Score

SVSFX

United Kingdom|5-10 years|

United Kingdom|5-10 years| https://www.svssecurities.com/

Website

Rating Index

Contact

Licenses

Licenses

Licensed Entity:SVS Securities Plc

License No. 220929

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

United Kingdom

United KingdomAccount Information

Users who viewed SVSFX also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Pepperstone

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

IC Markets Global

- 15-20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

FBS

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Website

Most visited countries/areas

India

svssecurities.com

Server Location

United States

Website Domain Name

svssecurities.com

Website

WHOIS.REGISTER.COM

Company

REGISTER.COM, INC.

Domain Effective Date

2002-12-18

Server IP

104.28.5.202

svsmarkets.com

Server Location

United States

Website Domain Name

svsmarkets.com

Website

WHOIS.GODADDY.COM

Company

GODADDY.COM, LLC

Domain Effective Date

2016-09-11

Server IP

172.67.201.38

svsfx.com

Server Location

United Kingdom

Most visited countries/areas

India

Website Domain Name

svsfx.com

ICP registration

沪ICP备17022567号-1

Website

WHOIS.REGISTER.COM

Company

REGISTER.COM, INC.

Domain Effective Date

0001-01-01

Server IP

178.238.129.84

Genealogy

VIP is not activated.

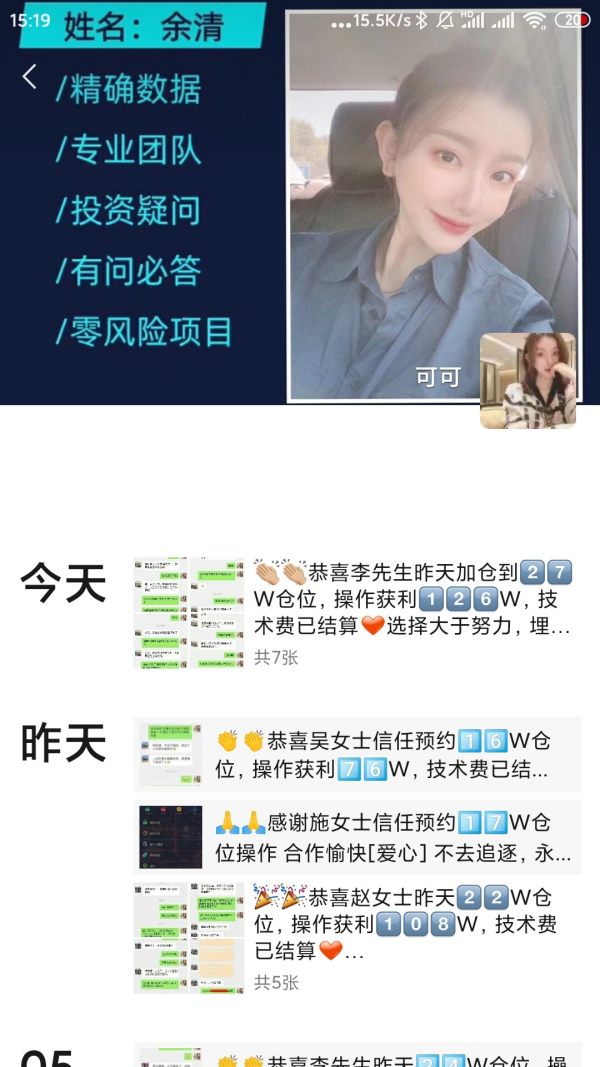

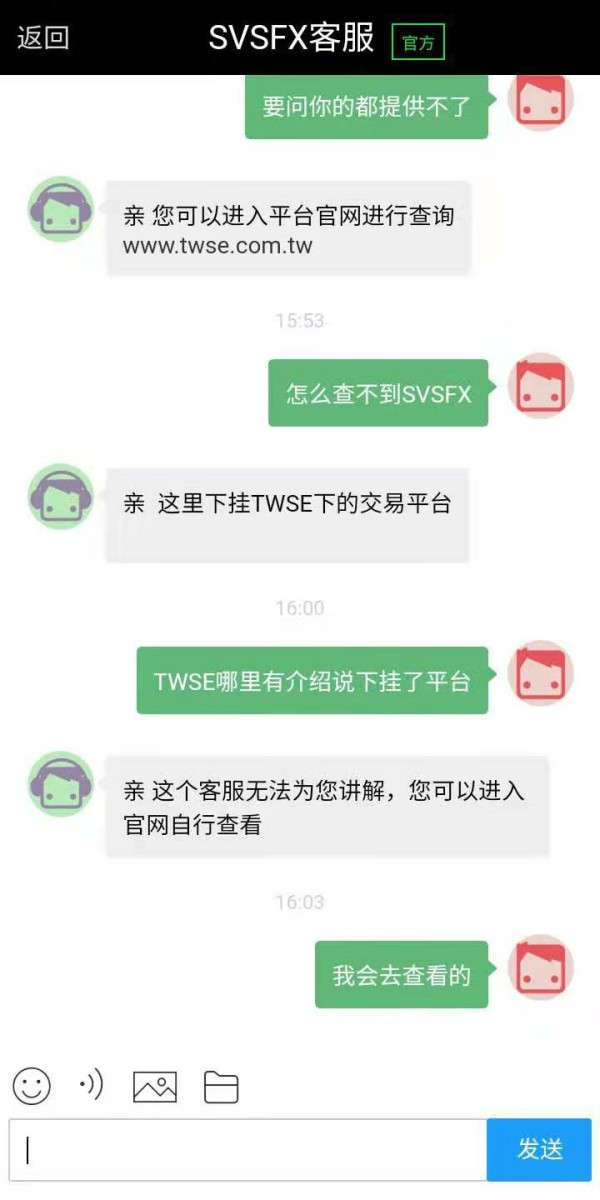

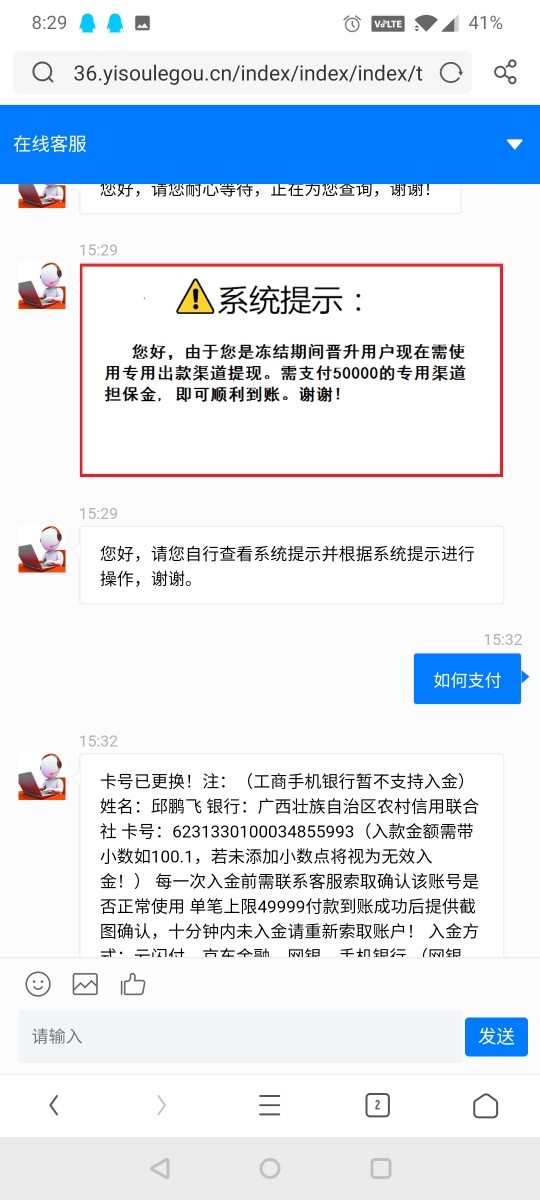

VIP is not activated.Fake SVSFX

Fake SVSFX

Fake SVSFX

Relevant Enterprises

Company Summary

| Aspect | Information |

| Company Name | SVSFX |

| Registered Country/Area | London, UK |

| Founded year | 2003 |

| Regulation | Revoked by FCA |

| Market Instruments | FX, CFDs |

| Account Types | Professional, Standard |

| Minimum Deposit | 500 USD |

| Maximum Leverage | 400:1 |

| Spreads | EURUSD/0.6-0.8 |

| Trading Platforms | MT4 (Desktop, Web, Mobile) |

| Customer Support | Phone +44 (0)20 3700 0106cn.support@svsfx.comsupport@svsfx.comhelp@svsfx.comi.support@svsfx.com |

| Deposit & Withdrawal | Credit/Debit Cards, e-wallets, bank transfers |

Overview of SVSFX

SVSFX, established in 2003 and based in London, UK, operates as an online broker supporting FX and CFDs trading for retail and institutional clients.

