简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

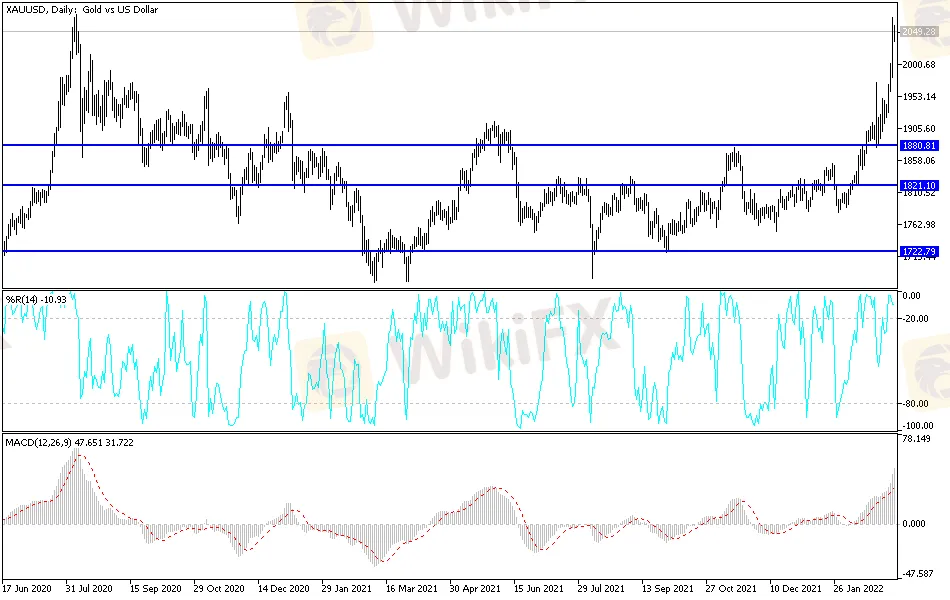

Gold Technical Analysis: Overbought Sharp Levels

Abstract:It should be noted that if the crisis calms down and the negotiation succeeds, and the military operations decrease, they may bring strong sales to reap the profits and return the gold price towards the support of 1960 dollars as a first stage.

It should be noted that if the crisis calms down and the negotiation succeeds, and the military operations decrease, they may bring strong sales to reap the profits and return the gold price towards the support of 1960 dollars as a first stage.

Gold prices rose sharply on Tuesday as the price of gold jumped towards the resistance level of $ 2070 an ounce, near the top of the fears of the COVID-19 pandemic. The weak dollar also contributed to the sharp rise in the yellow metal. The US Dollar Index DXY fell to as low as 98.71 before rebounding to 98.90, still sharply lower from the previous close at 99.29.

The United States is said to be planning to impose a ban on Russian oil imports without cooperating with its allies in Europe. However, a final decision has not been made yet. Meanwhile, the third round of talks between Ukraine and Russia failed to reach agreement on evacuation corridors from several besieged cities on Monday, with many roads leading to Russia or its ally Belarus.

Reflecting a jump in imports and a sharp decline in exports, the Commerce Department released a report on Tuesday showing the US trade deficit widened more than expected in January. In this regard, the Commerce Department said that the trade deficit rose to 89.7 billion dollars in January from 82.0 billion dollars in December.

Economists had expected the deficit to rise to $87.1 billion from originally $80.7 billion from the previous month. With the larger-than-expected increase, the trade deficit reached a new record high. Commenting on the results, Maher Rashid, an economist at Oxford Economics, said, “Our expectations see exports growing at a faster pace than imports this year, with domestic demand moderating, especially in the second half of the year.”

“But the recent appreciation of the dollar amid the war in Europe may limit demand for exports while imports become relatively cheaper,” he added. “Conversely, with inflation risks tilting to the upside, imports face similar headwinds if consumption slows more than expected.”

The wider trade deficit came with the value of imports rising 1.2 percent to $314.1 billion in January, after rising 1.7 percent to $310.3 billion in December. The report showed a marked increase in imports of automobiles and auto parts, industrial supplies, materials, food, and beverages. Meanwhile, the value of exports fell 1.7 percent to $224.4 billion in January after jumping 1.5 percent to $228.3 billion in December. The sharp decline in exports reflected a sharp decline in pharmaceutical exports as well as a significant drop in exports of travel services. The report also showed the goods deficit widening to $108.9 billion in January from $101.8 billion in December, while the services surplus decreased to $19.2 billion from $19.8 billion.

According to the technical analysis of gold: There is no doubt that the recent gains in the gold market pushed the technical indicators towards strong saturation levels, but it is necessary to consider that the continuation of the Russian war and its negative consequences on the future of global economic recovery and the plans of global central banks provide a fertile environment for the price of gold to continue breaking new historical highs. Accordingly, the purchase will be in a limited space with the placement of stop-loss orders, as everything is expected considering the continuation of the crisis. Currently, the closest targets for the bulls are 2085 and 2110, respectively.

It should be noted that if the crisis calms down and the negotiation succeeds, and the military operations decrease, they may bring strong sales to reap the profits and return the gold price towards the support of 1960 dollars as a first stage.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Bitcoin in 2025: The Opportunities and Challenges Ahead

BI Apprehends Japanese Scam Leader in Manila

Join the Event & Level Up Your Forex Journey

Is There Still Opportunity as Gold Reaches 4-Week High?

Bitcoin miner\s claim to recover £600m in Newport tip thrown out

Good News Malaysia: Ready for 5% GDP Growth in 2025!

FXCL Lucky Winter Festival Begins

Warning Against MarketsVox

Is the stronger dollar a threat to oil prices?

Rising Risk of Japan Intervening in the Yen's Exchange Rate

Currency Calculator