简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Unable to make a withdrawal? WikiFX investigated the reliability of EXANTE

Abstract:What does EXANTE look like? “My withdrawals have been delayed for three months.” “I checked the bank card number twice before I withdraw while the customer service said my card number was wrong and I have to pay 20% as the unfreezing fund!” With the experience of many years, EXANTE has been providing clients with global multi-asset financial services. However, reports of withdrawal problems have increased recently. Traders are unlikely to feel comfortable if they have continued withdrawal problems. If you want to know whether EXANTE is a reliable forex broker or not, please continue to read.

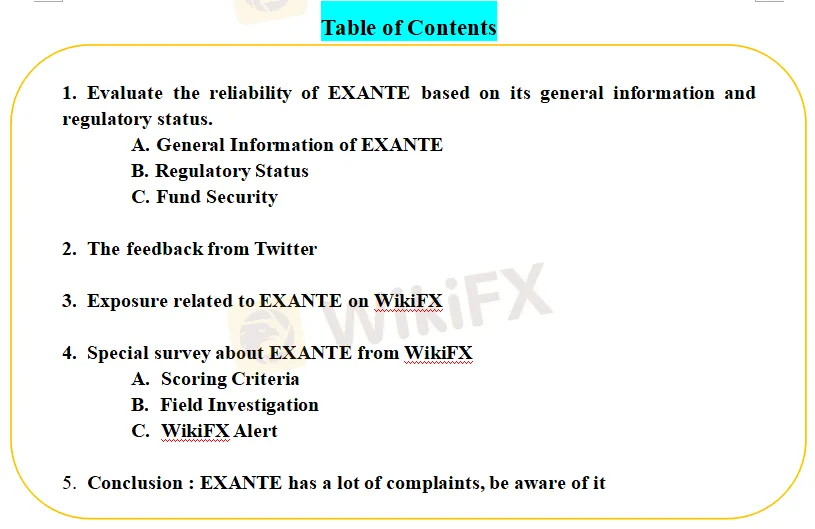

In this article

WikiFX provides inquiry services in the forex field.

WikiFX evaluates the reliability of EXANTE based on the facts.

What is WikiFX?

| WikiFX is an authoritative global inquiry platform providing basic information inquiry and regulatory license inquiry. |

| WikiFX is able to evaluate the safety and reliability of more than 31,000 global forex brokers. |

| WikiFX gives you a huge advantage while seeking the best forex brokers. For more information, such as the review and exposure of brokers, please visit our website (https://www.WikiFX.com/en) |

To explore whether EXANTE is a scammer or not, we evaluated EXANTE from different aspects, such as regulatory status, exposure, etc.

1. Evaluate the reliability of EXANTE based on its general information and regulatory status.

(source: Website)

To understand EXANTE better, we explore EXANTE by analyzing three main perspectives:

A. General Info of EXANTE

B. Regulatory Status

C. Fund Security

A. General Info of EXANTE

EXANTE s general info has been shown below:

(source: WikiFX)

(source: WikiFX)

EXANTE is the trading name of XNT Ltd or EXT Ltd, an investment services firm established in 2011, providing global multi-asset financial services

EXANTE directly access to over 50 financial markets through one account.

According to EXANTEs website, EXANTE supports ten different languages, including English, Chinese and Russian.

a. Market Instruments

Investors can trade currencies (more than 50 currency pairs), metals (gold, silver, copper, platinum, and palladium), futures, options, funds, bonds, as well as stocks and exchange-traded funds on the financial markets through the EXANTE.

b. Minimum Deposit

To open an account with the broker, a deposit of 10,000 Euros is required for a basic account for individuals and 50,000 for a corporate account, with currency gains and losses borne by traders.

c. Leverage

The maximum leverage level offered by EXANTE is up to 1:50, which is considered a low ratio, however this broker obviously targets big investors with capital to spare, who supposedly dont need high leverage levels.

d.Spreads & Commissions

Spreads for EUR/USD are 0.3 pips, GBPUSD spreads are 0.5 pips, and EURGBP spreads are 0.7 pips. The maximum rate on major US exchanges is $0.02 per share, and on European exchanges, the fees range from 0.02% to 0.18%. Transactions on major European exchanges (such as Euronext Brussels or Euronext Paris) are subject to a 0.05% commission. The company allows investors to access major Asian exchanges with fees ranging from 0.1% on the Tokyo exchange to 0.1927% on the Hong Kong exchange. The overnight fee applies to short positions and foreign exchange and is calculated as follows: (position value * interest rate / 360) * days = overnight fee amount.

e. Trading Platform

EXANTE does not yet offer traders MT4 & MT5 trading platforms. Currently, the company supports the trading platforms EXANTE for desktop and mobile devices.

f.Deposit & Withdrawal

The company supports wire transfers for withdrawals and deposits with a minimum deposit of 10,000 Euros and a withdrawal fee of 30 Euros or the corresponding currency equivalent. Withdrawals are processed within 3 to 5 banking days.

g.Customer Support

The EXANTE customer support can be reached through several channels, including telephone, email, and live chat. Traders can also get some basic answers via the ' FAQ' section on the page.