Despite its long-standing presence, the brokerage faces notable drawbacks. While offering a range of trading assets including currency pairs and CFDs, its regulatory status is risky, particularly after the revocation of regulation by the FCA. Traders may find limited regulatory oversight unsettling, impacting their confidence in the platform. Additionally, accessibility issues with the official website hinder user experience, potentially frustrating traders seeking efficient and reliable trading services.

Is SVSFX Legit or a Scam?

The revocation of SVSFX's regulation by the FCA, the Financial Conduct Authority, marks a significant shift in the regulatory landscape for traders on the platform.

The FCA's revocation of SVSFX's license implies that the brokerage no longer operates under the stringent oversight and regulatory framework set forth by one of the most reputable financial regulatory bodies globally. As a result, traders face increased risk exposure due to the absence of regulatory protections and oversight mechanisms.

Pros and Cons

| Pros | Cons |

| Wide range of market instruments including currency pairs, CFDs covering global indices, commodities, energy products, and precious metals | Negative exposure, including pyramid scheme complaints and scam allegations |

| Access to the popular MT4 trading platform via desktop, web, and mobile apps | Official website inaccessible |

| Limited contact options and potentially confusing hotline numbers for customer support | |

| Additional deposit and withdrawal fees for certain payment methods | |

| Revoke the regulation by the FCA |

Pros:

Wide range of market instruments: SVSFX offers traders a wide selection of trading instruments, including various currency pairs, global indices, commodities, energy products, and precious metals.

Access to the popular MT4 trading platform: Traders using SVSFX have access to the MetaTrader 4 (MT4) platform, which is widely regarded as one of the most popular and user-friendly trading platforms in the industry.

Cons:

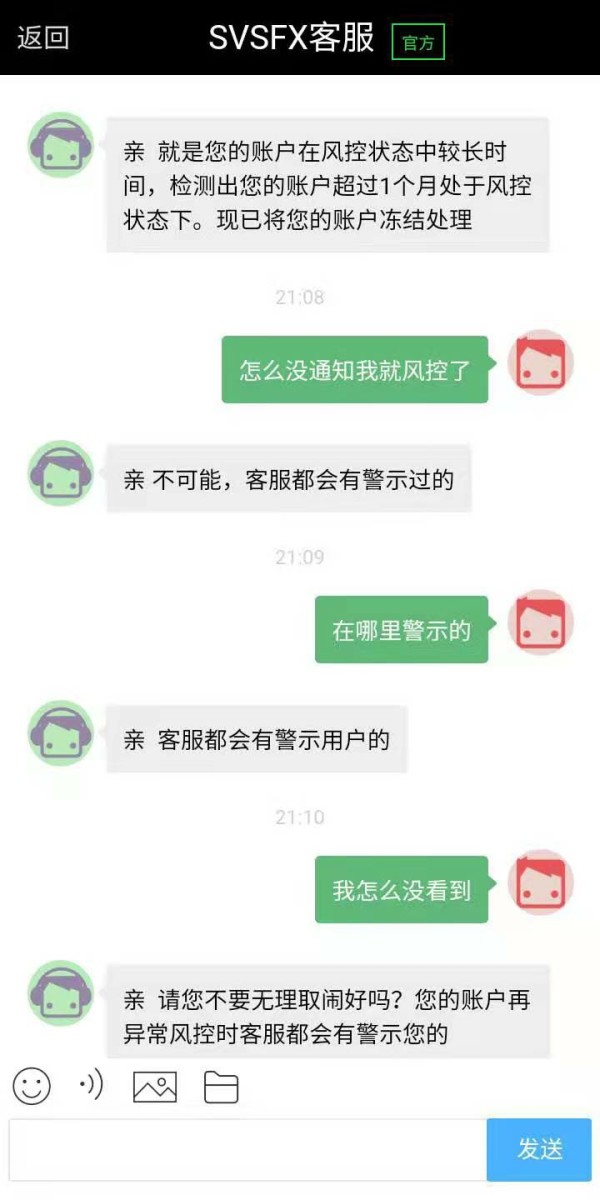

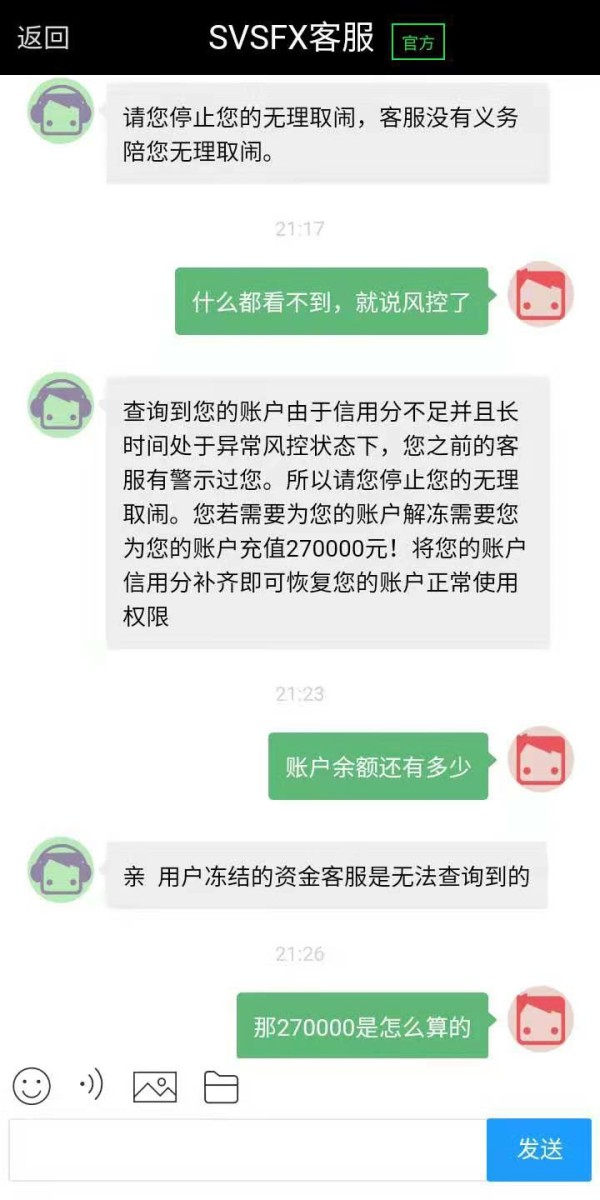

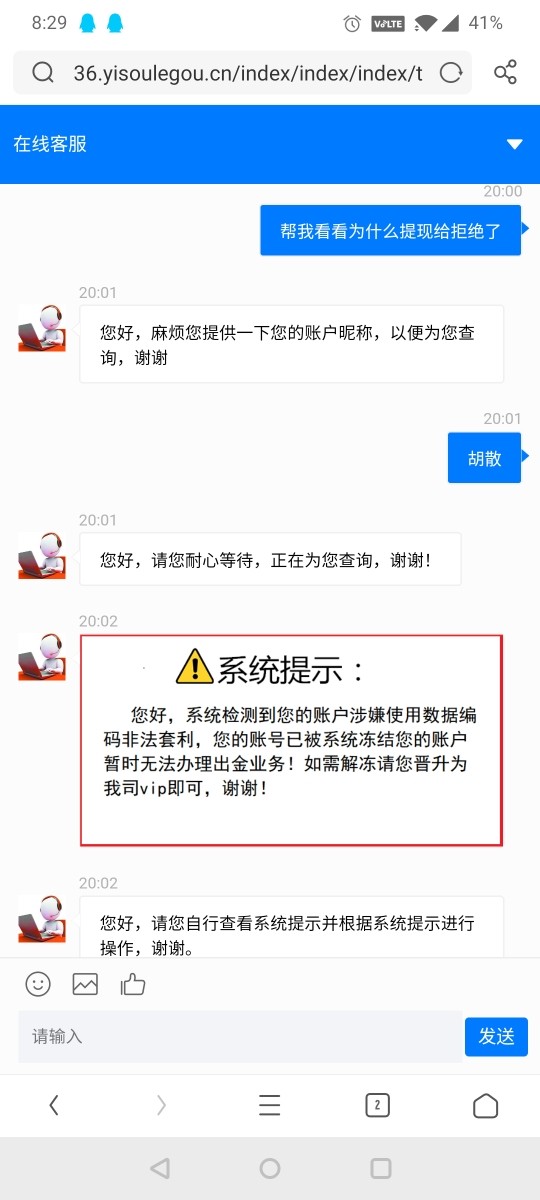

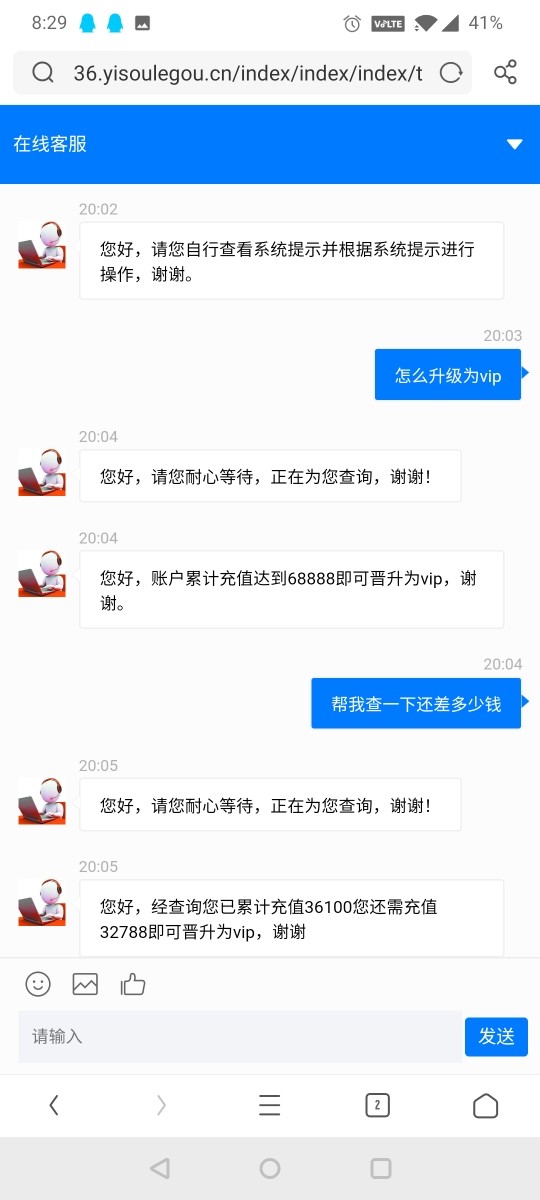

Negative exposure: SVSFX has faced negative exposure due to pyramid scheme complaints and scam allegations.

Official website inaccessible: The accessibility issues with SVSFX's official website can pose significant challenges for traders, especially when trying to access important account information, execute trades, or seek assistance from customer support.

Limited contact options and confusing hotline numbers: SVSFX's customer support suffers from limited contact options and potentially confusing hotline numbers, making it difficult for traders to reach out for assistance when needed.

Additional deposit and withdrawal fees: Traders using certain payment methods may incur additional deposit and withdrawal fees when using SVSFX.

Revocation of FCA regulation: The revocation of SVSFX's regulation by the FCA (Financial Conduct Authority) raises risks about the platform's adherence to regulatory standards and investor protection measures.

Market Instruments

SVSFX offers a wide array of trading assets, featuring currency pairs encompassing major, minor, and exotic options, exceeding 50 pairs. Recent enhancements have further enriched this selection.

Additionally, traders can access CFDs covering global indices, commodities, energy products, and precious metals.

Account Types

The Professional account is tailored for experienced traders and institutional investors seeking advanced trading features. With a maximum leverage of 200:1, it offers significant trading flexibility. The minimum deposit requirement of 10,000 USD reflects a commitment to accommodating high-volume traders who require substantial capital. Additionally, the tighter spreads on currency pairs like EURUSD and commodities like Gold, ranging from 0.6 to 2.0 pips, contribute to cost-effective trading.

On the other hand, the Standard account is suitable for a broader audience, including retail traders and those new to the market. With a maximum leverage of 400:1, it offers ample trading opportunities while requiring a more modest minimum deposit of 500 USD, making it accessible to a wider range of users. Although the spreads are slightly wider compared to the Professional account, ranging from 1.8 to 4.0 pips on EURUSD and Gold, respectively, this account type still provides access to popular trading instruments such as foreign exchange, precious metals, and CFDs.

| Professional account | Standard account | |

| Maximum Leverage | 200:1 | 400:1 |

| Minimum Deposit | 10,000 USD | 500 USD |

| Minimum Spread | EURUSD/0.6-0.8 Gold/2.0 | EURUSD/1.8 Gold/4.0 |

| Products | Foreign exchange, precious metals,CFDs | Foreign exchange, precious metals,CFDs |

| Minimum Position | 0.01 lot | 0.01 lot |

Leverage

SVSFX offers varying maximum leverage depending on the account type chosen.

For the Professional account, the maximum leverage stands at 200:1, providing experienced traders and institutional investors with substantial trading flexibility.

On the other hand, the Standard account offers a higher maximum leverage of 400:1, making it accessible to a broader range of users, including retail traders and newcomers to the market.

Spreads & Commissions

SVSFX offers competitive spreads and commissions across its different account types.

For the Professional account, spreads are notably tighter, with EURUSD spreads ranging from 0.6 to 0.8 pips and Gold spreads at 2.0 pips.

Conversely, the Standard account features slightly wider spreads, with EURUSD spreads ranging from 1.8 to 4.0 pips and Gold spreads at 4.0 pips. However, this account type compensates for the wider spreads by offering commission-free trading.

Trading Platform

SVSFX offers traders the worlds most popular trading platform – MT4, available through desktop, web and mobile apps.

Deposit & Withdrawal

Payment methods offered by SVSFX enclose Credit/Debit Cards (MasterCard, Visa, Maestro, Visa Electron), as well as popular e-wallets Skrill, Neteller and of course bank transfers are the option too.

There are some additional deposit and withdrawal fees. For instance, deposit by Credit Card will add 2% above or by Neteller – 4.4%. For the withdrawing way through Neteller will require an additional 2 % and 20% through Credit Card.

Customer Support

SVSFX's customer support appears inadequate with limited contact options and potentially confusing hotline numbers. The English support number, +44 (0)20 3700 0106, lacks toll-free options, potentially dissuading users. Similarly, the Chinese (Simplified) and German hotline, +44 (0)20 3700 0077, might confuse non-native speakers. While contact details for Hindi speakers are available at 4402037000077, the absence of dedicated toll-free numbers for various languages could inconvenience non-English speakers.

Though email addresses likecn.support@svsfx.com and support@svsfx.comoffer alternative communication channels, the lack of live chat or localized support offices could delay assistance, especially for urgent issues.

