简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

The Ultimate Guide to Automated Forex Trading in 2025

Abstract:Modern markets are revolutionized by automated trading systems, which now execute 70-85% of all transactions. These advanced automated trading software solutions, commonly called trading robots or Expert Advisors (EAs), leverage algorithmic precision for automatic trading across forex, stocks, and commodities 24/7. By removing emotional interference and executing trades in microseconds, auto forex trading platforms create fair opportunities for all market participants. For those new to automated trading for beginners, these systems provide disciplined, backtested strategies while significantly reducing manual effort.

Modern markets are revolutionized by automated trading systems, which now execute 70-85% of all transactions. These advanced automated trading software solutions, commonly called trading robots or Expert Advisors (EAs), leverage algorithmic precision for automatic trading across forex, stocks, and commodities 24/7. By removing emotional interference and executing trades in microseconds, auto forex trading platforms create fair opportunities for all market participants. For those new to automated trading for beginners, these systems provide disciplined, backtested strategies while significantly reducing manual effort.

Overview of the Automated Trading System

Automated trading software, also known as trading robots or expert advisors (EAs), is a programmatic trading system designed to execute buy/sell orders based on predefined rules. In essence, it acts as a digital clone of traders, operating around the clock, taking advantage of market opportunities across multiple assets. By leveraging advanced mathematical models and algorithmic strategies, these systems enable faster and more accurate trading while eliminating emotional biases.

The Evolution of Automatic Trading

The concept of algorithmic trading can be traced back to Richard Donchian in 1949, and John Henry further developed it in the 1980s. In the 1990s, technology-savvy traders began to try personalized automation systems. Today, institutional players such as Goldman Sachs and JPMorgan Chase and high-frequency trading companies (such as Virtu and Jump Trading) dominate the field, investing millions of dollars in customized systems supported by languages such as C++, Python, and Java.

