Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

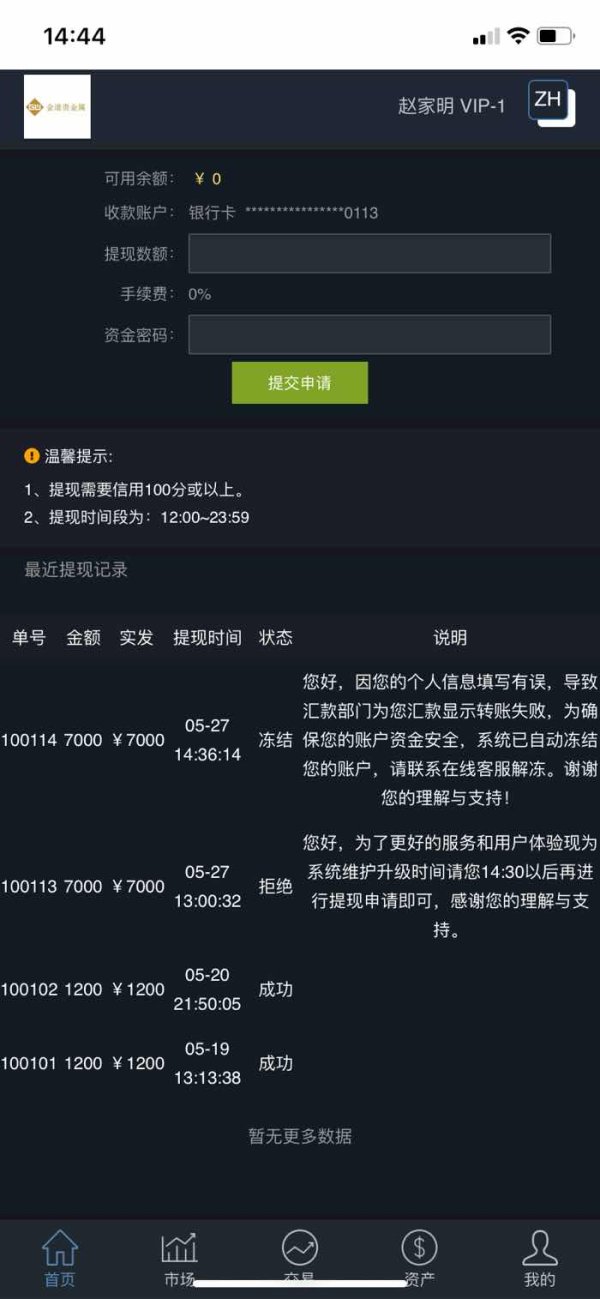

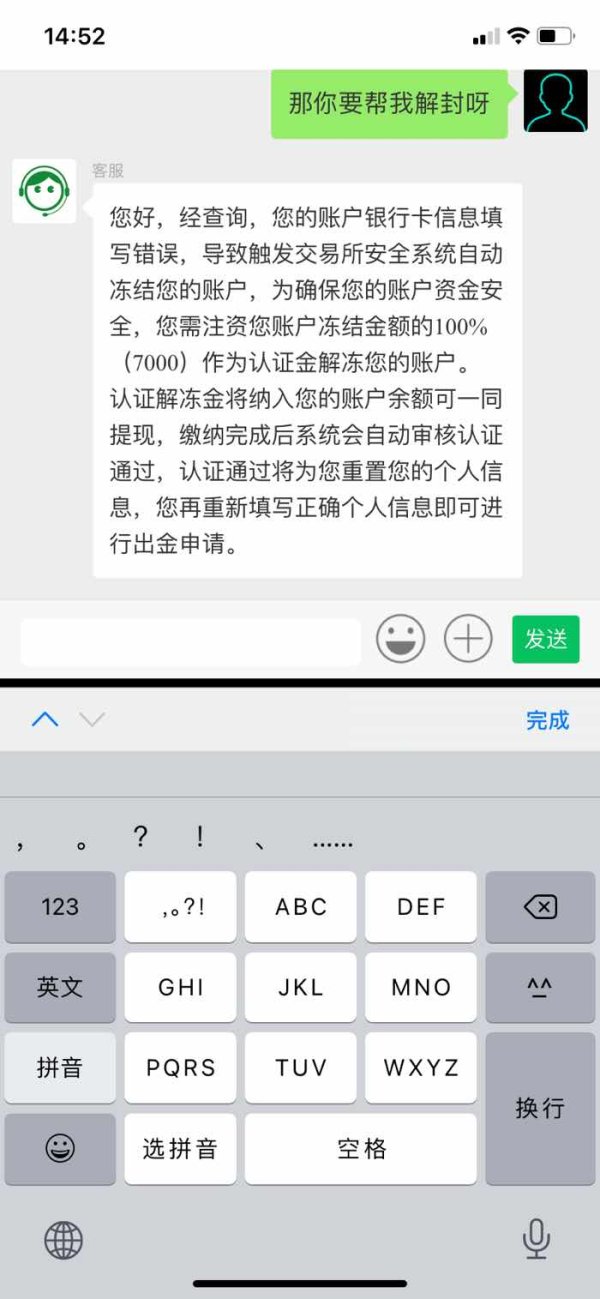

FX4247393671

Hong Kong

I applied for withdrawal of 7,000 while he said the system was under maintenance and I had to operate at two thirty. And I should refill my bank card info at that time. But I was told that my info was wrong and I should pay to unfreeze my account. I can make sure that my bank card info was right. But when I checked it, there was one more 0. Isn’t it a scam?

Exposure

2021-05-27

青苹果

Hong Kong

Scam platform cleared my account.

Exposure

2020-02-12

大鲸.余

Hong Kong

Unable to withdraw. Both the customer service and the website is unavailable. Garbage!

Exposure

2019-12-27

镜

Hong Kong

Both the funding page and the official website are unavailable.

Exposure

2019-12-23

田埂上的梦

Hong Kong

It ceased my trading account inexplicably.I was not satisfied with their bad manner!!!The company didn’t solve the my requirement timely,making me lose more than 800000 RMB.So irresponsible JinDao is!!!

Exposure

2019-11-14

一只丑陋的凸~

Hong Kong

After profiting a lot, my application for withdrawal was declined with the reason of wrong bank number.I was asked to pay 10% margin money to withdraw money.I was declined again with the reason of less-than 100 credit score and asked to deposit 35,200 in the platform.As I did so,it succeeded.I received a call from Hong Kong saying that I need to deposit 50,000 yuan to ensure the fund to my account.But the fund still hasn’t arrived.When I inquired if,I was told that a portion of my fund was stuck in the channel because of abnormal trade.Only by depositing 24,800 into the account, can the fund be abnormal.It is an absolute fraud platform.With upholding the banner of high profit,it induces investors to deposit money again and again .I have called the police.Hope you avoid being cheated.

Exposure

2019-08-21

FX9249301067

Hong Kong

