简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Best Time to Trade Forex in Pakistan

Abstract:For forex traders in Pakistan, timing isn’t just a detail—it’s the cornerstone of success. Nestled in the UTC+5 time zone, Pakistani traders face unique challenges and opportunities when navigating the 24-hour global forex market. Whether you’re scalping during London’s afternoon surge or capitalizing on USD/PKR volatility, aligning your trades with peak liquidity windows can dramatically boost profitability. This guide breaks down the best times to trade forex in Pakistan, tailored to local schedules and market overlaps. Discover how to turn time zones into your strategic edge.

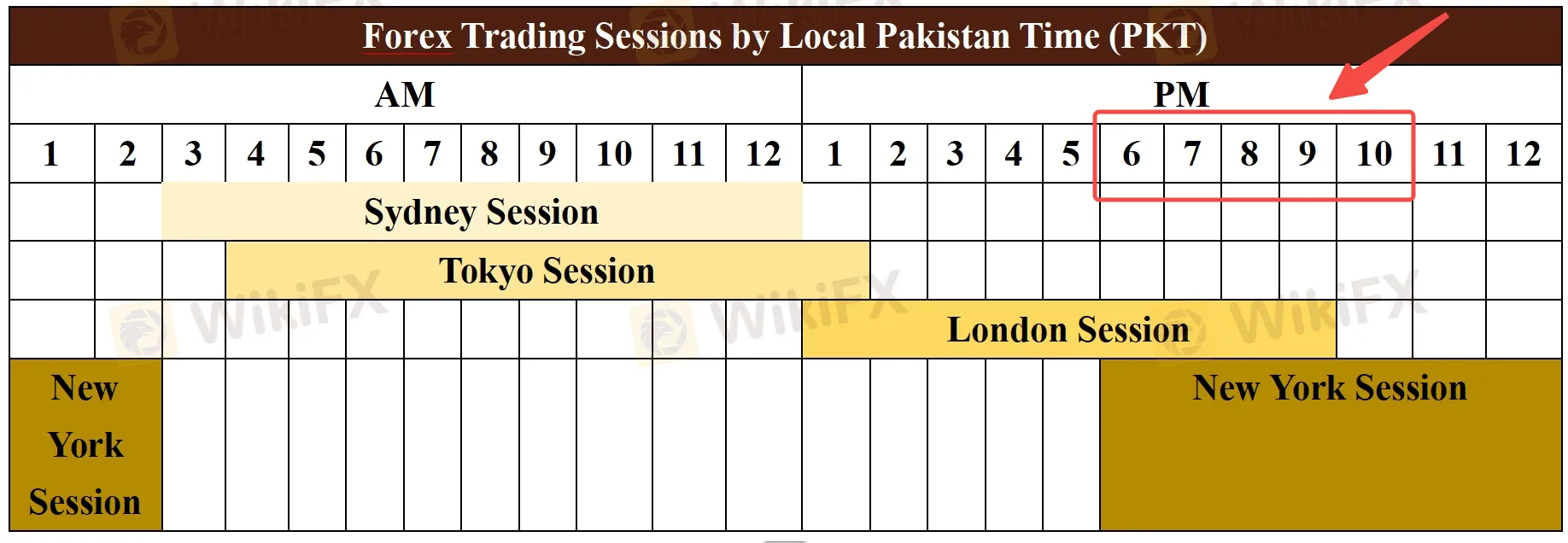

Forex Trading Sessions by Local Pakistan Time (PKT)

The Forex market operates around the clock, but its 24-hour nature doesnt mean all trading hours are created equal. For traders in Pakistan, understanding the global Forex sessions in terms of local Pakistan time (PKT) is crucial. Each session—Sydney, Tokyo, London, and New York—has its unique characteristics, offering varying levels of volatility, liquidity, and trading activity. See details in the table below:

| Session | Pakistan Standard Time (PKT) Time | Volatility | Best Currency Pairs |

| Sydney | 3:00 AM - 12:00 PM PKT | Low | AUD/USD, NZD/USD |

| Tokyo | 4:00 AM - 1:00 PM PKT | Moderate | USD/JPY, AUD/JPY |

| London | 1:00 PM - 9:00 PM PKT | High | EUR/USD, GBP/USD |

| New York | 6:00 PM - 3:00 AM PKT | Extreme | USD/CAD, GBP/JPY |

By aligning your trading strategy with the most active sessions and overlaps, you can identify the best times to trade and make the most of your efforts.

Some Key Points about Pakistan's Opening and Closing Times:

- Trading in the forex market closes at 3:00 AM PKT Saturday (New York session ends).

- Then it reopens at 3:00 AM PKT Monday (Sydney session resumes).