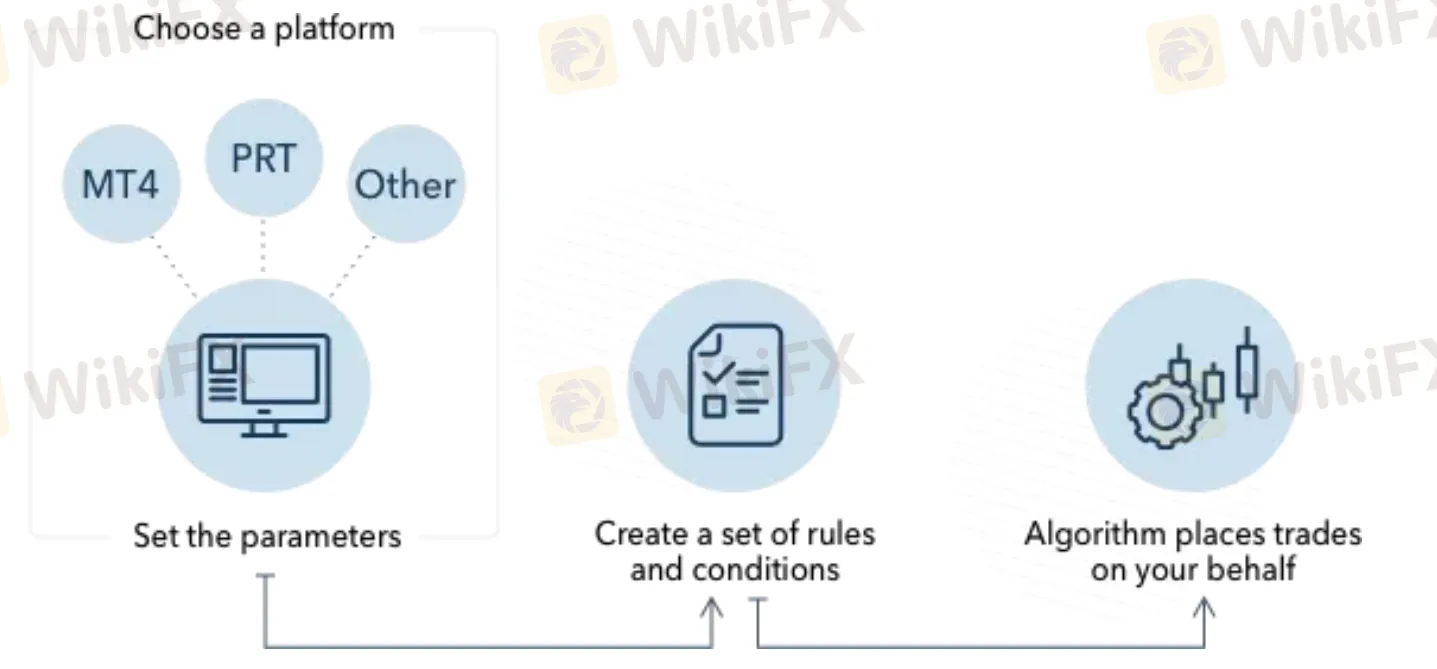

Working Principle

The automated trading system operates according to predefined rules that combine technical indicators (such as moving averages and RSI), entry/exit trigger conditions, and risk parameters. For example, a classic strategy might indicate,'Buy 100 shares of Apple stock when the 50-day average is above the 200-day average. These rules eliminate emotional bias while ensuring disciplined enforcement. The system scans the market around the clock and performs transactions immediately when conditions are consistent, taking advantage of opportunities faster than manual transactions.

However, many automatic strategies use leverage tools such as CFD, which calculate the profit/loss of all position values, not just margin. Although this amplifies the potential return, it also amplifies the risk exposure. Therefore, successful automated trading requires rigorous retrospective testing, clear risk limits, and continuous optimization to balance return potential and prudent risk management.

Note: How to use RSI for high-return investment? You can search for the past feature content'the most effective RSI indicator strategy'in the WikiFX Forex Encyclopedia section.

Automated trading systems also use a variety of complex strategies to take advantage of market opportunities. Each strategy has different characteristics and applications:

| Strategy Type | Key Principle | Primary Applications | Typical Markets |

| Trend Following | Capitalizes on persistent price movements by entering early in trends | Identifying breakouts/breakdowns using technical levels | Equities, Futures, FX |

| Mean Reversion | Exploits price deviations from historical averages | Trading range-bound assets with stable volatility | Bonds, Blue-chip stocks |

| Arbitrage | Profits from temporary price discrepancies across markets/instruments | Calendar spreads, triangular arbitrage, ETF mispricing | Futures, FX, Cross-listed securities |

| Grid Trading | Systematically trades predetermined price levels | Capturing volatility in sideways markets | Cryptocurrencies, Range-bound stocks |

| Momentum | Rides short-term price acceleration | Trading earnings surprises and event-driven moves | Growth stocks, Sector ETFs |

| AI/ML Strategies | Uses predictive modeling to identify complex patterns | Adaptive strategies for changing market regimes | All asset classes |

Automated Trading: A Balanced Perspective for Investors

Algorithmic trading refers to the use of computer programs and algorithms to perform trading decisions, which has been widely used in financial markets. The following are its main advantages and disadvantages:

| Category | Advantages | Risks & Challenges |

| Execution |

|

|

| Decision-Making |

|

|

| Strategy |

|

|

| Risk Management |

|

|

| Operational |

|

|

Advantages

Algorithmic trading has compelling advantages, including faster execution (capturing microsecond opportunities in foreign exchange/arbitrage), discipline that is not affected by emotions (eliminating panic selling/greedy-driven overtrading), and strong backtesting capabilities (optimizing strategies in the market cycle). These systems maintain strict consistency and enforce predefined rules with accuracy unmatched by human traders.

