简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Top 5 FX Events: Final Q418 US GDP & USDJPY Price Outlook

Abstract:Consensus forecasts call for Q418 US GDP to come in at 2.4% annualized.

Talking Points:

谈话要点:

- The final Q418 US GDP report will be released on Thursday, March 28 at 12:30 GMT.

- 最终的Q418美国GDP报告将于3月28日星期四格林尼治标准时间12:30公布。

- According to Bloomberg News, consensus forecasts are calling for US growth to have settled at a 2.4% annualized rate; however, growth expectations for Q218 are below 1%.

- 据彭博新闻社报道,市场普遍预期美国经济增长将以2.4%的年化率结算;然而,第二季度的增长预期低于1%。

- Retail traders are net-long USDJPY and recent changes in positioning suggest a bearish bias.

- 零售交易商是净多头美元兑日元,最近的定位变化表明看跌偏见。

{4}

03/28 THURSDAY | 12:30 GMT | USD GROSS DOMESTIC PRODUCT (4Q T)

03/28周四| 12:30 GMT |美元国内生产总值(第四季度)

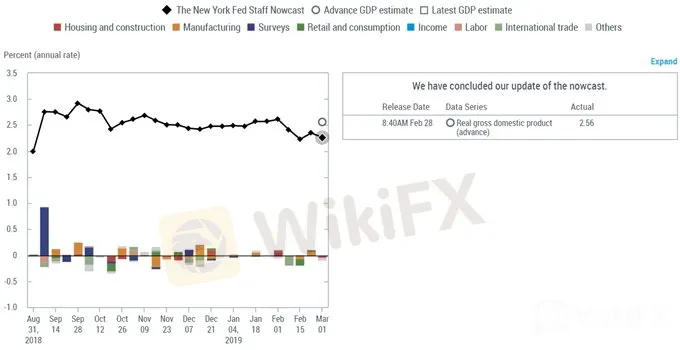

Growth expectations for the final Q4‘18 US GDP have been tempered thanks to the shutdown. The US Congressional Budget Office estimated that the economy lost at least -0.1% of GDP last quarter and -0.2% in Q1’19 as a result of the shutdown. The NYFed Nowcasting estimate sees growth due in at a more modest 2.6% annualized. Meanwhile, the consensus forecast, according to Bloomberg News, calls for headline growth in at 2.4%.

美国国内生产总值的最终增长预期因关闭而受到抑制。美国国会预算办公室估计,由于关闭,上季度经济损失至少占GDP的-0.1%,并且在1919年第一季度下降了-0.2%。 NYFed临近预测的增长预期为年均增长2.6%。与此同时,根据彭博社的消息,市场普遍预测整体增长率为2.4%。

The future doesn‘t appear any brighter. The NYFed Nowcasting estimate for Q1’19 shows growth at 1.29% while the Atlanta Fed GDPNow estimate is at 1.2%.

未来似乎没有任何更亮。 NYFed Nowcasting对19年第一季度的估计显示增长率为1.29%,而亚特兰大联储GDPNow估计为1.2%。

Pairs to Watch: DXY Index, EURUSD, USDJPY, Gold

值得观察:DXY指数,EURUSD,USDJPY,Gold

USDJPY Price Chart: Daily Timeframe (March 2018 to March 2019)

USDJPY价格走势图:每日时间表(2018年3月至2019年3月)

The rally by USDJPY since the Yen flash-crash at the start of 2019 may be finished. With the bearish outside engulfing bar developing on March 20, the uptrend from the post-flash crash low was breached. Price action since Wednesday has been showing signs of significant follow through to the downside. Having cleared out the early-March swing low at 110.75, the probability of more downside in the near-term has increased.

美元兑日元自2019年初日元暴跌以来的反弹可能已经结束。随着3月20日看跌外围吞没酒吧的上行趋势,上升趋势周三以来的价格走势一直显示出明显突破下行的迹象。已经清除了3月初的低点110.75,短期内更多下跌的可能性增加了。 。

To this end, USDJPY price is now below the daily 8-, 13-, and 21-EMA envelope while both daily MACD and Slow Stochastics are trending lower, having fallen out of overbought conditions. A near-term bearish bias may be appropriate unless the March 20 bearish outside engulfing bar high of 111.69 is breached.