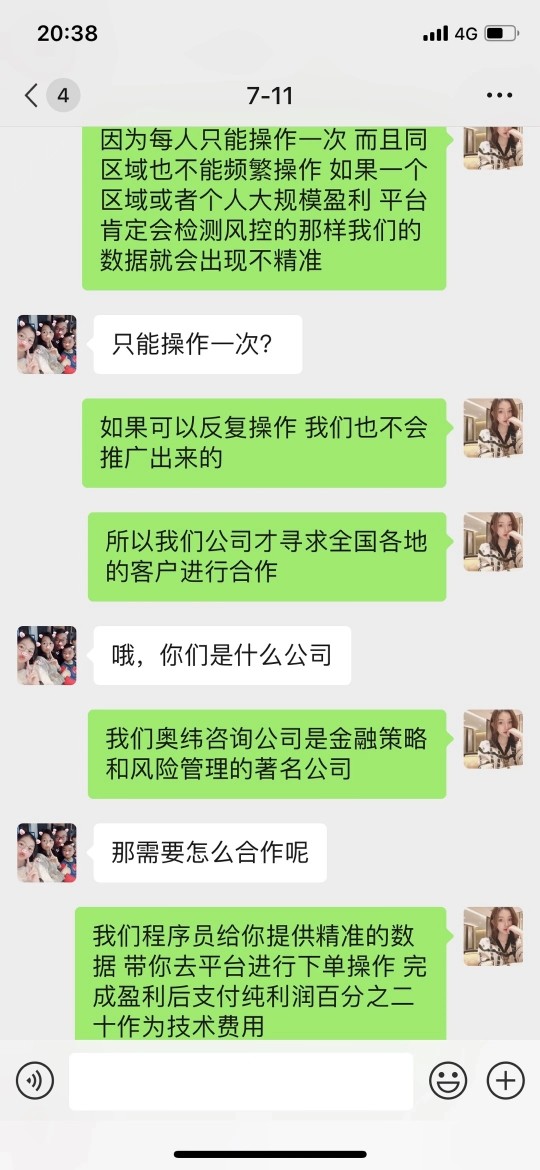

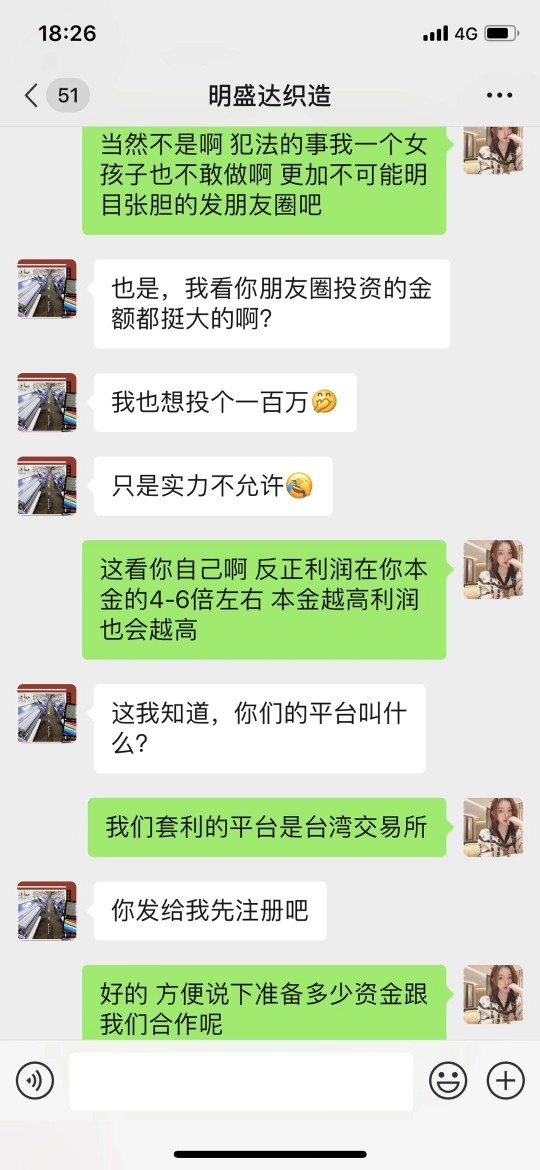

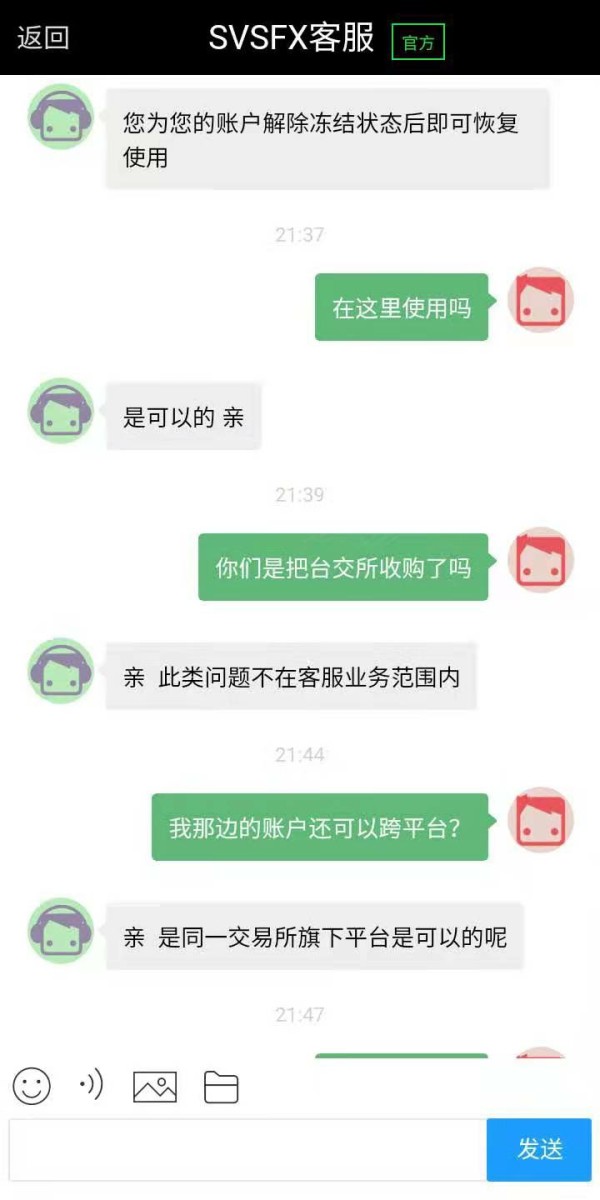

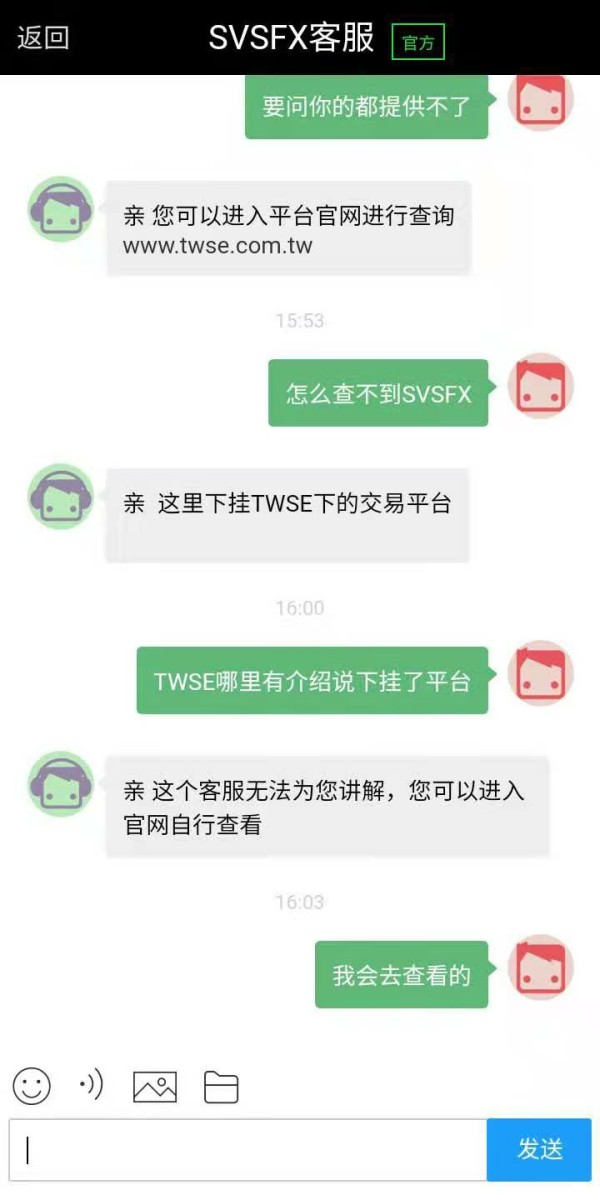

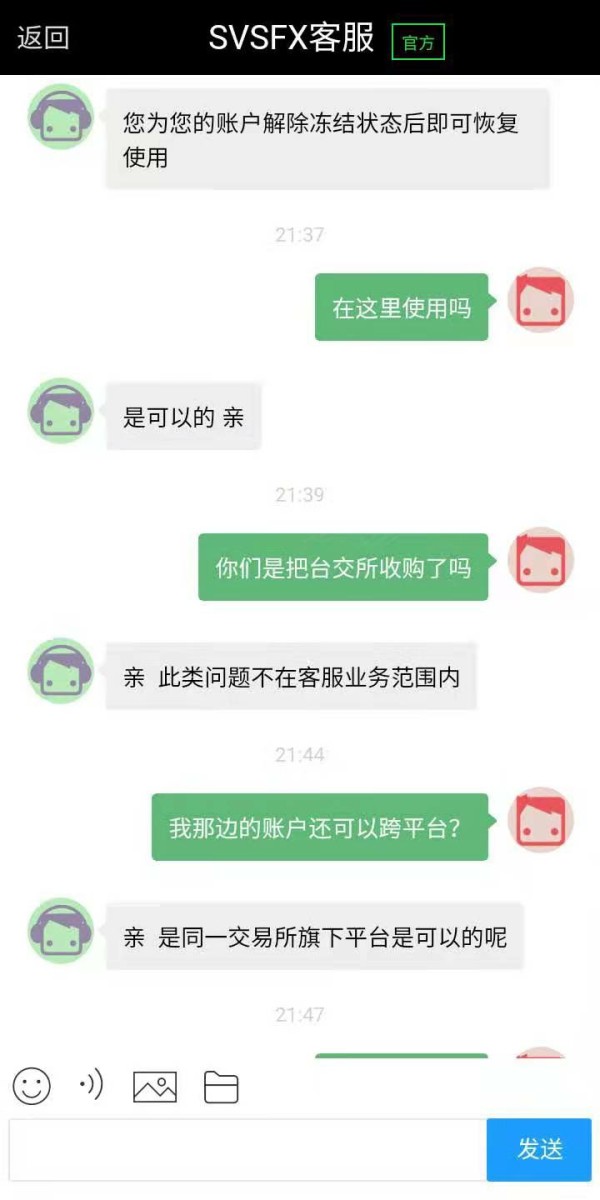

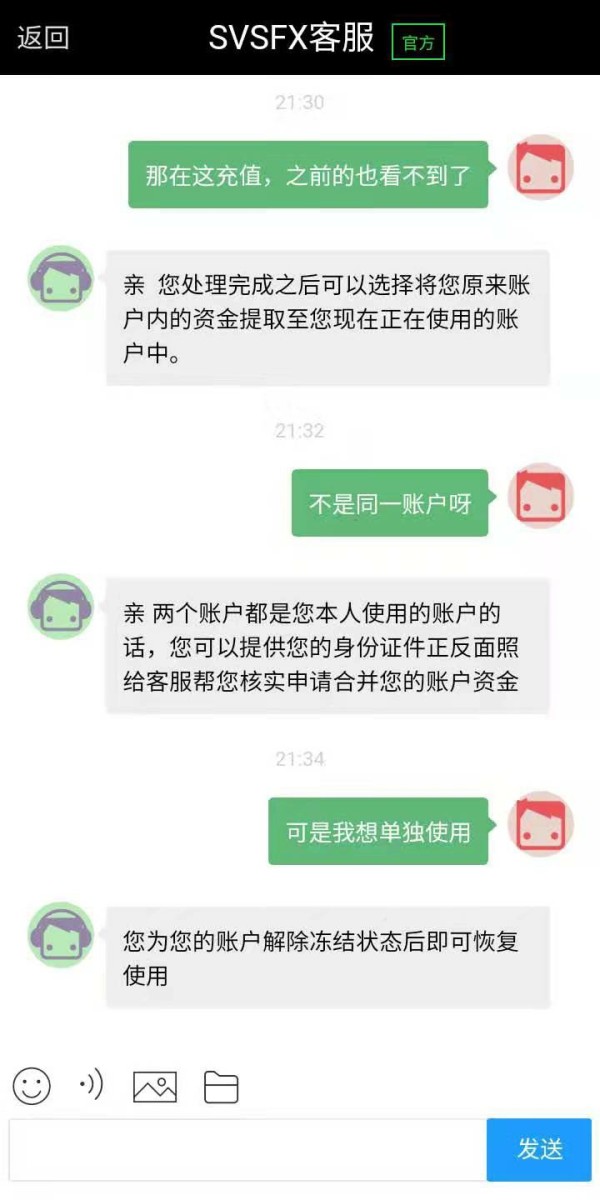

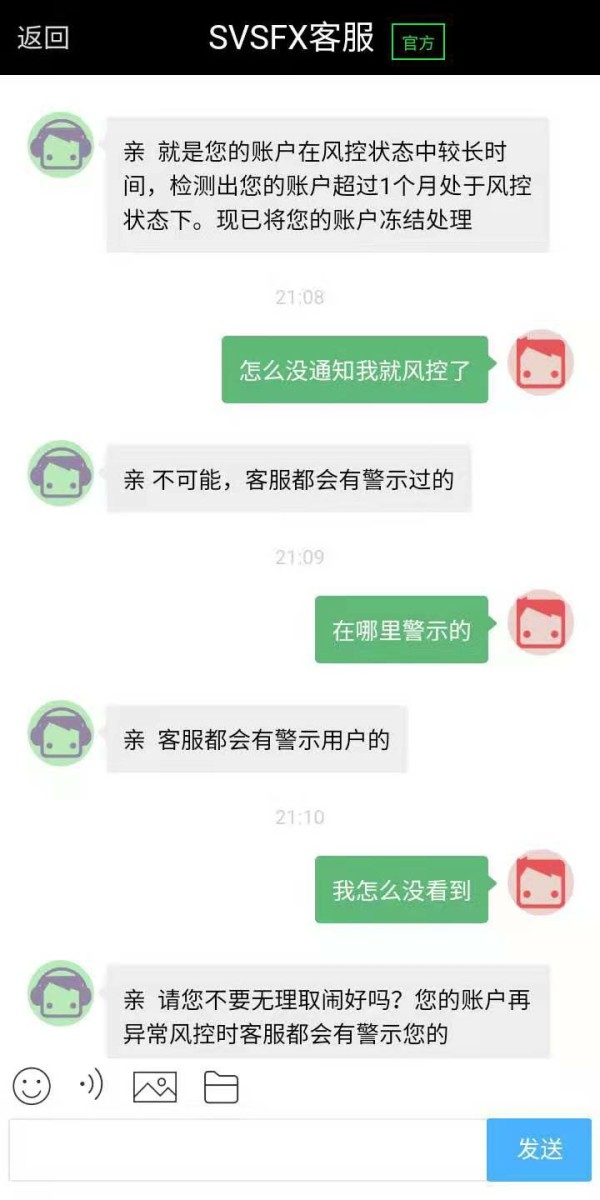

Exposure

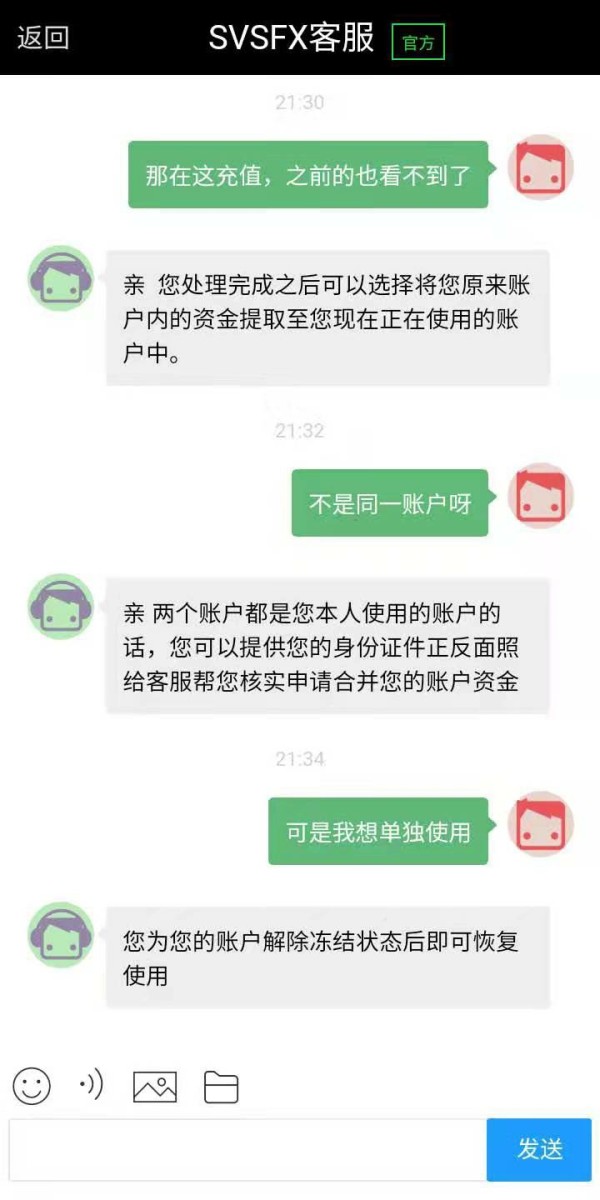

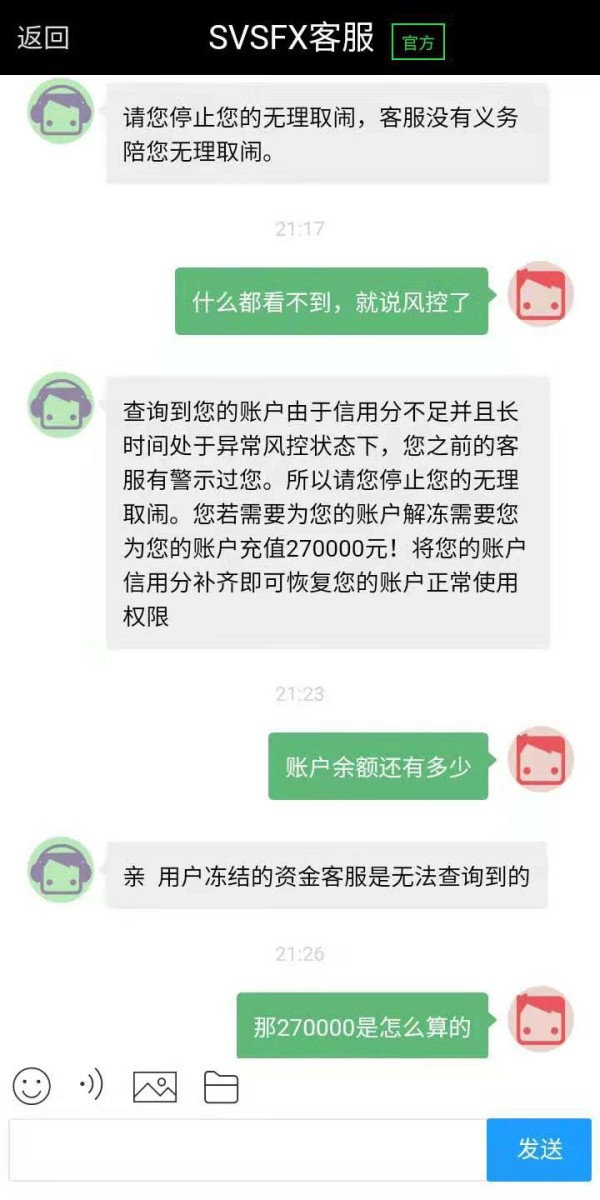

SVSFX has garnered negative exposure, including pyramid scheme complaints, scam allegations, and instances of users being unable to withdraw funds.

These incidents, documented over several years, indicate a pattern of dissatisfaction among users. Complaints range from agents misleading clients and subsequently disappearing to platform shutdowns and bankruptcy declarations. Such experiences can significantly impact traders' trust and confidence in SVSFX, potentially deterring new users from joining and prompting existing ones to seek alternative platforms. The accumulation of negative feedback suggests underlying issues within SVSFX's operations and customer service, highlighting the importance of transparency and accountability in the brokerage industry to maintain user trust and loyalty.

Conclusion

SVSFX, while offering a range of trading assets and account types, faces significant drawbacks. The revocation of its FCA regulation raises risks about its adherence to regulatory standards, potentially unsettling traders.