Risks and Challenges

However, significant risks need to be considered. Technical failures (such as Knight Capital's $460 million loss) and outdated strategies during market mechanism shifts can be costly. Crucially, the lack of flexibility of the algorithm in unprecedented circumstances made it difficult to respond to the Black Swan event (2008 crisis). In addition, over-optimization ('curve fitting') may create strategies that are effective in backtesting but fail in real-time markets.

Key adjustments:

- Integrate overlaps (e.g., merge sentiment/consistency advantages).

- Increase'over-optimization'as a unique risk.

- Structurization for quick understanding (key points → narrative process)

- Emphasize that a hybrid human/artificial intelligence approach is the best solution.

Reliable Automatic Trading Platform for Retail Investors

When evaluating trading systems, investors should first understand the basic choice between manual trading (manual execution) and algorithmic trading (rule-based automation). For retail investors seeking reliable automation solutions, we recommend:

MetaTrader Series (MT4/MT5) - Market Standards

MetaTrader 4 (MT4) maintains its position as the world's most widely used retail trading platform, providing traders with three main advantages: (1) Strong technical analysis, with more than 30 built-in indicators and customizable MQL4 programming, which can be used to develop proprietary expert consultants ; (2) access more than 10,000 copy trading signal providers through its integrated market ; (3) seamless mobile function, can copy the complete desktop experience.

For more mature traders, MetaTrader 5 (MT5) provides enhanced features, including (1) a multi-threaded strategy tester, which is 5-10 times faster than MT4 in backtesting ; (2) market depth (DOM) visibility, providing institutional-level order flow transparency; and (3) a true multi-asset feature that enables simultaneous foreign exchange, stock, and futures trading within a single account.

Although MT4 is still the ideal choice for basic Forex algorithm trading, the advanced features of MT5 can meet the needs of traders who need cross-asset strategies and more in-depth market analysis. Both platforms are constantly evolving. According to an industry survey in 2023, 78% of retail algorithm traders use one or two platforms.

cTrader—Institutional Alternatives

cTrader provides professional-level infrastructure, favored by serious traders, with ultra-low latency execution (less than 100 milliseconds through the FIX API) and true ECN pricing. Its cAlgo environment supports advanced C # algorithm development with full debugging tools, and the transparent commission structure (typically 3-36 per hand) eliminates spread markup concerns. The market depth display of the platform provides institutional order book visibility that retail traders rarely get.

ZuluTrade—Social Trading Expert

This FCA-regulated platform has entirely changed replication transactions through its performance-verified ranking system, which evaluates the audit results of more than 10,000 signal providers for more than 5 years. Unique risk management tools will automatically disperse replication transactions in unrelated strategies, while mandatory stop-loss protocols enforce discipline. ZuluTrade's algorithmic execution ensures followers can mirror transactions within 500 milliseconds — much faster than manual copying.

Forex Fury—Turnkey EA Solution

As a certified MT4/5 plug-in, Forex Fury provides retail traders with institutional-level algorithms and adaptive market detection (trend/scalp/reversal mode). This is an intelligent risk matrix that automatically adjusts the size of the position according to the account's equity while ensuring negative balance protection can prevent overexposure. The system requires minimal configuration so that non-programmers can also use complex automation. Backtesting shows that the risk-return ratio of the 15 major currency pairs is always 1:2.

Differences in Risk Tolerance Between Manual and Automated Trading

The following is a professional comparison table for traders to analyze risk tolerance in manual and automated trading:

| Risk Factor | Manual Trading | Automated Trading |

| Emotional Influence | Vulnerable to fear/greed (e.g., premature exits or overholding positions) | Emotion-free execution (strictly follows predefined stop-loss/take-profit rules) |

| Decision Speed | Limited by human reaction time (misses 70 %+ of micro-opportunities under 500ms) | Sub-100ms execution (captures 98% of programmed opportunities) |

| Risk Control | Inconsistent (depends on trader discipline) | Mathematical precision (e.g., auto-position sizing at 1-2% risk per trade) |

| Market Complexity | Adapts to black swan events via human intuition | Struggles with unprogrammed scenarios (requires stress-testing for 20+ scenarios) |

| Key Risk Metrics | Avg 40% wider slippage vs. auto systems | 89% strategy adherence rate (FCA 2023 data) |

