简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Is DERIV a scam? WikiFX helps you find the answer

Abstract:What does DERIV look like? “Refuse to Process my Withdrawal Request.” “deriv broker is a scam!!!!” DERIV claims itself to have more than 20 years of experience. But how reliable DERIV really is? If you want to know the answer, please continue to read.

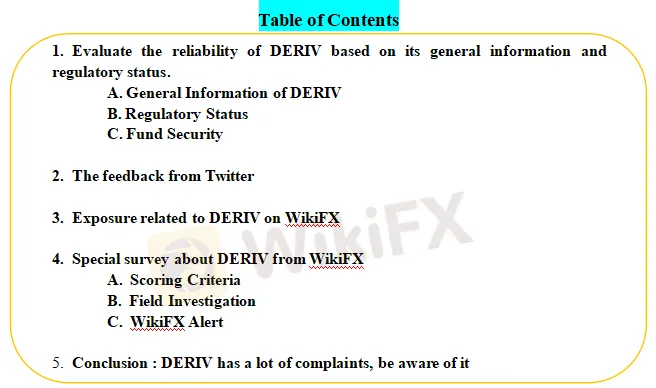

In this article

WikiFX provides inquiry services in the forex field.

WikiFX evaluates the reliability of DERIV based on the facts.

What is WikiFX?

| WikiFX is an authoritative global inquiry platform providing basic information inquiry and regulatory license inquiry. |

| WikiFX is able to evaluate the safety and reliability of more than 31,000 global forex brokers. |

| WikiFX gives you a huge advantage while seeking the best forex brokers. For more information, such as the review and exposure of brokers, please visit our website (https://www.WikiFX.com/en) |

To explore whether DERIV is a scammer or not, we evaluated DERIV from different aspects, such as regulatory status, exposure, etc.

1. Evaluate the reliability of DERIV based on its general information and regulatory status.

(source: DERIV website)

To understand DERIV better, we explore DERIV by analyzing three main perspectives:

A. General Info of DERIV

B. Regulatory Status

C. Funds Security

A. General Info of DERIV

DERIVs general info has been shown below:

(source: WikiFX)

(source: WikiFX)

The website of DRCFX supports 11 different languages, including English and Chinese(simplified/traditional).

Market Instruments

DERIV offers traders a wide range of financial products, including Forex currency pairs, composite indices, stock indices, and commodities.

Minimum Deposit

DERIV offers three trading types: margin trading, options trading, and multiplier options trading. Margin trading allows investors to purchase larger units of assets at a fraction of the cost while expanding potential profits but also increasing potential losses at the same time. Options trading allows payouts to be obtained by predicting market movements without the need to purchase the underlying asset—trading digital options at forex. Multiplier options allow trading with leverage while limiting the downside risk of an investment. Traders can increase their potential profits to the limit by multiplying any market movement by several times without having to take on more risk than their initial investment.

Leverage

DERIV offers flexible leverage up to 1:1000. This allows users to take larger position sizes by putting down a small deposit, known as margin, to increase potential returns. Margin requirements and leverage levels vary depending on the account and jurisdiction you register an account from. In the EU, for example, regulations limit the leverage retail traders can use on FX major currency pairs to 1:30.

Spreads & Commissions

On the DERIV platform, average spreads and commission data is limited. Additionally, a dormant fee may be charged to accounts inactive for a period of 12 months.

Trading Platforms

DERIV offers traders a choice of trading platforms, including Dtrader, DBot, DMT5, and SmartTrader. DMT5 is an all-in-one Forex and CFD trading platform.

Deposit & Withdrawal

DERIV accepts deposits and withdrawals from traders' investment accounts via bank transfer, debit/debit cards, e-wallets, and cryptocurrency payments.

Trading Hours

Trading is available 24/7, following respective market operating hours. With that said, weekend trading usually sees a reduction in volume, resulting in less competitive spreads.

(source : WikiFX)

B. Regulatory Status

The legitimate license of DERIV

(source: DERIV website)

DERIV claims itself to be licensed and regulated broker, however, according to WikiFX, the license that DERIV has are suspicious clones. DERIV currently doesn‘t hold a legitimate license. It isn’t regulated by any regulatory institution, which means you cant withdraw your money if something goes wrong. Be aware of the potential risk.

(source: WikiFX)

C. Funds Security

(source: DERIV website)

According to its website, DERIV guarantees clients‘ money is under protection. It said “you are allowed to withdraw your money at any time. All your money is segregated and held in secure financial institutions.” Account segregation is imperative since it allows traders to have access to their funds all the time. Even if the broker is bankrupt, traders will still be capable of getting their money back. However, it doesn’t mention what exactly “secure financial institutions”refer to.