Limited customer support options and potentially confusing hotline numbers further diminish the platform's appeal, hindering traders' ability to seek assistance when needed. Additionally, the presence of additional deposit and withdrawal fees may deter users seeking cost-effective trading solutions.

FAQs

Q: What is the minimum deposit required to open an account with SVSFX?

A: The minimum deposit for a Professional account is 10,000 USD, while for a Standard account, it's 500 USD.

Q: What is the maximum leverage offered by SVSFX?

A: SVSFX offers a maximum leverage of 200:1 for Professional accounts and 400:1 for Standard accounts.

Q: What trading instruments are available on SVSFX?

A: SVSFX provides access to FX (foreign exchange) and CFDs (contracts for difference), including currency pairs, global indices, commodities, energy products, and precious metals.

Q: What trading platform does SVSFX offer?

A: SVSFX offers the popular MetaTrader 4 (MT4) trading platform, accessible via desktop, web, and mobile applications.

Keywords

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- United Kingdom Market Maker (MM) Revoked

- High potential risk

News

News SVS Saga Ends as the Collapsed Broker Enters Dissolution

SVS Securities' special administration is ending, with all client funds and custody assets returned except for 8 clients. The cost of restoring assets is to be covered by clients, with a £44.5m cost cushion established. FSCS reimbursement covered most costs. There were not enough realizations to pay a dividend to insolvent or preferred debtors. No further action is necessary for clients.

2023-04-03 12:23

News Special Administration Case Of SVS Securities Against The UK Watchdog FCA

SVS Securities' joint special administrators are seeking to withdraw the broker's authorization with the FCA, the United Kingdom's financial market regulator (Financial Conduct Authority). It will prevent the broker from engaging in regulated operations.

2023-02-07 15:14

News WikiFX: WHAT TO DO IF SCAMMED

WikiFX discovered that scammers use the complexity of the foreign exchange market to maliciously hide important information about market reality from unsuspecting novice victims, claiming that their plans, information or software robots will bring success.

2021-08-27 12:08

Comment 21

Content you want to comment

Please enter...

Comment 21

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

痴心

Hong Kong

The guy who claimed himself to be a master offered exact data and asked u to invest in SVSFX. Please pat attention. The evil will be brought to justice one day

Exposure

2021-03-14

痴心

Hong Kong

They claimed that there were teachers giving accurate data and asked u to deposit here. Now its name has been changed to SVSFX. The evil will be punished one day

Exposure

2021-03-10

痴心

Hong Kong

Induced fraud. Unable to withdraw. The fraud platform traps investors. We should get together to report it

Exposure

2021-01-14

痴心

Hong Kong

The customer service knows nothing.

