简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Large Investors Building Heavy Short Positions for Bitcoin (BTC)

Abstract:The Bitcoin (BTC) price is down another 3% on the backdrop of unfavorable global macros and rising inflation. So if you think that this might be the right time to average, you might want to wait a little bit more.

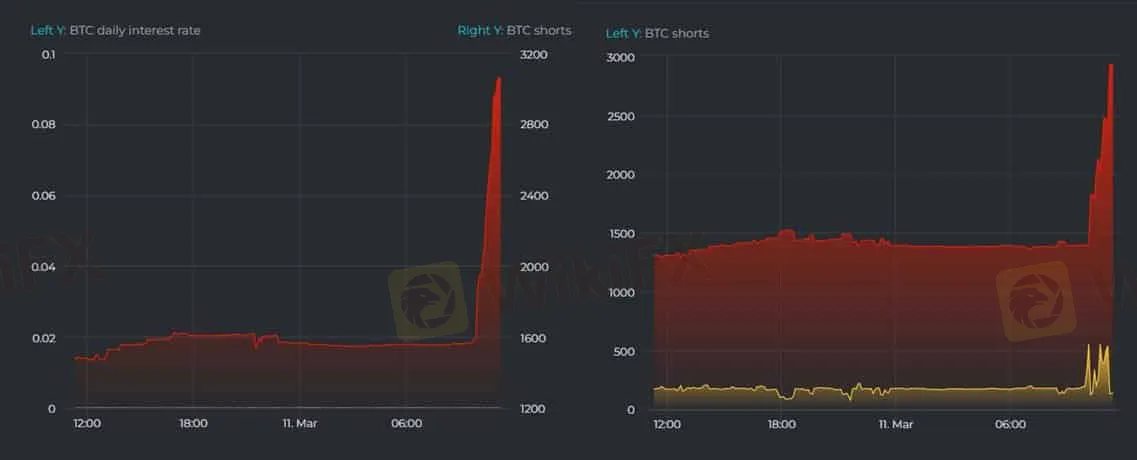

According to datamish, in the past 2 hours, some large investors (or institutions) have borrow about 1,500 BTC from Bitfinex for short positions. At present, a total of 3,063 BTC have been lent, and most of the short positions are non-hedging.

The worlds largest cryptocurrency Bitcoin has been gripped under strong volatility over the last two weeks. In this period, the Bitcoin price surged past $40,000 levels twice, however, it failed to hold it and has been trading under pressure on the downside.

However, if the massive build-up of the short positions turns true, we can see Bitcoin heading under $35,000 and all the way further to $30,000. Many analysts havent ruled out the possibility that the BTC price can once again touch under $30K levels.

Bitcoin Levels to Watch

We have seen Bitcoin showing large volatility in the range between $35K-$45K. However, every time it approaches $45K, it faces strong resistance to head lower. Crypto analyst Lark Davis explains:

I dont think that there is much to get excited about until we see Bitcoin cross back above this zone of resistance, and ideally back above the 200 day moving average. Until then, I will just keep stacking.

On the other hand, with the growing inflation numbers, the market will continue to be volatile going ahead. The Fed interest rate hikes are expected in the coming weeks and months and this time it could be more aggressive due to higher inflation.

While Bitcoin serves a great investment for the long term, one needs to be patient with all the short-term volatility.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

IG 2025 Most Comprehensive Review

This article evaluates the broker from multiple dimensions, including a basic introduction, fees, safety, account opening, and trading platforms.

EXNESS 2025 Most Comprehensive Review

This article evaluates the broker from multiple dimensions, including a basic introduction, fees, safety, account opening, and trading platforms.

WikiFX Review: Is IVY Markets Reliable?

IVY Markets, established in 2018, positions itself as a global brokerage offering a diverse range of trading instruments, including Forex, Commodities, Cryptocurrencies, and Stocks. The platform provides two primary account types—Standard and PRO—with a minimum deposit requirement of $50 and leverage up to 1:400.

B2BROKER Launches PrimeXM XCore Support for Brokers

B2BROKER launches PrimeXM XCore support and maintenance services, enhancing trading efficiency for brokers with expert management and optimization.

WikiFX Broker

Latest News

Germany's Election: Immigration, Economy & Political Tensions Take Centre Stage

WikiFX Review: Is IVY Markets Reliable?

IG 2025 Most Comprehensive Review

Construction Datuk Director Loses RM26.6 Mil to UVKXE Crypto Scam

SEC Drops Coinbase Lawsuit, Signals Crypto Policy Shift

Top Profitable Forex Trading Strategies for New Traders

EXNESS 2025 Most Comprehensive Review

ED Exposed US Warned Crypto Scam ”Bit Connect”

New SEC Chair Paul Atkins Targets Crypto Regulation Reform

WikiFX Elites Club —— Fun Spring Camping in Malaysia Successfully Concluded!

Currency Calculator