简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

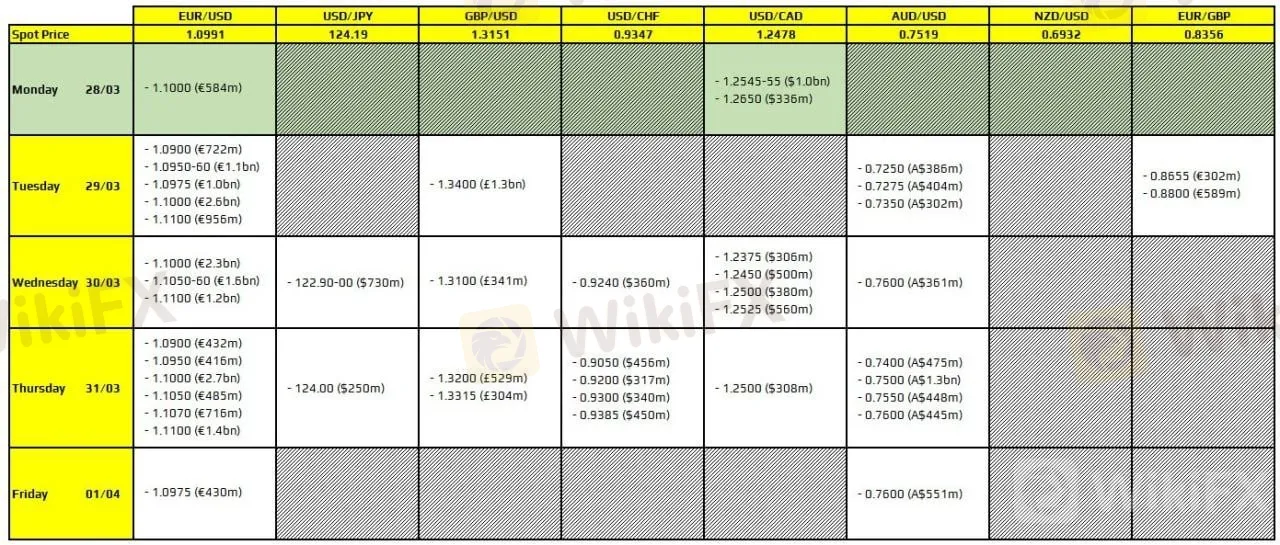

Financial Institution and Bank Orders

Abstract:FX Market Update

FX Market Update—The USD is trading generally higher on the session, and the DXY is

breaking out of its March consolidation range, as US yields continue to push higher and

markets price in an ever more aggressive Fed. The 10Y US Treasury bond yield is trading a

little over 2.50%, helping drive a near 2% sell-off in the JPY today alone. The BoJ also

announced that it would buy an unlimited amount of bonds for the next three days to cap

domestic yields at 0.25%, underscoring its divergence with the global trend in long-term

rates and the tilt towards tighter monetary policy in may countries. The USD reached

JPY125 for the first time since 2015 and is trading higher against most of its G10 peers.

European stocks are firmer, despite the broader sell off in fixed income, but US equity

futures are trading in the red. Chinese stocks fell as China announced a sweeping

lockdown and testing regime in Shanghai to combat Covid. The move is likely to have

significant ramifications for Chinese growth and could spill over as another headwind for

global activity as investors continue to mull the fall out from the Ukraine war. Crude oil is

down nearly 4% at writing in response, with copper also displaying some softness in

overnight trade (while iron ore is trading marginally higher). Yields will remain the focus

for markets this week, with another strong NFP report Friday liable to cement

expectations that the Fed will up the pace of tightening at the May and perhaps beyond.

We remain broadly bullish on the outlook for the USD.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Interactive Brokers introduces Forecast Contracts in Canada, enabling investors to trade on economic, political, and climate outcomes. Manage risk with ease.

Bank Negara Malaysia Flags 12 New Companies for Unauthorised Activity

Bank Negara Malaysia (BNM) has updated its Financial Consumer Alert List (FCA List) by adding 12 more entities, reinforcing its efforts to warn the public against unregulated financial schemes. Check if your broker made the list!

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

IG Group acquires Freetrade for £160M, boosting its UK investment offerings. Freetrade to operate independently, with plans for growth and innovation.

Exposing the Top 5 Scam Brokers of March 2025: A Closer Look by WikiFX

In its latest report for March 2025, WikiFX has released a cautionary ranking of brokers that have raised significant red flags within the trading community. These five platforms, marked by alarmingly low scores, serve as stark reminders of the importance of due diligence when selecting a broker. Below is an in-depth look at each one.

WikiFX Broker

Latest News

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

Stocks fall again as Trump tariff jitters continue

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

Currency Calculator