Exposure

2021-01-09

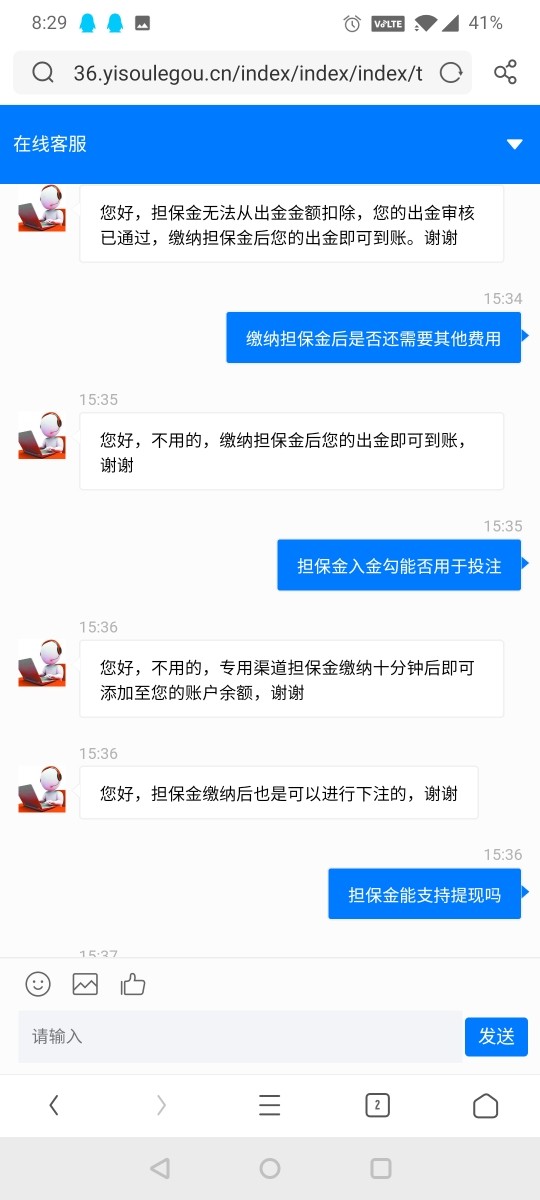

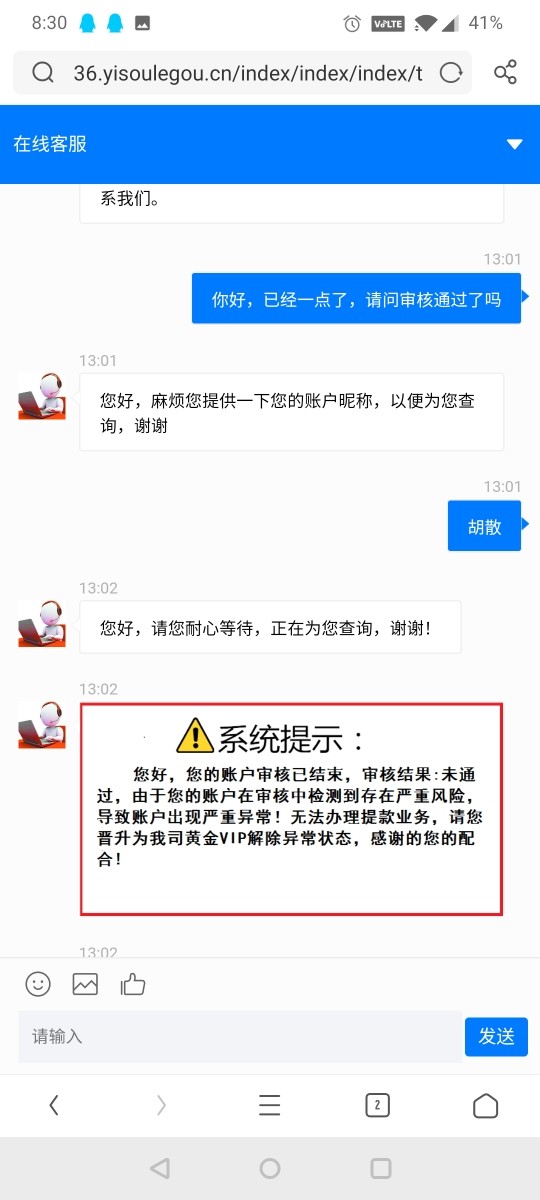

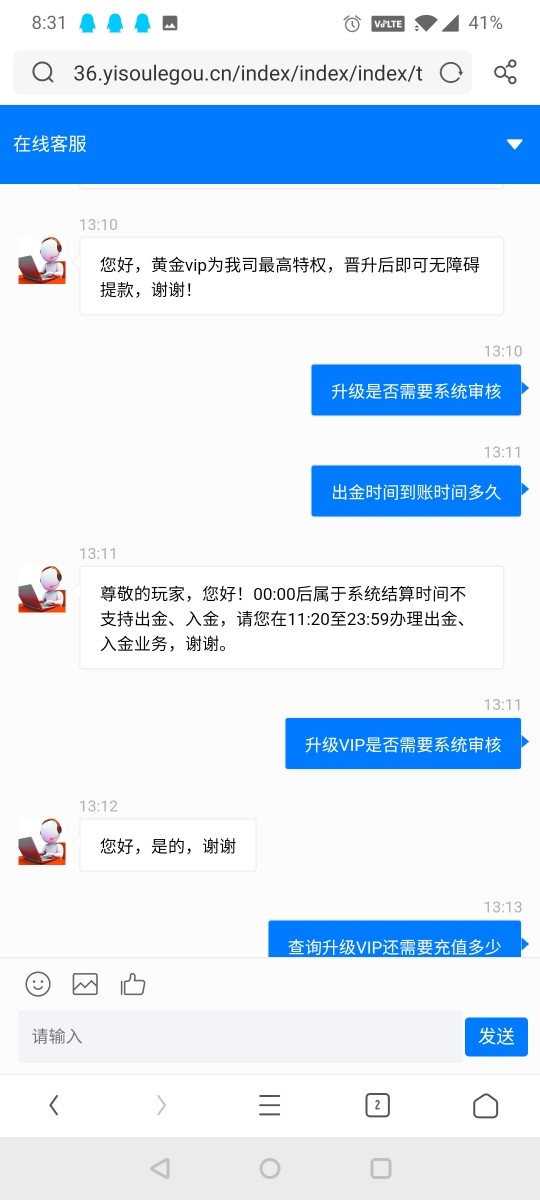

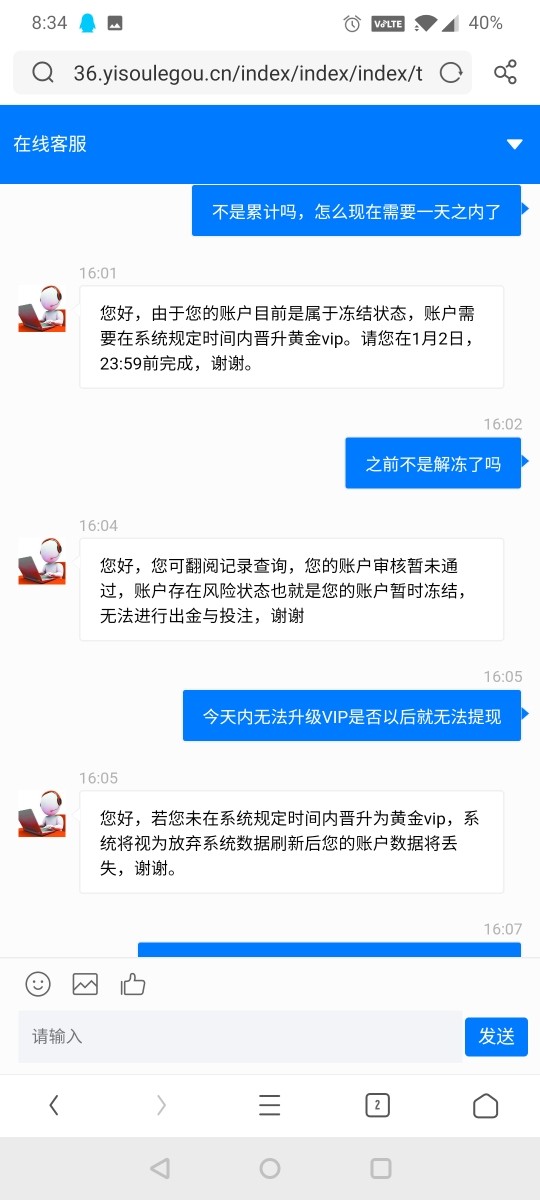

明知顾问

Hong Kong

First slander me, then freeze my account, ask me to pay for the upgrade, and finally need to upgrade on the same day, and then embezzle the money

Exposure

2021-01-02

微笑30914

Hong Kong

Unable to withdraw. Need margin

Exposure

2020-12-29

Carroll

Hong Kong

The withdrawal of profit and fund was guaranteed to be available after August 5th.It has been one month since no one responded.Where is the Dubai boss?