(source:WikiFX)

B. Regulatory Status

The legitimate license of EXANTE

EXANTE is a licensed broker. XNT LTD is authorized and regulated by the Malta Financial Services Authority (MFSA) with regulatory license number C 52182; EXT Ltd authorized and regulate by the Cyprus Securities and Exchange Commission(CySEC) with regulatory license number 165/12. However, according to WikiFX, the regulatory status of FCA (license number: 620980) is Revoked. And the SFC regulatory (license number: BNN565) claimed by this broker is a suspicious clone.

(source:WikiFX)

C. Fund Security

As a broker regulated by CySEC, EXANTE needs to keep the clients funds on segregated bank accounts. Account segregation is imperative since it allows traders to have access to their funds all the time. Even if the broker is bankrupt, traders will still be capable of getting their money back.

(source: WikiFX)

2. The feedback from Twitter

(Source:Twitter)

EXANTE has an official account on Twitter. It joined Twitter on September 2011, as of February 28th, 2022. It produces more than 3000 Tweets. it has around 1400 followers recently.

3. Exposure related to EXANTE on WikiFX

On WikiFX, the Exposure consists of feedback from traders. A bad track record of brokers can be checked via Exposure. WikiFXs Exposure function helps you get feedback from other traders and reminds you of the risks before it starts.

(source: WikiFX)

These traders complaints that they can not withdraw money from EXANTE. Some trader said he/she can‘t open his/her account, and no one help him/her. Some trader said EXANTE made excuses to delay the withdrawal. Another trader claimed EXANTE asked him/her to keep investing. The trader can’t withdraw all the money eventually.

4. Special survey about EXANTE from WikiFX

A. Scoring Criteria

WikiFX gives brokers a score from 0 to 10. The higher the score is, the more reliable the broker is.

| The Scoring criteria of Brokers on WikiFX |

| Lisence index: reliability and value of licenses |

| Regulatory index: license regulatory strength |

| Business index: enterprise stability and operational capability |

| Software Index: trading platform,instruments etc |

| Risk Management index: the degree of asset security |

According to WikiFX, EXANTE has been given a decent rating of 6.63/10.

(source:WikiFX)

It seems that EXANTE is very poor at risk management. Risk management includes the measurement, assessment, and contingency strategy of risk. Ideally, risk management is a series of prioritized events. EXANTE seems not to have enough capital and good strategies to secure clients assets in the unstable market. This may be one of the reasons why EXANTE makes so many traders angry.

B. Field Investigation

To help you fully understand the broker, WikiFX also investigates the brokers by sending surveyors to the brokers physical addresses.

On WikiFX, you can visually check the physical addresses of brokers by pressing the “Survey” button.

As of February 28th, 2022. WikiFX didnt do a site survey on EXANTE yet.

C. WikiFX Alerts

| The number of the complaints against this broker received by WikiFX reached 13 in the past 3 months. |

| FCA (license number: 620980) The regulatory status is abnormal, the official regulatory status is Revoked |

| The SFC regulatory (license number: BNN565) claimed by this broker is a suspicious clone. |

| Current data shows that this broker is using Non MT4/5 Software |

5. Conclusion:

EXANTE is an licensed broker that is strictly regulated by several authorities. However, due to so many complaints from the traders, we advise you to do more research and be aware of the potential risks. Non MT4/5 platforms makes EXANTE less attractive for the traders. If you want to know more information about the reliability of certain brokers, you can open our website (https://www.WikiFX.com/en). Or you can download the WikiFX APP for free through this link (https://www.wikifx.com/en/download.html). Running well in both the Android system and the IOS system, the WikiFX APP offers you the easiest and most convenient way to seek the brokers you are curious about.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

INFINOX Partners with Acelerador Racing for Porsche Cup Brazil 2025

INFINOX has teamed up with Acelerador Racing, sponsoring an Acelerador Racing car in the Porsche Cup Brazil 2025. This partnership shows INFINOX’s strong support for motorsports, adding to its current sponsorship of the BWT Alpine F1 Team.

The Daily Habits of a Profitable Trader

Every professional trader follows a structured approach to ensure they are well-prepared, disciplined, and able to seize opportunities with confidence. Whether you are a seasoned investor or an aspiring trader, adhering to a robust daily checklist can significantly enhance your performance. Use this checklist to check if you are a qualified trader

How a Housewife Lost RM288,235 in a Facebook Investment Scam

A 47-year-old housewife in Malaysia recently fell victim to an online investment scam, losing a substantial sum of RM288,235 after engaging with a fraudulent scheme advertised on Facebook.

A Trader’s Worst Mistake: Overlooking Broker Reviews Could Cost You Everything

In today’s digital age, reviews influence nearly every decision we make. When purchasing a smartphone, television, or home appliance, we pore over customer feedback and expert opinions to ensure we’re making the right choice. So why is it that, when it comes to choosing an online broker where real money and financial security are at stake many traders neglect the crucial step of reading reviews?

WikiFX Broker

Latest News

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

INFINOX Partners with Acelerador Racing for Porsche Cup Brazil 2025

The Impact of Interest Rate Decisions on the Forex Market

Billboard Warns of Crypto Scams Using Its Name – Stay Alert!

STARTRADER Spreads Kindness Through Ramadan Campaign

How a Housewife Lost RM288,235 in a Facebook Investment Scam

Rising WhatsApp Scams Highlight Need for Stronger User Protections

A Trader’s Worst Mistake: Overlooking Broker Reviews Could Cost You Everything

The Daily Habits of a Profitable Trader

Currency Calculator