Best Time for Forex Trading in Pakistan

For traders in Pakistan (UTC+5), the optimal forex trading times align with global market overlaps and volatility peaks. The best time for forex trading in Pakistan is 6:00 PM – 10:00 PM PKT, which is the London session and New York session overlap, combining 70% of daily forex volume.

During this period, the EUR/USD spread dropped to 0.5 - 1.0 pips. Besides, due to news releases, US/European economic data (e.g., NFP, ECB rates) hit markets. EUR/USD, GBP/USD, and USD/JPY are the best forex pairs to trade.

Worst Times for Forex Trading in Pakistan

Please avoid low-liquidity gaps! They are the worst times for forex trading in Pakistan. If you do not want to lose your money, avoid the time between Sydney closes and Tokyo opens (3:00 AM – 5:00 AM PKT) and the time after New York closes and before Sydney opens (12:00 AM – 3:00 AM PKT).

How to Start Forex Trading in Pakistan?

Forex trading in Pakistan is accessible but requires careful planning, education, and compliance with local regulations. Heres a structured approach to get started:

Step 1: Understand Forex Trading Basics

Are you ready for forex trading? Currency pairs, leverage, pip, market hours... Do you know what these concepts mean? If your answer is 'yes', you can get started. If your answer is 'no', it means you haven‘t yet grasped the most basic concepts of forex trading. Take time to learn the basics—don’t rush into trading blindly. Build a solid understanding of the forex market first, then take your next step.

Let's learn these basic concepts before starting forex trading:

- Currency Pairs: Major (e.g., EUR/USD), Minor (e.g., GBP/JPY), Exotic (e.g., USD/PKR)

- Leverage: Borrowed capital to amplify trades (e.g., 1:100 leverage = 100 control per 1 invested)

- Pips: Smallest price movement (e.g., EUR/USD moving from 1.0800 to 1.0801 = 1 pip)

- Market Hours: Align with global sessions (Sydney, Tokyo, London, New York)

Step 2: Choose a Regulated Broker

Prioritize brokers regulated by ASIC, FCA, or CySEC (avoid unlicensed platforms) and support Pakistani Rupee deposits/withdrawals. If the broker accepts Pakistani local payment methods, then it will be better, such as JazzCash, EasyPaisa, or bank transfers. Brokers like XM, FP Markets, and XM are all good brokers and in the next section 'Some Reliable Forex Brokers Qptimized for Pakistan Trading Hours', you can learn more.

Step 3: Open a Demo Account

Before exposing yourself to the risks of real trading, getting started with a demo account is a wise option. With a demo account, you can practice risk-free with virtual funds (e.g., 10k–100k) and test strategies during peak PKT hours (6:00–10:00 PM). Specifically, opening a demo account is very easy, go to the broker's website and sign up for a demo account. Follow the directions step by step and download MT4/MT5 or use a web platform to start your demo trading. Here is our advice: simulate trades for 2–3 months to build consistency.

Step 4: Develop a Trading Plan

First, you need to have a strategy, scalping (short-term), swing trading (medium-term), or position trading (long-term). Then, consider risk management. Typically, the risk less or equal to 2% per trade is suitable, and use stop-loss and take-profit orders. As for the trading hours, as we have mentioned before, focus on Lon-New overlap (6:00–10:00 PM PKT), which is the best time to trade forex in Pakistan.

Specifically, your plan needs to be specific to what currency pair you are going to trade (EUR/USD and GBP/USD are best choices), how much leverage (to limit risk, 1:30 is ok) you are prepared to choose, and most importantly, what is your daily goal (5-10 pips profit is ideal)?

Step 5: Open a Live Trading Account

Unlike demo account opening, if you have prepared for real trading and decide to open a live trading account, you need to verify your identity (e.g., submit ID (CNIC), proof of address) and fund your account (e.g., JazzCash, bank transfer). Here is our advice, start small! Trade micro lots (0.01) to minimize risk.

Step 6: Master Risk Management

Master risk management is very important. You had better set a stop loss (e.g., 20 pips), leverage caution (avoid 1:500 leverage unless experienced) and avoid overtrading (stick to 1–3 trades per day).

Additionally, use trading tools like the economic calendar (e.g., Forex Factory) to avoid high-impact news events, and volatility indicators (e.g., ATR) to adjust position sizes.

Step 7: Stay Updated & Improve

Always keep continuous learning. Follow market news on Reuters or Bloomberg and join local trading communities (e.g., Pakistani Forex Traders on Facebook). Avoid making some common mistakes, such as emotional trading, doubling down on losing trades, and ignoring spreads. Compare brokers for lowest spreads (e.g., FP Markets/HFM: 0.0 pips on EUR/USD).