为此,美元兑日元的价格现在低于每日8,13和21-EMA的信心,而日均MACD和慢速随机指标均走低,已经下跌除非3月20日看跌外部吞没高点111.69被突破,否则近期看跌偏见可能是合适的。

IG Client Sentiment Index: USDJPY (March 22, 2019)

IG客户情绪指数:美元兑日元(3月22日, 2019)

Retail trader data shows 60.0% of traders are net-long with the ratio of traders long to short at 1.5 to 1. The percentage of traders net-long is now its highest since Jan 08 when USDJPY traded near 108.749. The number of traders net-long is 15.7% higher than yesterday and 12.7% higher from last week, while the number of traders net-short is 26.3% lower than yesterday and 32.4% lower from last week.

零售交易者数据显示,60.0%的交易者为净多头,交易者多头做空比率为1.5比1.交易者的百分比净多头现在是自08年1月美元兑日元汇率在108.749附近交易以来的最高点。交易商净多头比昨天增加15.7%,比上周增加12.7%,而交易商净空头数比昨天减少26.3%,比上周减少32.4%。

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USDJPY prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USDJPY-bearish contrarian trading bias.

我们通常采取逆向观点来看待市场情绪,而且交易者净多头表明美元兑日元价格可能继续下跌。交易商的净持续时间比昨天和上周更长,目前市场情绪和近期变化的结合使我们对美元兑日元看跌的逆势交易产生了偏见。

Read more: Top 5 FX Events: March RBNZ Meeting & NZDUSD Price Outlook

阅读更多:前5名外汇事件:3月RBNZ会议和新西兰元美元价格展望

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

---由高级货币策略师CFA Christopher Vecchio撰写

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Wall Street Rally on Soft CPI

The most anticipated economic indicator of the week, the U.S. Consumer Price Index (CPI), was released yesterday, coming in at 2.9%, below the 3% threshold and in line with the Producer Price Index (PPI) data from the previous day. This further sign of easing inflationary pressure in the U.S. has heightened expectations that the Federal Reserve may implement its first rate cut in September.

Wall Street Advances Ahead of CPI

The equity markets continued their upward momentum, driven by the easing of the Japanese Yen's strength. The Yen was pressured by a dovish tone from Japanese authorities, signalling that the Bank of Japan (BoJ) might keep its monetary policy unchanged amid rising global economic uncertainties.

Nasdaq Bullish, Encourage by Upbeat U.S. Job Data

The financial markets reacted positively to the upbeat Initial Jobless Claims data released yesterday, which came in at 233k, lower than market expectations. This eased concerns about a weakening labour market and the heightened recession risks that emerged after last Friday's disappointing NFP report. Wall Street benefited from the improved risk appetite, with the Nasdaq leading gains, surging by over 400 points in the last session.

Japanese Yen Eases on BoJ Dovish Statement

The Japanese Yen eased on Wednesday morning after the BoJ Deputy Governor indicated that the Japanese central bank would not raise interest rates if global markets remained unstable. This statement has calmed the market and unwound concerns about Yen carry trades. Meanwhile, the dollar has regained strength, with the dollar index (DXY) climbing above the $103 mark.

WikiFX Broker

Latest News

Beware: Forex Investment Fraud Targeting Low Income Earners

Central Bank Policies,Forex Markets and Gold Prices

These 24 Crypto Scams Are Accelerating the Theft of Your Assets

49 Foreigners Arrested in Illegal POGO Raid in Pasay City

Beware of Fake 'Educational Foundations' Targeting Crypto Investors, Warns North Dakota Regulator

We Asked Grok About Illegal FX Brokers—Here’s What It Revealed

Exposing Trading Academy Scams: How Aspiring Traders are at Risk

Online Investment Scams on the Rise: How Two Victims Lost Over RM100K

Vanished Savings: How One Woman Lost RM412,443 to an Online Scam

Investor Alert: FCA Exposes 9 Unregistered Financial Companies

Currency Calculator