简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

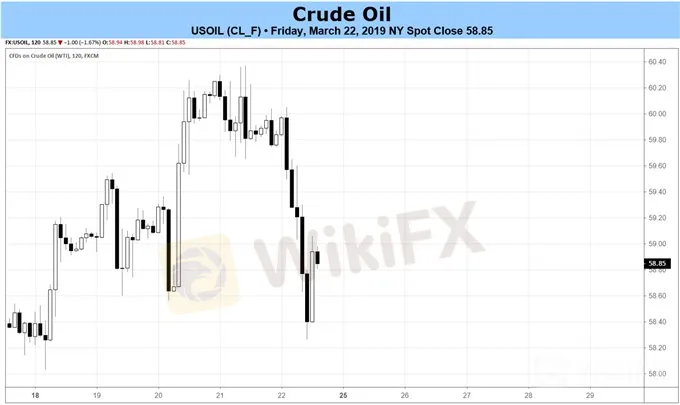

Crude Oil Weekly Forecast: Rising Global Growth Concerns Sink Oil Prices

Abstract:As more of the US Treasury yield curve sinks into inversion territory, concerns about global growth have flared – dragging down energy prices in the process.

Fundamental Forecast for Crude Oil: Neutral

原油基本面预测:中性

- News early in the week that OPEC would be canceling their April meeting initially help Crude Oil prices rally into their highest level since November 12.

- 本周早些时候欧佩克取消4月份会议的消息最初有助于原油价格上涨自11月12日以来一直反弹至最高水平。

- As more of the US Treasury yield curve sinks into inversion territory, concerns about the state of the US economy and global growth in general have flared – hitting oil prices hard by the end of the week.

- 随着更多美国国债收益率曲线陷入反转区域,对美国经济状况和全球增长的担忧普遍存在本周末油价惨烈打击。

- The IG Client Sentiment Indexshows that retail traders are buying the Crude Oil dip – a contrarian signal that more losses may be yet to come.

- IG客户情绪指数显示,零售交易商正在买入原油价格下跌 - 这是一个反向信号,即可能出现更多亏损尚未到来。

See our long-term forecasts for the Euro and other major currencies with the DailyFX Trading Guides.

使用DailyFX交易指南查看我们对欧元和其他主要货币的长期预测。

Crude Oil Weekly Price Recap

原油石油周刊价格回顾

After climbing through the first four days of the week to hit their highest level since November 12, Crude Oil prices dropped dramatically on Friday as a fresh wave of concern over the state of the global economy provoked a sell-off in high beta assets, growth-related commodities, and the risk-correlated currencies. The -1.97% drop on Friday saw Crude Oil cut its gain for the week down to 0.89% overall. Heading into the last week of the month, Crude is up by 3.18% since the start of March.

攀登前四天本周创下自11月12日以来的最高水平,周五原油价格大幅下挫,因全球经济状况的新一轮担忧引发了高贝塔资产,与增长相关的大宗商品以及风险 - 的抛售相关货币。周五下跌-1.97%,原油价格本周下跌至0.89%。进入本月最后一周,自3月初以来,原油价格上涨了3.18%。

OPEC Meeting Cancellation Suggests Supply Will Remain Tight

欧佩克会议取消建议供应将保持紧张

{8}

Global Growth Concerns Rise as US Treasury Yield Curve Continues to Invert

随着美国国债收益率曲线继续反转,经济增长担忧上升

Even as it appears the global energy supply will be constrained over the near-term horizon, markets may have reached their breaking point with respect to concerns over the global economy. The March Fed meeting on Wednesday jumpstarted the drop in yields on Wednesday, but the US Treasury yield curve‘s inversion by the end of the week may have been the proverbial straw that broke the camel’s back.

即使看起来全球能源供应将在短期内受到限制,市场可能已达到突破点关于对全球经济的担忧。周三3月美联储会议上周三启动了收益率下跌,但本周末美国国债收益率曲线的反转可能是打破骆驼背后的谚语。

{11}

Why does the US yield curve inversion matter? In the post-war era, every occasion in which the 3m5s and 3m10s yield curves have remained inverted for two consecutive quarters has pre-dated a US recession 100% of the time. Crude Oil prices may prove to be disadvantaged in an environment where global growth concerns begin to pick up.

为什么美国收益率曲线反转很重要?在战后时代,3m5s和3m10s收益率曲线的每个场合都连续两个季度保持倒转已经过时美国经济衰退的百分之百。在全球经济增长担忧开始复苏的环境下,原油价格可能会处于不利地位。

Inventory Data Due Out on Wednesday

周三库存数据到期

Latest COT Data Shows Longs Continued to Build

最新COT数据显示多头继续构建

Finally, looking at positioning, according to the CFTCs COT for the week ended March 19, speculators increased their net-long Crude Oil positions to 414.8K contracts, up from the 362.3K net-long contracts held in the week prior. Net-longs have now climbed for the past five consecutive weeks after bottoming out during the week of February 12, 2019. Positioning remains a significant distance from the highs seen over the past two years, which were 739.1K net-longs during the week of February 6, 2018.

最后,根据CFTC COT截至3月19日当周的情况,投机者将净多头原油头寸增加至414.8 K合约从362.3K开始上涨在前一周举行的长期合约。在2019年2月12日这一周触底后,净多头现已连续五周攀升。定位仍然与过去两年的高位相差很远,在过去两年中,净多头为739.1万净多头。 2018年2月6日。

IG Client Sentiment Index: Crude Oil (March 22, 2019)

IG客户情绪指数:原油(2019年3月22日)

Retail trader data shows 54.1% of traders are net-long with the ratio of traders long to short at 1.18 to 1. The number of traders net-long is 2.0% higher than yesterday and 4.4% lower from last week, while the number of traders net-short is 19.7% lower than yesterday and 15.0% lower from last week.

零售交易商数据显示,54.1%的交易者为净多头,交易者多头做空比率为1.18比1.交易者净多头比昨天高2.0%,比上周低4.4%,而交易商数量净空头比昨天减少了19.7%,比上周减少了15.0%。

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Oil - US Crude prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Oil - US Crude-bearish contrarian trading bias.

我们通常采取逆向观点来看待人群情绪,事实上交易者净多头意味着石油 - 美国原油价格可能继续下跌。交易商比昨天和上周进一步净多头,目前的情绪和最近的变化相结合,使我们的油价走强 - 美国原油看跌的逆势交易偏见。

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

---由高级货币策略师CFA Christopher Vecchio撰写

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Enlighten Securities Penalized $5 Million as SFC Uncovers Risk Control Failures

Why Are Financial Firms Adopting Stablecoins to Enhance Services and Stability?

Experienced Forex Traders Usually Do This Before Making a Lot of Money

Octa vs XM:Face-Off: A Detailed Comparison

When High Returns Go Wrong: How a Finance Manager Lost RM364,000

Bridging Trust, Exploring Best—WikiEXPO Hong Kong 2025 Wraps Up Spectacularly

Unlocking the Power of Algo Trading: Benefits and Limitation

Rise of Fake Trading Apps & Their Impact on Investors

Crypto-to-Cash Transfers Now Available for UK and Europe

U.S. and Japan Interest Rates Hit Recent Highs – Watch Out for Short Sellers

Currency Calculator