2. The feedback from Twitter

To figure out whether DERIV is a scammer or not, we made a survey about DERIV on Twitter.

Reviews on Twitter:

(source: Twitter)

DERIV does have an official account on Twitter. And they have around 14.6K followers. It looks like a very active account. DERIV showed us some events, such as IFX Expo Dubai, they recently participated in.

(source: Twitter)

One trader complaints that DERIV seemed to have behavior of manipulating funds.

3. Exposure related to DERIV on WikiFX

On WikiFX, the Exposure consists of feedback from traders. A bad track record of brokers can be checked via Exposure. WikiFXs Exposure function helps you get feedback from other traders and remind you of the risks before it starts.

As of February 24, 2022, the number of complaints received by WikiFX against this broker reached 24 in the past 3 months. The majority were talking about the withdrawal refusal. Some of traders claimed that their funds were under the manipulation of DERIV. Some of them were unhappy with the poor support service.

4. Special survey about DERIV from WikiFX

A. Scoring Criteria

WikiFX gives brokers a score from 0 to 10. The higher the score is, the more reliable the broker is.

| The Scoring Criteria of Brokers on WikiFX |

| License index: reliability and value of licenses |

| Regulatory index: license regulatory strength |

| Business index: enterprise stability and operational capability |

| Software index: trading platform,instruments etc |

| Risk management index: the degree of asset security |

According to WikiFX, DERIV has been given a very low rating of 1.36/10.

(source:WikiFX)

Please note that the broker with such a low score can be a potential scammer .

B. Field Investigation

In order to help you fully understand the broker, WikiFX also investigates the brokers by sending surveyors to the brokers physical addresses.

On WikiFX, you can visually check the physical addresses of brokers by pressing the “Survey” button.

As of February 24th 2022. WikiFX didnt do a site survey on DERIV.

C. WikiFX Alerts

| The number of complaints received by WikiFX against this broker reached 24 in the past 3 months |

| The MFSA regulatory information (license number: C 70156) claimed by this broker is a suspicious clone |

| The Virgin Islands FSC regulatory information(license number: SIBA/L/18/1114) claimed by this broker is a suspicious clone |

| The VFSC regulatory information(license number: Unreleased) claimed by this broker is a suspicious clone |

| The Virgin Islands FSC regulatory status with license number: SIBA/L/18/1114 is offshore regulation. |

| The VFSC regulatory status with license number: Unreleased is offshore regulation. |

| Current data shows that this broker is using Non MT4/5 Software |

(source: WikiFX)

5. Conclusion

As long as many people are unable to withdraw their money from DERIV, we dont advise you to invest in this broker. Besides, the licenses that DERIV hold are suspicious clones, so we assure DERIV is an unlicensed broker that may take your money away fraudulently. Thus, the reliability of DERIV is questionable. WikiFX contains details of more than 31,000 global forex brokers, which gives you a huge advantage while seeking the best forex brokers. If you want to know more information about the reliability of certain brokers, you can open our website (https://www.WikiFX.com/en). Or you can download the WikiFX APP for free through this link (https://www.wikifx.com/en/download.html). Running well in both the Android system and the IOS system, the WikiFX APP offers you the easiest and most convenient way to seek the brokers that you are curious about.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Bank Negara Malaysia Flags 12 New Companies for Unauthorised Activity

Bank Negara Malaysia (BNM) has updated its Financial Consumer Alert List (FCA List) by adding 12 more entities, reinforcing its efforts to warn the public against unregulated financial schemes. Check if your broker made the list!

March Oil Production Declines: How Is the Market Reacting?

Oil production cuts in March are reshaping the market. Traders are closely watching OPEC+ decisions and supply disruptions, which could impact prices and future production strategies.

How to Calculate Leverage and Margin in the Forex Market

Leverage amplifies both potential profits and risks. Understanding how to calculate leverage and margin helps traders manage risks and avoid forced liquidation.

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

In the world of online trading, the promise of quick profits and seamless transactions often masks a darker reality. One of the most insidious tactics employed by fraudulent brokers is blocking withdrawals, that is a deliberate strategy designed to trap traders and investors into paying more money under false pretences.

WikiFX Broker

Latest News

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

U.S. March ISM Manufacturing PMI Released

Should You Beware of Forex Trading Gurus?

Exposed by SC: The Latest Investment Scams Targeting Malaysian Investors

Currency Calculator