Exposure

2019-11-01

俊福-Justin

Hong Kong

Britain-based SVSFX declared its bankruptcy on the official website, https://industry.fx168.com/news/1908/3256260.shtml. Can I take some of my money back?

Exposure

2019-08-06

阿波刺的

Hong Kong

The websited shut up, and the deposit and withdrawal is unavailable,as well as clearing and opening a position.Informed by the customer service,I knew that the company might have been bankrupted...

Exposure

2019-08-05

芳华岁月

Hong Kong

On August 6th I found that it was easy to pay back from svsfx. The spread was relatively low, so I increased the number of transactions. There were more than 30,000 US dollars in the account. Each time I made orders of 10 hands, 20 hands and 30 hands. With risking of suffering a forced liquidation, I traded more than 6,000 lots in two days. But I only gained a profit of $ 1,856 in the end. I logged in my agent account 18115049, where the commissions were displayed normally. So I transferred the money to two normal trading accounts, and $4,1200 was transferred to the trading account. At this time, there were still $20,700 in the agent account, so I applied for withdrawing $20,700 from the agent account. But the request was rejected. Later, svsfx’ staff called and said that there was something wrong with the system and I could not withdraw money. I have communicated with them for a long time, but they said that there are some problems in the system upgradation, so the money cannot be withdrawn. The money transferred from the agent account to the trading account must also be returned. If I disagreed, the deposit couldn’t be withdrawn. So, I had to agree , hoping to take the deposit back. In the end, $6,1900 in the agent account transferred to the trading account is canceled, and the remaining money in the agent account is also unable to withdraw. When I lost, the platform allows me to withdraw nothing; when I gain profits, the customer service personnel will call and said that the platform system is a problem so that the money can’t be withdrawn. If you trade on svsfx, please stop doing so. The official website: http://svsmarkets.com /zh/

Exposure

2019-04-19

FX9999302411

Hong Kong

I am Yulin Sun.A net-pal added me from a chatting group.He said that he could make orders for me,with at least profit by 10% every month.He claimed that he could open the account for me directly that night.I gave him my Id and bank card information and opened an account in SVS.He helped me deposit by $1000 on-line,because of my ignorance,I nearly made all loss of $1000 within a week under his instruction.He felt so sorry to me and induced me to deposit another $500,deciding to profit double of my deposit.The same result with last time.I made all losses within a week,remaining $136.He advised me to change a platform because of high spread.With adjusting the leverage,I transferred the fund into USGFX platform.I made a loss of all within 4 days,$1510 in total,remaining $0.63.When I argued with him,he blacklisted me and run away.I could never contact him.I hope the platform address my problem seriously and let related co-operator contact me.

Exposure

2018-10-02

FX9999302411

Hong Kong

I am Yulin Sun.A net-pal added me from a chatting group.He said that he could make orders for me,with at least profit by 10% every month.He claimed that he could open the account for me directly that night.I gave him my Id and bank card information and opened an account in SVS.He helped me deposit by $1000 on-line,because of my ignorance,I nearly made all loss of $1000 within a week under his instruction.He felt so sorry to me and induced me to deposit another $500,deciding to profit double of my deposit.The same result with last time.I made all losses within a week,remaining $136.He advised me to change a platform because of high spread.With adjusting the leverage,I transferred the fund into USGFX platform.I made a loss of all within 4 days,$1510 in total,remaining $0.63.When I argued with him,he blacklisted me and run away.I could never contact him.I hope the platform address my problem seriously and let related co-operator contact me.

Exposure

2018-09-20

FX9999302411

Hong Kong

I am Yulin Sun.A net-pal added me from a chatting group.He said that he could make orders for me,with at least profit by 10% every month.He claimed that he could open the account for me directly that night.I gave him my Id and bank card information and opened an account in SVS.He helped me deposit by $1000 on-line,because of my ignorance,I nearly made all loss of $1000 within a week under his instruction.He felt so sorry to me and induced me to deposit another $500,deciding to profit double of my deposit.The same result with last time.I made all losses within a week,remaining $136.He advised me to change a platform because of high spread.With adjusting the leverage,I transferred the fund into USGFX platform.I made a loss of all within 4 days,$1510 in total,remaining $0.63.When I argued with him,he blacklisted me and run away.I could never contact him.I hope the platform address my problem seriously and let related co-operator contact me.

Exposure

2018-09-19

FX9999302411

Hong Kong

I am Yulin Sun.A net-pal added me from a chatting group.He said that he could make orders for me,with at least profit by 10% every month.He claimed that he could open the account for me directly that night.I gave him my Id and bank card information and opened an account in SVS.He helped me deposit by $1000 on-line,because of my ignorance,I nearly made all loss of $1000 within a week under his instruction.He felt so sorry to me and induced me to deposit another $500,deciding to profit double of my deposit.The same result with last time.I made all losses within a week,remaining $136.He advised me to change a platform because of high spread.With adjusting the leverage,I transferred the fund into USGFX platform.I made a loss of all within 4 days,$1510 in total,remaining $0.63.When I argued with him,he blacklisted me and run away.I could never contact him.I hope the platform address my problem seriously and let related co-operator contact me.

Exposure

2018-09-17

FX9999302411

Hong Kong

I am Yulin Sun.A net-pal added me from a chatting group.He said that he could make orders for me,with at least profit by 10% every month.He claimed that he could open the account for me directly that night.I gave him my Id and bank card information and opened an account in SVS.He helped me deposit by $1000 on-line,because of my ignorance,I nearly made all loss of $1000 within a week under his instruction.He felt so sorry to me and induced me to deposit another $500,deciding to profit double of my deposit.The same result with last time.I made all losses within a week,remaining $136.He advised me to change a platform because of high spread.With adjusting the leverage,I transferred the fund into USGFX platform.I made a loss of all within 4 days,$1510 in total,remaining $0.63.When I argued with him,he blacklisted me and run away.I could never contact him.I hope the platform address my problem seriously and let related co-operator contact me.

Exposure

2018-09-08

FX9999302411

Hong Kong

He is SVSFXand USGFX’s agent. After he defrauds me, he is missing. He blacklisted me. Everyone should be careful about this fraudster!

Exposure

2018-09-04

FX9999302411

Hong Kong

He is SVSFX and USGFX’s agent. After he defrauds me, he is missing. He blacklisted me. Everyone should be careful about this fraudster!

Exposure

2018-09-04

FX9999302411

Hong Kong

I am Yulin Sun.A net-pal added me from a chatting group.He said that he could make orders for me,with at least profit by 10% every month.He claimed that he could open the account for me directly that night.I gave him my Id and bank card information and opened an account in SVS.He helped me deposit by $1000 on-line,because of my ignorance,I nearly made all loss of $1000 within a week under his instruction.He felt so sorry to me and induced me to deposit another $500,deciding to profit double of my deposit.The same result with last time.I made all losses within a week,remaining $136.He advised me to change a platform because of high spread.With adjusting the leverage,I transferred the fund into USGFX platform.I made a loss of all within 4 days,$1510 in total,remaining $0.63.When I argued with him,he blacklisted me and run away.I could never contact him.I hope the platform address my problem seriously and let related co-operator contact me.

Exposure

2019-05-28

FX9999302411

Hong Kong

On 21st,June,the agent of SVS told me that the stable profit was available with at least 10% per month.Then I opened an account in this platform and deposited $1000 in it.I made all loss within half a month.He induced me add fund with sweet words.I deposited another $500,the same result as last.When I argued with him,I was even blacklisted by him.I hope the platform punish this cheater and contact me to give me an explain.If you ignore it,I will continuously exposing your platform.

Exposure

2019-05-28

FX9999302411

Hong Kong

SVS agents lure customers.By the way, the minimum monthly profit is 10%.In less than half a month, I lost 1510 dollars.Let me block it.Can't get in touch. missing.

Exposure

2018-08-31