The data show that there is a sharp contrast in trading methods: the risk-adjusted return volatility of manual traders is 3.2 times higher, reflecting the emotional unpredictability of human decision-making. According to CFTC research, automated systems show superior discipline and can reduce emotionally driven losses by 57%. However, the most effective method is to combine two methods—a hybrid system that combines algorithm execution with manual supervision can achieve the highest Sharpe ratio (0.8 vs. 0.5 of the pure method).

To obtain the best results:

- Deploy manual trading for event-driven opportunities (revenue/NFP), where manual interpretation works better.

- Using automation to perform technical strategies that require speed and accuracy (mean regression/breakthrough).

- Always run a 3-month parallel test (manual + automatic test on the same strategy) to compare actual performance.

Remember that even the best automated systems require quarterly reviews to adapt to changing market mechanisms.

Which trading method can bring higher returns to primary retail investors?

Novice traders should weigh key differences:

Manual trading provides flexibility for market adaptation, but traders who need professional knowledge (more than 100 learning hours) and emotional control, and who lack experience, often lose 2-3% per transaction due to impulsive decision-making.

Automated trading enforces discipline through preset rules and may generate 5-8% monthly returns under stable conditions. However, due to improper strategy selection, 78% of transactions failed within 6 months (FCA data).

Professional Tips: Start with a three-month simulation transaction, and then gradually combine automatic execution (80% of transaction volume) with selective manual intervention during major events to obtain the best risk-adjusted return.

Conclusion

Although algorithmic systems provide speed, discipline, and retrospective testing capabilities, they require careful strategy selection and monitoring, especially during the Black Swan event. On the contrary, manual trading retains human adaptability but requires a lot of expertise to overcome emotional traps.

In order to obtain the best results, consider a hybrid approach: use automation for routine execution while retaining manual supervision to cope with special market conditions. Keep in mind that 72% of retail traders will lose money no matter what method is used.

Ready to start? Start with a demo account, thoroughly test the strategy, and gradually expand your risk exposure.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Should You Beware of Forex Trading Gurus?

Know the reality behind forex trading gurus, examining their deceptive tactics, inflated promises, and the risks associated with trusting them for financial advice.

Webull Launches SMSF Investment Platform with Zero Fees

Webull introduces commission-free SMSF trading, offering over 3,500 US and Australian ETFs, with no brokerage fees and enhanced portfolio tools.

How Reliable Are AI Forex Trading Signals From Regulated Brokers?

Discover how reliable AI Forex trading signals are and why using a regulated broker boosts their effectiveness. Learn key factors to evaluate accuracy and enhance your trading.

Top Currency Pairs to Watch for Profit This Week - March 31, 2025

Discover the top 5 currency pairs to trade for profit this week, March 31, 2025—USD/JPY, EUR/USD, GBP/USD, AUD/USD, USD/CHF—with simple strategies and best times.

WikiFX Broker

Latest News

Exposing the Top 5 Scam Brokers of March 2025: A Closer Look by WikiFX

Gold Prices Climb Again – Have Investors Seized the Opportunity?

Webull Launches SMSF Investment Platform with Zero Fees

Australian Regulator Warns of Money Laundering and Fraud Risks in Crypto ATMs

FCA Warns Against 10 Unlicensed or Clone Firms

CySEC Warns Against 14 Unlicensed Investment Websites

Top Currency Pairs to Watch for Profit This Week - March 31, 2025

Will natural disasters have an impact on the forex market?

Philippines Deports 29 Indonesians Linked to Online Scam Syndicate in Manila

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

Currency Calculator