can be used to corroborate trade entry or exit signals.

The EUR/USD, for example, looks to be challenging a key support level. You're watching the market activity and hoping to sell on a negative breakthrough.

Because EUR/USD is positively associated with GBP/USD and negatively correlated with USD/CHF and USD/JPY, you want to examine if the other three pairs are going in the same direction as EUR/USD.

You'll observe that the GBP/USD pair is also trading at a major support level, while the USD/CHF and USD/JPY pair are also trading near important resistance levels.

Because the other three pairs are moving similarly, this indicates that the current rise is tied to the US dollar and confirms a likely breakthrough for EUR/USD. So you decide to trade the breakout as soon as it happens.

Let's pretend the other three pairings aren't moving at the same rate as the EUR/USD.

The GBP/USD isn't decreasing, the USD/JPY isn't gaining, and the USD/CHF is trading sideways.

This is generally a strong indication that the EUR/USD decrease is not caused by the US currency and is instead caused by unfavourable EU news.

Price may move below the crucial support level you've been watching, but there will be no price follow-through since the other three associated pairings aren't moving in lockstep with EUR/USD, resulting in a fakeout.

If you still wish to trade this setup despite the lack of “correlation confirmation” from the other pairings, you may minimise your risk by trading with a lower position size.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Currency Calculator