2018/9/26, JinDao has permanently disabled my MT4, MT5, GTS accounts for no reason. I have been trade since April 2016 until 2018/9 months. The accounts were still in normal use, with a total loss of 700,000 yuan. Now, my accounts were disabled with any notice. I can't find any transaction records with losses before. I hope that JinDao will give me an explanation.

Exposure

2019-01-16

FX9669673574

Hong Kong

The money I deposited would arrive instantly. I applied for a withdrawal, but nothing happened after a day. They told me it would just take 2 hours. The service is cooling me.

Exposure

2019-01-16

不忘初心--工艺礼品专供

Hong Kong

My account was banned after I made an inquiry about my money flow in JinDao. I still have money in it. Scam.

Exposure

2018-12-04

FX3639864874

Hong Kong

I was induced by their agent to invest in their platform from June to October. They promised me a 100% profit. But I lost a lot after then. Those so-called instructors deliberately gave me wrong directions. I contacted the platform, who said I am not their client at all. This is a scam.

Exposure

2018-12-03

FX3119859718

Hong Kong

JinDaofroze my account for no reason. I contacted the customer service personnel, and they still don't recognize that is their account. They said they could not find the account. Aren’t the emails that informed the money were successfully deposited into the account sent by them? If the platform changes its name, it will not recognize the former clients, and it is too irresponsible. I hope FXEYES can expose them.

Exposure

2018-11-21

FX6009685181

Hong Kong

JinDao is a scam. I can’t withdraw on it. They produced some video-verification shit to prevent me from withdrawing. This is a scam!

Exposure

2018-11-17

FX3219587820

Hong Kong

kindo permanently suspended my MT4,MT5 and GTS account for no reason on September 26, 2018/9/26. Since my operation in April 2016 till now, my account is still in normal use with a total loss of RMB 700,000. Now my account is suspended without any sign, and I cannot check any transaction records of previous losses.

Exposure

2018-10-17