Some Reliable Forex Brokers Optimized for Pakistan Trading Hours

For Pakistani traders, finding a reliable Forex broker that aligns with local trading hours and offers optimal trading conditions is essential for success. The best brokers not only provide access to the global Forex market during key sessions—such as the Tokyo, London, and New York overlaps—but also cater to the unique needs of traders in Pakistan, including Islamic swap-free accounts, low spreads, and responsive customer support.

In this section, well explore some of the most trusted brokers optimized for Pakistani traders. We have XM, FP Markets, and HFM on the list.

| Broker |  |  |  |

| XM | FP Markets | HFM | |

| Year Established | 2009 | 2005 | 2005 |

| Headquarters | UK | Australia | Cyprus |

| Regulation | ASIC, CySEC, DFSA, FSC (Offshore) | ASIC, CySEC | CySEC, FCA, DFSA, FSA (Offshore) |

| Negative Balance Protection | ✅ | ✅ | ✅ |

| Segregated Account | ✅ | ✅ | ✅ |

| Minimum Deposit | $5 | A$100 or equivalent | $0⭐ |

| Demo Account | ✅ (30 days) | ✅ (30 days) | ✅(unlimited)⭐ |

| Islamic Account | ✅ | ✅ | ✅ |

| Maximum Leverage | 1:1000 | 1:500 | 1:2000 |

| Average Trading Cost | Spread from 0.8 pips | EUR/USD spread from 0.0 pips⭐ | |

| Trading Platform | MT4/MT5, XM App | MT4/MT5, TradingView, cTrader, FP Markets Trading App | MT4/MT5, HFM Trading App |

| Copy/Social Trading | ✅ | ✅ | ✅ |

| Deposit & Withdrawal Method | Credit and debit cards, bank transfers, e-wallets | Visa, MasterCard, BPAY, UnionPay, POLi, PayPal, Skrill, Neteller, Fasapay, Bank Transfer | UnionPay (only withdrawal), Wire Transfer, MasterCard, Visa, Crypto, Fasapay, Neteller, Skrill |

| Live Chat Support | ✅ | ✅ | ✅ |

Final Takeaway

- For Pakistani traders, 6:00–10:00 PM PKT is the golden forex trading time.

- Prioritize EUR/USD and GBP/USD during this period, and use tools like volatility indicators to filter noise.

- Always test strategies on a demo account (e.g., XMs $5M virtual funds) before going live.

Forex Trading in Pakistan FAQs

Is forex trading legal in Pakistan?

Yes. Forex trading is legal in Pakistan if conducted through authorized entities (banks or regulated brokers). Choose the broker regulated by the Securities and Exchange Commission of Pakistan (SECP) and the State Bank of Pakistan (SBP).

Is forex trading safe in Pakistan?

Yes, but risky. Most brokers offer investor protection such as negative balance protection, segregated accounts, etc. Use brokers like XM, FP Markets, and HFM for secure trading.

Should I pay taxes for forex trading in Pakistan?

Yes. Profits from forex trading are considered part of your taxable income. The tax rate you pay will depend on your total income, including your forex profits, and the applicable tax slab.

When does the forex market open and close in Pakistan time?

The forex market closes at 3:00 AM PKT Saturday (New York session ends) and then reopens at 3:00 AM PKT Monday (Sydney session resumes).

What are the best hours to trade forex in Pakistan?

6:00 PM – 10:00 PM PKT (London-New York overlap; highest volatility).

What is the best forex pair to trade in Pakistan?

EUR/USD (high liquidity) or GBP/USD (volatility during London hours).

What is the best broker for forex trading in Pakistan?

AvaTrade, Exness, FXCM, Pepperstone, IC Markets, Tickmill, XM, FP Markets, Admiral Markets, and HFM are all good choices for forex trading in Pakistan. For detailed info, please refer to Best Forex Brokers in Pakistan for 2025 (https://www.wikifx.com/en/best/best-forex-brokers-in-pakistan.html).

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Related broker

WikiFX Broker

Latest News

Plunging Oil Prices Spark Market Fears

Celebrate Ramadan 2025 with WelTrade & YAMarkets

WikiFX App Version 3.6.4 Release Announcement

Indian Watchdog Approves Coinbase Registration in India

SILEGX: Is This a New Scammer on the Block?

How Can Fintech Help You Make Money?

Good News for Nigeria's Stock Market: Big Gains for Investors!

IIFL Capital Faces SEBI's Regulatory Warning

Why Is OKX Crypto Exchange Under EU Probe After Bybit $1.5B Heist?

Gold Trading Insights: Prepare for Moves Above $2,900 Post-CPI

Currency Calculator