简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

How To Set A Stop Loss Based On Price Volatility

Abstract:If you move to a general term, the volatility is the amount that the market can potentially move within a certain time. If you know how much the currency pair tends to move, you can establish the correct stop loss level and avoid early extraction from random price fluctuations.

If you move to a general term, the volatility is the amount that the market can potentially move within a certain time.

If you know how much the currency pair tends to move, you can establish the correct stop loss level and avoid early extraction from random price fluctuations.

For example, assuming you are in a swing trade and you know that EUR/USD has moved around 100 pips every day throughout the most recent month, setting your stop to 20 pips will presumably get you halted out too soon on a little intraday move against you. Realizing the normal volatility assists you with setting your stops to give your trading a little space to breathe and an opportunity to be correct.

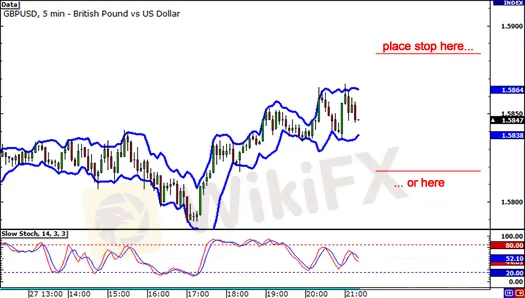

Method #1: Bollinger Bands

As we clarified in a past example, one method for estimating volatility is by utilizing Bollinger Bands.

You can utilize Bollinger Bands to provide you with a thought of how volatile the market is at this moment.

This can be especially valuable assuming you are doing some range trading. Just set your stop past the bands.

Assuming price hits this point, it implies volatility is increase and a breakout could be in play.

Method #2: Average True Range (ATR)

One more method for observing the normal volatility is by utilizing the Average True Range (ATR) indicator.

This is a typical indicator that can be found on most charting platforms, and it's truly simple to utilize.

All the ATR requires is that you input the “period” or measure of bars, candlesticks, or time it thinks back to work out the normal range.

For instance, assuming that you are taking a gander at a daily chart, and you input “20” into the settings, then, at that point, the ATR indicator will mysteriously work out the normal range for the pair throughout recent days.

Or on the other hand in the event that you are taking a look at an hourly chart and you input 50 into the settings, then, at that point, the ATR pointer will show you the normal movement of the most recent 50 hours. Sweet, huh?

This process can be used as a stop loss by itself or in combination with other stop loss method.

The point is to give your trades plenty of space to breathe to wiggle around before they go your way.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Currency Calculator